CPS Technologies Corporation Announces Second Quarter 2020 Results

July 29 2020 - 4:07PM

CPS Technologies Corporation (NASDAQ: CPSH) today announced

revenues of $5.8 million and an operating profit of $331 thousand

for the quarter ended June 27, 2020. This compares with

revenues of $6.4 million and an operating profit of $258 thousand

for the quarter ended June 29, 2019.

For the six months ending June 27, 2020, revenues are $12.3

million with an operating profit of $952 thousand. This

compares with revenue of $11.6 million and an operating loss of

$486 thousand for the six months ended June 29, 2019.

Grant Bennett, President and CEO, said: “Revenues, while strong,

were down compared to the first quarter of 2020 due primarily to

impacts of the coronavirus pandemic on the purchasing decisions of

a major customer. This customer increased inventory in

Q1 to guard against possible supply chain interruptions; they then

reduced purchases in Q2 to bring inventory down to more appropriate

levels.

Gross margins and operating profits were considerably higher in

the three-month and six-month periods just ended than they were in

the corresponding periods a year ago. This significant

positive swing in performance reflects the pricing, product mix and

operational improvements discussed in previous

quarters.

CPS has been open and operating throughout the pandemic.

To date most of our customers remain open and

operational. We saw in Q2 and expect to see in future

quarters increased volatility in short-term demand as individual

customers address pandemic-related issues including managing

inventories up and down, shortages of other components, short-term

shutdowns, longer approval cycles given many employees are working

from home, etc.

CPS continues to follow CDC and OSHA guidance in our

workplace. Employees’ temperatures are taken at the beginning

of each shift, shifts have been staggered to reduce employee

overlap, workstations have been rearranged to ensure social

distancing, all employees are using facemasks, etc.

Any forward looking comments must begin with the clear caveat

that the pandemic is injecting considerable uncertainty at

customers and suppliers so conditions can and may change

quickly. Nonetheless, we currently anticipate continued

strong performance for the remainder of 2020, albeit not as strong

as we were anticipating pre-pandemic. Our product sales

pipeline is strong. Our sales team continues to generate new

business both from existing and new customers. We note that

over the past six months we have seen some customer programs using

SiC die accelerating and we are particularly excited about the

near-term revenue growth potential in this area.”

The Company will be hosting its second quarter conference call

with investors at 4:45pm on Wednesday, July 29. Those interested in

participating in the conference call should dial:

Call in Number: 1-833-953-1394

Conference ID: 6958894

About CPS CPS Technologies Corporation is a global leader in

producing metal-matrix composite components used to improve the

reliability and performance of various electrical systems.

CPS products are used in motor controllers for hybrid and electric

vehicles, high-speed trains, subway cars and wind turbines.

They are also used as heatspreaders in internet switches, routers

and high-performance microprocessors. CPS also develops and

produces metal-matrix composite armor.

Safe Harbor Statements made in this document that are not

historical facts or which apply prospectively, including those

relating to 2020 financial results, are forward-looking

statements that involve risks and uncertainties. These

forward-looking statements are identified by the use of terms and

phrases such as "will," "intends," "believes," "expects," "plans,"

"anticipates" and similar expressions. Investors should not rely on

forward looking statements because they are subject to a variety of

risks and uncertainties and other factors that could cause actual

results to differ materially from the company's expectation.

Additional information concerning risk factors is contained from

time to time in the company's SEC filings, including its Annual

Report on Form 10-K and other periodic reports filed with the SEC.

Forward-looking statements contained in this press release speak

only as of the date of this release. Subsequent events or

circumstances occurring after such date may render these statements

incomplete or out of date. The company expressly disclaims any

obligation to update the information contained in this release.

CPS TECHNOLOGIES CORPORATION

Statements of Operations

(Unaudited)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

June 27, |

|

|

|

June 29, |

|

|

June 27, |

|

|

June 29, |

|

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

Product sales |

$ |

5,758,015 |

|

|

$ |

6,366,951 |

|

|

$ |

12,269,586 |

|

|

$ |

11,636,489 |

|

|

|

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

|

Total revenues |

|

5,758,015 |

|

|

|

6,366,951 |

|

|

|

12,269,586 |

|

|

|

11,636,489 |

|

|

|

|

|

|

|

|

|

|

|

| Cost of product

sales |

|

4,574,686 |

|

|

|

5,191,964 |

|

|

|

9,536,047 |

|

|

|

10,302,078 |

|

|

|

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

|

Gross Margin |

|

1,183,329 |

|

|

|

1,174,987 |

|

|

|

2,733,539 |

|

|

|

1,334,411 |

|

|

|

|

|

|

|

|

|

|

|

| Selling, general,

and |

|

|

|

|

|

|

|

|

|

administrative expense |

|

852,773 |

|

|

|

917,079 |

|

|

|

1,781,362 |

|

|

|

1,820,765 |

|

|

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

|

Income (loss) from

operations |

|

330,556 |

|

|

|

257,908 |

|

|

|

952,176 |

|

|

|

(486,354 |

) |

| |

|

|

|

|

|

|

|

| Interest income

(expense), net |

|

(31,325 |

) |

|

|

(7,310 |

) |

|

|

(51,291 |

) |

|

|

(7,261 |

) |

|

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

| Net income (loss)

before |

|

|

|

|

|

|

|

|

|

income tax |

|

299,231 |

|

|

|

250,598 |

|

|

|

900,885 |

|

|

|

(493,615 |

) |

| Income tax provision

(benefit) |

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

|

Net income (loss) |

$ |

299,231 |

|

|

$ |

250,598 |

|

|

$ |

900,885 |

|

|

$ |

(493,615 |

) |

|

|

|

========= |

|

|

========= |

|

|

========= |

|

|

========= |

|

| Net income (loss)

per |

|

|

|

|

|

|

|

|

|

basic common share |

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.07 |

|

|

$ |

(0.04 |

) |

|

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

|

------------ |

|

CPS TECHNOLOGIES

CORPORATIONBalance Sheets (Unaudited)

|

|

|

|

June 27, |

|

December 28, |

|

|

|

|

|

2020 |

|

|

2019 |

| ASSETS |

------------- |

|

------------- |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash

equivalents |

$ |

116,612 |

|

$ |

133,965 |

|

|

Accounts

receivable-trade, net |

|

4,975,842 |

|

|

4,086,945 |

|

|

Inventories, net |

|

3,872,868 |

|

|

3,099,824 |

|

|

Prepaid expenses and

other current assets |

|

173,237 |

|

|

147,786 |

|

|

|

|

------------- |

|

------------- |

|

|

|

Total current assets |

|

9,138,559 |

|

|

7,468,520 |

|

|

|

|

------------- |

|

------------- |

| Property and

equipment: |

|

|

|

|

|

Production

equipment |

|

10,008,886 |

|

|

9,649,169 |

|

|

Furniture and office

equipment |

|

508,423 |

|

|

508,423 |

|

|

Leasehold

improvements |

|

934,195 |

|

|

934,195 |

|

|

|

|

------------- |

|

------------- |

|

|

|

Total cost |

|

11,451,504 |

|

|

11,091,787 |

|

|

|

|

|

|

|

|

|

Accumulated

depreciation and amortization |

|

(10,357,620) |

|

|

(10,110,663) |

|

|

Construction in

progress |

|

320,209 |

|

|

255,754 |

|

|

|

|

------------- |

|

------------- |

|

|

|

Net property and

equipment |

|

1,414,093 |

|

|

1,236,878 |

|

|

|

|

------------- |

|

------------- |

| Right-of-use lease

asset |

|

100,000 |

|

|

171,000 |

| Deferred taxes,

net |

|

147,873 |

|

|

147,873 |

|

|

|

------------- |

|

------------- |

|

|

Total

assets |

$ |

10,800,525 |

|

$ |

9,024,271 |

|

|

|

|

========= |

|

========= |

(continued)

CPS TECHNOLOGIES

CORPORATIONBalance Sheets

(Unaudited)(concluded)

| LIABILITIES AND

STOCKHOLDERS` |

June 27, |

|

December 28, |

| |

EQUITY |

|

2020 |

|

|

2019 |

| |

|

|

------------- |

|

------------- |

| Current

liabilities: |

|

|

|

| |

Borrowings against

line of credit |

|

1,026,765 |

|

|

1,249,588 |

| |

Note payable, current

portion |

|

37,311 |

|

|

-- |

| |

Accounts payable |

|

1,770,160 |

|

|

1,436,417 |

| |

Accrued expenses |

|

908,994 |

|

|

815,166 |

| |

Deferred revenue |

|

482,997 |

|

|

21,110 |

| |

Lease liability,

current portion |

|

100,000 |

|

|

148,000 |

| |

|

|

------------- |

|

------------- |

| Total current

liabilities |

|

4,326,227 |

|

|

3,670,281 |

| |

|

|

------------- |

|

------------- |

| Note payable less

current portion |

|

159,360 |

|

|

-- |

| Long term lease

liability |

|

-- |

|

|

23,000 |

| |

|

|

------------- |

|

------------- |

| Total

liabilities |

|

4,485,587 |

|

|

3,693,281 |

| |

|

|

|

| Commitments (note

4) |

|

|

|

| |

|

|

|

| Stockholders`

equity: |

|

|

|

| |

Common stock, $0.01

par value, |

|

|

|

| |

|

authorized 20,000,000

shares; |

|

|

|

| |

|

issued 13,427,492; |

|

|

|

| |

|

outstanding 13,207,436; |

|

|

|

|

|

|

at

June 27, 2020 and December 28, 2019; |

|

134,275 |

|

|

134,275 |

| |

Additional paid-in

capital |

|

36,177,264 |

|

|

36,094,201 |

| |

Accumulated

deficit |

|

(29,479,548) |

|

|

(30,380,433) |

| |

Less cost of 220,056

common shares repurchased |

|

|

|

| |

|

at June 27, 2020 and December 28,

2019 |

|

(517,053) |

|

|

(517,053) |

| |

|

|

------------- |

|

------------- |

| Total stockholders`

equity |

|

6,314,938 |

|

|

5,330,990 |

| |

|

|

------------- |

|

------------- |

| Total liabilities and

stockholders` |

|

|

|

| |

equity |

$ |

10,800,525 |

|

$ |

9,024,271 |

| |

|

|

========== |

|

========== |

CPS Technologies

Corporation

Chuck Griffith, Chief Financial

Officer

111 South Worcester

Street

Norton, MA 02766 Telephone: (508) 222-0614 Web Site:

www.alsic.com

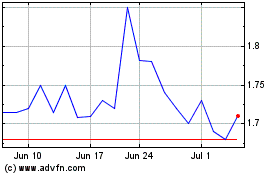

CPS Technologies (NASDAQ:CPSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

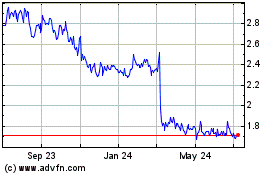

CPS Technologies (NASDAQ:CPSH)

Historical Stock Chart

From Apr 2023 to Apr 2024