Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

June 27 2022 - 5:22PM

Edgar (US Regulatory)

Prospectus Supplement No. 1

(to Prospectus dated February 11, 2022)

|

|

As Filed Pursuant to Rule 424(b)(3)

Registration No. 333-260137

|

111,111 Shares of Common Stock issuable

upon exercise of the Representative’s Warrants

This prospectus supplement updates and supplements

the prospectus dated February 11, 2022 (the “Prospectus”), which forms a part of our Registration Statement on Form S-1, as

amended (Registration No. 333-260317) filed pursuant to Rule 462(b) promulgated under the Securities Act of 1933, as amended

(the “Securities Act”) (the “Registration Statement”). This prospectus supplement is being filed

to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K, filed with the

Securities and Exchange Commission on June 24, 2022 (the “Current Report on Form 8-K”). Accordingly, we have attached

the Current Report on Form 8-K to this prospectus supplement.

This prospectus supplement should be read in

conjunction with the Prospectus as amended and supplemented to date. This prospectus supplement updates and supplements the information

in the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should

rely on the information in this prospectus supplement.

We are an “emerging growth company”

as that term is defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, as such, have elected to take advantage

of certain reduced public company reporting requirements for the Prospectus and future filings.

Our common stock is listed on the Nasdaq Capital

Market (“Nasdaq”) under the symbol “BWV.” The last reported sale price of the shares of common stock on

Nasdaq on June 24, 2022 was $2.55 per share. Our shares of common stock have experienced extreme volatility in market prices and trading

volume since listing. From February 18, 2022 (the date our shares were initially listed on Nasdaq) to the date hereof, the market price

of our common stock has fluctuated from an intra-day low on Nasdaq of $2.16 on June 23, 2022 to an intra-day high of $90.90 per share

on February 22, 2022. By comparison, our initial public offering, which closed on February 23, 2022, was conducted at $9.00 per share.

During this time, we have made one announcement regarding certain research developments for our vaccine candidates. Notwithstanding the

foregoing, since our initial public offering on February 18, 2022, there were no material recent publicly disclosed changes in the financial

condition or results of operations of the Company, such as our earnings or revenue, that are consistent with or related to the changes

in our stock price. The trading price of our common stock has been, and may continue to be, subject to wide price fluctuations in response

to various factors, many of which are beyond our control, including those described under the heading “Risk Factors” in the

Prospectus.

Investing in our securities involves a high

degree of risk. Please read the section in the Prospectus entitled “Risk Factors”.

Neither the U.S. Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 24, 2022

Blue Water Vaccines Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41294 |

|

83-2262816 |

(State or other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 201 E. Fifth Street, Suite 1900 Cincinnati, Ohio |

|

45202 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (513) 620-4101

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which

Registered |

| Common Stock, par value $0.00001 per share |

|

BWV |

|

The Nasdaq Stock Market LLC |

Emerging growth

company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Due

to delays caused by manufacturing, disruptions relating to suppliers, and those caused by the global COVID-19 pandemic, the Companyhas

adjusted the estimated timeline previously reported in its public filings with respect to the development of its vaccine candidates, BWV-102

and BWV-302 to account for additional time needed to optimize vaccine platform approach and perform sufficient preclinical studies. An

updated summary of the Company’s pipeline for all vaccine candidates is provided as follows:

The

FDA regulatory approval process is lengthy and time-consuming, and we may experience significant delays in the clinical development

and regulatory approval of our vaccine candidates. Our vaccine candidates are in early stages of development and may fail in

development or suffer delays that materially and adversely affect their commercial viability. We may be unable to complete

development of or commercialize our vaccine candidates or experience significant delays in doing so due to regulatory or other

uncertainties.

Additional

details regarding the Company and its vaccine candidates are available in the Company’s updated corporate presentation, which is

attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Blue Water Vaccines Inc. |

| |

|

|

| Date: June 24,

2022 |

By: |

/s/

Joseph Hernandez |

| |

|

Joseph Hernandez |

| |

|

Chief Executive Officer |

Exhibit 99.1

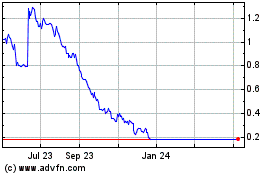

Blue Water Biotech (NASDAQ:BWV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blue Water Biotech (NASDAQ:BWV)

Historical Stock Chart

From Apr 2023 to Apr 2024