Telephone Number, Including Area Code of Agent

For Service.

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS SUMMARY

The Commission allows us to “incorporate

by reference” certain information that we file with the Commission, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and

information that we file later with the Commission will update automatically, supplement and/or supersede the information disclosed in

this prospectus. Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus shall

be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or

in any other document that also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You should read the following summary together with the more detailed information regarding our company, our Common Stock and our financial

statements and notes to those statements incorporated herein by reference.

Our Company

We are a biotechnology company focused on the research

and development of transformational vaccines to prevent infectious diseases worldwide. Our versatile vaccine platform has unique molecular

properties that enables delivery of various antigens, which can be utilized to develop singular or multi-targeted vaccines. Our lead influenza

(flu) vaccine program uses proprietary technology to identify specific epitopes, or proteins, with cross-reactive properties that enables

the potential development of a universal flu vaccine. We are focused on developing novel vaccines that induce durable and long-term immunity.

We believe that our pipeline and vaccine platform are synergistic for developing next generation preventive vaccines to improve both health

outcomes and quality of life globally.

Our

pipeline includes novel vaccine candidates exclusively licensed from renowned research institutions. We seek to develop vaccines that

provide long-lasting immunity to harmful viral and bacterial pathogens that cause infections in patient populations with high unmet needs.

Our exclusive license agreements include patented influenza epitopes of limited variability, or ELV, identified through a proprietary

computational research and discovery process, discovered by Dr. Sunetra Gupta and her team at the University of Oxford. Our collaborators

are pioneers in vaccine discovery and development. We are exploring the development of these influenza ELV’s utilizing our Norovirus

shell and protrusion (S&P) nanoparticle vaccine platform licensed from Cincinnati Children’s Hospital Medical Center, or CHMC. We

are also utilizing our platform to develop a vaccine for the prevention of gastroenteritis cause by both norovirus and rotavirus.

We are also utilizing this platform to assess the potential to create a novel monkeypox vaccine candidate. Our

exclusively licensed S. pneumoniae vaccine candidate is from St. Jude Children’s Research Hospital. The vaccine is designed

to prevent harmful middle-ear infections in children as well as to prevent pneumococcal pneumonia, and is being developed for intranasal

delivery, well suited for both pediatric and adult patients. We leverage the expertise of our collaborators to pursue the discovery and

development of vaccines for these diseases, which are high unmet needs globally.

In addition, we have expertise in identifying business

development opportunities for our platform vaccines technologies and portfolio. This allows for both internal pipeline expansion and the

ability to generate non-dilutive revenue from potential licensing partners to utilize our discovery engine vaccine platform. There is

potential for adjunctive or next generation therapeutic exploration to enhance current standard of care options.

Vaccination has been used as an effective

method of protecting individuals against harmful diseases by utilizing the body’s natural defense system to develop resistance

or immunity to infections (World Health Organization, https://www.who.int/news-room/q-a-detail/herd-immunity-lockdowns-and-covid-19).

The body’s immune system naturally creates antibodies and cell -mediated immunity to defend against foreign pathogens.

Vaccines introduce or present these foreign pathogens, prompting the body’s immune system produce a response protective

against the pathogen without exposing the body to the relevant lethal or harmful infection (World Health Organization, https://www.who.int/news-room/q-a-detail/herd-immunity-lockdowns-and-covid-19).

While vaccines are generally able to provide resistance against disease, many infectious diseases can evolve or mutate leading to

shortcomings of traditional vaccines, such as yearly reformulations. We believe our vaccine candidates can provide an alternative to

the current standards of care by harnessing durable and long-lived immune response to specific or multiple antigens.

The global vaccine market has recently experienced

significant growth caused by rising awareness of the importance of immunization and vaccination benefits in emerging markets as well as

by projects to fuel further global market expansion. For instance, The World Health Organization (WHO) has undertaken initiatives to increase

immunization awareness through its Global Vaccine Action Plan and Global Immunization Vision and Strategy.

As such, market research professionals project the

global vaccine market size to reach $73.78 billion by 2028, representing a CAGR of 7.3% over the forecast period, driven by rising

prevalence of infectious diseases, increasing government funding for vaccine production and growing emphasis on becoming immunized.

This market acceleration has been coupled with various

strategic transactions in the sector, including consolidations and mergers and acquisitions in recent years. Major market participants

have strategically acquired start-ups and mid-sized companies to broaden their products portfolios and service offerings. For instance,

in February 2019, Bharat Biotech acquired Chiron Behring Vaccines, one of the leading manufacturers of rabies vaccines across the

globe. Additionally, in October 2018, Emergent BioSolutions, a multinational specialty biopharmaceutical company, acquired PaxVax

for $270 million, and in July 2017 Sanofi acquired Protein Sciences for $650 million. The appetite of these companies to

buttress their vaccine programs and pipelines reflects the increasing importance of vaccines in the healthcare sector, both nationally

and worldwide.

The U.S. Centers for Disease Control, or CDC,

its Advisory Committee on Immunization Practices, or ACIP, and similar international advisory bodies develop vaccine recommendations for

both children and adults. New pediatric vaccines that receive ACIP preferred recommendations are almost universally adopted, and adult

vaccines that receive a preferred recommendation are widely adopted. We believe that our vaccine candidates will be well-positioned to

obtain these preferred recommendations, by virtue of their longer and more durable immunity, which could drive rapid and significant market

adoption.

Pipeline

Our vaccine candidates are being developed in a

manner that is scalable, designed to be cost-effective and provide long-term benefit to patients from infectious agents.

The FDA regulatory approval process is lengthy and time-consuming,

and we may experience significant delays in the clinical development and regulatory approval of our vaccine candidates. Our vaccine candidates

are in early stages of development and may fail in development or suffer delays that materially and adversely affect their commercial

viability. We may be unable to complete development of or commercialize our vaccine candidates or experience significant delays in doing

so due to regulatory or other uncertainties.

Our Vaccine Platform

BWV Norovirus (NoV) S&P Nanoparticle Versatile Vaccine Platform

Our Approach to Stimulating the Immune System for Infectious Disease

Protection

Our S&P platform was co-invented by two researchers,

Xi Jason Jiang, Ph.D., and Ming Tan, Ph.D., of the Division of Infectious Disease at the Cincinnati Children’s Hospital Medical

Center. The pre-clinical research conducted at CHMC provided encouraging data that we believe supports investigation and development of

the platform for our vaccine candidates. The S&P platform combines two or more immunogenic components, a norovirus antigen plus at

least one additional antigen, together creating novel constructs. The norovirus nanoparticle enhances immunogenicity.

Key Elements of our Platform

We are leveraging our disruptive norovirus nanoparticle

platform to develop novel, broad-spectrum vaccines for adult and child infectious disease prevention by taking advantage of:

| ● | Flexible and Scalable discovery platform engine. We

believe we are able to design and create novel vaccines that are stable and scalable for broad spectrum prophylactics. Through this platform’s

adaptability, we may opportunistically expand our pipeline and potentially collaborate with third parties for additional vaccines, as

well as therapeutics. |

| | | |

| ● | Cost-effective and Rapid Production of Novel Vaccines. We

are potentially able to reduce the cost and time to manufacture a vaccine candidate by utilizing an E.coli expression platform,

compared to traditional vaccine production which uses other, longer production-time platforms, such as Chinese Hamster Ovary (CHO) cells.

We have bioengineered these nanoparticles to be stable and effective, determined through animal immunogenicity studies, using E.coli

expression, which may provide cost savings and efficiency compared to other VLPs needing a eukaryotic expression system (Pharmaceutics

2019, 11, 472; doi:10.3390/pharmaceutics11090472). |

| | | |

| ● | Multi-antigen and Pathogen Capabilities. The power of our platform is its ability to carry

multiple antigens at a time, thereby creating a multi-targeted vaccine. It also provides the opportunity to develop vaccines for

protection against not only viral pathogens, but also bacterial, parasitic and fungal pathogens. |

| | | |

| ● | Therapeutic potential. We believe our platform may offer opportunities to develop

non-infectious disease therapeutic products, for example, being used as a carrier or vehicle to transport drugs to specific target

locations. |

Our Vaccine Candidates

BWV-101 and BWV-102: Influenza vaccine program

Our lead vaccine program is focused on developing

a transformational novel universal influenza vaccine, BWV-101. This program is licensed from the University of Oxford, where all relevant

studies were performed to support our hypothesis. We are developing a broad-spectrum vaccine using patented epitopes of limited variability,

or ELV, that provide cross reactive immune response to multiple historical flu strains. Additionally, based upon the successful pre-clinical

proof-of-concept (POC) of our H1 epitopes, we are developing a stand-alone H1 influenza vaccine, BWV-102, to provide a long-lasting induced

immune response. This POC will be leveraged to develop BWV-101 by studying the cross-reactivity of different flu strains, H1, H3 and influenza

B. Data in mice models have demonstrated proof of concept of neutralization against historical and current H1 strains, which includes

annual and pandemic strains. This would negate annual flu shots, reformulation and potentially provide protection against future influenza

pandemics. (Thompson et al. Nature Communications. 2018. 9:385).

BWV-201: Streptococcus pneumoniae (S. pneumoniae) vaccine program

We are developing BWV-201, licensed from St. Jude

Children’s Research Hospital, to prevent Acute Otitis Media, or AOM, in children and adults, a leading cause of hospital visits,

prescription antibiotics and potentially permanent hearing loss. AOM due to S. pneumoniae infections range from 30 to 50% of all

AOM infections each year (Monsata 2012 2012; 7(4): e36226). In addition to AOM, we are exploring the potential for BWV-201 to protect

against non-invasive pneumococcal pneumonia, or colonization of the bacteria within the lungs that has not spread to the blood or other

major organs. According to the CDC, pneumococcal pneumonia leads to an estimated 150,000 hospitalizations each year in the US alone (CDC

Fast Facts: Pneumococcal Disease) and while there are commercially available pneumococcal vaccines, efficacy rates against pneumococcal

pneumonia are low (Berild 2020; 9(4): 259) and vaccines are serotype independent (CDC: Pneumococcal Disease). BWV-201 is a live attenuated

serotype-independent intranasal vaccine candidate for S. pneumoniae induced AOM and pneumococcal pneumonia.

BWV-301: Norovirus-rotavirus vaccine program

We are developing a norovirus-rotavirus vaccine,

BWV-301, to prevent gastroenteritis utilizing our S&P platform. Preclinical data from gnotobiotic pig studies have shown our vaccine

can prevent severe gastroenteritis and reduces viral shedding. While rotavirus vaccines exist in the market, no norovirus vaccine is available

to date. Our vaccine would protect people from two of the most globally prevalent viruses causing vomiting and diarrhea.

BWV-302: Norovirus-malaria vaccine program

Additionally, we are currently investigating a malaria vaccine, BWV-302,

utilizing our norovirus S&P platform. The vaccine is designed to offer protection from both norovirus and malaria, infectious diseases

that occur frequently together in geographic regions. The vaccine utilizes a protein identified on the surface of the plasmodium parasite

being presented on the surface of the norovirus nanoparticle.

Recent

Developments

Buyback Program

On November 10, 2022, the Company’s

Board of Directors approved a share repurchase program to allow for the Company to repurchase up to 5 million shares, with discretion

to management to make purchases subject to market conditions.

Boustead Settlement

On April 15, 2022, the Company received a demand

letter (the “Demand Letter”) from Boustead Securities, LLC (“Boustead”). The Demand Letter alleged that the Company

breached its underwriting agreement with Boustead, in connection with the Company’s February 2022 initial public offering. The Demand

Letter alleged that, by engaging H.C. Wainwright & Co., LLC as placement agent for a private placement financing that closed in April

2022 (the “April Private Placement”), the Company breached Boustead’s right of first refusal (“ROFR”) to

act as placement agent granted to Boustead under the underwriting agreement and, as a result of selling securities in the April Private

Placement, breached the Company’s obligation under the underwriting agreement not to offer, sell, issue, agree or contract to sell

or issue or grant or modify the terms of any option for the sale of, any securities prior to February 17, 2023 (the “Standstill”).

On October 9, 2022, the Company and Boustead entered

into a Settlement Agreement and Release effective as of September 28, 2022, pursuant to which Boustead agreed to waive the ROFR and the

Standstill and to release Company from certain claims with respect to the April Private Placement, the private placement financing closed

in August 2022, and all future private, public equity or debt offerings of the Company. As consideration for such waiver, the Company

agreed to pay Boustead a cash fee of $1,000,000 plus $50,000 in legal expenses and release Boustead from all claims, subject to certain

exceptions. In addition, the Company agreed to issue to Boustead 93,466 shares of restricted common stock in exchange for the cancellation

of that certain Representative Warrant, dated February 23, 2022, issued to Boustead. Concurrent with the execution of the Settlement Agreement,

the Company and Boustead Capital Markets, LLP (“Boustead Capital”) entered into a three-month Advisory Agreement (the “Advisory

Agreement”) for which consideration equal to 200,000 shares of restricted common stock, with no vesting provisions, was issuable

to Boustead Capital upon execution of the Advisory Agreement.

August Private Placement

On August 11, 2022, the Company consummated the

closing of a private placement (the “August Private Placement”), pursuant to the terms and conditions of a securities purchase

agreement, dated as of August 9, 2022. At the closing of the August Private Placement, the Company issued 1,350,000 shares of common stock,

pre-funded warrants to purchase an aggregate of 2,333,280 shares of common stock and preferred investment options to purchase up to an

aggregate of 4,972,428 shares of common stock. The purchase price of each share of common stock together with the associated preferred

investment option was $2.715, and the purchase price of each pre-funded warrant together with the associated preferred investment option

was $2.714. The aggregate net cash proceeds to the Company from the August Private Placement were approximately $8.7 million, after deducting

placement agent fees and other offering expenses. In addition, the investors in the August Private Placement, who are the same investors

from the April Private Placement, agreed to cancel preferred investment options to purchase up to an aggregate of 1,180,812 shares of

the Company’s common stock issued in April 2022. The pre-funded warrants have an exercise price of $0.001 per share, are exercisable

on or after August 11, 2022, and are exercisable until the pre-funded warrants are exercised in full. On September 20, 2022, 945,000 of

the pre-funded warrants were exercised, and as such the Company issued 945,000 shares of common stock on that date. The preferred investment

options are exercisable at any time on or after August 11, 2022 through August 12, 2027, at an exercise price of $2.546 per share, subject

to certain adjustments as defined in the agreement.

Wainwright acted as the exclusive placement agent

for the August Private Placement. The Company agreed to pay Wainwright a placement agent fee and management fee equal to 7.5% and 1.0%,

respectively, of the aggregate gross proceeds from the August Private Placement and reimburse certain out-of-pocket expenses up to an

aggregate of $85,000. In addition, the Company issued warrants to Wainwright (the “August Wainwright Warrants”) to purchase

up to 220,997 shares of common stock. The August Wainwright Warrants are in substantially the same form as the preferred investment options,

except that the exercise price is $3.3938. The form of the preferred investment options is a warrant, and as such the preferred investment

options, the pre-funded warrants, and the August Wainwright Warrants are collectively referred to as the “August Private Placement

Warrants”. Further, upon any exercise for cash of any preferred investment options, the Company agreed to issue to Wainwright additional

warrants to purchase the number of shares of common stock equal to 6.0% of the aggregate number of shares of common stock underlying the

preferred investment options that have been exercised, also with an exercise price of $3.3938 (the “August Contingent Warrants”).

The maximum number of August Contingent Warrants issuable under this provision is 298,346, which includes 70,849 of April Contingent Warrants

that were modified in connection with the August Private Placement.

In connection with the August Private Placement,

the Company entered into a Registration Rights Agreement with the purchasers, dated as of August 9, 2022 (the “August Registration

Rights Agreement”). The August Registration Rights Agreement provides that the Company shall file a registration statement covering

the resale of all of the registrable securities (as defined in the August Registration Rights Agreement) with the SEC no later than the

30th calendar day following the date of the August Registration Rights Agreement and have the registration statement declared effective

by the SEC as promptly as possible after the filing thereof, but in any event no later than the 45th calendar day following August 9,

2022 or, in the event of a full review by the SEC, the 80th day following August 9, 2022. The registration statement on Form S-1 required

under the Registration Rights Agreement was filed with the SEC on August 29, 2022, and became effective on September 19, 2022.

Upon the occurrence of any Event (as defined

in the August Registration Rights Agreement), which, among others, prohibits the purchasers from reselling the securities for more than

ten consecutive calendar days or more than an aggregate of fifteen calendar days during any 12-month period, and should the registration

statement cease to remain continuously effective, the Company is obligated to pay to each purchaser, on each monthly anniversary of each

such Event, an amount in cash, as partial liquidated damages and not as a penalty, equal to the product of 2.0% multiplied by the aggregate

subscription amount paid by such purchaser in the August Private Placement.

April Private Placement

On April 19, 2022, we consummated the closing

of a Private Placement (the “April Private Placement”), in which we received approximately $6.9 million in net cash proceeds,

pursuant to the terms and conditions of the Securities Purchase Agreement, dated as of April 13, 2022 (the “April Purchase

Agreement”), by and among the Company and certain purchasers named on the signature pages thereto. At the closing of the April Private

Placement, the Company issued 590,406 shares of common stock, pre-funded warrants to purchase an aggregate of 590,406 shares

of common stock and preferred investment options to purchase up to an aggregate of 1,180,812 shares of common stock. The purchase

price of each share and associated preferred investment option was $6.775 and the purchase price of each prefunded warrant and associated

preferred investment option was $6.774. The aggregate gross proceeds to the Company from the April Private Placement were approximately

$8.0 million, before deducting placement agent fees and other offering expenses. H.C. Wainwright & Co., LLC (“Wainwright”)

acted as the exclusive placement agent for the April Private Placement.

In connection with the April Private Placement,

we entered into a registration rights agreement with the purchasers, dated as of April 13, 2022 (the “April Registration Rights

Agreement”), pursuant to which we filed a registration statement covering the resale of registrable securities under the April Registration

Rights Agreement, which was declared effective on May 20, 2022.

Upon the occurrence of any Event (as defined in

the April Registration Rights Agreement), which, among others, includes the purchasers being prohibited from reselling the securities

acquired in the April Private Placement for more than ten (10) consecutive calendar days or more than an aggregate of fifteen

(15) calendar days during any 12-month period, we are obligated to pay to each purchaser, on each monthly anniversary of each

such Event, an amount in cash, as partial liquidated damages and not as a penalty, equal to the product of 2.0% multiplied by the aggregate

subscription amount paid by such purchaser pursuant to the April Purchase Agreement.

Wainwright served as the exclusive placement agent

for the April Private Placement and received a cash fee of 7.5% of the aggregate gross proceeds of the offering and received warrants

(the “April Wainwright Warrants”) to purchase up to 70,849 shares of our common stock, which was equivalent to 6.0% of

the shares and prefunded warrants sold in the April Private Placement. We also agreed to pay Wainwright a management fee equal to 1.0%

of the aggregate gross proceeds from the offering and reimburse certain out-of-pocket expenses up to an aggregate of $85,000. We also

agreed, upon any exercise for cash of any preferred investment options, to issue to Wainwright warrants to purchase the number of shares

equal to 6.0% of the aggregate number of placement shares underlying the preferred investment options that have been exercised (the “April

Contingent Warrants”). The maximum number of April Contingent Warrants issuable under this provision is 70,849.

Ology Agreement

On April 20, 2022, the Company and Ology entered

into an amendment to the second Project Addendum (the “Ology Amendment”). The Ology Amendment provides for an increase to

the Company’s obligation of $0.3 million, specifically related to regulatory support on the project.

On August 30, 2022, the Company and Ology entered

into another amendment to the second Project Addendum, which provides for a decrease to the Company’s obligation of $0.4 million,

as a result of the change in the scope of work comprising certain tasks defined in the second Project Addendum.

St. Jude Children’s Research Hospital, Inc. Agreement

On May 11, 2022, the Company and St. Jude entered

into a first amendment to the St. Jude Agreement (the “St. Jude Amendment”). The St. Jude Amendment provides for a revised

development milestone timeline, a one-time license fee of $5,000, and an increase to the royalty rate from 4% to 5%. The St. Jude Amendment

also provides for an increase to the contingent milestone payments, from $1.0 million to $1.9 million in the aggregate; specifically,

development milestones of $0.3 million, regulatory milestones of $0.6 million, and commercial milestones of $1.0 million.

The Company also entered into a second sponsored

research agreement with St. Jude, dated August 29, 2022, pursuant to which the Company is obligated to pay St. Jude an amount of $75,603

which is due within 30 days of the effective date of the agreement.

Butantan Letter of Intent

On May 19, 2022, the Company and Instituto

Butantan (“Butantan”) entered into a letter of intent, pursuant to which the Company and Butantan intend to establish a future

technological collaboration in order to improve Butantan’s platform and develop the universal influenza vaccine candidate in collaboration

with the Company.

Oxford University Innovation Limited

In December 2018, the Company entered into

an option agreement with Oxford University Innovation (“OUI”), which was a precursor to a license agreement (the “OUI

Agreement”), dated July 16, 2019. Under the terms of the OUI Agreement, the Company holds an exclusive, worldwide license to

certain specified patent rights and biological materials relating to the use of epitopes of limited variability and virus-like particle

products and practice processes that are covered by the licensed patent rights and biological materials for the purpose of developing

and commercializing a vaccine product candidate for influenza.

Pursuant to the terms of the OUI Agreement, the

Company entered into a sponsored research agreement (the “SRA”) dated December 18, 2019 with Oxford University relating

to research and optimization of the Company’s universal influenza vaccine candidate, BWV-101, which carried a term of three years

and required aggregate payments of £420,000, which was previously paid by the Company. Pursuant to the Sponsor Research Agreement,

Oxford University is required to finalize certain pre-clinical studies of the universal influenza vaccine. On May 16, 2022,

the Company entered into an amendment to the Sponsor Research Agreement (the “Amendment”), the term of the research under

the SRA was extended for an additional 18 months, culminating on June 18, 2024. The Company will also provide additional funding

in connection with the research in a sum of approximately $56,000.

We

were incorporated in Delaware on October 26, 2018. Our principal executive offices are located at 201 E. Fifth Street,

Suite 1900, Cincinnati, Ohio 45202, and our telephone number is (513) 620-4101. Our corporate website address is

www.bluewatervaccines.com. The information contained on or accessible through our website is not a part of this prospectus, and

the inclusion of our website address in this prospectus is an inactive textual reference only.

The Offering

| Outstanding Common Stock: |

|

15,474,957 shares of our Common Stock are outstanding as of November 9, 2022. |

| |

|

|

| Common Stock Offered: |

|

Up to 1,000,000 shares of Common Stock for sale by the Selling Stockholders (which include our employees, consultants, executive officers and directors) for their own account pursuant to the 2022 Plan. |

| |

|

|

| Selling Stockholders: |

|

The Selling Stockholders are set forth in the section entitled “Selling Stockholders” of

this reoffer prospectus on page 110. The amount of securities to be offered or resold by means of the reoffer prospectus by the

designated Selling Stockholders may not exceed, during any three month period, the amount specified in Rule 144I. |

| |

|

|

| Use of proceeds: |

|

We will not receive any proceeds from the sale of our Common Stock by the Selling Stockholders. We would, however, receive proceeds upon the exercise of the stock options by those who receive options under the Plan and exercise such options for cash. Any cash proceeds will be used by us for general corporate purposes. |

| |

|

|

| Risk Factors: |

|

The securities offered hereby involve a high degree of risk. See “Risk Factors.” |

| |

|

|

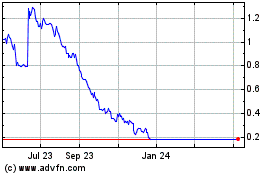

| Nasdaq Capital Market trading symbol: |

|

BWV |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We

are “incorporating by reference” in this prospectus certain documents we file with the Commission, which means that we can

disclose important information to you by referring you to those documents. The information in the documents incorporated by reference

is considered to be part of this prospectus. Statements contained in documents that we file with the Commission and that are incorporated

by reference in this prospectus will automatically update and supersede information contained in this prospectus, including information

in previously filed documents or reports that have been incorporated by reference in this prospectus, to the extent the new information

differs from or is inconsistent with the old information. We have filed or may file the following documents with the Commission and they

are incorporated herein by reference as of their respective dates of filing.

| |

(i) |

our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 as filed with the SEC on March 31, 2022; |

| |

|

|

| (ii) | our Quarterly Report on Form 10-Q for the quarter ended March

31, 2022 as filed with the SEC on May 13, 2022; our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 as filed with the

SEC on August 15, 2022; and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2022 as filed with the SEC on November

14, 2022 ; |

| | | |

| |

(iii) |

our Current Report on Form 8-K/A dated March 4, 2022, our Current Report

on Form 8-K dated March 22, 2022; our Current Report on Form 8-K dated April 19, 2022; our Current Report on Form 8-K dated April 20,

2022; our Current Report on Form 8-K dated April 20, 2022; our Current Report on Form 8-K dated April 21, 2022; our Current Report on

Form 8-K dated May 25, 2022; our Current Report on Form 8-K dated June 1, 2022; our Current Report on Form 8-K dated June 24, 2022; our

Current Report on Form 8-K dated June 30, 2022; our Current Report on Form 8-K dated July 25, 2022; our Current Report on Form 8-K dated

August 11, 2022; our Current Report on Form 8-K dated August 22, 2022; our Current Report on Form 8-K dated September 12, 2022; our Current

Report on Form 8-K dated October 11, 2022; our Current Report on Form 8-K dated October 12, 2022; our Current Report on Form 8-K dated

November 8, 2022; and our Current Report on Form 8-K dated November 10, 2022. |

| |

|

|

| |

(iv) |

the description of our securities registered under Section 12 of the Exchange Act as filed as Exhibit 4.2 on Annual Report on Form 10-K for the year ended December 31, 2021 as filed with the SEC on March 31, 2022. |

All documents that we file

with the Commission pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date of this prospectus that

indicates that all securities offered under this prospectus have been sold, or that deregisters all securities then remaining unsold,

will be deemed to be incorporated in this prospectus by reference and to be a part hereof from the date of filing of such documents.

Any statement contained in

a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed modified, superseded or replaced

for purposes of this prospectus to the extent that a statement contained in this prospectus, or in any subsequently filed document that

also is deemed to be incorporated by reference in this prospectus, modifies, supersedes or replaces such statement. Any statement so modified,

superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a part of this prospectus. None

of the information that we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K or any corresponding information, either

furnished under Item 9.01 or included as an exhibit therein, that we may from time to time furnish to the Commission will be incorporated

by reference into, or otherwise included in, this prospectus, except as otherwise expressly set forth in the relevant document. Subject

to the foregoing, all information appearing in this prospectus is qualified in its entirety by the information appearing in the documents

incorporated by reference.

You may request, orally or in writing, a copy of these documents, which

will be provided to you at no cost (other than exhibits, unless such exhibits are specifically incorporated by reference), by contacting

Erin Henderson, c/o Blue Water Vaccines Inc., at 201 E. Fifth Street, Suite 1900, Cincinnati, OH 45202. Our telephone number is (513)

620-4101. Information about us is also available at our website at http://www.bluewatervaccines.com. However, the information on our website

is not a part of this prospectus and is not incorporated by reference.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

AND INDUSTRY AND MARKET DATA

Special Note Regarding Forward-Looking Statements

This prospectus contains forward-looking statements

that involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections titled “Prospectus

Summary,” “Risk Factors” and “The Company,” but are also contained elsewhere in this prospectus. In some

cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,”

“would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,”

“believe,” “estimate,” “predict,” “project,” “potential,” “continue”

and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future,

although not all forward-looking statements contain these words. These statements relate to future events or our future financial performance

or condition and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity,

performance or achievement to differ materially from those expressed or implied by these forward-looking statements. These forward-looking

statements include, but are not limited to, statements about:

| ● | our projected financial position and estimated cash burn

rate; |

| ● | our estimates regarding expenses, future revenues and capital

requirements; |

| ● | our ability to continue as a going concern; |

| ● | our need to raise substantial additional capital to fund

our operation; |

| ● | the success, cost and timing of our clinical trials; |

| ● | our dependence on third parties in the conduct of our clinical

trials; |

| ● | our ability to obtain the necessary regulatory approvals

to market and commercialize our product candidates; |

| ● | the ultimate impact of the ongoing COVID-19 pandemic, or

any other health epidemic, on our business, our clinical trials, our research programs, healthcare systems or the global economy as a

whole; |

| ● | the potential that results of pre-clinical and clinical trials

indicate our current product candidates or any future product candidates we may seek to develop are unsafe or ineffective; |

| ● | the results of market research conducted by us or others; |

| ● | our ability to obtain and maintain intellectual property

protection for our current product candidates; |

| ● | our ability to protect our intellectual property rights and

the potential for us to incur substantial costs from lawsuits to enforce or protect our intellectual property rights; |

| ● | the possibility that a third party may claim we or our third-party

licensors have infringed, misappropriated or otherwise violated their intellectual property rights and that we may incur substantial

costs and be required to devote substantial time defending against claims against us; |

| ● | our reliance on third parties; |

| ● | the success of competing therapies and products that are

or become available; |

| ● | our ability to expand our organization to accommodate potential

growth and our ability to retain and attract key personnel; |

| ● | the potential for us to incur substantial costs resulting

from product liability lawsuits against us and the potential for these product liability lawsuits to cause us to limit our commercialization

of our product candidates; |

| ● | market acceptance of our product candidates, the size and

growth of the potential markets for our current product candidates and any future product candidates we may seek to develop, and our

ability to serve those markets; and |

| ● | the successful development of our commercialization capabilities,

including sales and marketing capabilities. |

These forward-looking statements are subject to

a number of risks, uncertainties and assumptions, including those described in “Risk Factors.” Moreover, we operate in a very

competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all

risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties

and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ

materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements

as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking

statements will be achieved or occur. Moreover, except as required by law, neither we nor any other person assumes responsibility for

the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements

for any reason after the date of this prospectus to conform these statements to actual results or to changes in our expectations.

You should read this prospectus and the documents

that we reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus forms

a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially

different from what we expect.

THE COMPANY

Overview

We are a biotechnology company focused on the

research and development of transformational vaccines to prevent infectious diseases worldwide. Our versatile vaccine platform has unique

molecular properties that enables delivery of various antigens, which can be utilized to develop singular or multi-targeted vaccines.

Our lead influenza (flu) vaccine program uses proprietary technology to identify specific epitopes, or proteins, with cross-reactive properties

that enables the potential development of a universal flu vaccine. We are focused on developing novel vaccines that induce durable and

long-term immunity. We believe that our pipeline and vaccine platform are synergistic for developing next generation preventive vaccines

to improve both health outcomes and quality of life globally.

Our pipeline includes novel vaccine candidates exclusively

licensed from renowned research institutions. We seek to develop vaccines that provide long-lasting immunity to harmful viral and bacterial

pathogens that cause infections in patient populations with high unmet needs. Our exclusive license agreements include patented influenza

epitopes of limited variability, or ELV, identified through a proprietary computational research and discovery process, discovered by

Dr. Sunetra Gupta and her team at the University of Oxford. Our collaborators are pioneers in vaccine discovery and development.

We are exploring the development of these influenza ELV’s utilizing our Norovirus shell and protrusion (S&P) nanoparticle vaccine

platform licensed from Cincinnati Children’s Hospital Medical Center, or CHMC. We are also utilizing our platform to develop

a vaccine for the prevention of gastroenteritis cause by both norovirus and rotavirus. We are also utilizing this platform to assess the

potential to create a novel monkeypox vaccine candidate. Our exclusively licensed S. pneumoniae vaccine candidate is from St. Jude Children’s

Research Hospital. The vaccine is designed to prevent harmful middle-ear infections in children and is being developed for intranasal

delivery well suited for pediatric patients. We are also exploring the potential for this vaccine candidate to protect individuals, particularly

elderly individuals, against pneumococcal pneumonia. We leverage the expertise of our collaborators to pursue the discovery and development

of vaccines for these diseases, which are high unmet needs globally.

In addition, we have expertise in identifying

business development opportunities for our platform vaccines technologies and portfolio. This allows for both internal pipeline expansion

and the ability to generate non-dilutive revenue from potential licensing partners to utilize our discovery engine vaccine platform. There

is potential for adjunctive or next generation therapeutic exploration to enhance current standard of care options.

Vaccination has been used as an effective method

of protecting individuals against harmful diseases by utilizing the body’s natural defense system to develop resistance or immunity

to infections (World Health Organization, https://www.who.int/news-room/q-a-detail/herd-immunity-lockdowns-and-covid-19). The body’s

immune system naturally creates antibodies and cell — mediated immunity to defend against foreign pathogens. Vaccines

introduce or present these foreign pathogens, prompting the body’s immune system produce a response protective against the pathogen

without exposing the body to the relevant lethal or harmful infection (World Health Organization, https://www.who.int/news-room/q-a-detail/herd-immunity-lockdowns-and-covid-19).

While vaccines are generally able to provide resistance against disease, many infectious diseases can evolve or mutate leading to shortcomings

of traditional vaccines, such as yearly reformulations. We believe our vaccine candidates can provide an alternative to the current standards

of care by harnessing durable and long-lived immune response to specific or multiple antigens.

The global vaccine market has recently experienced

significant growth caused by rising awareness of the importance of immunization and vaccination benefits in emerging markets as well as

by projects to fuel further global market expansion. For instance, The World Health Organization (WHO) has undertaken initiatives to increase

immunization awareness through its Global Vaccine Action Plan and Global Immunization Vision and Strategy.

As such, market research professionals project

the global vaccine market size to reach $73.78 billion by 2028, representing a CAGR of 7.3% over the forecast period, driven by rising

prevalence of infectious diseases, increasing government funding for vaccine production and growing emphasis on becoming immunized.

This market acceleration has been coupled with

various strategic transactions in the sector, including consolidations and mergers and acquisitions in recent years. Major market

participants have strategically acquired start-ups and mid-sized companies to broaden their products portfolios and service offerings.

For instance, in February 2019, Bharat Biotech acquired Chiron Behring Vaccines, one of the leading manufacturers of rabies vaccines

across the globe. Additionally, in October 2018, Emergent BioSolutions, a multinational specialty biopharmaceutical company, acquired

PaxVax for $270 million, and in July 2017 Sanofi acquired Protein Sciences for $650 million. The appetite of these companies

to buttress their vaccine programs and pipelines reflects the increasing importance of vaccines in the healthcare sector, both nationally

and worldwide.

The U.S. Centers for Disease Control, or

CDC, its Advisory Committee on Immunization Practices, or ACIP, and similar international advisory bodies develop vaccine recommendations

for both children and adults. New pediatric vaccines that receive ACIP preferred recommendations are almost universally adopted, and adult

vaccines that receive a preferred recommendation are widely adopted. We believe that our vaccine candidates will be well-positioned to

obtain these preferred recommendations, by virtue of their longer and more durable immunity, which could drive rapid and significant market

adoption.

PIPELINE

Our vaccine candidates are being developed in

a manner that is scalable, designed to be cost-effective and provide long term benefit to patients from infectious agents.

The FDA regulatory approval process is lengthy and

time-consuming, and we may experience significant delays in the clinical development and regulatory approval of our vaccine candidates.

Our vaccine candidates are in early stages of development and may fail

in development or suffer delays that materially and adversely affect their commercial viability. We may be unable to complete development

of or commercialize our vaccine candidates or experience significant delays in doing so due to regulatory or other uncertainties.

Strategy

We aim to identify, discover and develop novel

preventive vaccines for infectious diseases. Key elements of our strategy include:

| ● | Investment in advancing the development of our novel vaccine

pipeline programs through IND-enabling activities and Phase I clinical studies. |

| ● | We plan to advance

our main vaccine programs: influenza, S. pneumoniae induced AOM and pneumococcal pneumonia,

norovirus-rotavirus, and norovirus-malaria. |

| ● | Our in-licensed vaccine candidates are carefully selected

based on the following criteria: area of significant unmet medical need for preventive long-term vaccine; strong scientific rationale

and established clinical and regulatory pathways; defined competitive landscape and potential future commercial opportunity; and license

exclusivity. |

| ● | Prioritizing the research and development for our lead

influenza vaccine candidates, BWV-101 and BWV-102 through Phase I. |

| ● | Our goal is to develop a universal influenza vaccine that

protects against all strains of influenza, including pandemic strains. In collaboration with The University of Oxford and CHMC, we are

evaluating vaccine candidates to pursue the best development path forward to stimulate durable and broad-spectrum immunogenicity. |

| ● | We will leverage the pre-clinical and clinical experience

we gain from the development of BWV-102 to accelerate the development of the BWV-101 program. We expect that the manufacturing and clinical

data collected will provide invaluable insight for development of the universal vaccine candidate. |

| ● | Maximize and utilize the value of our collaborators and

third-party vendors. |

| ● | We will combine disciplined business strategies to further

expand the potential synergies with current collaborators. |

| ● | Deploy and expand our proprietary norovirus S&P nanoparticle

platform. |

| ● | Our immunogenic multi-purpose vaccine platform technologies

can be utilized with an array of infectious disease agents to access multiple development pathways and allow for potential next-generation

life cycle management to expand our pipeline and pursue business development opportunities. There is potential for the platform to pursue

adjunctive therapies to currently available drugs, and for current therapies to be re-optimized and formulated to protect against multiple

antigens. |

Management and History

Blue Water Vaccines Inc. was founded in October 2018

by our Chief Executive Officer, or CEO, Joseph Hernandez, with the initial goal of developing a transformational universal flu vaccine

to treat and prevent infections in patients globally. Our initial technology, licensed from the University of Oxford, provides a novel

approach to developing a universal influenza vaccine. Subsequently, our team has identified other program candidates and technologies

to broaden and diversify our vaccine pipeline.

Mr. Hernandez, our Chairman and CEO, is a veteran

entrepreneur, philanthropist, and operator with a broad skillset of founding, building, and selling companies, as well as executing business

development transactions and securing private and public capital, including Digene, Noachis Terra and Blue Water Acquisition Corp. Mr.

Hernandez was responsible for our initial $7 million seed funding round from investors including CincyTech. In addition to his position

as our Chairman and CEO, Mr. Hernandez also served on the board of directors for Clarus Therapeutics, Inc. (Nasdaq: CRXT) until August

2022, and serves on the board of certain other private companies. Subsequently, a team of veteran industry executives and advisors were

assembled, bringing valuable expertise to our growing infectious disease company.

Jon Garfield, our Chief Financial Officer, has over

20 years of financial leadership experience, including with healthcare companies. Mr. Garfield regularly provides consulting

services to private equity funds and privately held companies and has served as the CEO of Unity MSK since February 2021, and served

as interim Chief Financial Officer of Blue Water Vaccines Inc. from September 2021 until the consummation of our initial public offering

in February 2022, upon which he became our full-time Chief Financial Officer. Erin Henderson, who serves as our Chief Business Officer

and Corporate Secretary, has over 20 years of leading strategic transactions, governmental and stakeholder relations and corporate

expansion. Previously, since 2010 she was the Managing Principal at The Aetos Group, a management consulting firm serving both the public

and private sectors. Andrew Skibo is our Head of Biologic Operations and was recently Head of Global Biologics Operations at MedImmune/AstraZeneca

and previously worked for Amgen and Genentech (now Roche), where he was responsible for operations, engineering, construction, and validation

for large-scale capital projects related to bio-pharmaceutical manufacturing. Ronald Cobb, Ph.D., our Head of Science and Discovery, was

recently Chief Scientific Officer at Ology Bioservices (formerly Nanotherapeutics) and previously worked for RTI Biologics and Berlex

Biosciences. Brian Price, Ph.D., our Head of Technology Strategy, brings over 20 years of successful product development experience

and business development growth based on programs in toxicology, analytics, and therapeutic and vaccine development.

Additionally, members of our Board of Directors have extensive expertise

in the fields of life sciences, business, and finance. In addition to Mr. Hernandez, our directors include Kimberly Murphy, former VP,

Commercialization Leader, influenza at GlaxoSmithKline, President, CEO and Director of Oragenics, Inc. (Nasdaq: OGEN) and former Chair

of Clarus Therapeutics (Nasdaq: CRXT), Simon Tarsh, a retired Deloitte Consulting Managing Director with experience in Life Sciences,

James Sapirstein, R.Ph., M.B.A, President, CEO and Chairman of First Wave BioPharma, Inc. (Nasdaq:FWBI), and Vuk Jeremić, previous

Chair of the Council of Europe’s Committee of Ministers and previous President of the United Nations General Assembly. Our Scientific

Advisory Board includes Sunetra Gupta, Ph.D., Professor of Theoretical Epidemiology at The University of Oxford, a leading voice in infectious

disease globally; and John Rice, Ph.D., Managing Director at CincyTech, with more than 30 years of biotechnology advising experience.

Subject to certain non-compete restrictions, our

chief executive officer, Joseph Hernandez, and other key personnel may pursue other business or investment ventures while employed with

us. Accordingly, they may have conflicts of interest in allocating time among various business activities and potentially competitive

fiduciary and pecuniary interests that conflict with our interests. See “Risk Factors — Our Chief Executive Officer,

Joseph Hernandez and our Chief Financial Officer, Jon Garfield, hold certain management positions and directorships of other companies

and may allocate their time to such other businesses, which may cause conflicts of interest in their determination as to how much time

to devote to our affairs and potentially competitive fiduciary and pecuniary interests that conflict with our interests.” Any such

additional business activities or ventures may present conflicts to our interests. We do not believe that any such potential conflicts

would materially affect our ability to conduct our operations.

Our Vaccine Platform

BWV Norovirus (NoV) S&P Nanoparticle Versatile Vaccine Platform

Bioengineering the shell (S) and protruding

(P) domains of the norovirus capsid protein, polyvalent nanoparticles and polymers/oligomers provide a versatile vaccine platform

with wide applications

Our Approach to Stimulating the Immune System

for Infectious Disease Protection

Our S&P platform was co-invented by two researchers,

Xi Jason Jiang, Ph.D., and Ming Tan, Ph.D., of the Division of Infectious Disease at the Cincinnati Children’s Hospital Medical

Center. The pre-clinical research conducted at CHMC provided encouraging data that supports further investigation and development of the

platform for our vaccine candidates. The S&P platform combines two or more immunogenic components, a norovirus antigen plus at least

one additional antigen, together creating novel constructs. The norovirus nanoparticle enhances immunogenicity of the inserted antigen.

The S & P particles themselves also act as antigens, and are large enough to trigger an immune response to a foreign substance.

By combining the norovirus nanoparticle with one or more antigens from other infectious disease(s), the immune system is stimulated to

create antibodies to both the norovirus and the additional antigen(s).

Key Elements of our Platform

We are leveraging our disruptive norovirus nanoparticle

platform to develop novel, broad-spectrum vaccines for adult and child infectious disease prevention by taking advantage of:

| ● | Flexible and Scalable discovery platform engine. We believe we are able to design and create

novel vaccines that are stable and scalable for broad spectrum prophylactics. Through this platform’s adaptability, we may

opportunistically expand our pipeline and potentially collaborate with third parties for additional vaccines, as well as

therapeutics. |

| ● | Cost-effective and Rapid Production of Novel Vaccines. We are potentially

able to reduce the cost and time to manufacture a vaccine candidate by utilizing an E.coli expression platform, compared to

traditional vaccine production which uses other, longer production-time platforms, such as Chinese Hamster Ovary (CHO) cells. We

have bioengineered these nanoparticles to be stable and effective, as determined through animal immunogenicity studies, using E.coli expression

which may provide cost savings and efficiency compared to other VLPs needing a eukaryotic expression system (Pharmaceutics 2019, 11,

472; doi:10.3390/pharmaceutics11090472). |

| ● | Multi-antigen and Pathogen Capabilities. One

of the key features of our platform is its ability to carry multiple antigens at a time, thereby creating a multi-targeted vaccine. It

also provides the opportunity to develop vaccines for protection against not only viral pathogens, but also bacterial and potentially

parasitic and fungal pathogens. |

| ● | Therapeutic potential. We believe our platform may offer opportunities to develop

non-infectious disease therapeutic products, for example being used as a carrier or vehicle to transport drugs to specific target

locations. |

Viral capsid proteins are responsible for many

basic functions necessary for viral life cycles, such as viral attachment and entry, and thus can elicit neutralizing antibodies against

viral infection after immunization to humans and animals. Consequently, viral capsid proteins are promising vaccine targets against viral

infection. Indeed, various capsid protein nanoparticles and complexes have been developed and used as nonreplicating subunit vaccines

to combat various infectious diseases.

Unlike traditional live-attenuated and inactivated

virus vaccines that need cultivation of infectious virions and are associated with certain safety concerns, the nonreplicating VLP vaccines

derived from bioengineered viral capsid proteins do not involve an infectious agent and, therefore, may be safer and have lower manufacturing

costs than traditional vaccines. Thus, VLP vaccines represent a next generation of innovative vaccine strategy.

Structure

| ● | The NoV (VP1) capsid structure consists of two major domains:

(i) a N-terminal shell (S) domain and (ii) a C-terminal protruding (P) domain. The S domain builds the interior shell of the

capsid and the P domain forms the dimeric protrusions of the capsid. |

| ● | The protrusions (P) of norovirus capsid interact with

viral glycan receptors for attachment to host cells to initiate an infection. |

| ● | The S domain interacts homotypically and drives self-formation

of an approximately 60 nm VLP. |

| ● | The P domain exhibits homotypic interactions, forming a 24

nm VLP with dimeric protrusions for stabilization of the viral capsid. Additionally, it can also form oligomers or polymers. |

Figure 1. Lineage structures of norovirus

capsid protein or viral protein 1 (VP1) and various nanoparticles derived from full-length or truncated VP1. The N-terminal shell (S) (green)

and the C-terminal protruding (P) (dark blue) domains with a short flexible hinge (light blue) in between (with amino acid numbers

based on GI.1 Norwalk virus VP1) are shown. (A) Production of full-length norovirus VP1s via a eukaryotic expression system self-assembles

into virus-like particles (VLPs). (B) Production of the S or P domain via the Escherichia coli expression system self-assembles

into S or P nanoparticles.

Due to the homotypic interaction attributed to

the norovirus capsid domains, researchers at CHMC, through bioengineering, designed and generated two subviral nanoparticles, the 24-valent

P24 and the 60-valent S60 nanoparticles, and P-derived polymers to serve as a multifunctional vaccine platform against

different pathogens and illnesses.

| ● | These nanoparticles and polymers are easily produced, highly

stable, and extremely immunogenic which we believe makes them compelling platforms to serve to display foreign antigens, self-assembling

into chimeric nanoparticles or polymers as vaccine candidates. |

| ● | There are several preclinical studies that showed P24/S60

chimeric vaccine candidates that can display different foreign antigens and epitopes, as set forth below in Tables 1 and 2. Therefore,

there may be additional candidates to further explore as human vaccines. (Xia et al. ACS Nano 2018, 12, 10665−10682). |

| ● | Such VLPs and capsid-like nanoparticles may be excellent

vaccine candidates against corresponding viral pathogens because they can retain arrays of antigenic epitopes that faithfully mimic those

of the native virions, and these repeated viral antigens and epitopes stimulate strong immune responses in their animal and human hosts.

In addition, such highly immunogenic subviral nanoparticles may also serve as versatile platforms that are able to display foreign antigens

for improved immune responses to facilitate development of novel vaccines against various pathogens and diseases. |

| ● | The fact that the P24 VLP nanoparticles and polymers

are composed of authentic norovirus antigens and retain norovirus-specific molecular patterns make it an excellent vaccine candidate

against the norovirus. |

| ● | In addition, the natures of self-formation, high stability,

polyvalence, and high immunogenicity, as evidenced by animal studies conducted in gnotobiotic pig models and mouse models, results included

herein, of the nanoparticles and polymers make them strong vaccine candidate platforms to display foreign antigens, resulting in chimeric

nanoparticles as vaccine candidates against further pathogens and diseases. |

Our multifunctional vaccine platform is a robust

discovery engine and has broad application using both S60 and P24 nanoparticles to target multiple pathogens and

illnesses.

The P24 nanoparticle has also been

used to display multiple viral epitopes for enhanced immunogenicity for novel subunit vaccine development, see Table 1 below. These include

the M2e epitope of the matrix 2 (M2) protein and the HA2 protein B cell epitope of influenza viruses, the B cell epitope of VP3 of enterovirus

71 (EV71), the 4E10 and 10E8 epitopes of human immunodeficiency virus type 1 (HIV-1), among others.

Table 1. Summary of norovirus nanoparticles and polymers as vaccine

candidates and platforms to display foreign antigens and epitopes.

| Nanoparticle/ Polymer |

|

Antigen/Epitope to be Displayed (Pathogen) |

|

Chimeric Products as

Vaccine Candidate |

|

Immunity against

Pathogens or Diseases |

| S60 |

|

VP8* (rotavirus) |

|

S60 – VP8* |

|

Rotavirus |

| P24 |

|

P domain (norovirus) |

|

P24 |

|

Norovirus |

| P24 |

|

VP8* (rotavirus) |

|

P24 – VP8* |

|

Rotavirus and norovirus |

| P24 |

|

M2e (influenza virus) |

|

P24 – M2e |

|

Influenza virus |

| P24 |

|

HA2 B cell epitope

(influenza virus) |

|

Trivalent HA2-PP (P24-HA2:90-105) |

|

Influenza A virus and influenza B virus |

| P24 |

|

VP3 B cell epitope (EV71) |

|

PP-71-6 (P24-71-6) |

|

EV71 |

| P24 |

|

4E10/10E8 epitopes (HIV-1) |

|

4E10-PP/10E8-PP |

|

HIV-1 |

| P24 |

|

Amyloid-beta, Aβ |

|

PP-3copy-Aβ1-6 |

|

Alzheimer’s disease |

| P polymer |

|

P domains (noroviruses) |

|

NoV PGI-NoV PGII

GST NoV P+ |

|

Different noroviruses |

| P polymer |

|

P domain (HEV) |

|

NoV P-HEV P |

|

Norovirus and HEV |

| P polymer |

|

P domain (astrovirus) P domain (HEV) |

|

Ast P-HEV P-NoV P |

|

Norovirus, astrovirus,

and HEV |

| P polymer |

|

P domain (astrovirus) P domain (HEV)

VP8* (rotavirus) |

|

Ast P-HEV P-VP8* |

|

Rotavirus, astrovirus,

and HEV |

Note: EV71, enterovirus 71; HIV-1, human immunodeficiency virus type

1; HEV, hepatitis E virus; Ast, astrovirus, NoV, norovirus, P, protruding domain; P+, the P domain with an end-linked cysteine-containing

peptide that can self-assemble into oligomers; PP, P particle; GI, norovirus genogroup I; GII, norovirus genogroup II. Please

see the main text for details.

The S60 Nanoparticle as a Multifunctional vaccine platform

Recent technology has generated S nanoparticles

using an E. coli system with stabilized expression and self-assembly. The S nanoparticles feature exposed C-terminal flexible hinge

sites that offer ideal fusion sites for displaying foreign antigens.

Researchers at CHMC have developed a technology

to produce uniform 60-valent NoV S60 nanoparticles with high efficiency using a simple bacterial expression system. This was

achieved by taking advantage of the homotypic interactions of the NoVVP1 S domain that naturally builds the interior shells of NoV capsids,

as well as several modifications to stabilize the S domain proteins and enhance the inter-S domain interactions, respectively. Specifically,

we introduced an R69A mutation to destruct the exposed protease cleavage sites on the surface of the native shell that otherwise leads

to easy degradation of the S proteins. In addition, we introduced triple (V57C/Q58C/S136’C) cysteine mutations to establish inter-S

domain disulfide bonds between two pairs of sterically close residues that belong to two neighboring S domains. This led to significantly

enhanced stability and yields of the self-assembled S60 nanoparticles produced by the simple E. coli system. The below

bullets are supported by published data by Ming Tan, the co-inventor of the S&P platform, and his research team at CHMC.

| ● | An important feature of our technology was to rationally

introduce intermolecular disulfide bonds to stabilize the S60 nanoparticles. This approach could also be used to stabilize

other viral protein particles or complexes. |

| ● | The 60 freely exposed C-termini are a key feature facilitating

the S60 nanoparticle to be a useful vaccine platform. Foreign antigens or epitopes can simply be fused to the end of the S

domain via flexible linker through recombinant DNA technology. |

| ● | Uniform 60-valent NoV VLPs or S particles produced in a bacterial

expression system have not been produced before. |

| ● | Importantly, our S60 nanoparticles maintained

the native conformation with authentic antigenicity; thus, our NoV S60 nanoparticle technology represents a significant bioengineering

advancement as uniform 60-valent NoV VLP or S particle via an expression system have never been produced before (Xia et al. ACS

Nano 2018, 12, 10665−10682). |

| ● | Uniform complexity and size of vaccine particles are important

factors in quality control of vaccine products, as variations in complexity and size will result in variations in immunization outcomes

of the vaccines. |

Broad application to fuse several antigens to the S60

nanoparticle based on multiple studies shown below conducted by CHMC (Xia et al. ACS Nano 2018, 12, 10665−10682)

CHMC has been able to fuse several antigens to

the S60 nanoparticle to the same exposed S domain C-terminus via the same linker. These included (1) the rotavirus (RV)

surface spike protein VP8*; (2) the HA1 antigen or receptor-binding domain (RBD) (223 amino acids) of the hemagglutinin (HA)

of anH7N9 influenza A virus; (2) the TSR antigen (67 amino acids) of the circumsporozoite surface protein (CSP) of the malaria

parasite Plasmodium falciparum; (3) the protruding domain antigen (187 amino acids) of a hepatitis E virus; (4) a longer

version of the RV VP8*antigen (231 amino acids); and (5) the VP8*antigen (159 amino acids) of the murine RV (mRV) EDIM

strain (Table 1). Particle formations of these fusion proteins have been shown by gel-filtration and/or EM (Table1). In addition, they

have shown that the S60nanoparticle-displayed HA1 and mRV VP8*antigens elicited significantly higher HA1- and mRV VP8*-specific

antibody titers, respectively, than those elicited by the free HA1 or mRV VP8*antigens (Table 2).

Table 2. List of Antigens That Have Been Displayed by the S60

Nanoparticles

| epitope/antigen |

|

size

(residue) |

|

|

yield (mg/L

bacteria culture) |

|

S60 – antigen

particle

formation |

|

significant

immune

enhancement

in micef |

| RV VP8* antigen |

|

|

159 |

|

|

~40 |

|

yes |

|

yes |

| HA1 antigena |

|

|

223 |

|

|

~10 |

|

yes |

|

yes |

| TSR/CSP antigenb |

|

|

67 |

|

|

~10 |

|

yes |

|

ND |

| full RV VP8* antigenc |

|

|

231 |

|

|

~20 |

|

yes |

|

ND |

| murine RV VP8* antigend |

|

|

159 |

|

|

~5 |

|

yes |

|

yes |

| HEV protruding domain antigene |

|

|

187 |

|

|

~10 |

|

yes |

|

ND |

| a |

HA1 antigen containing the receptor binding site is the head portion of the hemagglutinin (HA) of H7N9 influenza A virus. |

| b |

TSR/CSP antigen is the C-terminal portion of the major surface protein of acircumsporozoite (CSP) that plays a key role in host cell invasion of the malaria parasite Plasmodium falciparum. |

| c |

Full RV VP8*antigen is the full-length VP8*domain of the spike protein of a human P[8] rotavirus. |

| d |

Murine RV VP8*antigen is the core portion of the VP8*protein constituting the head of the spike protein of a murine rotavirus EDIM strain. |

| e |

HEV protruding domain antigen is part of the protruding domain of a hepatitis E virus capsid. |

| f |

Immune enhancements of the S60 nanoparticle-displayed antigens were measured in mice using free monomeric antigens as control for comparisons. “ND” = not determined. |

S60 nanoparticles may serve as a polyvalent vaccine platform

(Xia et al. ACS Nano 2018, 12, 10665−10682)

| ● | We believe the self-assembled, polyvalent S60

nanoparticle with 60 flexibly exposed S domain C-termini is an ideal vaccine platform for antigen presentation and immunogenicity enhancement. |

| ● | This has been supported by studies showing that when Hisx6

tag was fused to the hinge of the S domain via a linker, fusion proteins self-formed into the S60 nanoparticles. |

| ● | This has also been demonstrated by constructing a chimeric,

and reconfirmed by cyroEM density map, S60 nanoparticle displaying 60 RV (rotavirus) VP8* proteins, the major rotavirus neutralizing

antigen. The S60 -VP8*particles can be easily produced with high stability. The chimeric nanoparticle induced higher

immunoglobulin, or IgG, response in mice (n=6) toward the displayed VP8*antigen than soluble VP8* antigen. Mouse sera experiments were

completed analyzing vaccinated versus the control group to show neutralizing activity against RV infection. The statistical differences

between the groups are (*P < 0.05, **P < 0.01, ***P < 0.001) as shown below (Figure 2) (Xia et al. ACS Nano 2018, 12, 10665−10682). |

| ● | The RV surface spike protein, VP8* was tested for feasibility

of the S60 nanoparticle by the analysis using EM micrograph examination and ESI-MS analysis. S60-VP8*particles

exhibited stronger blockade in mice (n=6) sera after vaccination (P=0.0003) (Xia et al. ACS Nano 2018, 12, 10665−10682). |

| ● | The polyvalent B- and T-cell epitopes of the antigens on

the polyvalent VLP platform led to induction of stronger humoral and cellular immune responses, respectively, in animals and humans compared

with those elicited by the monovalent epitopes of the free antigen. Thus, the polyvalent VLP platform is likely to increase the immunogenicity

of the displayed antigens. Mouse sera experiments were completed analyzing vaccinated versus the control group to show neutralizing activity

against RV infection. The statistical differences between the groups are (*P < 0.05, **P < 0.01, ***P < 0.001) as shown below.

(Xia et al. ACS Nano 2018, 12, 10665−10682). |

Figure 2. S60-VP8*particles

enhanced immunogenicity toward the displayed RV VP8*antigens. The same dose/dosage of the S60-VP8*particles, free VP8*antigens,

and S60 nanoparticles without VP8*was given to mice (N=6), respectively, followed by measurements of theVP8*-specific IgG responses

(A), 50% blocking titers (BT50) against RV VP8*-glycan ligand interaction (B), and neutralization activity against RV infection/replication

in culture cells (C) of the resulting mouse antisera. (A) VP8*-specific IgG responses/titers elicited by theS60-VP8*particles,

free VP8*antigens, and the S60nanoparticles, respectively. (B) BT50against RV VP8*−ligand interactions by the mouse sera after

vaccination with the same three immunogens, respectively. (C) Neutralizing activity against RV infection/replication in culture cells

by mouse sera after immunization with the same three immunogens, respectively. In all these experiments mouse sera after immunization

with diluent (PBS) are used as negative controls.

The P24 Nanoparticle as a versatile platform (Tan et

al. Nanomedicine, 2012. 7.6,1-9)

The crystal structure of norovirus VLPs indicates

that P domain is involved in strong dimeric interactions forming dimeric protrusions on the viral surface. The oligomeric interactions

of the P domains are also observed at the five-fold axes to further stabilize the capsid structure. When the P domain protein was expressed

using the E. coli system, it self-assembled into P dimers, as well as 24 valent P nanoparticles, P24. P dimers

and P24 nanoparticles can exchange dynamically, depending on concentration of the P domain protein, indication that the assembled

P24 particles at this stage were unstable and easy to disassemble back into P dimers. To facilitate P24 nanoparticle

formation, inter-P domain disulfide bonds were introduced through fusion of a cysteine-containing peptide to the end of the P domain.

During the P24 nanoparticle assembly, the cysteine patches were brought to the center of the P24 nanoparticles,

resulting in sterically close contact and thus forming inter-P domain disulfide bonds that significantly stabilized the P24

nanoparticles, which could no longer disassemble back into the P dimers.

| ● | P24 nanoparticles can be produced using an E.

coli expression system faster and a lower cost than VLPs. |

| ● | Both VLP and P24 nanoparticles without adjuvant

produce innate, humoral, and cellular immunity. |