Applied Materials Flags 2020 as Memory's 'Recovery Year' After Posting Weak 3Q -- Update

August 15 2019 - 9:12PM

Dow Jones News

By Maria Armental

Semiconductor-equipment supplier Applied Materials Inc. (AMAT)

says 2020 could be a recovery year for the memory sector, albeit

one that shaped like a "U" implying a long, slow rebound.

"We don't see any big hockey sticks," Chief Executive Gary

Dickerson said in a conference call with analysts, referring to a

sudden, sharp recovery. "It's going go be a long journey."

Chief Financial Officer Dan Durn reiterated that while he can't

yet call the bottom of the cycle, early signs of improvement are

visible as inventories fall and prices stabilize.

Asked why he didn't feel comfortable saying that the cycle has

hit a turning point, Mr. Durn cited the geopolitical environment,

saying: "I just think it's prudent...to set expectations in a

modest way."

Based on what the executives are observing, the recovery will be

led by NAND flash, the memory chips used in most mobile devices,

followed by DRAM, or dynamic random-access memory, which is used in

desktop computers and servers.

Along with the cyclical downturn, the sector has experienced a

shift brought about by artificial intelligence, big-data analytics

and the so-called Internet of Things, which connects everyday

objects such as household appliances and automobiles to the

internet.

"At a time when improvements in power, performance, area and

cost are paramount, classic Moore's law scaling is running out of

gas," Mr. Dickerson said, referring to what for decades was the

golden rule for the electronics industry.

He said Applied is rearranging and boosting its business around

what it calls the sector's new play book, one that urges new

architecture, materials and manufacturing techniques, among other

things.

Last month, Applied disclosed plans to buy Japanese

semiconductor-equipment supplier Kokusai Electric Corp. from

investment group KKR & Co. (KKR).

Applied has long focused on single-wafer processing, while

Kokusai is a leader in batch-processing technology and is

especially strong in the memory market.

Late on Thursday, Applied posted sharply lower profit and

revenue in the July quarter and forecast another difficult period

this quarter.

Profit for the quarter ended July 28 dropped 44% to $571

million, or 61 cents a share. On an adjusted basis, profit fell to

74 cents a share from $1.04 a share in the same quarter a year

earlier.

Net sales fell 14% to $3.56 billion.

The company had projected 67 cents to 75 cents a share in

adjusted profit and about $3.53 billion in revenue, while analysts

surveyed by FactSet forecast 70 cents a share and $3.53

billion.

Gross profit margin narrowed to 43.7% from 44.8%.

For the first nine months of the year, profit narrowed 12% while

net sales slid 16%.

This quarter, Applied Materials projects adjusted profit of 72

cents to 80 cents a share and about $3.69 billion in revenue,

compared with analysts' expectations for 76 cents a share in

adjusted profit and $3.66 billion in revenue.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 15, 2019 20:57 ET (00:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

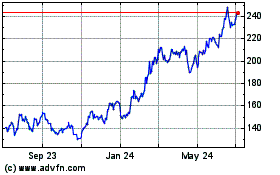

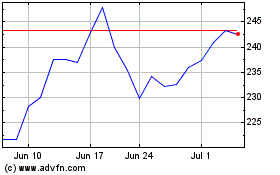

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024