Applied Materials Reports Lower 3Q Profit, Revenue, Gives Downbeat Forecast

August 15 2019 - 4:46PM

Dow Jones News

By Maria Armental

Semiconductor-equipment supplier Applied Materials Inc. (AMAT)

reported sharply lower profit and revenue in the latest period and

forecast another difficult period this quarter.

Third-quarter profit fell 44% to $571 million, or 61 cents a

share. On an adjusted basis, profit fell to 74 cents a share from

$1.04 a share a year earlier.

Net sales fell 14% to $3.56 billion.

The company had projected 67 cents to 75 cents a share in

adjusted profit and about $3.53 billion in revenue, while analysts

surveyed by FactSet projected 70 cents a share and $3.53 billion in

revenue.

This quarter, Applied Materials projects adjusted profit of 72

cents to 80 cents a share and about $3.69 billion in revenue,

compared with analysts' projected 76 cents a share in adjusted

profit and $3.66 billion in revenue.

Company officials have framed the challenges as short-term

growth pains as the sector moves away from the smartphones that

drove the majority of semiconductor capital investments in recent

years toward the artificial intelligence and big data that are

expected to fuel the sector's growth.

A memory cycle also has weighed on Applied Materials'

performance in recent quarters, but company officials said in May

when they reported second-quarter results that NAND pricing was

stabilizing and inventory levels were down from their peak, though

prices were still above normal levels.

DRAM, Chief Executive Gary Dickerson said at the time, wasn't as

far along in the correction cycle.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 15, 2019 16:31 ET (20:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

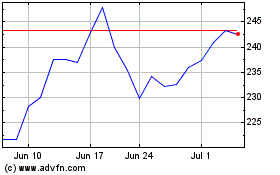

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

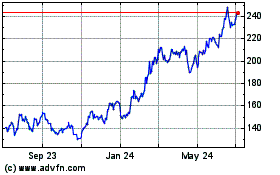

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024