MARKET MOVEMENTS:

-- Brent crude oil is up 0.6% at $80.02 a barrel.

-- European benchmark gas is up 3.4% to EUR47.35 a

megawatt-hour.

-- Gold futures are down 0.4% at $1,952.80 a troy ounce.

-- LME three-month copper futures are up 0.1% to $8,113 a metric

ton.

-- Wheat futures are down 1.3% to $5.85 a bushel.

TOP STORY:

The Electric-Car Era Needs a Lot of Really Big Trees

Electric cars. The solar build-out. Washington's rural-broadband

initiative. Utilities bracing the grid for stronger storms. They

all depend on the same thing: big trees.

The utility-pole business is booming, thanks to a flood of

public and private infrastructure spending. So the hunt is on for

the tallest, straightest, knot-free conifers, which are peeled,

dried and pressure-treated at facilities such as Koppers Holdings '

pole plant in southeastern Georgia's pinelands.

Employees cruise surrounding pine plantations, marking

pole-worthy loblolly and longleaf and making offers. The bigger,

the better these days, given how much more equipment and cable

poles must hold in the era of fiber optics and electric cars, said

Jim Healey, Koppers' vice president of utility and industrial

products.

For landowners, especially the families and individuals who grow

much of the South's pine, the pole boom means higher prices for

standout trees than what sawmills pay.

OTHER STORIES:

Agricultural Giant Syngenta Delays $9 Bln IPO Amid Chinese

Market Volatility

Agricultural company Syngenta Group said its listing on

Shanghai's main market won't happen this year due to weak market

conditions, the latest delay in its yearslong pursuit of a

blockbuster initial public offering.

The Swiss company-which was acquired by Chinese state-owned

ChemChina for $43 billion in 2017-has been working on an IPO since

2021. The company is aiming to raise 65 billion Chinese yuan ($8.93

billion), which would have made it the biggest IPO globally this

year based on Dealogic data.

--

Qatar Pursues Oil Deal After Brokering End to Venezuela

Sanctions

For more than a year, Qatar quietly hosted talks between senior

U.S. and Venezuelan officials that led to a breakthrough last month

when Washington lifted sanctions on Venezuela's crippled energy

industry.

Now the tiny Arab state, and a Qatari conglomerate, are trying

to cash in.

Days after the Oct. 17 deal to lift sanctions was struck, a

private oil company owned by a Qatari magnate, Ghanim Bin Saad,

signed a preliminary agreement to restart an oil refinery and

terminal on the Dutch Caribbean island of Curacao, just 40 miles

from Venezuela's coast, the refinery and the company said. Island

officials have long said they hope to resume its once-lucrative

role of processing and shipping Venezuelan oil to Asia and other

international markets.

--

U.K. Hits Russian Gold, Oil Sectors With New Sanctions

Package

The U.K. government has sanctioned 29 entities and individuals

operating in and supporting Russia's gold and oil sectors, in an

effort to cut off revenue streams funding its war in Ukraine.

Entities sanctioned Wednesday include Nord Gold and Highland

Gold Mining, two of the largest producers of Russian gold, and

Paloma Precious DMCC, a United Arab Emirates-based network the U.K.

said has channeled more than $300 million in gold revenue to

Russia.

The U.K. government also sanctioned a Dubai-based unit of

Geneva-based Paramount Energy & Commodities, saying the

subsidiary was used by Russia to help mitigate the impact of

oil-related sanctions against the country.

Nord Gold and Paloma Precious didn't immediately respond to a

request for comment. Highland Gold Mining couldn't be reached for

comment.

--

The $2 Million Coal Mine That Might Hold a $37 Bln Treasure

Twelve years ago, former Wall Street banker Randall Atkins

bought an old coal mine outside Sheridan, Wyo., sight unseen, for

about $2 million.

He thought the mine might eke out a profit. Instead, Atkins

recently learned it could bring a windfall.

Several years after Atkins bought the Brook Mine, government

researchers came around asking if they could run some tests to see

if the ground contained something called "rare-earth elements."

When Atkins acquired the mine, he says he "didn't know the

difference between rare earths and rare coins." When he got the

test results, including some as recently as September, he says he

was surprised and humbled: His sleepy mine contains what might be

the largest so-called unconventional rare-earth deposit in the

U.S., according to government researchers.

At current market prices, it could be worth around $37

billion.

MARKET TALKS:

Palm Oil Closes Lower on Prospect of Lower China Demand

1016 GMT - Palm oil prices closed lower on expectations of a

slowdown in demand from China and ahead of export and production

data, AmInvestment Bank's head of futures broking Low York Hong

said. China's palm oil demand is likely to cool down with the onset

of the winter season's cold temperatures, which cause thetropical

oil to solidify. Investors are waiting for October demand and

supply data from the Malaysian Palm Oil Board due on Friday, with

some expecting a 12% increase in stock levels. The Bursa Malaysia

Derivatives contract for January delivery closed MYR24 lower at

MYR3,744 a ton. (jiahui.huang@wsj.com; @ivy_jiahuihuang)

--

ArcelorMittal's 3Q Earnings Beat Consensus, But Caution

Remains

0907 GMT - ArcelorMittal's third quarter Ebitda came ahead of

consensus, but the Luxembourg-based steelmaker's cash flow missed

Barclays' estimate, analysts say in a research note. At $50

million, free cash flow missed Barclays' estimate of $206 million

and is light compared with peers, Barclays says. The company

performed better than expected in Brazil, but missed expectations

in Europe due to weak volumes, Barclays says. It adds that it

remains "cautious and think[s] it is too early to get excited at

this stage of the cycle," as European demand continues to

deteriorate. Shares trade 1.3% lower to EUR21.04.

(pierre.bertrand@wsj.com)

--

Metals Slip Amid Demand Worries

0840 GMT - Metal prices are falling as a strong dollar and weak

demand adds pressure to commodities. Three-month copper is flat at

$8,109.50 a metric ton while aluminum is 0.7% lower at $2,247.50 a

ton. Gold meanwhile is down 0.4% to $1,951 a troy ounce. The ICE

dollar index is also up 0.6% this week so far. Deutsche Bank says

in a note that investors have become increasingly concerned about

economic demand, not least after several weaker-than-expected data

releases since the start of the month. It highlights several

falling commodity prices amid the weak demand including gold, which

is now down 2.2% this month. That said, lower commodity prices are

helping to push down inflation expectations--a boost for central

bankers, it adds. (yusuf.khan@wsj.com)

--

Crude Oil Steadies After Further Losses Wednesday

0830 GMT - Crude oil prices are steadying as worries over

fundamentals overshadow the risk presented by the Israel-Hamas war.

Brent crude and WTI are up 0.7% to $80.12 a barrel and $75.85 a

barrel, respectively. Both benchmarks had losses of more than 2%

late Wednesday, with Brent closing below $80 for the first time

since July. The relative price weakness is being driven by rising

supply rather than demand weakness, UBS says. U.S. and Brazilian

production are at record highs, while Iranian production is rising,

the Swiss bank says in a note. Still, the market is likely to

remain volatile, with the market undersupplied, UBS says. It

expects prices to recover to trade in a $90 to $100 a barrel range

amid falling oil inventories. (yusuf.khan@wsj.com)

--

Arabica Coffee Prices Expected to Fall as Global Output

Recovers

0441 GMT - Global arabica coffee prices will likely trend lower

during the remainder of 2023 amid recovering production in top

grower Brazil, says BMI, a unit of Fitch Solutions. However, lower

inventories and the El Nino weather event could support prices, it

says in a note. For 2023-24, BMI expects global coffee output to

rise 2.4% to 177.4 million bags and a smaller 1.9% increase in

consumption. The coffee surplus will likely reach 5 million bags,

higher than the USDA's forecast of 4.1 million bags. "We expect

that Brazilian coffee production will increase by almost 9.5%

between 2022/23 and 2026/27, approaching 70mn bags," BMI says. "It

is our view that Vietnam will see the largest increase in annual

output over the same period...followed by Uganda and Honduras."

(nicholas.bariyo@wsj.com; @Nicholasbariyo)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

November 09, 2023 07:33 ET (12:33 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

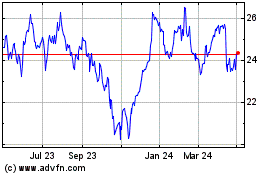

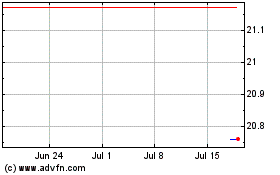

ArcelorMittal (EU:MT)

Historical Stock Chart

From Oct 2024 to Nov 2024

ArcelorMittal (EU:MT)

Historical Stock Chart

From Nov 2023 to Nov 2024