Bushveld Minerals Limited Issue of Equity and Total Voting Rights (2974B)

February 10 2022 - 4:24AM

UK Regulatory

TIDMBMN

RNS Number : 2974B

Bushveld Minerals Limited

10 February 2022

Market Abuse Regulation ("MAR") Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

10 February 2022

Bushveld Minerals Limited

("Bushveld Minerals" "Bushveld" or the "Company")

Issue of Equity and Total Voting Rights

Bushveld Minerals Limited (AIM: BMN), the AIM quoted, integrated

primary vanadium producer and energy storage solutions provider

with ownership of high-grade assets in South Africa, confirms that

in partial satisfaction of awards, which were granted under the

2020 Short-term Incentives ("STI") scheme, the Company is issuing a

total of 1,510,320 new ordinary shares of 1 pence each in the

Company ("Ordinary Shares") representing 50% of the Bonus Awards,

which vested 12 months after the 2020 award period, along with

Ordinary Shares that were awarded as a result of two thirds of the

cash component of the 2020 STI being settled in equity. The

Ordinary Shares are being issued to senior employees who are not

deemed persons discharging managerial responsibilities ("PDMRs").

This includes Lyndon Williams who is no longer deemed a PDMR.

The Company confirms that a further announcement will be made

once Ordinary Shares are issued to PDMRs in respect of awards

granted under the 2020 STI scheme (as announced on 6 August 2021)

once all vesting conditions have been met.

Admission to AIM and Total Voting Rights

Application will be made for admission of the combined 1,510,320

new Ordinary Shares to trading on AIM ("Admission"). It is expected

that Admission will take place on or around 15 February 2022.

Following Admission, there will be a total of 1,261,969,177

Ordinary Shares in issue, 670,000 of which are held in treasury.

Shareholders should use the figure of 1,261,299,177 as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in the voting rights of the Company, under the FCA's

Disclosure and Transparency Rules.

ENDS

Enquiries: info@bushveldminerals.com

Bushveld Minerals Limited +27 (0) 11 268 6555

Fortune Mojapelo, Chief Executive

Officer

Andrew Mari, Head of Investor

Relations

SP Angel Corporate Finance

LLP Nominated Adviser & Broker +44 (0) 20 3470 0470

Richard Morrison / Charlie

Bouverat

Grant Baker / Richard Parlons

Tavistock Financial PR

Gareth Tredway / Annabel

de Morgan / Tara Vivian-Neal +44 (0) 207 920 3150

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a low-cost, vertically integrated primary

vanadium producer. It is one of only three operating primary

vanadium producers, owning 2 of the world's 4 operating primary

vanadium processing facilities. In 2020, the Company produced more

than 3,600 mtV, representing approximately three per cent of the

global vanadium market. With a diversified vanadium product

portfolio serving the needs of the steel, energy and chemical

sectors, the Company participates in the entire vanadium value

chain through its two main pillars: Bushveld Vanadium, which mines

and processes vanadium ore; and Bushveld Energy, an energy storage

solutions provider. Bushveld Vanadium is targeting to materially

grow its vanadium production and achieve an annualised steady state

production run rate of between 5,000 mtVp.a. and 5,400 mtVp.a by

the end of 2022, from projects currently being implemented. Beyond

that, pre-feasibility studies are in progress to determine the

optimal path to increase production even further to a steady state

production run rate of between 6,400 mtVp.a. and 6,800 mtVp.a. in

the medium-term and to a steady state production run rate of 8,400

mtVp.a in the long term.

Bushveld Energy is focused on developing and promoting the role

of vanadium in the growing global energy storage market through the

advancement of vanadium-based energy storage systems, specifically

Vanadium Redox Flow Batteries ("VRFBs").

Detailed information on the Company and progress to date can be

accessed on the website www.bushveldminerals.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEANAEFFFAEEA

(END) Dow Jones Newswires

February 10, 2022 04:24 ET (09:24 GMT)

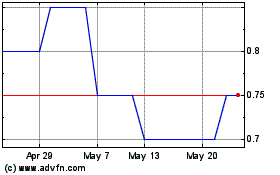

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From May 2024 to Jun 2024

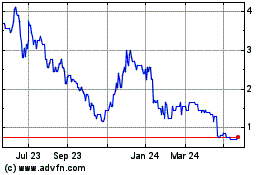

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Jun 2023 to Jun 2024