TIDMBMN

RNS Number : 6937V

Bushveld Minerals Limited

10 April 2019

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

10 April 2019

Bushveld Minerals Limited

("Bushveld Minerals" or the "Company")

Lemur Q1 Operational Update

Bushveld Minerals Limited (AIM: BMN), the AIM listed, integrated

primary vanadium producer, with ownership of high grade vanadium

assets in South Africa, is pleased to provide an operational update

in respect of Lemur Holdings Limited ("Lemur"), the Company's coal

and energy subsidiary that is developing an integrated thermal coal

mining and independent power project (the "Imaloto Project") in

Madagascar, for the quarter ended 31 March 2019.

Key Highlights

-- Lemur has signed a Project Preparation Finance ("PPF") facility agreement with the Development Bank of Southern

Africa ("DBSA") for an amount of US$1 million.

-- The facility will assist in funding the completion of the project development activities and advisory services

for the Imaloto Project, thereby enabling Lemur to reach financial close1.

-- Review and sign-off of the power bankable feasibility study ("BFS") has been completed by Sinohydro.

-- Review of opencast mine BFS completed. Optimisation exercise underway to consider the inclusion of underground

mining within the development plan.

-- Engineering, Procurement and Construction ("EPC") contract negotiations for the power plant are progressing.

-- Social and Environmental Impact Assessment ("SEIA") fieldwork ongoing and on track to be completed in Q2 CY2019.

-- Negotiations with potential lenders are progressing.

1. Financial close refers to the date on which Lemur secures

funding to implement the Imaloto Project pursuant to all finance

documents being entered into and all the conditions precedent being

fulfilled to the satisfaction of the funders.

Prince Nyati, CEO of Lemur Holdings Limited, commented:

"We are pleased that the Imaloto Project is progressing

according to plan. We are particularly delighted to receive support

from the DBSA. We believe that the funding will help us finalise

our objective of achieving financial close and providing reliable

base load power to southern Madagascar. DBSA participation in the

development of the Imaloto Project highlights the economic

potential of our project as well as the developmental benefits it

offers to southwestern Madagascar."

Details of DBSA Project Preparation Financing

According to the DBSA, the PPF has been created and is earmarked

for projects which the DBSA's financing divisions can include in

their pipeline. The funds are intended to be used for the

following:

-- Creating an environment for implementation of infrastructure projects in Southern Africa;

-- Conducting pre-feasibility studies;

-- Conducting bankable feasibility studies; and

-- Assisting with costs to reach financial close.

The funds are provided with the view that projects financed

through this stream will be funded through DBSA's lending

divisions.

Context for Lemur Holdings:

In December 2018, the DBSA board of directors approved the

funding of US$1 million in the PPF for Lemur.

The PPF is important to Lemur for the following primary

reasons:

-- Provides "at-risk" funding for Lemur so it can develop its Imaloto Project, complete feasibility and reach

financial close

-- Participating in a PPF with a lender accelerates the due-diligence and approval process for the eventual project

finance.

Subsequent to the approval of the DBSA board of directors, the

parties signed the facility agreement on 12 March 2019 at the DBSA

offices in South Africa. The following are the key points in the

US$1 million Facility Agreement:

-- All amounts advanced under the facility shall be applied only to cover eligible costs as part of project

preparation, such as the costs to be incurred by Lemur during the project preparation phase in relation to the

project development;

-- More specifically, the facility agreement specifically covers funding for the following project development

activities:

-- Completion of the Social and Environmental Impact Assessment

("SEIA"), including various specialist studies;

-- Technical support and advisory services; and

-- Legal, financial / transactional and other advisory

services;

-- Operating costs, purchase of equipment and land are not eligible;

-- A joint project steering committee between DBSA and Lemur has been appointed;

-- The project steering committee will be responsible for the

review and disbursement of payments for eligible project costs. The

committee will be made up of at least three representatives from

DBSA and two representatives from Lemur and will meet on a regular

basis.

Lemur will be able to draw down on the facility once South

African Reserve Bank approval has been received.

Mohale Ragkate, Group Executive of the Project Preparation

Division at DBSA, commented:

"Energy is central to any country's development, and the Imaloto

Project is well positioned to play an important role in providing

electricity to Madagascar. A reliable power supply would have

transformational developmental benefits for the country's southwest

region, which currently does not have any baseload or transmission

infrastructure. We believe that the conclusion of the project

preparation financing paves the way for advanced discussions

between DBSA and Lemur on project finance for the construction

phase of the project."

Other developments

-- Sinohydro has completed the review of Lemur's power BFS and signed-off on the final report.

-- Review of the opencast mine BFS has been completed. Lemur has begun to focus on optimising the mix of opencast

and underground mine output and an independent consultant, Bara Consulting, has been appointed to conduct the

underground mine BFS.

-- Negotiations on an EPC contract have reached an advanced stage. Lemur expects a contract to be signed by the end

of Q2 2019.

-- Fieldwork for the SEIA is ongoing and is on track to be completed by the end of Q2 2019, despite the excessive

rains encountered in March 2019. Submission to the Ministry of Energy is to follow.

-- Negotiations have progressed with various lenders to secure construction funding on a project finance basis.

2019 Project Objectives

Objective Current Status

Complete Mine BFS and optimisation Currently under final review

---------------------------------

Conclude the SEIA Study in Q2 2019 Field work ongoing

---------------------------------

Appoint EPC Contractor for power Legal advisors shortlisted

plant in Q2 2019

---------------------------------

Invite contractors for transmission Preparing expression of interest

and operation and maintenance of and request for proposal

information

---------------------------------

Conclude funding, credit and political Formal discussions ongoing

risk cover

---------------------------------

Update on Vametco mineral reserve and resource estimate:

Further to the update announced on 27 March 2019, the Vametco

Mineral reserve and resource estimate is currently undergoing final

stages of review and will be published as soon as it is available,

albeit this may now be after 15 April 2019.

Enquiries: info@bushveldminerals.com

+27 (0) 11 268

Bushveld Minerals 6555

Fortune Mojapelo, Chief Executive

Officer

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance Nominated Adviser +44 (0) 20 3470

LLP & Broker 0470

Ewan Leggat / Richard Morrison

Jonathan Williams / Richard

Parlons

Alternative Resource Capital Joint Broker

+44 (0) 20 7186

Rob Collins 9001

+44 (0) 20 7186

Alex Wood 9004

+44 (0) 20 7236

BMO Capital Markets Limited Joint Broker 1010

Jeffrey Couch / Tom Rider

Michael Rechsteiner / Neil

Elliot

+44 (0) 20 7920

Tavistock Financial PR 3150

Charles Vivian / Gareth Tredway

Financial PR (South +27 (0) 11 502

Brunswick Africa) 7300

Miyelani Shikwambana

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a low cost, integrated, primary vanadium

producer, with ownership of high grade vanadium assets.

The Company's flagship vanadium platform includes a 74 per cent

controlling interest in Bushveld Vametco Alloys (Pty) Ltd, a

primary vanadium mining and processing company; the Mokopane

Vanadium Project and the Brits Vanadium Project.

Bushveld's vision is to become a significant, low cost,

integrated primary vanadium producer through owning high grade

assets. This incorporates development and promotion of the role of

vanadium in the growing global energy storage market through

Bushveld Energy Ltd, the Company's energy storage solutions

provider. Whilst the demand for vanadium remains largely anchored

in the steel industry, Bushveld believes there is strong potential

for an imminent and significant global vanadium demand surge from

the fast-growing energy storage market, particularly through the

use and adoption of Vanadium Redox Flow Batteries.

While the Company's focus is on vanadium operations and the

development and promotion of VRFBs, it has additional investments

in coal, power and tin.

The coal platform comprises the wholly-owned Imaloto Coal

Project, which is being developed as one of Madagascar's leading

independent power producers. The Company's tin interests are held

through its shareholding in AIM listed AfriTin Mining Limited.

The Company's approach to project development recognises that,

whilst attractive project economics are imperative, they are

insufficient to secure capital to bring them to account. A clear

path to production within a visible timeframe, low capital

expenditure requirements and scalability are important factors in

ensuring a positive return on investment. This philosophy is core

to the Company's strategy in developing projects.

Detailed information on the Company and progress to date can be

accessed on the website www.bushveldminerals.com

About Lemur Holdings

Lemur Holdings is a wholly owned subsidiary of Bushveld Minerals

and is the company's coal and power platform. The Imaloto Power

Project is located in the southwest of Madagascar and consists of a

136 million tonne coal resource (90 per cent of which is of JORC

compliant Measured and Indicated). The Project also includes a

30-year Concession for an initial 60MW mine mouth coal power plant

as well as over 250km of new transmission lines, developed in

parallel as one of Madagascar's leading independent power

producers. Imaloto also has a secured 30-year electricity off-take

with JIRAMA, the State Utility.

The initial phase of the Imaloto Power Project will potentially

increase Madagascar's baseload capacity by approximately 15 per

cent and almost double the transmission lines in the country. This

is particularly important as the southwest region is mostly rural

and about 95 per cent of the population does not have access to

electricity. In terms of the in economic impact on southwest

Madagascar, the Imaloto Power Project is set to contribute close to

US$200 million in foreign direct investment into Madagascar and

will create over 1,000 jobs and approximately US$1 billion dollars

in revenue for the government of Madagascar over its useful

life.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDDMGGDZLDGLZZ

(END) Dow Jones Newswires

April 10, 2019 02:01 ET (06:01 GMT)

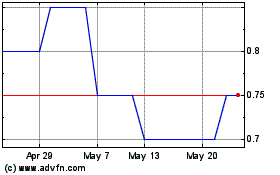

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From May 2024 to Jun 2024

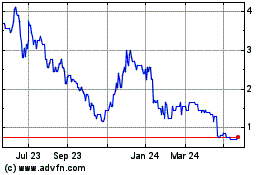

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Jun 2023 to Jun 2024