TIDMBMN

RNS Number : 9689B

Bushveld Minerals Limited

26 September 2018

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

26 September 2018

Bushveld Minerals Limited

("Bushveld" or the "Company")

Unaudited interim results performance report for the period

ended 30 June 2018

Bushveld Minerals Limited (AIM: BMN), the AIM listed, integrated

primary vanadium producer, with ownership of high grade vanadium

assets, is pleased to announce its half year unaudited results, for

the six months ended 30 June 2018.

H1 2018 Financial Highlights

-- First period of fully consolidated accounts since the Company

increased its shareholding in Bushveld Vametco Holdings

(Proprietary) Limited ("Vametco") from 26.6% to a controlling 59.1%

in December 2017, and subsequently to 75% in September 2018;

-- Bushveld Minerals consolidated H1 2018 Revenue of GBP62.1

million;

-- Bushveld Minerals consolidated EBITDA of GBP31.7 million (H1

2017: GBP1.0 million including share of results of associate);

-- Bushveld Minerals consolidated Profit after tax of GBP21.1

million (H1 2017: GBP1.1 million);

-- Bushveld Minerals consolidated Free cash flow(1) of GBP10.2

million (H1 2017: (GBP1.4million));

-- Bushveld Minerals consolidated Cash balance of GBP26.2

million as at 30 June 2017 (H1 2017: GBP71.5 thousand);

-- Bushveld Minerals consolidated Gross debt of nil (H1 2017:

nil);

-- Earnings per share of 1.14p (H1 2017: 0.26p).

(1) Free cash flow: comprises net operating cash flows less net

investing cash flows.

H1 2018 Operational Highlights

-- Nitrovan(TM) sales of 1,403 mtV (H1 2017: 1, 341 mtV);

-- Nitrovan(TM) production of 1,360 mtV (H1 2017: 1,441

mtV);

-- Bushveld remains one of the lowest cost vanadium producers in

the world, with H1 operating costs of ZAR248.4/KgV (US$20.2/KgV)

(H1 2017: US$15.4/KgV);

-- Phase Two of the Vametco Expansion project completed on time

and within budget to raise nameplate capacity to 3,750mtV;

-- The exploration programme at the Brits Vanadium Project has

shown vanadium grades in magnetite of 1.54 - 2.09% V(2) O(5) ;

-- Bushveld Energy and the Industrial Development Corporation

("IDC") received delivery of the first vanadium redox flow battery

("VRFB") from UniEnergy Technologies ("UET") in South Africa;

-- Bushveld Energy and IDC continue to progress work to build an

electrolyte manufacturing plant in South Africa, to be located at

Vametco and the East London Industrial Zone;

-- Lemur Holdings and the Government of Madagascar concluded the

30-year Project Concession Agreement;

-- Lemur Holdings completed the inception site visit for the

Social and Environmental Impact Assessment ("SEIA") at the Imaloto

Power Project with related field studies commencing thereafter;

-- Lemur Holdings and the state-owned utility, Jiro sy Rano

Malagasy ("JIRAMA"), amended the Power Purchase Agreement to

significantly increase the latter's offtake to up to 25MW.

H1 2018 Corporate Highlights

-- Completed a GBP15.7 million (US$22.2 million) equity placing

before expenses by way of an oversubscribed placing of 152,749,172

new ordinary shares at a price of 10.3p per share;

-- Redeemed and settled the Atlas Convertible Bonds in full, for

a final aggregate cash payment of GBP5.12 million;

-- Appointed Michael J. Kirkwood as Senior Independent

Non-Executive Director;

-- Appointed Alternative Resource Capital, a trading name of

Shard Capital Partners LLP, as joint broker of the Company;

-- Listing on the Johannesburg Stock Exchange remains a priority

for the Company, with the work progressing accordingly;

-- Number of Warrants in issue as at 25 September 2018.

No. of warrants outstanding Exercise Price Lapse Date

(GBp)

3,598,684 6.9p 31 March 2020

--------------- --------------

22 September

6,257,309 13.84p 2020

--------------- --------------

H1 2018 Bushveld Vanadium Update

-- Vametco H1 2018 Revenue increased by 139.2% to ZAR 1,050

million (GBP62.1 million) compared with H1 2017 revenue of ZAR 439

million (GBP26.4 million).

-- Vametco H1 2018 EBITDA increased by 429.6% to ZAR 521 million

(GBP30.8 million) compared with ZAR 98.4 million in H1 2017 (GBP5.7

million).

-- The Metal Bulletin FeV mid-average price for H1 2018 was

US$65.5/ KgV, an increase of approximately 150% relative to the H1

2017 average price of US$26.2/ KgV.

-- Vametco's realised price is based on an average one month prior to sale.

-- FeV price has continued to strengthen with the Metal Bulletin

FeV mid-price averaging US$80/ KgV in the two months ended August

2018.

-- Vametco achieved an all-time record magnetite kiln feed

during Q1 2018, supported by the completion of Phase One of the

expansion project.

-- Vametco completed Phase Two of the expansion project. This

phase of the expansion project will increase the nameplate capacity

from 3,035 mtV, achieved in Phase One, to 3,750 mtV, through

self-funded capital expenditure of US$2.5 million.

-- The Company commenced an exploration programme at the Brits

Vanadium Project, which has shown positive results with vanadium

grades in magnetite of 1.54-2.09% V(2) O(5) , similar to grades

mined at Vametco.

H1 2018 Bushveld Energy Update

Electrolyte production facility

-- Engaged an international chemicals company that has already

designed and built a vanadium electrolyte production plant with

multiple megalitre annual capacity.

-- Initiated the Environmental Impact Assessment (EIA) process

for the electrolyte production plant, including appointment of

local EIA consultants.

Eskom VRFB project

-- Completed manufacturing of the Direct Current (DC) portion of

the VRFB.

-- Appointed two technicians from South Africa to perform

installation support and maintenance on the Eskom project. The

first phase of the technicians' training was held at UET, in April

2018. This will give Bushveld Energy the capability to install and

maintain future VRFB installations in South Africa and

regionally.

-- Bushveld Energy and the IDC received delivery of the first

VRFB from UET in South Africa. This included the mixed-acid

vanadium electrolyte to be used in the battery.

H1 2018 Lemur Holdings Update

-- Lemur Holdings and the Government of Madagascar concluded a

30-year Project Concession Agreement which gives Lemur the right to

build, own, operate and supply an initial 60 MW. In addition, the

concession gives Lemur the right to build an evacuation line of up

to 138kV for transport of the electricity to the connection

points.

-- Completed the inception site visit for the SEIA at the

Imaloto Power Project and commenced the relevant field work for the

SEIA.

-- Amended the Power Purchase Agreement with the state-owned

JIRAMA from the existing 10MW to allow the utility to offtake up to

25MW.

Events post 30 June 2018

Bushveld Minerals

-- Completed the acquisition of a 21.22% interest in Strategic

Minerals Corporation("SMC") (the ultimate holding company of

Vametco Alloys Proprietary Limited) from Sojitz Noble Alloys

Corporation. The Acquisition of all of Sojitz's legal and

beneficial interest in SMC was acquired for a total cash

consideration of US$20,000,000, including US$2,500,000 in accrued

dividends. The acquisition increased Bushveld Minerals' controlling

interest in Vametco Holdings from 59.1% to 75%.

-- An unprotected industrial action at Vametco temporarily

stopped production from the evening of 5 September. The industrial

action was in relation to historic legacy issues and compensation

structures prior to Bushveld's acquisition of Vametco. The strike

ended on 21 September, when Bushveld Minerals and the Association

of Mineworkers and Construction Union ("AMCU") announced that they

had reached an agreement. The agreement includes:

-- The settlement agreement, signed between Vametco and AMCU in

May 2018 in respect of payments in lieu of Employee Share Options

Scheme ("ESOPS") for the period 2013 to December 2017, is valid and

recognised.

-- Vametco will pay employees an amount in lieu of ESOPS for the

year 2018 on the same basis as the ESOPS payment made as part of

the May 2018 settlement agreement. The payments (the "2018 ESOPS

payment") will be structured as a two-part payment:

-- A payment of R15,000 (post-tax) shall be paid to each

employee in respect of the period 1 January to 30 June 2018. This

amount shall be paid on 28 September 2018.

-- A second payment, in respect of the period 1 July 2018 to 31

December 2018, shall be payable after the release of the financial

results of Bushveld Vametco Alloys Limited for FY2018 which is

expected to be paid by 31 March 2019.

-- The new agreement discourages any future participation in

unprotected industrial actions by the workers at the risk of losing

participation of any ESOP payments.

Following 16 days of unprotected industrial action, operations

and production at Vametco resumed on 22 September 2018.

The unprotected industrial action may impact Vametco's 2018

production and cost guidance. The Company is in the process of

quantifying the impact of the stoppage and such guidance will be

provided no later than the Q3 2018 Bushveld Vanadium Operational

update.

Bushveld Energy

-- During commissioning of the VRFB, a performance issue was

experienced, and initial assessments confirmed a vanadium

electrolyte constraint. As a result, the battery was not able to

meet the specified operational performance. It was also determined

that it would not be possible to resolve the constraint in South

Africa at this time and a remediation strategy was immediately

implemented. The remediation includes the provision of new

electrolyte and hardware for the DC module of the battery. This

will allow commissioning to resume and be completed in Q4 2018. The

Company will provide an update on progress in November 2018.

-- Bushveld Energy was awarded a grant from the Government of

the United States of America, acting through the U.S. Trade and

Development Agency (USTDA). The grant will provide support in

implementation and enhancement of Bushveld Energy's previously

announced VRFB project at the Eskom mini-grid at its Research,

Testing & Development centre. It will also support the

development of new modelling capabilities to cover the combination

- or "stacking" - of multiple benefits from energy storage supplied

by one battery.

Commenting on the results, CEO Fortune Mojapelo said:

"I am pleased to report the first set of financial results that

reflect the full consolidation of Vametco's accounts since Bushveld

Minerals acquired a majority controlling interest last December. It

is particularly pleasing to report our first ever consolidated net

profit and net free cash flow for the Bushveld Group. We expect to

show continuously improving performance as we integrate and grow

the business.

"We recently increased our interest in Vametco to 75% to gain

maximum exposure of the business we operate. While Vametco is

already a low cost producer of vanadium, we believe potential exits

to further improve its cost position by improving its productivity.

To this end we will be developing and implementing several

productivity initiatives, in addition to the expansion plans

announced to date, to enhance Vametco's performance across the

production process. We expect to see the positive effects of these

initiatives in the coming year.

"Key to the success of our efforts at Vametco is a healthy

cooperative relationship with all of our stakeholders, not least

the local communities in which we operate and the workers. The

recent unprotected strike action at the mine, while unfortunate

only underscores the importance of us succeeding in this objective.

We are pleased that we were able to reach a resolution with the

workers and delighted that they will participate in the success of

the Company through an Employee Share Options Scheme Structure.

"Meanwhile our efforts in building a leading energy storage

company through Bushveld Energy are progressing well on all fronts,

the construction of the electrolyte manufacturing plant in South

Africa, the deployment of a VRFB at Eskom, securing mandates for

large scale VRFB deployments as well as the development of vanadium

electrolyte leasing products to promote the adoption of VRFBs in

the global energy storage industry. The grant of US$500,000

received from the Government of the United States of America will

go a long way to fund the implementation and enhancement of the

Eskom Vanadium Redox Flow Batteries project. The commissioning

delay experienced with the Eskom Vanadium Redox Flow Batteries

project has meant the new battery is now expected to be

commissioned during the Q4 2018.

"The signing of a 30-year Project Concession Agreement between

Lemur Holdings and the Government of Madagascar is a critical

milestone in the development of Lemur's integrated coal-to-power

project, bringing it even closer to implementation.

"As we continue to steadily execute our firm strategy to grow

into a significant, low-cost vertically integrated vanadium

platform, we have a busy pipeline of corporate and operational

activities ahead. I look forward to providing further updates on

the operations in the second half of the year.

"Finally, we are pleased to see the South Africa government move

to clear regulatory uncertainty around the South Africa's Mining

Charter bringing much needed clarity and direction for

investors."

Enquiries: info@bushveldminerals.com

Bushveld Minerals +27 (0) 11 268 6555

Fortune Mojapelo, Chief Executive

Officer

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance

LLP Nominated Adviser & Broker +44 (0) 20 3470 0470

Ewan Leggat

Richard Morrison

Alternative Resource Capital Joint Broker

Rob Collins +44 (0) 207 186 9001

Alex Wood +44 (0) 207 186 9004

Tavistock Financial PR

Charles Vivian / Gareth Tredway +44 (0) 207 920 3150

Lifa Communications Financial PR (South Africa)

Gabriella von Ille +27 (0) 711 121 907

--

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a low cost, integrated, primary vanadium

producer, with ownership of high grade vanadium assets.

The Company's flagship vanadium platform includes a 75 per cent

controlling interest in Bushveld Vametco Alloys (Pty) Ltd, a

primary vanadium mining and processing company; the Mokopane

Vanadium Project and the Brits Vanadium Project.

Bushveld's vision is to become a significant, low cost,

integrated primary vanadium producer through owning high grade

assets. This incorporates development and promotion of the role of

vanadium in the growing global energy storage market through

Bushveld Energy, the Company's energy storage solutions provider.

Whilst the demand for vanadium remains largely anchored in the

steel industry, Bushveld Minerals believes there is strong

potential for an imminent and significant global vanadium demand

surge from the fast-growing energy storage market, particularly

through the use and adoption of Vanadium Redox Flow Batteries.

While the Company's focus is on vanadium operations and the

development and promotion of VRFBs, it has additional investments

in coal, power and tin.

The coal platform comprises the wholly-owned Imaloto Coal

Project, which is being developed as one of Madagascar's leading

independent power producers. The Company's tin interests are held

through its shareholding in AIM listed AfriTin Mining Limited.

The Company's approach to project development recognises that,

whilst attractive project economics are imperative, they are

insufficient to secure capital to bring them to account. A clear

path to production within a visible timeframe, low capital

expenditure requirements and scalability are important factors in

ensuring a positive return on investment. This philosophy is core

to the Company's strategy in developing projects. Detailed

information on the Company and progress to date can be accessed on

the website www.bushveldminerals.com

Consolidated Income Statement

For the six months ended 30 June 2018

6 Months ended 6 Months ended 10 Months

ended

30 June 2018 30 June 2017 31 December

2017

(unaudited) (unaudited) (audited)

GBP GBP GBP

Continuing operations

Revenue 62,069,509 - 2,210,430

Cost of sales (24,030,309) - (1,093,443)

Gross profit 38,039,200 - 1,116,987

Other operating income 3,445,271 - -

Selling and distribution

costs (3,831,079) - (220,724)

Other mine operating costs (814,098) - (122,707)

Idle plant costs (405,146) - (24,216)

Administration expenses (5,165,521) (43,202) (3,740,558)

Operating profit/(loss) 31,268,627 (43,202) (2,991,218)

Share of results of associate - 1,083,019 3,610,066

Impairment loss on demerger

of tin assets - - (547,441)

Finance income 813,323 19,099 107,045

Finance costs (1,348,493) - (863,035)

Profit / (loss) before tax 30,733,457 1,058,916 (684,583)

Taxation (9,588,550) - (8,144)

Profit / (loss) after taxation 21,144,907 1,058,916 (692,727)

Attributable to:

Owners of the parent 11,198,436 1,058,916 (953,358)

Non-controlling interests 9,946,471 - 260,811

============== ============== =============

Profit / (loss) per ordinary share

(note 4)

Basic and diluted profit / (loss)

per share (in pence) 1.14 0.26 (0.12)

All results relate to continuing activities.

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2018

6 Months ended 6 Months ended 10 Months ended

30 June 2018 30 June 2017 31 December

GBP GBP 2017

GBP

(unaudited) (unaudited) (audited)

Profit/(loss) for the

period / year 21,144,907 1,058,916 (692,727)

Other comprehensive

income, net of tax:

Items that may be subsequently

reclassified to profit

or loss:

Currency translation

differences (7,995,163) (305,694) 1,354,597

Available-for-sale financial

assets - net change

in fair value 205,145 - (779,930)

Total comprehensive

income for the period

/ year 13,354,889 753,222 (118,060)

=============== ================== ===================

Attributable to:

Owners of the parent 7,892,739 753,222 (327,272)

Non-controlling interests 5,462,150 - 209,212

Total comprehensive

income for the period

/ year 13,354,889 753,222 (118,060)

=============== ================== ===================

Consolidated Statement of Financial Position

As at 30 June 2018

Company number: 54506

30 June 2018 30 June 2017 31 December 2017

Note GBP GBP GBP

(unaudited) (unaudited) (audited)

Assets

Non-current assets

Intangible assets:

exploration and evaluation 5 43,387,123 60,397,078 45,110,207

Property, plant and

equipment 6 35,323,848 304,910 32,922,605

Investment properties 2,255,524 - 2,448,489

Deferred tax asset 2,536,647 - 2,427,455

Total Non-Current

assets 83,503,142 60,701,988 82,908,756

Current assets

Inventories 7 12,023,125 - 12,727,444

Trade and other receivables 8 17,906,049 6,633,573 10,286,266

Restricted investment 4,059,340 - 3,844,454

Income tax receivable - - 862,162

Available-for-sale

financial assets 1,429,771 - 1,224,626

Cash and cash equivalents 9 26,176,707 71,544 7,218,820

Total Current assets 61,594,992 6,705,117 36,163,772

Total assets 145,098,134 67,407,105 119,072,528

============ ============ ================

Equity and liabilities

Share capital 12 10,760,245 8,065,153 8,758,948

Share premium 12 68,082,937 62,091,768 51,306,449

Accumulated profit/(deficit) 1,473,104 (6,893,429) (9,725,332)

Warrant reserve 2,196,180 594,127 1,566,755

Foreign exchange translation

reserve (2,116,253) 294,087 1,394,589

Fair value reserve (574,785) - (779,930)

------------ ------------ ----------------

Equity attributable

to owners of the parent 79,821,428 64,151,706 52,521,479

Non-controlling interests 32,431,445 2,058,010 26,969,295

Total Equity 112,252,873 66,209,716 79,490,774

Non-Current liabilities

Borrowings 11 - - 5,815,092

Other financial liabilities - - 1,012,490

Post-retirement medical

liability 1,874,944 - 2,063,042

Environmental rehabilitation

liability 4,670,671 - 4,943,249

Deferred consideration 8,717,393 - 8,167,393

Total Non-Current

liabilities 15,263,008 - 22,001,266

Current liabilities

Trade and other payables 10 11,222,372 1,197,389 15,007,199

Provisions 6,359,881 - 2,573,289

Total Current liabilities 17,582,253 1,197,389 17,580,488

Total Equity and liabilities 145,098,134 67,407,105 119,072,528

============ ============ ================

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2018

Attributable to owners of the parent company

Foreign Fair Non-

Share Share Accumulated Warrant translation value controlling Total

capital premium deficit reserve reserve reserve Total interests equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Total equity at 1 January

2017 (unaudited) 6,839,087 61,177,827 (7,658,258) 594,127 (11,607) 60,941,176 2,079,259 63,020,435

---------------------------- ---------- ------------ ----------- ---------- ----------- --------- ------------ ----------- ------------

Profit for the period - - 1,058,916 - - - 1,058,916 - 1,058,916

Other comprehensive income:

Currency translation

differences - - (294,087) - 305,694 - 11,607 - 11,607

Total comprehensive income

for the period - - 764,829 - 305,694 - 1,070,523 - 1,070,523

Transactions with owners:

Issue of shares 1,226,066 1,340,121 - - - - 2,566,187 - 2,566,187

Share issue expenses - (426,180) - - - - (426,180) - (426,180)

Non-controlling interest - - - - - - - 305,694 305,694

Total equity at 30 June

2017 (unaudited) 8,065,153 62,091,768 (6,893,429) 594,127 294,087 - 64,151,706 2,384,953 66,536,659

---------------------------- ---------- ------------ ----------- ---------- ----------- --------- ------------ ----------- ------------

Loss for the period - - (2,831,903) - - - (2,831,903) - (2,831,903)

Other comprehensive income:

Fair value movement on

investments - - - - - (779,930) (779,930) - (779,930)

Currency translation

differences - - - - 1,100,502 - 1,100,502 21,249 1,121,751

---------------------------- ---------- ------------ ----------- ---------- ----------- --------- ------------ ----------- ------------

Total comprehensive loss

for the period - - (2,831,903) - 1,100,502 - (2,511,331) 21,249 (2,490,082)

Transactions with owners

Grant of warrants - - - 972,628 - - 972,628 - 972,628

Issue of shares 693,795 5,362,681 - - - - 6,056,476 - 6,056,476

Distribution of capital

on de-merger - (16,148,000) - - - - (16,148,000) - (16,148,000)

Non-controlling interest - - - - - - - 24,563,093 24,563,093

---------------------------- ---------- ------------ ----------- ---------- ----------- --------- ------------ ----------- ------------

Total equity at 31 December

2017

(audited) 8,758,948 51,306,449 (9,725,332) 1,566,755 1,394,589 (779,930) 52,521,479 26,969,295 79,490,774

Profit for the period - - 11,198,436 - - - 11,198,436 9,946,471 21,144,907

Other comprehensive income:

Fair value movement on

investments - - - - - 205,145 205,145 - 205,145

Currency translation

differences - - - - (3,510,842) - (3,510,842) (4,484,321) (7,995,163)

Total comprehensive income

for the period - - 11,198,436 - (3,510,842) 205,145 7,892,739 5,462,150 13,354,889

Transactions with owners

Grant of warrants - - - 629,425 - - 629,425 - 629,425

Issue of shares 2,001,297 17,577,082 - - - - 19,578,379 - 19,578,379

Share issue costs - (800,594) - - - - (800,594) - (800,594)

Non-controlling interest - - - - - - - - -

Total equity at 30 June

2018 (unaudited) 10,760,245 68,082,937 1,473,104 2,196,180 (2,116,253) (574,785) 79,821,428 32,431,445 112,252,873

---------------------------- ---------- ------------ ----------- ---------- ----------- --------- ------------ ----------- ------------

Consolidated Statement of Cash Flows

For the six months ended 30 June 2018

6 Months ended 6 Months ended 10 Months ended

30 June 2018 30 June 2017 31 December

GBP GBP 2017

GBP

(unaudited) (unaudited) (audited)

PROFIT/(LOSS) AFTER TAXATION 21,144,907 1,058,916 (692,727)

Adjustments for:

Depreciation property, plant

and equipment 462,565 3,725 50,369

Impairment loss on de-merger - - 547,472

Finance income (813,323) (19,099) (107,045)

Finance costs 1,348,493 - 863,035

Share of profit in associate - (1,083,019) (3,610,066)

Changes in working capital (6,268,188) (750,510) (1,144,094)

------------------- --------------------

Net cash generated from/(used

in) operating activities 15,874,454 (789,987) (4,093,056)

------------------- --------------------

Cash flows from investing

activities

Finance income 813,323 19,099 107,045

Purchase of exploration

and evaluation assets (15,244) (475,897) (1,261,590)

Purchase of property, plant

and equipment (4,488,101) (21,249) -

Net cash impact of acquisition

of Bushveld Vametco Limited - - 4,412,912

Net cash (used in)/generated

from investing activities (3,690,022) (478,047) 3,258,367

------------------- --------------------

Cash flows from financing

activities

Finance costs (1,348,493) - -

Net proceeds of capital

raise 15,279,790 - -

Net proceeds from issue

of shares and warrants 1,170,213 1,916,187 1,691,011

Proceeds from convertible

bond issue (net of repayments) - - 6,545,000

Net repayments of other

borrowings (5,115,906) - (128,767)

------------------- --------------------

Net cash generated from

financing activities 9,985,604 1,916,187 8,107,244

------------------- --------------------

Net increase in cash and

cash equivalents 22,170,036 648,153 7,272,555

Cash and cash equivalents

at the beginning of the

period 7,218,820 131,155 131,155

Effect of foreign exchange

rates (3,212,149) (707,764) (184,890)

Cash and cash equivalents

at end of the period 26,176,707 71,544 7,218,820

=================== ====================

1. Corporate information and principal activities

Bushveld Minerals Limited ("Bushveld") was incorporated and

domiciled in Guernsey on 5 January 2012 and admitted to the AIM

market in London on 26 March 2012.

The company changed its reporting date from 28 February to 31

December during the prior period. These unaudited interim financial

statements are for the six months 30 June 2018 with comparatives to

30 June 2017. The ten months to 31 December 2017 are audited.

2. Basis of preparation

The results presented in this report are unaudited and they have

been prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards ('IFRS")

as adopted by the EU that are expected to be applicable to the next

set of financial statements and on the basis of the accounting

policies to be used in those financial statements.

The interim financial information does not include all of the

information required for full annual financial statements and

accordingly, whilst the interim financial information has been

prepared in accordance with the recognition and measurement

principles of IFRS, it cannot be construed as being in full

compliance with IFRS. The financial information contained in this

announcement does not constitute statutory accounts as defined by

the Companies (Guernsey) Law 2008.

The audited financial information for the period ended 31

December 2017 is based on the statutory accounts for the financial

period ended 31 December 2017. The auditors reported on those

accounts: their report was unqualified and did not contain

statements where the auditor is required to report by

exception.

The directors do not believe that the adoption of new standards,

including IFRS 9 and IFRS 15,will have a material impact on the

reported results.

3. Use of estimates and judgements

In the application of the group's accounting policies, the

directors are required to make judgements, estimates and

assumptions about the carrying amounts of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates in particular, information about

significant areas of estimation uncertainty considered by

management in preparing the financial statements is described

below:

i. Decommissioning and rehabilitation obligations

Estimating the future costs of environmental and rehabilitation

obligations is complex and requires management to make estimates

and judgements as most of the obligations will be fulfilled in the

future and contracts and laws are often not clear regarding what is

required. The resulting provisions are further influenced by

changing technologies, political, environmental, safety, business

and statutory considerations.

ii. Asset lives and residual values

Property, plant and equipment are depreciated over its useful

life taking into account residual values, where appropriate. The

actual lives of the assets and residual values are assessed

annually and may vary depending on a number of factors. In

reassessing asset lives, factors such as technological innovation,

product life cycles and maintenance programmes are taken into

account. Residual value assessments consider issues such as future

market conditions, the remaining life of the asset and projected

disposal values.

iii. Post-retirement employee benefits

Post-retirement medical aid liabilities are provided for certain

existing employees. Actuarial valuations are based on assumptions

which include employee turnover, mortality rates, the discount

rate, health care inflation costs and rates of increase in

costs.

iv. Surface rights liabilities

The group has provided for surface lease costs that would accrue

to the owners of the land on which the mine is built. The quantum

of the amounts due post implementation of the MPRDA and the

granting of the new order mining right to the group is somewhat

uncertain and need to be negotiated with such owners. The group has

conservatively accrued for possible costs in this regard, but the

actual obligation may be materially different when negotiations

with the relevant parties are completed.

v. Impairment of exploration and evaluation assets

Determining whether an exploration and evaluation asset is

impaired requires an assessment of whether there are any indicators

of impairment, including by reference to specific impairment

indicators prescribed in IFRS 6 - Exploration for and Evaluation of

Mineral Resources. If there is any indication of potential

impairment, an impairment test is required based on value in use of

the asset. The valuation of intangible exploration assets is

dependent upon the discovery of economically recoverable deposits

which, in turn, is dependent on future of Ferro Vanadium prices,

future capital expenditures and environmental and regulatory

restrictions. The directors have concluded that there are no

indications of impairment in respect of the carrying value of

intangible assets at 31 December 2017 based on planned future

development of the projects and current and forecast commodity

prices.

4. Profit/Loss per share

From continuing operations

The calculation of a basic profit per share of 1.14 pence

(December 2017: 0.12 pence loss), is calculated using the total

profit for the six months attributable to the owners of the company

of GBP11,198,436 (December 2017: GBP953,538) and the weighted

average number of shares in issue during the six months of

985,904,707 (December 2017: 789,578,440). The dilutive effect of

other shares in issue would be immaterial to the profit per

share.

5. Intangible exploration and evaluation assets

Vanadium

and Iron Tin Total

ore GBP GBP

GBP

As at 1 January 2017 41,653,048 18,268,133 59,921,181

-------------------------- ------------ ------------- -------------

Additions to 30 June

2017 475,897 - 475,897

-------------------------- ------------ ------------- -------------

As at 30 June 2017

(unaudited) 42,128,945 18,268,133 60,397,078

Exchange differences 1,719,672 (1,572,661) 147,011

Additions to 31 December

2017 1,261,590 - 1,261,590

Impairment/loss on

disposal - (16,695,472) (16,695,472)

-------------------------- ------------ ------------- -------------

As at 31 December

2017 (audited) 45,110,207 - 45,110,207

Additions to June

2018 15,244 - 15,244

Exchange differences (1,738,328) - (1,738,328)

-------------------------- ------------ ------------- -------------

As at 30 June 2018

(unaudited) 43,387,123 - 43,387,123

-------------------------- ------------ ------------- -------------

The Company's subsidiary, Bushveld Resources Limited has a 64%

interest in Pamish Investment No 39 (Proprietary) Limited

("Pamish") which holds an interest in Prospecting right 95 ("Pamish

39"). Bushveld Resources Limited also has a 68.5% interest in

Amaraka Investment No 85 (Proprietary) Limited ("Amaraka") which

holds an interest in Prospecting right 438 ("Amaraka 85").

Under the agreements to acquire the licences within Bushveld

Resources, the group is required to fully fund the exploration

activities up to the issue of the corresponding mining licences. As

the non-controlling interest party retains their equity interest,

the funding of their interest is accounted as deemed purchase

consideration and is included in the additions in the year to

exploration activities. A corresponding increase is credited to

non-controlling interest.

Brits Vanadium Project

The Company is in a process to secure regulatory approval in

terms of section 11 of the Mineral and Petroleum Resources

Development Act (MPRDA) for change of control in respect of the

acquired Sable Metals & Mining Ltd.'s subsidiaries. Following

approval, Bushveld Minerals will commence with activities to

delineate the shallow resource on the Uitvalgrond farm portion.

-- NW 30/5/1/1/2/11069 PR - held through Great Line 1 (Pty) Ltd

-- NW 30/5/1/1/2/11124 PR - held through Great Line 1 (Pty) Ltd

-- GP 30/5/1/1/02/10142 PR - held through Gemsbok Magnetite (Pty) Ltd

6. Property, plant and equipment

Buildings Plant and Motor Decommissioning Assets under Total

and other machinery vehicles assets construction

improvements furniture

and

equipment

GBP GBP GBP GBP GBP

Cost at 1

January 2017

and 30 June

2017 - 750,921 - - - 750,921

Disposals - (301,185) - - - (301,185)

Additions due

to

acquisition 452,703 30,606,619 21,249 1,116,965 692,541 32,890,077

Exchange

differences - 182,448 - - - 182,448

----------------------- -------------------- -------------------- -------------------------- ----------------------- ----------------

At 31

December

2017

(audited) 452,703 31,238,803 21,249 1,116,965 692,541 33,522,261

======================= ==================== ==================== ========================== ======================= ================

Additions to

30 June 2018 - - 225,192 - 4,262,909 4,488,101

Assets under

construction

capitalised - 88,309 - - (88,309) -

Exchange

differences - (1,624,293) - - - (1,624,293)

======================= ==================== ==================== ========================== ======================= ================

At 30 June

2018

(unaudited) 452,703 29,702,819 246,441 1,116,965 4,867,141 36,386,069

======================= ==================== ==================== ========================== ======================= ================

Depreciation

1 January

2017 - 442,286 - - - 442,286

Charged for

six months

to 30 June

2017 - 3,725 - - - 3,725

Exchange - - - - - -

differences

----------------------- -------------------- -------------------- -------------------------- ----------------------- ----------------

At 30 June

2017

(unaudited) - 446,011 - - - 446,011

======================= ==================== ==================== ========================== ======================= ================

Charge for

the six

months

to 31

December

2017 - 50,369 - - - 50,369

Exchange

differences - 103,274 - - - 103,274

----------------------- -------------------- -------------------- -------------------------- ----------------------- ----------------

At 31

December

2017

(audited) - 599,656 - - - 599,656

======================= ==================== ==================== ========================== ======================= ================

Charge for

the six

months

to 30 June

2018 54,602 323,988 83,975 - - 462,565

Exchange - - - - - -

differences

----------------------- -------------------- -------------------- -------------------------- ----------------------- ----------------

At 30 June

2018

(unaudited) 54,602 923,644 83,975 - - 1,062,221

======================= ==================== ==================== ========================== ======================= ================

Net book

value 30

June

2018

(unaudited) 398,101 29,779,175 162,466 1,116,965 4,867,141 35,323,848

======================= ==================== ==================== ========================== ======================= ================

Net book

value 31

December

2017

(audited) 452,703 30,639,147 21,249 1,116,965 692,541 32,922,605

======================= ==================== ==================== ========================== ======================= ================

Net book

value 30

June

2017

(unaudited) - 304,910 - - - 304,910

======================= ==================== ==================== ========================== ======================= ================

7. Inventories

30 June 2018 30 June 2017 31 December

GBP GBP 2017

GBP

Unaudited Unaudited Audited

Finished goods 4,287,521 - 4,800,578

Work in progress 3,008,165 - 3,255,013

Raw materials 1,660,681 - 1,198,704

Consumable stores 3,066,758 - 3,473,149

------------ ----------------- ----------------

Inventories 12,023,125 - 12,727,444

============ ================= ================

The amount of write-down of inventories due to net realisable

value provision requirement is nil.

8. Trade and other receivables

30 June 2018 30 June 2017 31 December

GBP GBP 2017

GBP

Unaudited Unaudited Audited

Trade receivables 11,181,598 2,513,256 6,136,121

Other receivables 6,724,451 4,120,317 4,150,145

---------------------- --------------------- -------------------

Trade and other

receivables 17,906,049 6,633,573 10,286,266

====================== ===================== ===================

Trade receivables are non-interest bearing and are generally on

15-90 day terms. There were no indicators of impairment at 30 June

2018. At 30 June 2018 the group had one customer which accounted

for approximately 90% of trade receivables.

9. Cash and cash equivalents

30 June 2018 30 June 2017 31 December

GBP GBP 2017

GBP

(unaudited) (unaudited) (audited)

Cash at hand and

in bank 26,176,707 71,544 7,218,820

====================== ================== ================

Cash and cash equivalents (which are presented as a single class

of assets on the face of the Statement of Financial Position)

comprise cash at bank and other short-term highly liquid

investments with an original maturity of three months or less. The

directors consider that the carrying amount of cash and cash

equivalents approximates their fair value.

10. Trade and other payables

30 June 2018 30 June 2017 31 December

GBP GBP 2017

GBP

(unaudited) (unaudited) (audited)

Trade payables 6,347,003 298,914 8,059,604

Other payables 2,955,871 83,275 4,729,604

Accruals 1,919,498 815,200 2,217,991

--------------------- ------------------- ----------------

11,222,372 1,197,389 15,007,199

===================== =================== ================

Trade and other payables principally comprise amounts

outstanding for trade purchases and on-going costs. The average

credit year taken for trade purchases is 30 days.

11. Borrowings

Since December 2017 the outstanding convertible bonds balance

was reduced by the following conversions:

-- GBP250,000 of convertible bonds converted into 3,078,817

ordinary shares of 1 pence each of the Company at a conversion

price of 8.12 pence each on 18 January 2018. Following the

exercise, Atlas held a total of GBP6,700,000 Convertible Bonds;

-- GBP700,000 of convertible bonds converted into 8,620,689

ordinary shares of 1 pence each of the Company at a conversion

price of 8.12 pence each on 23 January 2018. Following the

exercise, Atlas held a total of GBP6,000,000 Convertible Bonds;

-- GBP1,000,000 of convertible bonds converted into 11,990,407

ordinary shares of 1 pence each of the Company at a conversion

price of 8.34 pence each on 19 February 2018. Following the

exercise, Atlas held a total of GBP5,000,000 Convertible Bonds;

-- GBP725,000 of convertible bonds converted into 8,809,234

ordinary shares of 1 pence each of the Company at a conversion

price of 8.23 pence each 14 March 2018. Following this exercise,

Atlas held a total of GBP4,275,000 Convertible Bonds.

On 14 June 2018, Bushveld fully redeemed the issued Convertible

Bonds. The Convertible Bonds were settled in full for a final

aggregate cash payment of GBP5.116 million, including interest and

early redemption charges.

12. Share capital and share premium

Number of

shares issued Nominal value Total share capital

and fully Issue price of shares of Share and premium

paid Per share 1 pence each premium GBP

GBP GBP GBP GBP

Balance at 1

January 2017

(audited) 683,908,870 6,839,087 61,177,827 68,016,914

Warrants

exercised

January to June

2017 3,866,667 0.05 38,667 19,333 58,000

Warrants

exercised

January to June

2017 4,833,333 0.018 48,333 38,667 87,000

Warrants

exercised

January to June

2017 67,549,458 0.024 675,495 945,692 1,621,187

Warrants

exercised

January to June

2017 5,357,143 0.028 53,571 96,429 150,000

Shares issued for

Uis Transaction 41,000,000 0.016 410,000 240,000 650,000

Share issue

expenses (426,180) (426,180)

Balance at 30

June 2017

(unaudited) 806,515,471 8,065,153 62,091,768 70,156,921

-------------- ------------- --------------- ------------ ---------------------

Balance brought

down 1 July 2017 806,515,471 8,065,153 62,091,768 70,156,921

Warrants

exercised July

to December 2017 470,886 0.024 4,710 6,591 11,301

Warrants

exercised July

to December 2017 652,000 0.045 6,520 22,820 29,340

Warrants

exercised July

to December 2017 434,000 0.068 4,340 25,172 29,512

50,000

convertible

bonds converted

October 540,540 0.0925 5,405 44,595 50,000

1,000,000

convertible

bonds converted

December 12,515,644 0.0799 125,156 874,844 1,000,000

Shares issued on

acquisition 54,766,364 0.091 547,664 4,388,658 4,936,322

Distribution of

capital on

de-merger

Afritin (16,148,000) (16,148,000)

Balance at 31

December 2017

(audited) 875,894,905 8,758,948 51,306,449 60,065,397

-------------- ------------- --------------- ------------ ---------------------

Balance brought

down 1 January

2018 875,894,905 8,758,948 51,306,449 60,065,397

Warrants exercised January to June 2018 190,638 0.024 1,905 2,669 4,574

950,000 convertible bonds converted January

2018 11,699,506 0.0812 116,995 833,005 950,000

1,000,000 convertible bonds converted

February

2018 11,990,407 0.0834 119,904 880,096 1,000,000

725,000 convertible bonds converted March

2018 8,809,234 0.0823 88,092 636,908 725,000

Capital raise and placing 26 March 2018 152,749,172 0.103 1,527,492 14,205,673 15,733,165

Darwin warrants exercised April 2018 3,039,473 0.079 30,396 209,725 240,120

Darwin warrants exercised April 2018 4,052,631 0.099 40,526 360,684 401,210

Wogan warrants exercised May 2018 7,598,684 0.069 75,987 448,322 524,309

Share issue expenses (800,594) (800,594)

Balance at 30 June 2018 (unaudited) 1,076,024,650 10,760,245 68,082,937 78,843,182

------------- ------ ---------- ---------- ----------

The Board may, subject to Guernsey Law, issue shares or grant

rights to subscribe for or convert securities into shares. It may

issue different classes of shares ranking equally with existing

shares. It may convert all or any classes of shares into redeemable

shares. The Company may also hold treasury shares in accordance

with the law. Dividends may be paid in proportion to the amount

paid up on each class of shares.

As at the 30 June 2018 the Company owns 670,000 (30 June 2017

and 31 December 2017: 670,000) treasury shares with a nominal value

of 1 penny.

On 26 March 2018, the Company raised approximately US$22.2

million (GBP15.7 million) (before expenses) by way of an

oversubscribed placing of 152,749,172 new ordinary shares of 1

penny each at a price of 10.3 pence per share with leading

institutional and mining investors (the "Placing"). The price was

calculated as the 5 day volume weighted average price (as published

by Bloomberg) at close of trading Monday 19 March 2018. The Placing

shares represented approximately 14.4% of the Company's issued

share capital on admission.

13. Events after the reporting period

On 6 July 2018, the Company received an exercise notice for the

exercise of warrants over 4,000,000 ordinary shares of 1 pence each

("Ordinary Shares") with an exercise price of 6.9 pence per

Ordinary Share. Accordingly, 4,000,000 new Ordinary Shares have

been issued. The new Ordinary Shares rank pari passu with the

Company's existing Ordinary Shares.

On 6 July 2018, the Company received an exercise notice for the

exercise of warrants over 5,000,000 ordinary shares of 1 pence each

("Ordinary Shares") with an exercise price of 13.84 pence per

Ordinary Share. Accordingly, 5,000,000 new Ordinary Shares have

been issued. The new Ordinary Shares rank pari passu with the

Company's existing Ordinary Shares.

On 8 August 2018, the issue and allotment of 24,847,310 new

ordinary shares of 1 pence each to be issued to certain directors,

senior employees and advisors of the Company (the "Compensation

Shares") was approved. Accordingly, 24,847,310 new Ordinary Shares

have been issued. The new Ordinary Shares rank pari passu with the

Company's existing Ordinary Shares.

On 13 September 2018 the Group completed the acquisition of a

21.22 per cent interest in Strategic Minerals Corporation ("SMC"),

an intermediate holding company of Vametco Alloys Proprietary

Limited, "Vametco") from Sojitz Noble Alloys Corporation ("Sojitz")

for a total cash consideration of US$20,000,000 (the

"Acquisition"). On completion of the Acquisition, Bushveld

increased its indirect beneficial interest in Vametco from 59.1 per

cent to 75 per cent.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LFMATMBATMMP

(END) Dow Jones Newswires

September 26, 2018 02:01 ET (06:01 GMT)

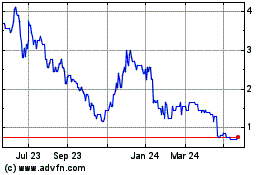

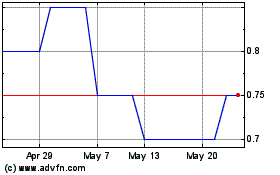

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From May 2024 to Jun 2024

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Jun 2023 to Jun 2024