EQRx, Inc. (Nasdaq: EQRX), a new type of pharmaceutical company

committed to developing and delivering innovative medicines to

patients at radically lower prices, today reported financial

results for the second quarter ended June 30, 2022 and provided an

overview of recent corporate progress.

“We made significant progress against our business

objectives this quarter, highlighted most recently by the

initiation of our Phase 3b, U.S.-led comparative study with

aumolertinib and acceptance of EQRx’s first filing by a global

regulatory agency,” said Melanie Nallicheri, president and chief

executive officer of EQRx. “We also recently presented important

clinical data that supports the strength and quality of our lead

oncology programs. Our team remains focused on advancing these

programs towards regulatory approvals, building our Global Buyers

Club, and maintaining our strong financial position that provides

expected cash runway at least into 2025.”

Recent Business Highlights

Catalog of Medicines in

Development

Aumolertinib (third-generation epidermal growth

factor receptor (EGFR) inhibitor)

EGFR-mutated Non-small Cell Lung Cancer

(NSCLC)

- Initiated a U.S.-led, randomized, three-arm, open-label,

controlled, Phase 3b clinical trial to evaluate the safety and

efficacy of aumolertinib and chemotherapy versus aumolertinib

alone, along with an osimertinib reference arm, for the first-line

treatment of EGFR-mutated NSCLC. This study is designed to address

the applicability of the Phase 3 AENEAS trial results to current

U.S. medical practice and patient population.

- In June 2022, the United Kingdom’s (U.K.) Medicines and

Healthcare products Regulatory Agency (MHRA) accepted for review

the marketing authorization application (MAA) for aumolertinib,

EQRx’s first submission to a regulatory agency. EQRx continues to

engage in constructive conversations with the United States (U.S.)

Food and Drug Administration (FDA) to gain greater clarity on the

regulatory path forward in the U.S.

- Presented clinical data from the pivotal Phase 3 AENEAS study

at the 2022 American Society of Clinical Oncology (ASCO) Annual

Meeting, demonstrating that aumolertinib reduced the risk of

central nervous system (CNS) progression as a first-line treatment

in patients with locally advanced or metastatic EGFR-mutated NSCLC

who had baseline CNS metastases by 68% compared to gefitinib (29.0

vs 8.3 months; HR=0.319; 95% CI, 0.176-0.580; P<0.0001).*

- EQRx’s partner Turning Point Therapeutics initiated a Phase

1b/2 clinical trial evaluating the safety, tolerability and

preliminary efficacy of aumolertinib in combination with

elzovantinib in patients with EGFR mutant MET-amplified advanced

NSCLC.

Sugemalimab (anti-PD-L1 antibody)

Stage IV Non-small Cell Lung Cancer

- Presented clinical data from a pre-specified interim analysis

of overall survival (OS) from the pivotal Phase 3 GEMSTONE-302

study at the 2022 ASCO Annual Meeting.**

- Results demonstrated that sugemalimab plus platinum-based

chemotherapy reduced the risk of death by 35% compared to

platinum-based chemotherapy plus placebo in patients with

previously untreated Stage IV NSCLC (25.4 vs 16.9 months; HR=0.65;

95% CI, 0.50-0.84; P=0.0008). OS benefit was observed in the

sugemalimab plus chemotherapy group compared with the placebo plus

chemotherapy group, including in patients with different levels of

PD-L1 expression (PD-L1 ≥1%, median OS 27.0 vs. 19.0 months,

HR=0.64; PD-L1 <1%, median OS 19.4 vs. 14.8 months, HR=0.66). No

new safety signals were observed with longer follow-up.

- EQRx’s first regulatory submission for sugemalimab for Stage IV

NSCLC is expected outside of the U.S. during the second half of

2022. The company continues to engage in constructive conversations

with the FDA to gain greater clarity on the regulatory path forward

in the U.S.

- Planning to initiate a U.S.-led, randomized, comparative

clinical trial in Stage IV NSCLC to evaluate sugemalimab vs. other

approved checkpoint inhibitor(s). The goal of this study is to

assess the applicability of GEMSTONE-302 study results to current

U.S. medical practice and patient population.

Stage III Non-small Cell Lung Cancer

- Presented final progression-free survival (PFS) results from

the pivotal Phase 3 GEMSTONE-301 trial of sugemalimab in a

late-breaking, oral presentation at the International Association

for the Study of Lung Cancer (IASLC) 2022 World Conference on Lung

Cancer (WCLC).**

- These results showed that sugemalimab continued to demonstrate

a clinically and statistically significant improvement in PFS

compared to placebo as consolidation therapy for patients with

locally advanced, unresectable Stage III NSCLC without disease

progression after concurrent or sequential chemoradiotherapy. There

are currently no immunotherapy consolidation treatments in the U.S.

or Europe approved for patients with unresectable Stage III NSCLC

who have received sequential chemoradiotherapy.

- An interim analysis of overall survival from GEMSTONE-301 is

expected in 2023.

Extranodal NK/T-cell Lymphoma (ENKTL)

- Presented clinical data from the primary analysis from the

Phase 2 GEMSTONE-201 study of sugemalimab in relapsed or refractory

ENKTL, a rare and aggressive form of non-Hodgkin lymphoma, in an

oral presentation at the 2022 ASCO Annual Meeting. The objective

response rate for patients treated with sugemalimab was 46.2%, with

37.2% of patients achieving a complete response. The one-year

duration of response rate was 86%, and the median duration of

response was not reached as of the cutoff date.**

- A U.S. regulatory submission for relapsed or refractory ENKTL

is expected in 2023; sugemalimab was granted Breakthrough Therapy

designation by the FDA for ENKTL in 2020.

Other Pipeline Programs

- EQRx plans to investigate the JAK-1 inhibitor EQ121 in atopic

dermatitis to start building its immunology and inflammation

franchise.

- A Phase 3 multiregional trial of the anti-PD-1 antibody

nofazinlimab (EQ176, also known as CS1003) in combination with

lenvatinib as first-line treatment for patients with advanced

hepatocellular carcinoma (HCC) is ongoing. EQRx’s partner CStone

Pharmaceuticals announced in March 2022 that the study had met its

pre-specified enrollment target.

- A Phase 2 multiregional trial of the CDK4/6 inhibitor

lerociclib (EQ132) as first- and second-line treatment for

metastatic breast cancer is ongoing.

- EQRx entered into a research and development collaboration with

Aurigene to jointly accelerate the development of drug candidates

in the areas of oncology and immune-inflammatory diseases, bringing

EQRx’s total number of drug engineering partners to seven.

Global Buyers Club

- Signed memoranda of understanding (MOUs) with payers and health

systems that have approximately 30 million lives within their

networks. This brings the count of total lives covered by the

payers and health systems with which EQRx has MOUs in place to

approximately 210 million.

Second Quarter 2022 Financial

Highlights

- Cash Position: Cash, cash equivalents and

short-term investments totaled $1.6 billion at June 30, 2022. EQRx

expects to maintain sufficient capital resources to fund

anticipated operations at least into 2025.

- Operating Expenses: Total operating expenses

for the three months ended June 30, 2022 were $79.1 million, as

compared to $34.6 million for the three months ended June 30, 2021.

EQRx continues to expect full year 2022 operating expenses to be

$400.0 million or less.

- R&D Expenses: Research and development

expenses for the three months ended June 30, 2022 were $47.3

million, as compared to $21.4 million for the three months ended

June 30, 2021. This increase was primarily driven by a $14.3

million increase in discovery, preclinical and clinical development

costs; an $11.4 million increase in employee-related expenses; as

well as a net increase in consulting and professional fees and

other research and development activities.

- G&A Expenses: General and administrative

expenses for the three months ended June 30, 2022 were $31.8

million, as compared to $13.2 million for the three months ended

June 30, 2021. The increase was primarily driven by a

$14.4 million increase in employee-related expenses and a

$3.4 million increase in consulting and professional fees.

- Net Loss: Net loss totaled $82.5 million for

the three months ended June 30, 2022, as compared to a net loss of

$34.5 million for the three months ended June 30, 2021.

Conference Call and Webcast

Information EQRx will host a conference call and webcast

today, August 11, 2022, at 8:00 a.m. Eastern Time. A live webcast

of the call will be available on the “Investor Relations” page of

EQRx’s website at

https://investors.eqrx.com/news-events/events-presentations. To

access the call by phone, participants should visit this link

(registration link) to receive dial-in details. Participants are

requested to register at least 15 minutes before the start of the

call. The webcast will be made available for replay on EQRx’s

website beginning approximately two hours after the event.

About EQRx EQRx is a new type of

pharmaceutical company committed to developing and delivering

innovative medicines to patients at radically lower prices.

Launched in January 2020, EQRx is purpose-built, at scale, with a

growing catalog of medicines in development in high-cost drug

categories and emerging partnerships with leading payers and health

systems. Leveraging cutting-edge science and technology and

strategic partnerships with stakeholders from across the healthcare

system, EQRx aims to provide innovative, patent-protected medicines

more efficiently and cost-effectively than ever before. To learn

more, visit www.eqrx.com and follow us on social media:

Twitter: @EQRxInc, LinkedIn,

Instagram: @eqrxinc.

EQRx™ and Remaking Medicine™ are trademarks of

EQRx.

Cautionary Statement Regarding

Forward-Looking Statements This press release contains

certain forward-looking statements within the meaning of the

federal securities laws. These forward-looking statements may be

identified by the use of words such as “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “design,” “strategy,”

“future,” “opportunity,” “continue,” “aim,” “goal,” “plan,” “may,”

“look forward,” “should,” “will,” “would,” “will be,” “will likely

result,” and similar expressions. These forward-looking statements

include, but are not limited to, express or implied statements

regarding EQRx’s cash runway; the timing of regulatory submissions;

plans for clinical trials; ability of trials to address current

U.S. medical practice; gaining clarity on a regulatory path forward

in the U.S.; presentation of data for EQRx’s product candidates;

estimated operating expenses; and EQRx’s ability to create a

market-based solution to lower drug prices and expand patient

access to innovative medicines; among others. Forward-looking

statements are predictions, projections and other statements about

future events that are based on current expectations and

assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this press

release, including but not limited to the inherent risks in

pharmaceutical development, including with respect to the conduct

of clinical trials and risk of delays; risks that the results of

prior clinical trials may not be predictive of future results;

risks regarding the timing and outcome of EQRx’s interactions with

regulatory authorities and its ability to gain clarity on a

regulatory path forward; risks that the regulatory pathway in one

or more markets may not be compatible with EQRx’s business model;

risks associated with successfully demonstrating the safety and

efficacy of its drug candidates and obtaining regulatory approvals;

risks associated with EQRx’s ability to otherwise implement its

business plans, including risks associated with its growth strategy

and expanding and maintaining the Global Buyers Club; variations in

operating performance across competitors; changes in the

competitive and highly regulated industries in which EQRx operates,

including laws and regulations affecting EQRx’s business; and other

risks associated with its plans to create a new kind of

pharmaceutical company, among others. The foregoing list of factors

is not exhaustive. You should carefully consider the foregoing

factors and the other risks and uncertainties described in the

“Risk Factors” section in EQRx’s most recent Annual Report on Form

10-K as well as any other filings with the SEC. These filings

identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from

those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and EQRx assumes no obligation, and does not intend, to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise.

Investors and others should note that we

communicate with our investors and the public using our website

www.eqrx.com, including, but not limited to, company disclosures,

investor presentations and FAQs, SEC filings, press releases,

public conference call transcripts and webcast transcripts. The

information that we post on our website could be deemed to be

material information. As a result, we encourage investors, the

media and other interested parties to review the information that

we post there on a regular basis. The contents of our website shall

not be deemed incorporated by reference in any filing with the

SEC.

EQRx, Inc. Condensed

Consolidated Statements of Operations

(unaudited) (in thousands, except share

and per share data)

| |

|

|

|

|

| |

|

Three months

ended |

|

Six months

ended |

| |

|

June 30, |

|

June 30, |

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

47,298 |

|

|

$ |

21,416 |

|

|

$ |

100,726 |

|

|

$ |

38,093 |

|

|

General and administrative |

|

|

31,792 |

|

|

|

13,223 |

|

|

|

64,055 |

|

|

|

23,505 |

|

|

Total operating expenses |

|

|

79,090 |

|

|

|

34,639 |

|

|

|

164,781 |

|

|

|

61,598 |

|

| Loss from

operations |

|

|

(79,090 |

) |

|

|

(34,639 |

) |

|

|

(164,781 |

) |

|

|

(61,598 |

) |

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of contingent earn-out liability |

|

|

(8,205 |

) |

|

|

— |

|

|

|

93,569 |

|

|

|

— |

|

|

Change in fair value of warrant liabilities |

|

|

1,184 |

|

|

|

— |

|

|

|

5,131 |

|

|

|

— |

|

|

Interest income, net |

|

|

4,091 |

|

|

|

19 |

|

|

|

4,273 |

|

|

|

163 |

|

|

Other (expense) income, net |

|

|

(526 |

) |

|

|

94 |

|

|

|

(12 |

) |

|

|

92 |

|

|

Total other (expense) income, net |

|

|

(3,456 |

) |

|

|

113 |

|

|

|

102,961 |

|

|

|

255 |

|

| Net

loss |

|

$ |

(82,546 |

) |

|

$ |

(34,526 |

) |

|

$ |

(61,820 |

) |

|

$ |

(61,343 |

) |

| Net loss per

share - basic |

|

$ |

(0.17 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.19 |

) |

| Net loss per

share - diluted |

|

$ |

(0.17 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.19 |

) |

| Weighted

average common shares outstanding - basic |

|

473,058,458 |

|

|

318,272,186 |

|

|

471,849,487 |

|

|

314,903,264 |

|

| Weighted

average common shares outstanding - diluted |

|

473,058,458 |

|

|

318,272,186 |

|

|

471,849,487 |

|

|

314,903,264 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

EQRx, Inc. Selected

Condensed Consolidated Balance Sheet Data

(unaudited) (in thousands)

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

|

| |

|

2022 |

|

2021 |

|

| |

|

|

|

|

|

|

|

|

Cash, cash equivalents and short-term investments |

|

$ |

1,557,347 |

|

$ |

1,678,542 |

|

|

Working capital(1) |

|

|

1,533,036 |

|

|

1,666,556 |

|

|

Total assets |

|

|

1,608,279 |

|

|

1,729,442 |

|

|

Total stockholders’ equity |

|

|

1,474,501 |

|

|

1,514,839 |

|

|

Restricted cash |

|

|

633 |

|

|

633 |

|

| |

|

|

|

|

|

|

|

(1) Working capital is defined as current

assets less current liabilities.

EQRx Contacts:

Media: Dan Budwick 1AB dan@1abmedia.com

Investors: investors@eqrx.com

* EQRx and Hansoh Pharmaceuticals have partnered

on the global development of aumolertinib. This presentation was

shared by Hansoh Pharmaceuticals and its collaborators.

** EQRx and CStone Pharmaceuticals have partnered

on the global development of sugemalimab. This presentation was

shared by CStone Pharmaceuticals and its collaborators.

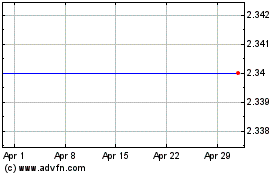

EQRx (NASDAQ:EQRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

EQRx (NASDAQ:EQRX)

Historical Stock Chart

From Apr 2023 to Apr 2024