Data Storage Corporation (Nasdaq: DTST) (“DSC” and

the “Company”), a provider of diverse business continuity solutions

for disaster-recovery, cloud infrastructure, cyber-security and

data analytics solutions, today provided a business update and

reported financial results for the first quarter ended March 31,

2022.

Chuck Piluso, CEO of Data Storage Corporation, commented, “I am

pleased to report we have witnessed increased sales, as well as an

increase in monthly subscription services, which contributed to our

revenue growth from $2.6 million to $8.7 million, a year-over-year

increase of 236% for the first quarter of 2022. At the same time,

we achieved positive net income and generated over $600 thousand of

EBITDA (see reconciliation below). We continue to deliver

critically required information technology solutions to a niche

multi-billion-dollar market and have invested millions of dollars

to establish ourselves as a leader within the IBM Power cloud

infrastructure and disaster recovery industry. As anticipated, the

Flagship merger has positioned us as a comprehensive

one-stop-solutions provider with the ability to cross-sell

solutions across our respective clients. The synergies of the

merger are already evident, as illustrated by the

multi-million-dollar contract with a highly recognized national

sports team announced earlier this year, as well as our expanded

our partnership with the Professional Fighters League. The sports

industry represents just one of several key markets we are

targeting for our solutions. Importantly, we believe we are

extremely well positioned to take advantage of the ever increasing

market demand for cloud infrastructure services, disaster recovery,

cyber security, and data analytics/AI markets, which we believe

will translate to accelerated revenue growth, especially as more

companies migrate their IBM Power infrastructure to the cloud.”

“Overall, we continue to execute on our business growth

strategy, which has resulted in transformational acquisitions, as

well as significant contracts and new partnerships. We have built a

robust proposal pipeline to support our growth, while at the same

time, we are increasing our sales force, expanding our marketing

initiatives, as well as investing in highly skilled personnel and

infrastructure. With over $13 million in cash as of March 31, 2022

and no long-term debt, we are well positioned to take advantage of

the countless opportunities within this emerging

multi-billion-dollar market.”

Conference Call

The Company plans to host a conference call at

10:00 am Eastern Time today, May 16, 2022 to discuss the company's

financial results for the first quarter ended March 31, 2022, as

well as corporate progress and other developments.

The conference call will be available via telephone by dialing

toll-free 888-506-0062 for U.S. callers or for international

callers +1 973-528-0011 and using entry code: 708934. A webcast of

the call may be accessed

at https://www.webcaster4.com/Webcast/Page/2763/45417, or on the

Company’s Investor Relations section of the

website, ir.datastoragecorp.com.

A webcast replay of the call will be available on the Company’s

Investor Relations section of the website (ir.datastoragecorp.com)

through May 16, 2023. A telephone replay of the call will be

available approximately one hour following the call, through May

30, 2022, and can be accessed by dialing 877-481-4010 for U.S.

callers or +1 919-882-2331 for international callers and entering

conference ID: 45417.

About Data Storage

Corporation

The Company provides a broad range of premium

business continuity and analytics solutions from seven data center

facilities and two technical labs throughout the USA and Canada.

The Company serves its clients with cloud infrastructure, disaster

recovery, cyber security and data analytics. Clients look to Data

Storage Corporation to ensure disaster recovery, business

continuity, enhance cyber security, and meet increasing industry,

state, and federal regulations. The Company markets to businesses,

government, education, and the healthcare industry.

For more information, please visit

http://www.DTST.com/.

Safe Harbor Provision

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended, that are intended to be covered by the safe

harbor created thereby. Forward-looking statements are subject to

risks and uncertainties that could cause actual results,

performance or achievements to differ materially from any future

results, performance or achievements expressed or implied by such

forward-looking statements. Statements preceded by, followed by or

that otherwise include the words “believes,” “expects,”

“anticipates,” “intends,” “projects,” “estimates,” “plans” and

similar expressions or future or conditional verbs such as “will,”

“should,” “would,” “may” and “could” are generally forward-looking

in nature and not historical facts, although not all

forward-looking statements include the foregoing. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, it can provide no

assurance that such expectations will prove to have been correct.

These risks should not be construed as exhaustive and should be

read together with the other cautionary statements included in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2021, subsequent Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K filed with the Securities and Exchange

Commission. Any forward-looking statement speaks only as of the

date on which it was initially made. Except as required by law, the

Company assumes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, changed circumstances or otherwise.

Contact:Crescendo Communications,

LLC212-671-1020DTST@crescendo-ir.com

SOURCE: Data Storage Corporation

[Tables follow]

|

DATA STORAGE CORPORATION AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

March 31, 2022 |

|

December 31, 2021 |

|

|

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

13,420,707 |

|

|

$ |

12,135,803 |

|

|

Accounts receivable (less allowance for credit losses of $47,523

and $30,000 in 2021 and 2020, respectively) |

|

|

3,524,464 |

|

|

|

2,384,367 |

|

|

Prepaid expenses and other current assets |

|

|

1,256,243 |

|

|

|

536,401 |

|

|

Total Current Assets |

|

|

18,201,414 |

|

|

|

15,056,571 |

|

| |

|

|

|

|

|

|

|

|

| Property and Equipment: |

|

|

|

|

|

|

|

|

|

Property and equipment |

|

|

7,502,490 |

|

|

|

6,595,236 |

|

|

Less—Accumulated depreciation |

|

|

(4,939,373 |

) |

|

|

(4,657,765 |

) |

|

Net Property and Equipment |

|

|

2,563,117 |

|

|

|

1,937,471 |

|

| |

|

|

|

|

|

|

|

|

| Other Assets: |

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

6,560,671 |

|

|

|

6,560,671 |

|

|

Operating lease right-of-use assets |

|

|

374,356 |

|

|

|

422,318 |

|

|

Other assets |

|

|

78,045 |

|

|

|

103,226 |

|

|

Intangible assets, net |

|

|

2,184,836 |

|

|

|

2,254,566 |

|

|

Total Other Assets |

|

|

9,197,908 |

|

|

|

9,340,781 |

|

| |

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

29,962,439 |

|

|

$ |

26,334,823 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

4,335,372 |

|

|

$ |

1,343,391 |

|

|

Deferred revenue |

|

|

292,450 |

|

|

|

366,859 |

|

|

Finance leases payable |

|

|

395,324 |

|

|

|

216,299 |

|

|

Finance leases payable related party |

|

|

741,830 |

|

|

|

839,793 |

|

|

Operating lease liabilities short term |

|

|

206,231 |

|

|

|

205,414 |

|

|

Total Current Liabilities |

|

|

5,971,207 |

|

|

|

2,971,756 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

177,348 |

|

|

|

226,344 |

|

|

Finance leases payable |

|

|

568,588 |

|

|

|

157,424 |

|

|

Finance leases payable related party |

|

|

434,050 |

|

|

|

364,654 |

|

|

Total Long Term Liabilities |

|

|

1,179,986 |

|

|

|

748,422 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

|

7,151,193 |

|

|

|

3,720,178 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Common stock, par value $.001;

250,000,000 shares authorized; 6,697,127 and 6,693,793 shares

issued and outstanding in 2022 and 2021, respectively |

|

|

6,697 |

|

|

|

6,694 |

|

| Additional paid in

capital |

|

|

38,314,591 |

|

|

|

38,241,155 |

|

| Accumulated deficit |

|

|

(15,394,788 |

) |

|

|

(15,530,576 |

) |

| Total Data Storage Corp

Stockholders’ Equity |

|

|

22,926,500 |

|

|

|

22,717,273 |

|

| Non-controlling interest in

consolidated subsidiary |

|

|

(115,254 |

) |

|

|

(102,628 |

) |

| Total Stockholder’s

Equity |

|

|

22,811,246 |

|

|

|

22,614,645 |

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

29,962,439 |

|

|

$ |

26,334,823 |

|

|

DATA STORAGE CORPORATION AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

Sales |

|

$ |

8,657,199 |

|

|

$ |

2,574,691 |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

6,011,289 |

|

|

|

1,420,899 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

|

|

2,645,910 |

|

|

|

1,153,792 |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

2,459,866 |

|

|

|

1,118,407 |

|

|

|

|

|

|

|

|

|

|

|

|

Income from Operations |

|

|

186,044 |

|

|

|

35,385 |

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense) |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(62,882 |

) |

|

|

(35,045 |

) |

|

Total Other Expense |

|

|

(62,882 |

) |

|

|

(35,045 |

) |

|

|

|

|

|

|

|

|

|

|

|

Income before provision for income taxes |

|

|

123,162 |

|

|

|

340 |

|

|

|

|

|

|

|

|

|

|

|

|

Benefit from income taxes |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

|

123,162 |

|

|

|

340 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest in consolidated subsidiary |

|

|

12,626 |

|

|

|

1,759 |

|

|

|

|

|

|

|

|

|

|

|

|

Net Income attributable to Data Storage Corp |

|

|

135,788 |

|

|

|

2,099 |

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock Dividends |

|

|

— |

|

|

|

(38,883 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Attributable to Common Stockholders |

|

$ |

135,788 |

|

|

$ |

(36,784 |

) |

|

|

|

|

|

|

|

|

|

|

|

Earnings per Share – Basic |

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

Earning pers Share – Diluted |

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

Weighted Average Number of Shares - Basic |

|

|

6,695,966 |

|

|

|

3,213,485 |

|

|

Weighted Average Number of Shares - Diluted |

|

|

6,955,900 |

|

|

|

3,213,485 |

|

|

DATA STORAGE CORPORATION AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2022 |

|

2021 |

|

Cash Flows from Operating Activities: |

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

123,162 |

|

|

$ |

340 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

351,338 |

|

|

|

267,189 |

|

|

Stock based compensation |

|

|

66,505 |

|

|

|

42,171 |

|

|

Changes in Assets and Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,140,097 |

) |

|

|

(170,096 |

) |

|

Other assets |

|

|

25,180 |

|

|

|

(345 |

) |

|

Prepaid expenses and other current assets |

|

|

(719,842 |

) |

|

|

(290,018 |

) |

|

Right of use asset |

|

|

47,962 |

|

|

|

21,492 |

|

|

Accounts payable and accrued expenses |

|

|

2,991,981 |

|

|

|

558,679 |

|

|

Deferred revenue |

|

|

(74,409 |

) |

|

|

(59,489 |

) |

|

Operating lease liability |

|

|

(48,179 |

) |

|

|

(21,364 |

) |

| Net Cash Provided by

Operating Activities |

|

|

1,623,601 |

|

|

|

348,559 |

|

| Cash Flows from Investing

Activities: |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(25,946 |

) |

|

|

(257,238 |

) |

| Net Cash Used in Investing

Activities |

|

|

(25,946 |

) |

|

|

(257,238 |

) |

| Cash Flows from Financing

Activities: |

|

|

|

|

|

|

|

|

|

Repayments of finance lease obligations related party |

|

|

(271,574 |

) |

|

|

(313,925 |

) |

|

Repayments of finance lease obligations |

|

|

(48,112 |

) |

|

|

(36,682 |

) |

|

Cash received for the exercised of options |

|

|

6,935 |

|

|

|

— |

|

| Net Cash Used in Financing

Activities |

|

|

(312,751 |

) |

|

|

(350,607 |

) |

| |

|

|

|

|

|

|

|

|

| Increase (decrease) in Cash

and Cash Equivalents |

|

|

1,284,904 |

|

|

|

(259,286 |

) |

| |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents,

Beginning of Period |

|

|

12,135,803 |

|

|

|

893,598 |

|

| |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents, End

of Period |

|

$ |

13,420,707 |

|

|

$ |

634,312 |

|

| Supplemental Disclosures: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

61,262 |

|

|

$ |

31,971 |

|

|

Cash paid for income taxes |

|

$ |

— |

|

|

$ |

— |

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

|

|

|

|

Accrual of preferred stock dividend |

|

$ |

— |

|

|

$ |

38,883 |

|

|

Assets acquired by finance lease |

|

$ |

881,308 |

|

|

$ |

50,000 |

|

|

DATA STORAGE CORPORATION AND SUBSIDIARIES |

|

NON-GAAP FINANCIAL MEASURES |

Adjusted EBITDA

To supplement our consolidated financial

statements presented in accordance with GAAP and to provide

investors with additional information regarding our financial

results, we consider and are including herein Adjusted EBITDA, a

Non-GAAP financial measure. We view Adjusted EBITDA as an operating

performance measure and, as such, we believe that the GAAP

financial measure most directly comparable to it is net income

(loss). We define Adjusted EBITDA as net income adjusted for

interest and financing fees, depreciation, amortization,

stock-based compensation, and other non-cash income and expenses.

We believe that Adjusted EBITDA provides us an important measure of

operating performance because it allows management, investors,

debtholders and others to evaluate and compare ongoing operating

results from period to period by removing the impact of our asset

base, any asset disposals or impairments, stock-based compensation

and other non-cash income and expense items associated with our

reliance on issuing equity-linked debt securities to fund our

working capital.

Our use of Adjusted EBITDA has limitations as an

analytical tool, and this measure should not be considered in

isolation or as a substitute for an analysis of our results as

reported under GAAP, as the excluded items may have significant

effects on our operating results and financial condition.

Additionally, our measure of Adjusted EBITDA may differ from other

companies’ measure of Adjusted EBITDA. When evaluating our

performance, Adjusted EBITDA should be considered with other

financial performance measures, including various cash flow

metrics, net income and other GAAP results. In the future, we may

disclose different non-GAAP financial measures in order to help our

investors and others more meaningfully evaluate and compare our

future results of operations to our previously reported results of

operations.

The following table shows our reconciliation of net income to

adjusted EBITDA for the three months ended March 31, 2022 and 2021,

respectively:

|

|

|

For the Three Months Ended |

|

|

|

March 31, |

|

March 31, |

|

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

Net income |

|

$ |

123,162 |

|

|

|

340 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

351,338 |

|

|

|

267,189 |

|

|

Flagship acquisition costs |

|

|

605 |

|

|

|

— |

|

|

Interest income and expense |

|

|

62,882 |

|

|

|

35,045 |

|

|

Stock based compensation |

|

|

66,505 |

|

|

|

42,171 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

604,492 |

|

|

|

344,745 |

|

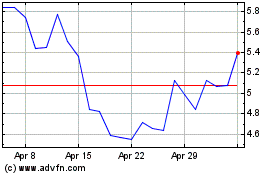

Data Storage (NASDAQ:DTST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Data Storage (NASDAQ:DTST)

Historical Stock Chart

From Apr 2023 to Apr 2024