Current Report Filing (8-k)

April 08 2022 - 5:14PM

Edgar (US Regulatory)

0001679817

false

0001679817

2022-04-04

2022-04-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

April

4, 2022

Date

of Report

(Date

of earliest event reported)

OZOP

ENERGY SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-55976 |

|

35-2540672 |

(State

or other jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

42

N. Main St.

Florida,

NY 10921

(Address

of principal executive offices, including zip code)

(845)

544-5112

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities

Act |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Item

1.01 Entry into a Material Definitive Agreement.

On

April 4, 2022 Ozop Energy Solutions, Inc. (the “Company) entered into a purchase agreement (the “Purchase Agreement”)

with GHS Investments LLC (“GHS”). Under the terms of the Purchase Agreement, the Company may require GHS to purchase a maximum

of Two Hundred Million (200,000,000) shares of common stock (“GHS Purchase Shares”) over a six-month term that ends on October

4, 2022.

The

Purchase Agreement provides that, upon the terms and subject to the conditions and limitations set forth in the Purchase Agreement, the

Company, in its sole discretion, has the right from time to time during the term of the Purchase Agreement, to deliver to GHS a purchase

notice (a “Purchase Notice”) directing GHS to purchase (each, a “GHS Purchase”) a specified number of GHS Purchase

Shares. A GHS Purchase will be made in a minimum amount of Ten Thousand Dollars ($10,000) and up to a maximum of: (1) one hundred percent

(100%) of the average daily volume traded for the Common Stock during the relevant Valuation Period if the lowest VWAP during the Valuation

Period is below $0.03 (subject to adjustments for stock splits, dividends, and similar occurrences), (2) one hundred and fifty percent

(150%) of the average daily volume traded for the Common Stock during the Valuation Period if the lowest VWAP during the relevant Valuation

Period is between $0.03 and $0.035 (subject to adjustments for stock splits, dividends, and similar occurrences), and (3) two hundred

percent (200%) of the average daily volume traded for the Common Stock during the Valuation Period if the lowest VWAP during the relevant

Valuation Period is above $0.035 per share (subject to adjustments for stock splits, dividends, and similar occurrences), all subject

to the maximum of Two Hundred Million (200,000,000) GHS Purchase Shares.

On

the first trading day after the last day of the relevant Valuation Period, the Company will cause to be delivered to GHS that number

of shares of common stock that equal one hundred percent (100%) of the aggregate GHS Purchase Shares specified in the Purchase Notice.

The

GHS Purchase Agreement prohibits the Company from directing GHS to purchase any shares of common stock if those shares, when aggregated

with all other shares of our common stock then beneficially owned by GHS and its affiliates, would result in GHS and its affiliates having

beneficial ownership, at any single point in time, of more than 4.99% of the then total outstanding shares of our common stock.

Events

of default under the GHS Purchase Agreement include the following:

| ● | the

effectiveness of the Registration Statement lapses for any reason (including, without limitation,

the issuance of a stop order or similar order) or such Registration Statement (or the prospectus

forming a part thereof) is unavailable to the Investor for resale of any or all of the Purchase

Shares to be issued to the Investor under the Transaction Documents; |

| | | |

| ● | the

suspension of the Common Stock from trading on the Principal Market for a period of two (2)

Business Days, provided that the Company may not direct the Investor to purchase any shares

of Common Stock during any such suspension; |

| | | |

| ● | the

delisting of the Common Stock from the OTC Pink provided, however, that the Common Stock

is not immediately thereafter trading on The NASDAQ Capital Market, The NASDAQ Global Market,

The NASDAQ Global Select Market, the New York Stock Exchange, the NYSE American, or the OTCQB

or the OTCQX operated by the OTC Markets Group, Inc. (or any nationally recognized successor

to any of the foregoing); |

| | | |

| ● | the

failure for any reason by the Transfer Agent to issue Purchase Shares to the Investor within

three (3) Business Days after the applicable date on which the Investor is entitled to receive

such Purchase Shares; |

| ● | the

Company breaches any representation, warranty, covenant or other term or condition under

any Transaction Document if such breach could have a Material Adverse Effect and except,

in the case of a breach of a covenant which is reasonably curable, only if such breach continues

for a period of at least five (5) Business Days; |

| | | |

| ● | if

any Person or entity commences a proceeding against the Company pursuant to or within the

meaning of any Bankruptcy Law; |

| | | |

| ● | if

the Company, pursuant to or within the meaning of any Bankruptcy Law, (i) commences a voluntary

case, (ii) consents to the entry of an order for relief against it in an involuntary case,

(iii) consents to the appointment of a Custodian of it or for all or substantially all of

its property, or (iv) makes a general assignment for the benefit of its creditors or is generally

unable to pay its debts as the same become due; |

| | | |

| ● | a

court of competent jurisdiction enters an order or decree under any Bankruptcy Law that (i)

is for relief against the Company in an involuntary case, (ii) appoints a Custodian of the

Company or for all or substantially all of its property, or (iii) orders the liquidation

of the Company; or |

| | | |

| ● | if

at any time the Company is not eligible to transfer its Common Stock electronically as DWAC

Shares. |

So

long as an Event of Default has occurred and is continuing, the Company shall not deliver to the Investor any Purchase Notice.

The

foregoing information is a summary of the Purchase Agreement described above, is not complete, and is qualified in its entirety by reference

to the full text of the Purchase Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K. Readers should review

the Purchase Agreement for a complete understanding of the terms and conditions of the transaction described above.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Report to be signed on its behalf by the

undersigned hereunto duly authorized.

Dated:

April 8, 2022

| |

OZOP

ENERGY SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Brian Conway |

| |

Name: |

Brian

Conway |

| |

Title: |

Chief

Executive Officer |

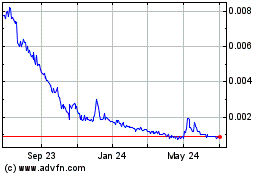

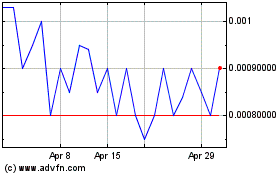

Ozop Energy Solutions (PK) (USOTC:OZSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ozop Energy Solutions (PK) (USOTC:OZSC)

Historical Stock Chart

From Apr 2023 to Apr 2024