Securities Registration: Employee Benefit Plan (s-8)

January 11 2022 - 4:07PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on January 11, 2022

Registration No. 333- _______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

ICONIC BRANDS, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

13-4362274

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(IRS Employer

Identification Number)

|

44 Seabro Avenue

Amityville, New York 11701

(Address of Principal Executive Offices)

Iconic Brands, Inc. 2021 Equity Incentive Plan

(Full title of the plan)

Larry Romer

Chief Executive Officer

44 Seabro Avenue

Amityville, NY 11701

(631) 464-4050

(Name, address including zip code, and telephone number, including area code, of agent for service)

Copies of all communications to:

|

Eric M. Hellige, Esq.

Pryor Cashman LLP

7 Times Square

New York, NY 10036

(212) 421-4100

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Securities to be Registered

|

|

Amount to be Registered(1)

|

|

|

Proposed Maximum Offering Price

per Share(2)

|

|

|

Proposed Maximum Aggregate

Offering Price(2)

|

|

|

Amount of Registration Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value per share, issuable pursuant to the Iconic Brands, Inc. 2021 Equity Incentive Plan

|

|

|

18,540,000

|

|

|

$

|

0.46

|

|

|

$

|

8,528,400

|

|

|

$

|

790.58

|

|

|

TOTAL

|

|

|

18,540,000

|

|

|

$

|

0.46

|

|

|

$

|

8,528,400

|

|

|

$

|

790.58

|

|

_______________

|

(1)

|

In accordance with Rule 416 under the Securities Act of 1933, as amended, this registration statement shall also be deemed to cover any additional securities that may from time to time be offered or issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

|

(2)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rules 457(c) under the Securities Act of 1933, as amended, based on the average of the bid and asked price of the Registrant’s common stock on January 10, 2022.

|

EXPLANATORY NOTE

This Registration Statement on Form S-8 (this “Registration Statement”) is filed by Iconic Brands, Inc. (the “Registrant”), to register a total of 18,540,000 shares of its common stock, $0.001 par value per share (“Common Stock”), pursuant to the Iconic Brands, Inc. 2021 Equity Incentive Plan (the “Plan”).

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified in Part I of Form S-8 will be sent or given to each participant in the Plan as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”). These documents and the documents incorporated by reference herein pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. Such documents are not filed as part of this Registration Statement in accordance with the Note to Part I of the Form S-8 Registration Statement.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents, which have been previously filed by the Registrant with the Securities and Exchange Commission (the “SEC”), are hereby incorporated by reference in this Registration Statement:

|

|

(a)

|

The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as filed with the SEC on April 13, 2021;

|

|

|

(b)

|

The Registrant’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2021, June 30, 2021 and September 30, 2021, as filed with the SEC on May 24, 2021, August 16, 2021 and November 22, 2021, respectively; and

|

|

|

(d)

|

The description of the Registrant’s Common Stock set forth under the caption “Description of Our Securities” in the prospectus forming a part of the Registrant’s Registration Statement on Form S-1 (File No. 333-261400), originally filed with the SEC on November 29, 2021.

|

Until such time that a post-effective amendment to this Registration Statement has been filed which indicates that all securities offered hereby have been sold or which deregisters all securities remaining unsold at the time of such amendment, all documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents. Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which is also deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers

Our Articles of Incorporation, as amended (our “Articles”), provide to the fullest extent permitted by the Nevada Revised Statutes, that our directors or officers shall not be personally liable to us or our stockholders for damages for breach of such director’s or officer’s fiduciary duty. The effect of this provision of our Articles is to eliminate our rights and our stockholders’ rights (through stockholders’ derivative suits on behalf of our company) to recover damages against a director or officer for breach of the fiduciary duty of care as a director or officer (including breaches resulting from negligent or grossly negligent behavior), except under certain situations defined by statute. We believe that the indemnification provisions in our Articles are necessary to attract and retain qualified persons as directors and officers.

Our Bylaws also provide that the Board of Directors may also authorize us to indemnify our employees or agents, and to advance the reasonable expenses of such persons, to the same extent, following the same determinations, and upon the same conditions as are required for the indemnification of, and advancement of, expenses to our directors and officers. As of the date of this Registration Statement, the Board of Directors has not extended indemnification rights to persons other than directors and officers.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, or persons controlling us pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

Item 9. Undertakings

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act; and

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement; and

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement.

|

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

Provided, however, that paragraphs (1)(i) and (1)(ii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Company pursuant to Section 13 or Section 15(d) of the Securities Exchange Act that are incorporated by reference in the Registration Statement.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant's annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Amityville, State of New York, on January 11, 2022.

|

|

Iconic Brands, Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ David Allen

|

|

|

|

Name:

|

David Allen

|

|

|

|

Title:

|

Chief Financial Officer

|

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Larry Romer and David Allen, and each one of them, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in their name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to sign any registration statement for the same offering covered by this registration statement that is to be effective on filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and all post-effective amendments thereto, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Larry Romer

|

|

Chief Executive Officer

|

|

January 11, 2022

|

|

Larry Romer

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ David Allen

|

|

Chief Financial Officer and Secretary

|

|

January 11, 2022

|

|

David Allen

|

|

(Principal Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Richard DeCicco

|

|

President and Chairman of the Board

|

|

January 11, 2022

|

|

Richard DeCicco

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Roseann Faltings

|

|

Director

|

|

January 11, 2022

|

|

Roseann Faltings

|

|

|

|

|

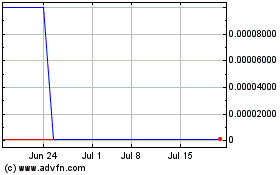

Iconic Brands (CE) (USOTC:ICNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iconic Brands (CE) (USOTC:ICNB)

Historical Stock Chart

From Apr 2023 to Apr 2024