Initial Statement of Beneficial Ownership (3)

February 19 2021 - 6:15AM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Kohn Bernhard L III |

2. Date of Event Requiring Statement (MM/DD/YYYY)

2/10/2021

|

3. Issuer Name and Ticker or Trading Symbol

PLBY Group, Inc. [PLBY]

|

|

(Last)

(First)

(Middle)

C/O PLBY GROUP, INC., 10960 WILSHIRE BLVD, SUITE 2200 |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

__X__ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

CEO and President / |

|

(Street)

LOS ANGELES, CA 90024

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 50000 | I (1) | See Footnote (1) |

| Common Stock | 1082950 (2) | D (2) | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Option (Right to buy) | (3) | 8/28/2028 | Common Stock | 948322 | $3.35 | D | |

| Stock Option (Right to buy) | (4) | 1/31/2031 | Common Stock | 965944 | $10.52 | D | |

| Explanation of Responses: |

| (1) | Represents shares of common stock held directly by RT PE Investment LLC ("RT PE Investment"). RT PE Investment acquired 100,000 shares of common stock of the Issuer in a private placement transaction in connection with the merger (the "Merger") described in that certain Agreement and Plan of Merger (the "Merger Agreement"), dated as of September 30, 2020, among Mountain Crest Acquisition Corp, now known as PLBY Group, Inc. ("PLBY"), MCAC Merger Sub Inc., Playboy Enterprises, Inc. ("Playboy"), and Suying Liu (solely for purposes of Section 7.2 and Article XI). The Reporting Person indirectly holds 50% of the pecuniary interests in RT PE Investment LLC. Mr. Kohn disclaims beneficial ownership of the shares owned by RT PE Investment, except to the extent of his pecuniary interest therein., and the inclusion of these securities in this report shall not be deemed an admission of beneficial ownership of the reported securities for purpose of Section 16 or for any other purpose. |

| (2) | Represents shares of PLBY common stock that will be issued in settlement of 193,275 restricted stock units originally granted to the Reporting Person by Playboy (the "Playboy RSUs") that became fully vested and then were terminated prior to the Merger. In connection with the Merger, PLBY assumed the obligation to settle the terminated Playboy RSUs in shares of its common stock in accordance with the allocation schedule under the Merger Agreement within 10 days following the first anniversary of the Merger (or, if earlier, the date the Playboy RSUs would have been settled in accordance with their original terms upon the occurrence of certain events). |

| (3) | The Stock Option was received in connection with the Merger upon the conversion of an option to purchase 169,248 shares of common stock of Playboy, with an exercise price of $18.73, into an option to purchase shares of common stock of PLBY pursuant to the terms of the Merger Agreement and the allocation schedule thereunder. The Stock Option is fully vested. |

| (4) | The Stock Option was received in connection with the Merger upon the conversion of an option to purchase 172,393 shares of common stock of Playboy, with an exercise price of $58.89, into an option to purchase shares of common stock of PLBY pursuant to the terms of the Merger Agreement and the allocation schedule thereunder. 1/3 of the shares subject to the Stock Option will vest on the first anniversary of the closing date of the Merger, or February 10, 2022, and the remainder will vest ratably in 24 equal monthly installments thereafter, subject, in each case, to the Reporting Person's continued employment or service through each applicable vesting date. The Stock Option is also subject to full acceleration of vesting in the event the Reporting Person is subject to a qualifying involuntary termination of employment. |

Remarks:

Exhibit List Exhibit 24.1 - Power of Attorney |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Kohn Bernhard L III

C/O PLBY GROUP, INC.

10960 WILSHIRE BLVD, SUITE 2200

LOS ANGELES, CA 90024 | X |

| CEO and President |

|

Signatures

|

| /s/ Christopher Riley, as Attorney-in-Fact | | 2/16/2021 |

| **Signature of Reporting Person | Date |

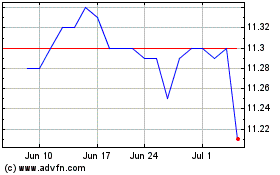

Monterey Capital Acquisi... (NASDAQ:MCAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

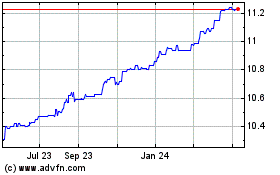

Monterey Capital Acquisi... (NASDAQ:MCAC)

Historical Stock Chart

From Apr 2023 to Apr 2024