Current Report Filing (8-k)

November 09 2020 - 4:35PM

Edgar (US Regulatory)

0001401257false--12-3100014012572020-11-092020-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2020

FORUM ENERGY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35504

|

|

61-1488595

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10344 Sam Houston Park Drive

|

Suite 300

|

Houston

|

TX

|

77064

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(Address of principal executive offices and zip code)

Registrant's telephone number, including area code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

FET

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 3.03 Material Modification to Rights of Security Holders.

In connection with the previously announced 1-for-20 reverse stock split of Forum Energy Technologies, Inc.’s (the “Company”) issued and outstanding shares of common stock, par value $0.01 per share, and corresponding decrease in the Company’s authorized shares of common stock (the “Reverse Stock Split”), the Company has filed an amendment to its Third Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware (the “Amendment”). The Amendment, effective after market close on November 9, 2020, converted each 20 issued and outstanding shares of common stock into one new share of common stock.

The Reverse Stock Split affected all record holders of common stock uniformly and did not affect any record holder’s percentage ownership interest in the Company, except for de minimis changes as a result of the elimination of fractional shares. The Reverse Stock Split reduced the number of shares of common stock outstanding from approximately 111.5 million to approximately 5.6 million shares. The number of authorized shares of common stock was reduced from 296,000,000 to 14,800,000.

The common stock will begin trading on a reverse split-adjusted basis on the New York Stock Exchange (“NYSE”) at the opening of trading on November 10, 2020. The common stock will continue trading on the NYSE under the symbol “FET” with a new CUSIP number (34984V209). The holders of common stock who hold in “street name” in their brokerage accounts do not have to take any action as a result of the Reverse Stock Split. Their accounts will be automatically adjusted to reflect the number of shares owned.

Proportionate adjustments will be made to the conversion rate of the Company’s outstanding 9.000% Convertible Senior Secured Notes due 2025 and to the outstanding awards and number of shares issued and issuable under the Company’s Second Amended and Restated 2016 Stock and Incentive Plan and all predecessor plans. The Reverse Stock Split will not affect the par value of the common stock.

In accordance with the terms of that certain Rights Agreement (the “Rights Agreement”), dated as of April 29, 2020, between the Company and American Stock Transfer & Trust Company, LLC, as rights agent (the “Rights Agent”), as amended by that certain Amendment to Rights Agreement, dated as of August 4, 2020, between the Company and the Rights Agent, 20 rights shall be associated with each share of common stock following the effectiveness of the Reverse Stock Split.

The Reverse Stock Split followed (i) the approval by the Company’s stockholders at the Annual Meeting of Stockholders held on May 12, 2020 (the “Annual Meeting”) of a grant of discretionary authority to the Board of Directors of the Company (the “Board”) to effect an amendment to the Company’s Third Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s common stock, at a ratio between 1-for-10 and 1-for-25, with such ratio to be determined by the Board in its sole discretion, and a corresponding reduction in the number of authorized shares of the Company’s common stock and (ii) the approval by the Board of the specific 1-for-20 reverse stock split ratio on October 30, 2020. The voting results from the Annual Meeting and the stockholder approval of the Reverse Stock Split proposal were disclosed in a Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on May 14, 2020.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the complete Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

To the extent required by Item 5.03 of Form 8-K, the information contained in Item 3.03 of this Current Report on Form 8-K is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit Title or Description

|

|

3.1

|

|

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: November 9, 2020

|

FORUM ENERGY TECHNOLOGIES, INC.

|

|

|

|

/s/ John C. Ivascu

|

|

|

|

John C. Ivascu

|

|

|

|

Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary

|

|

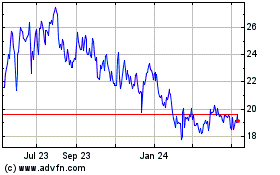

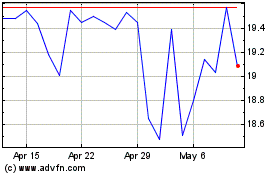

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Apr 2023 to Apr 2024