Table of Contents

As filed with the Securities and Exchange Commission on

June 11, 2019

Registration File No. 333-231550

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

VITALIBIS, INC.

(Exact name of Registrant as specified

in its charter)

|

Nevada

|

|

0001636509

|

|

30-0828224

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

3960 Howard Hughes Parkway, Suite 500

Las

Vegas, NV 89169

702-944-9620

(Address, including zip code, and telephone

number,

including area code, of Registrant’s

principal executive offices)

Steven Raack

3960 Howard Hughes Parkway, Suite 500

Las

Vegas, NV 89169

702-944-9620

(Name, address, including zip code, and

telephone number,

including area code, of agent for service)

Copies to:

Michael J. Morrison, Esq.

Michael J. Morrison, Chtd.

1495 Ridgeview Dr., Ste. 220

Reno, NV 89519

(775) 827-6300

As soon as practicable after the effective

date of this Registration Statement.

(Approximate date of commencement of

proposed sale to the public)

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box: [ ]

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the

Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration

statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration

statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer,

smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated

filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange

Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

|

Emerging Growth Company

|

[X]

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided to Section 7(a)(2)(B) of the Securities Act. [_]

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

|

|

Proposed

Maximum

Offering Price

Per Unit (1)(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Primary Offering:

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, par

value $0.001 per share (1)(2)(5)

|

|

5,000,000

|

|

$1.00

|

|

$5,000,000

|

|

|

$ 606.00(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secondary Offering:

(8)

|

|

|

|

|

|

|

|

|

|

|

|

Warrants (4)

|

|

3,500,000

|

|

$

1.00

|

|

$3,500,000

|

|

|

$424.20

|

|

|

Common Stock, par value $0.001 per share, underlying common stock purchase warrants

|

|

3,500,000

|

|

$1.00

|

|

$3,500,000

|

|

|

$424.20

|

|

|

Common stock, par value $0.001 per share (3)

|

|

4,161,371

|

|

$1.00

|

|

$4,161,371

|

|

|

$504.36

|

|

|

Common stock, par value $0.001 per share (7)

|

|

5,321,400

|

|

$1.00

|

|

$5,321,400

|

|

|

$644.95

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

(primary and secondary offerings)

|

|

21,482,771

|

|

$1.00

|

|

$21,482,771

|

(8)

|

|

$2,603.71

|

(9)

|

(1) The aggregate maximum offering

price of the 5,000,000 shares of common stock offered and sold in the Primary Offering by the registrant pursuant to this registration

statement shall not have a maximum aggregate offering price that exceeds $5,000,000 in U.S. dollars or the equivalent at the time

of offering in any other currency.

(2) The registrant will offer its 5,000,000

shares at the price of $1.00 per share. The selling stockholders, as applicable, will determine the proposed maximum offering

price per share from time to time in connection with, and at the time of, their respective sale of their shares. Securities

registered hereby may be offered for U.S. dollars or foreign currencies or currency units and may be sold separately or together

in units with other securities registered hereby. Although the market price is currently at $.68 per share, as reported by

the OTC Markets Group’s OTCQB, the price has fluctuated in the last 52 weeks from $.55 to $4.91 all on extremely low volume.

The $1.00 offering price for the 5,000,000 shares in our primary offering is believed by the Company to better represent the market

price, given the fact that the market price held in the $1.00 range for the past 6 months.

(3) Includes such indeterminate

principal amount, liquidation amount or number of securities as may be issued upon conversion or exchange of any securities

that provide for conversion or exchange into other securities. Separate consideration may or may not be received by the

registrant for securities that are issuable on exercise, conversion or exchange of other securities.

(4) The warrants registered hereby are

warrants to purchase common stock.

(5) Estimated solely for purposes of calculating

the registration fee pursuant to Rule 457(o) under the Securities Act.

(6) Calculated in accordance with Rule

457(o) under the Securities Act.

(7) Up to 3,571,400 shares of common stock

may from time to time be sold pursuant to this registration statement by the selling stockholders named herein. Includes shares

of common stock issued to the selling stockholders and an additional 1,750,000 shares of common stock that may be earned by certain

of the selling stockholders and sold hereunder.

(8) Estimated solely for purposes

of calculating the registration fee pursuant to Rule 457(c) under the Securities Act.

(9) Calculated in accordance with Rule

457(c) and (o) under the Securities Act. (This Registration Fee has already been paid with the filing if the original

Form S-1).

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act, or until the registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer

to buy these securities in any state where the offer or sale is not permitted.

Subject to

Completion, dated June __, 2019

PROSPECTUS

Vitalibis,

Inc.

5,000,000

SHARES

OF COMMON STOCK

(Offered by the Company)

5,321,400

SHARES OF COMMON STOCK

(Offered by the Selling Stockholders)

3,500,000

COMMON

STOCK PURCHASE WARRANTS

(Offered by the Selling Warrant Holder)

3,500,000

SHARES OF COMMON STOCK

(Underlying common stock purchase

warrants)

4,161,371

SHARES OF COMMON STOCK

(Underlying securities that provide

for conversion or exchange into other securities)

Unless

otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “us,”

the “Company” and “VCBD” mean Vitalibis, Inc. and, where appropriate, our consolidated subsidiaries. This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”).

This

prospectus describes some of the general terms that may apply to the securities offered by us or the selling stockholders or the

two (2) selling warrant holders, and the general manner in which they may be offered.

This Form S-1/A and prospectus

relating thereto includes:

|

|

(a)

|

the sale of up to 5,000,000 shares of the

Company's common stock by the Company, at an offering price of $1.00 per share (the "Company’s Securities")

in our Primary Offering; no other securities are involved in our Primary Offering,

|

|

|

(b)

|

the resale of 5,321,400 shares held by certain

stockholders of the Company named in the registration statement (“Selling Stockholders”), previously purchased

by the Selling Stockholders in a Private Placement at $1.00 per share,

|

|

|

(c)

|

the resale of 1,500,000 common stock purchase warrants held by one stockholder of the

Company named in the registration statement (“Warrant Holder BLB”), previously acquired in conjunction with an

agreement with the Company, and the resale of 2,000,000 common stock purchase warrants held by one stockholder of the Company

named in the registration statement (“ Warrant Holder Dusty”), previously acquired by such Warrant Holders in

conjunction with a separate agreement each Warrant Holder entered into with the Company; there is no relationship of

whatsoever nature between BLB and Dusty.

|

|

|

|

|

|

|

(d)

|

the 1,500,000 shares of our common stock issuable upon exercise of common stock purchase

warrants held by Warrant Holder BLB are exercisable at $1.01 per share for a term of two (2) years; and the 2,000,0000 shares

of our common stock issuable upon exercise of common stock purchase warrants held by Warrant Holder Dusty are exercisable

at $1.50 per share for a term of three (3) years, with an additional one-year extension, at the holder’s option (with 90 days’ prior written

notice from the holder).

|

|

|

(e)

|

4,161,371 shares of our common stock issuable

upon conversion or exchange of any securities that provide for conversion or exchange into other securities.

|

The registration

statement, while effective, allows the Selling Warrant Holders named in the registration statement to publicly sell the Warrants.

The Company will not receive any proceeds from the sale of the Warrants by the selling warrant holders.

Upon

the cash exercise of the warrants, the Company will receive the exercise price of the warrants. There can be no assurance

any warrants will be exercised.

We, and

the selling stockholders and two (2) selling warrant holders may offer and sell these securities directly to purchasers. No underwriters,

dealers or agents are involved in these offerings.

The specific terms of our 5,000,000

shares of common stock being offered by us, and the specific manner in which they may be offered, are described below, respectively,

in the Sections designated the cover page of the prospectus; “About This Prospectus”, at page i,

infra

,; “Description

of Securities”, sub-sections “General” and “Common Stock”, at page10,

infra

; “The Offering”,

commencing at page 3; and “Plan of Distribution”, beginning at page 8,

infra

. You should read this prospectus

carefully before you invest.

Our common

stock is quoted by the OTC Markets Group’s OTCQB under the symbol “VCBD.” We have not yet determined whether

any of the other securities that may be offered by this prospectus will be listed on any exchange, inter-dealer quotation

system or over-the-counter market. Our principal executive offices are located at 3960 Howard Hughes Parkway, Suite 500,

Las

Vegas, NV 89169,

and our telephone number is

702-944-9620.

Investing

in our securities involves risks. You should carefully read and consider the risk factors included in our periodic reports

and other information that we file with the Securities and Exchange Commission and that are incorporated by reference into

this prospectus before you invest in our securities. See “

Risk Factors

” on page v of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities

or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal

offense.

The date of this prospectus is ,

2019.

ABOUT THIS PROSPECTUS

Unless otherwise indicated or the context

otherwise requires, all references in this prospectus to “we,” “us,” the “Company” and “VCBD”

mean Vitalibis, Inc. and, where appropriate, our consolidated subsidiaries. This prospectus is part of a registration statement

that we filed with the Securities and Exchange Commission (the “SEC”).

There are no underwriting commissions

involved in this offering. We have agreed to pay all the costs and expenses of this offering. Selling shareholders will pay no

offering expenses. As of the date of this prospectus, there is a limited trading market in our common stock. Our common stock

is quoted by the OTC Markets Group’s OTCQB under the symbol “VCBD.”. There is no guarantee that our securities

will ever trade on the NASDAQ or other exchange.

This offering is highly

speculative and these securities involve a high degree of risk and should be considered only by persons who can afford the loss

of their entire investment. Additionally, auditors have expressed substantial doubt as to our Company’s ability to continue

as a going concern.

See

“

Risk Factors

” beginning on page v,

infra

.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy

of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus provides you with a

general description of the securities we or the selling stockholders may offer. You should read this prospectus together with

the additional information described under the heading “Where You Can Find More Information.”

You

should rely only on the information that we have provided in this prospectus. We have not, and the selling stockholders have not,

authorized anyone to provide you with different information. This prospectus is an offer to sell only the securities offered hereby,

and only under circumstances and in jurisdictions where it is lawful to do so. The information in this prospectus is accurate

only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

Neither the delivery of this prospectus

nor any sale made under it implies that the information in this prospectus is correct as of any date after the date of this prospectus.

You should assume that the information in this prospectus, or any related free writing prospectus is accurate only as of the date

thereof and that any information incorporated by reference in this prospectus or any related free writing prospectus is accurate

only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, or any related

free writing prospectus, or any sale of a security.

This prospectus contains summaries of certain

provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein

have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under “Incorporation by Reference.”

TABLE OF CONTENTS

You should rely only on the information

contained in this prospectus and any free writing prospectus prepared by us or on our behalf. We have not authorized anyone to

provide you with different or additional information. If anyone provides you with different or additional information, you should

not rely on it. The information in this prospectus is accurate only as of the date on the front of this prospectus. Our business,

financial condition, results of operations and prospects may have changed since the date of this prospectus. This prospectus is

not an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to

the securities is not authorized. You should not consider this prospectus to be an offer or solicitation relating to the securities

if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer

or solicitation.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and current reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information

concerning us can be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or

on the Internet at http://www.sec.gov. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room.

The

SEC also maintains a web site at http://www.sec.gov that contains reports, proxy statements and other information about issuers,

such as us, who file electronically with the SEC.

This prospectus is

part of a registration statement on Form S-1 under the Securities Act of 1933, as amended (the “Securities Act”) with

respect to the securities covered by this prospectus. This prospectus, which is a part of the registration statement, does not

contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further

information with respect to us and the securities covered by this prospectus, please see the registration statement and the exhibits

filed with the registration statement. A copy of the registration statement and the exhibits filed with the registration

statement may be inspected without charge from the SEC as indicated above, or from us as indicated under “Incorporation by

Reference.”

INCORPORATION BY REFERENCE

The SEC allows us

to “incorporate by reference” into this prospectus the information that we file with the SEC. This permits us to disclose

important information to you by referring to these filed documents. Any information referred to in this way is considered part

of this prospectus, and any information filed with the SEC by us after the date of this prospectus will automatically be deemed

to update and supersede this information. We incorporate by reference the following documents that have been filed with the SEC

(other than, in each case, documents or information deemed furnished and not filed in accordance with SEC rules, including pursuant

to Item 2.02 or Item 7.01 or any related exhibit furnished under Item 9.01(d) of Form 8-K, and no such information shall be deemed

specifically incorporated by reference hereby):

|

|

·

|

The description of our common stock contained in our Registration Statement on

Form S-1, filed with the SEC on March 25, 2015

(File No. 333-202970), and any amendment or reports filed for the purpose of updating such description.

|

We also incorporate

by reference any future filings (other than information in such documents that is not deemed to be filed) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) until

we file a post-effective amendment which indicates the termination of the offering of the securities made by this prospectus.

We will provide without

charge upon written or oral request a copy of any or all of the documents that are incorporated by reference into this prospectus,

other than exhibits which are specifically incorporated by reference into such documents. Requests should be directed to our Corporate

Secretary at Vitalibis, Inc., 3960 Howard Hughes Parkway, Suite 500,

Las Vegas, NV 89169

,

telephone number is

702-944-9620.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and

the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Some of these statements can be identified by use of forward-looking words such as “believes,”

“expects,” “anticipates,” “may,” “will,” “should,” “seeks,”

“approximately,” “intends,” “plans” or “estimates,” or the negative of these words,

or other comparable terminology. The discussion of financial trends, strategy, plans or intentions may also include forward-looking

statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from

those projected, anticipated, or implied. Although it is not possible to predict or identify all such risks and uncertainties,

they may include, but are not limited to, the factors discussed under “Risk Factors” in our most recent Annual Report

on Form 10-K, in our Quarterly Reports on Form 10-Q, and in other information contained in our publicly available SEC filings

and press releases.

You should not consider

this list to be a complete statement of all risks and uncertainties. You are cautioned not to place undue reliance on any such

forward-looking statements, which speak only as of the date such statements were first made. Except to the extent required by federal

securities laws, we undertake no obligation to publicly release the result of any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

RISK FACTORS

As

a “smaller reporting company”, we are not required to provide the information required by this Item.

However,

investing in our securities involves significant risks. You should carefully consider the risks factors set forth in the documents

and reports filed by us with the SEC and incorporated by reference into this prospectus before deciding whether to buy

our securities. Additional risks and uncertainties not presently known to us or that we believe are immaterial may also significantly

impair our business operations. If any of these risks actually occur, our business, financial condition and results of operations

could be materially affected, and you could lose all or part of your investment in offered securities

You should carefully

consider the risks discussed under “Risk Factors” in our most recent Annual Report on Form 10-K, in our Quarterly

Reports on Form 10-Q related hereto, and in other information contained in our publicly available SEC filings and press

releases. See “

Where You Can Find Additional Information

.”

You should rely only

on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf. We have not authorized

anyone to provide you with different or additional information. If anyone provides you with different or additional information,

you should not rely on it. The information in this prospectus is accurate only as of the date on the front of this prospectus.

Our business, financial condition, results of operations and prospects may have changed since the date of this prospectus. This

prospectus is not an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation

relating to the securities is not authorized. You should not consider this prospectus to be an offer or solicitation relating to

the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive

such an offer or solicitation.

PROSPECTUS SUMMARY

This summary highlights certain information

appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider

prior to investing. After you read this summary, you should read and consider carefully the more detailed information and financial

statements and related notes that we include in this prospectus, especially the sections entitled “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If you invest in our

securities, you are assuming a high degree of risk.

Unless we have indicated otherwise or

the context otherwise requires, references in the prospectus to “Greater Cannabis Company” the “Company,”

“we,” “us” and “our” or similar terms are to Vitalibis, Inc.

Going Concern

The Company intends to overcome the circumstances

that impact its ability to remain a going concern through a combination of the expansion of revenues, with interim cash flow deficiencies

being addressed through additional equity and debt financing. The Company anticipates raising additional funds through public

or private financing, strategic relationships or other arrangements in the near future to support its business operations; however,

the Company may not have commitments from third parties for a sufficient amount of additional capital. The Company cannot be certain

that any such financing will be available on acceptable terms, or at all, and its failure to raise capital when needed could limit

its ability to continue its operations. The Company’s ability to obtain additional funding will determine its ability to

continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have a material

adverse effect on the Company’s financial performance, results of operations and stock price and require it to curtail or

cease operations, sell off its assets, seek protection from its creditors through bankruptcy proceedings, or otherwise. Furthermore,

additional equity financing may be dilutive to the holders of the Company’s common stock, and debt financing, if available,

may involve restrictive covenants, and strategic relationships, if necessary, to raise additional funds, and may require that

the Company relinquish valuable rights. Please see NOTE 1- ORGANIZATION AND GOING CONCERN

,

in our financial statements,

at page F-6,

infra

,

for further information.

There can be no assurance that sufficient

funds required during the next year or thereafter will be generated from operations or that funds will be available from external

sources such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability

to generate cash flow from operations or to raise capital from external sources would force the Company to substantially curtail

or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance

that any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive

effect on the Company’s existing stockholders.

Company

Vitalibis,

Inc. (the “Company”) was formed on April 11, 2014, as a Nevada corporation, under the name Crowd 4 Seeds, Inc. On

January 9, 2017, the Company filed a certificate of amendment to its Certificate of Incorporation with the Secretary of State

of the State of Nevada in order to change its name to "Sheng Ying Entertainment Corp." On December 16, 2017, new management

took over control of the Company and, on February 5, 2018, the Company filed a certificate of amendment to its Certificate of

Incorporation with the Secretary of State of the State of Nevada in order to change its name to “Vitalibis, Inc”.

As

of December 31, 2017, and through current date, most of our resources and work have been devoted to adopting and integrating our

new business plan, research and development, seeking capital to finance our operations and complying with our obligations under

applicable securities laws, rules and regulations.

We

are a public company and, as such, we have incurred and will continue to incur significant expenses for legal, accounting and

related services. As a public entity, subject to the reporting requirements of the Exchange Act of 1934, we incur ongoing expenses

associated with professional fees for accounting, legal and a host of other expenses including annual reports and proxy statements,

if required. We estimate that these costs will range up to $80,000 per year over the next few years and may be significantly higher

if our business volume and transactional activity increases, based on our overall business volume (and financial transactions),

and we will not yet be subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 until we exceed $75 million

in market capitalization (if ever). These obligations will certainly reduce our ability and resources to expand our business plan

and activities. We hope to be able to use our status as a public company to increase our ability to use non-cash means of settling

outstanding obligations (i.e. issuance of restricted shares of our common stock) and compensate independent contractors who provide

professional services to us, although there can be no assurances that we will be successful in any of these efforts. We will also

reduce compensation levels paid to management (if we attract or retain outside personnel to perform this function) if there is

insufficient cash generated from operations to satisfy these costs.

We

hope to be able to use our status as a public company to enable us to use non-cash means of settling obligations and compensate

persons and/or firms providing services to us, although there can be no assurances that we will be successful in any of those

efforts. However, these actions, if successful, will result in dilution of the ownership interests of existing shareholders, may

further dilute common stock book value, and that dilution may be material. Such issuances may also serve to enhance existing management’s

ability to maintain control of the Company because the shares may be issued to parties or entities committed to supporting existing

management. The Company may offer shares of its common stock to settle a portion of the professional fees incurred in connection

with its registration statement. No negotiations have taken place with any professional and no assurances can be made as to the

likelihood that any professional will accept shares in settlement of obligations due to them.

Other

than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party

to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary

course of our business.

We

do not have any subsidiaries.

Current Business

Commencing

in December 2017, the Company changed its business to focus on the development of technologies and products related to hemp-based

personal care and nutritional products.

The Hemp Market

Our

current business plan, which is in the early stages of operations, marketing and sales of our products, is focused exclusively

on the non-medicinal hemp-based product market which includes full spectrum oils with naturally occurring cannabidiol ("CBD")

along with other elements of the hemp plant including cannabinoids, terpenes, chlorophyll, flavonoids, etc.

Full

spectrum oil can be produced from hemp, which is a legal crop in the United States. Scientific research is now bringing to light

the many health benefits of full spectrum hemp-based products.

We market and sell consumer products

containing

full Spectrum phyto-cannabinoid rich hemp oil with naturally

occurring CBD

under our

Vitalibis™

brand in a range of market sectors including wellness, and beauty

care. We currently distribute 3 products and we expect to continue to add new products to our

Vitalibis™

portfolio

to enhance our line of

full spectrum phyto-cannabinoid rich hemp products with

naturally occurring cannabidiol (CBD)

and hemp-related consumer products. We also expect to develop and launch

new brands under the

Vitalibis™

product development umbrella to more effectively market and sell certain

products. We also sell

full spectrum phyto-cannabinoid rich hemp powder with

naturally occurring cannabidiol (CBD)

acquired through our supply relationships in the United States to various

customers that produce products for resale into the market. We also began offering of our technology back-end which is being

offered as a Software as a Service (SaaS) platform.

We seek to take

advantage of an emerging worldwide trend to re-energize the production of industrial hemp and to foster its many uses for consumers.

Historically cultivated for industrial and practical purposes, hemp is used today for textiles, paper, auto parts, biofuel, cosmetics,

animal feed, nutritional supplements, and much more. The market for hemp-derived products is expected to increase substantially

over the next five years, and we believe Vitalibis™ is well positioned to be a significant player in the hemp industry.

THE OFFERING

|

Securities offered

|

|

Up to 5,000,000 shares of our Common Stock by the Company

|

|

|

|

|

|

|

|

Up to 5,321,400 shares of

our Common Stock by the Selling Shareholders

Up to 3,500,000 Common Stock Purchase Warrants

by the Selling Warrant Holders

Up to 3,500,000 shares of common stock

underlying the Common Stock Purchase Warrants by the Selling Warrant Holder

4,161,371 shares of common stock issuable upon conversion or exchange of any securities that provide for

conversion or exchange into other securities

|

|

|

|

|

|

Terms of the Offering

|

|

|

|

|

|

|

|

Minimum number of shares

that must be sold to release

subscription proceed

|

|

This is a “no minimum” offering, which means no subscription proceeds are required

to be held in escrow until a minimum amount of proceeds have been received, but rather, all subscription proceeds received

from subscribers will be immediately released to the Company upon receipt from the subscriber until the termination of the

Primary Offering (see below)

|

|

|

|

|

|

Offering Amount

|

|

$ 21,482,771

|

|

|

|

|

|

Use of Proceeds

|

|

We will receive all proceeds from the sale of any and all of our 5,000,000 shares sold in the Primary

Offering. We will not receive any proceeds from the sale of shares of our common

stock by the selling stockholders pursuant to this prospectus. We will, however, receive proceeds from the selling stockholders’

exercise of the Warrants to purchase shares of our common stock, which shares we are hereby registering. We will use these

proceeds for general corporate purposes, including for working capital and acquisitions. See “Use of Proceeds.”

|

|

|

|

|

|

Offering price

|

|

$ 1.00 per share of Common Stock

offered by the Company in the Primary Offering.

The selling stockholders will determine (a) if, when and how they will sell the common stock offered in this

prospectus, and (b) the price at which they each severally decide their offering price.

|

|

|

|

|

|

Common Stock Issued and Outstanding Before This Offering

|

|

30,781,400 (as of May 10, 2019)

|

|

|

|

|

|

Common Stock Issued and Outstanding After This Offering

|

|

30,781,400

(1)(2)(3)(4)(5)(6)

|

|

|

|

|

|

Risk Factors

|

|

See

“

Risk

Factors

” beginning on page v and the other information set forth in this prospectus for a discussion of factors

you should consider before deciding to invest in our securities.

|

|

|

|

|

|

Market for Common Stock

|

|

VCBD - OTCQB

|

|

|

|

|

|

Dividends

|

|

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future.

|

|

|

|

|

|

Termination of the Offering

|

|

The offering will terminate upon the earlier of (a) such time as all of the shares of common stock offered

hereby have been sold, or (b) the expiration of 180 calendar days from the effective date (“Termination”).

|

(1) On December 31, 2018, BLB was issued a warrant to

purchase 1,500,000 shares of the Company’s common stock (“BLB Warrant”). The shares to be issued under this

warrant were not included in the offering nor in the calculation of the shares outstanding as of May 10, 2019. Please

see NOTE 6- STOCKHOLDERS’ DEFICIT in our financial statements, at page F-10,

infra

,

for further

information. We will, however, receive proceeds from the issuance of 3,500,000 shares of our common stock underlying the

warrant issued to BLB pursuant to the Securities Purchase Agreement dated December 31, 2018. The BLB warrants have an

exercise price of $1.01 and are exercisable for a period of two (2) years.

(2) On March 29, 2019, the Company entered into an agreement

with a contractor (“Dusty”) for services. Dusty may earn a total of 1,000,000 shares of common stock and 2,000,000

warrants to purchase common stock. The warrants have an exercise price of $1.50 per share, and an initial term of 3 years from

the date of issuance, with an additional one-year extension, at the holder’s option (with 90 days’ prior written notice

from the holder) (The “Dusty Warrants”). Of the total awards, 250,000 shares and 334,000 warrants were earned upon

execution of the agreement, with the 250,000 shares being issued in April 2019. The remaining shares and warrants vest upon completion

of certain performance-related milestones.

(3) In the event that BLB and Dusty were to fully exercise

their combined warrants (3,500,000), the total number of shares outstanding would increase to 34,281,400.

(4) On January 10, 2019, the Company entered into a Securities

Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required

to reserve One Million One Hundred Sixty-Three Thousand and Seventy-Six shares (1,163,076) of the Company’s common stock.

Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount

of One Hundred Twenty-Six Thousand NO/100 Dollars ($126,000.00). The shares reserved in the PUL transaction will not be issued

until the Company receives a Notice of Conversion and are not included in the shares calculated in the common stock issued and

outstanding before this offering within “The Offering” table. Please see NOTE 5- CONVERTIBLE NOTES PAYABLE in our

financial statements, at page F-8,

infra

,

for further information.

(5) On February 7, 2019, the Company entered into a Securities

Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required

to reserve Seven Hundred Sixty-Six Thousand One Hundred and Fifty-Three shares (766,153) of the Company’s common stock.

Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount

of Eighty-Three Thousand NO/100 Dollars ($83,000.00). The shares reserved in the PUL transaction will not be issued until the

Company receives a Notice of Conversion and are not included in the shares calculated in the common stock issued and outstanding

before this offering within “The Offering” table. Please see NOTE 5- CONVERTIBLE NOTES PAYABLE

,

in

our financial statements, at page F-9,

infra

,

for further information.

(6) On March 29, 2019, the Company entered into a Securities

Purchase Agreement with Triton Funds LP (“Triton”). As per the terms of the Agreement, the Company is required to

reserve Two Million Two Hundred and Thirty-Two Thousand One Hundred and Forty Two shares (2,232,142) of the Company’s common

stock. Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to Triton

in the amount of Two Hundred and Fifty Thousand NO/100 Dollars ($250,000.00). The shares reserved in the Triton transaction

will not be issued until the Company receives a Notice of Conversion and are not included in the shares calculated in the common

stock issued and outstanding before this offering within “The Offering” table. Please see NOTE 9- SUBSEQUENT EVENTS

,

in our financial statements, at page F-12,

infra

,

for further information.

SUMMARY FINANCIAL DATA

The following summary of our financial

data should be read in conjunction with, and is qualified in its entirety by reference to, “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, appearing elsewhere

in this prospectus.

Statements of Operations Data

|

|

|

For the

Three months Ended March 31, 2019

|

|

|

For the

year-ended

December 31, 2018

|

|

|

For the

year-ended

December 31, 2017

|

|

|

Revenue

|

|

$

|

139,585

|

|

|

$

|

51,331

|

|

|

$

|

–

|

|

|

Loss from operations

|

|

$

|

(2,445,159

|

)

|

|

$

|

(2,227,920

|

)

|

|

$

|

(102,865

|

)

|

|

Net loss

|

|

$

|

(2,448,499

|

)

|

|

$

|

(2,228,620

|

)

|

|

$

|

(102,904

|

)

|

Balance Sheets Data

|

|

|

As of

March 31, 2019

|

|

|

As of

December 31, 2018

|

|

|

As of

December 31, 2017

|

|

|

Cash

|

|

$

|

60,679

|

|

|

$

|

171,979

|

|

|

$

|

–

|

|

|

Total assets

|

|

$

|

408,682

|

|

|

$

|

570,407

|

|

|

$

|

–

|

|

|

Total liabilities

|

|

$

|

235,772

|

|

|

$

|

180,389

|

|

|

$

|

6,169

|

|

|

Total stockholders’ equity (deficit)

|

|

$

|

172,910

|

|

|

$

|

390,018

|

|

|

$

|

(6,169

|

)

|

NOTE ABOUT FORWARD-LOOKING STATEMENTS

Statements under “Prospectus Summary,”

“Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

“Description of Business” and elsewhere in this prospectus may be “forward-looking statements.” Forward-looking

statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions

or any other statements relating to our future activities or other future events or conditions. These statements include, among

other things, statements regarding:

|

|

·

|

the growth of our business and revenues and our expectations about the factors that influence our success;

|

|

|

·

|

our plans to continue to invest in systems, facilities, and infrastructure, increase our hiring and grow our business;

|

|

|

·

|

our plans for the build out and expansion of our online store and portal, GCC Superstore, and the strategy and timing of any plans to monetize our network;

|

|

|

·

|

our user growth expectations;

|

|

|

·

|

our ability to attain funding and the sufficiency of our sources of funding;

|

|

|

·

|

our expectation that our cost of revenues, development expenses, sales and marketing expenses, and general and administrative expenses will increase;

|

|

|

·

|

fluctuations in our capital expenditures; and

|

|

|

·

|

our plans for potential business partners and any acquisition plans;

|

as well as other statements regarding our

future operations, financial condition and prospects, and business strategies. These statements are based on current expectations,

estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees

of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes

and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due

to numerous factors, including those described above and those risks discussed from time to time in this registration statement,

of which this prospectus is a part, including the risks described under “Risk Factors.” Any forward-looking statements

speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement

to reflect events or circumstances that occur in the future.

If one or more of these or other risks

or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what

we may have projected. Any forward-looking statements you read in this prospectus reflect our current views with respect to future

events and are subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations,

financial condition, growth strategy and liquidity. You should specifically consider the factors identified in this prospectus

that could cause actual results to differ before making an investment decision. In addition, as discussed in “Risk Factors,”

our shares may be considered a “penny stock” and, as a result, the safe harbors provided for forward-looking statements

made by a public company that files reports under the federal securities laws may not be available to us.

TAX CONSIDERATIONS

We are not providing any tax advice as

to the acquisition, holding or disposition of the securities offered herein. In making an investment decision, investors are strongly

encouraged to consult their own tax advisor to determine the U.S. Federal, state and any applicable foreign tax consequences relating

to their investment in our securities.

DETERMINATION OF OFFERING PRICE

The pricing of the Shares has been arbitrarily

determined and established by the Company. No independent accountant or appraiser has been retained to protect the interest of

the investors. No assurance can be made that the offering price is in fact reflective of the underlying value of the Shares. Each

prospective investor is urged to consult with his or her counsel and/or accountant as to offering price and the terms and conditions

of the Shares. Factors to be considered in determining the price include the amount of capital expected to be required, the market

for securities of entities in a new business venture, projected rates of return expected by prospective investors of speculative

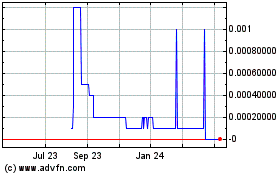

investments, the Company’s prospects for success and prices of similar entities. Although the market price is currently

at $.68 per share, the price has fluctuated in the last 52 weeks from $.55 to $4.91 all on extremely low volume. In the business

judgement of the Company, there was not enough trading volume on which to base a fair, just and equitable market price/average.

The $1.00 offering price for the 5,000,000 shares in our primary offering is believed by the Company to better represent a market

price for purposes of this offering, given the fact that the market price held in the $1.00 range for the past 6 months.

DILUTION

The Company does not have adequate revenue

to fund all of its operational needs and may require additional financing to continue its operations if it is unable to generate

substantial revenue growth. There can be no assurance that such financing will be available at all or on favorable terms. Failure

to generate substantial revenue growth could result in delay or indefinite postponement of the Company’s deployment of its

products, and may result in the Company looking to obtain such additional financing, resulting in possible dilution. Any such financing

will dilute the ownership interest of the Company’s shareholders at the time of the financing, and may dilute the value of

their shareholdings.

PLAN OF DISTRIBUTION

There are no underwriters, dealers

or agents involved in this offering.

We or the selling stockholders may

sell the securities in one or more of the following ways from time to time:

|

|

·

|

to or through underwriters or dealers;

|

|

|

·

|

directly to one or more purchasers;

|

|

|

·

|

through a combination of any of these methods

of sale; or

|

|

|

·

|

any other method permitted pursuant to applicable

law.

|

We or the selling

stockholders may also sell securities, including shares of our common stock, in one or more of the following transactions: (i)

block transactions (which may involve crosses) in which a broker-dealer may sell all or a portion of such shares as agent, but

may position and resell all or a portion of the block as principal to facilitate the transaction; (ii) purchases by any such broker-dealer

as principal, and resale by such broker-dealer for its own account pursuant to an accompanying prospectus; (iii) a special offering,

an exchange distribution or a secondary distribution in accordance with applicable OTCQB or other stock exchange, quotation system

or over-the-counter market rules; (iv) ordinary brokerage transactions and transactions in which any such broker-dealer solicits

purchasers; (v) sales “at the market” to or through a market maker or into an existing trading market, on an exchange

or otherwise, for such shares; and (vi) sales in other ways not involving market makers or established trading markets.

For each offering

of securities, the applicable prospectus or other offering materials relating to the offering will set forth the terms of such

offering, including:

|

|

·

|

the name or names of any underwriters, dealers

or agents;

|

|

|

·

|

the purchase price of the offered securities

and the net proceeds to VCBD from the sale;

|

|

|

·

|

any underwriting discounts and commissions

or agency fees and other items constituting underwriters’ or agents’ compensation; and

|

|

|

·

|

any initial public offering price and any

discounts or concessions allowed or reallowed or paid to dealers; and

|

|

|

·

|

any securities exchanges on which such offered

securities may be listed.

|

Any initial public

offering prices, discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

If underwriters

are used in the sale, the underwriters will acquire the offered securities for their own account and may resell them from time

to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices

determined at the time of sale. The offered securities may be offered either to the public through underwriting syndicates represented

by one or more managing underwriters or by one or more underwriters without a syndicate. Unless otherwise set forth in this prospectus,

the obligations of the underwriters to purchase any series of securities will be subject to certain conditions precedent, and

the underwriters will be obligated to purchase all of such series of securities, if any are purchased.

In connection

with underwritten offerings of the offered securities and in accordance with applicable law and industry practice, underwriters

may over-allot or effect transactions that stabilize, maintain or otherwise affect the market price of the offered securities

at levels above those that might otherwise prevail in the open market, including by entering stabilizing bids, effecting syndicate

covering transactions or imposing penalty bids, each of which is described below:

|

|

·

|

a stabilizing bid means the placing of any

bid, or the effecting of any purchase, for the purpose of pegging, fixing or maintaining the price of a security;

|

|

|

·

|

a syndicate covering transaction means the

placing of any bid on behalf of the underwriting syndicate or the effecting of any purchase to reduce a short position created

in connection with the offering; and

|

|

|

·

|

a penalty bid means an arrangement that permits

the managing underwriter to reclaim a selling concession from a syndicate member in connection with the offering when offered

securities originally sold by the syndicate member are purchased in syndicate covering transactions.

|

These transactions

may be effected on the OTC Markets Group’s OTCQB or otherwise. Underwriters are not required to engage in any of these activities,

or to continue such activities if commenced.

If a dealer is

used in the sale, VCBD will sell such offered securities to the dealer, as principal. The dealer may then resell the offered securities

to the public at varying prices to be determined by that dealer at the time for resale. The names of the dealers and the terms

of the transaction will be set forth in this prospectus. Offered securities may be sold directly by VCBD or the selling stockholders

to one or more institutional purchasers, or through agents designated by VCBD or the selling stockholders from time to time, at

a fixed price or prices, which may be changed, or at varying prices determined at the time of sale. Any agent involved in the

offer or sale of the offered securities in respect of which this prospectus is delivered will be named, and any commissions payable

by VCBD or the selling stockholders to such agent will be set forth, in the prospectus.

Our common stock

is quoted by the OTC Markets Group’s OTCQB under the symbol “VCBD”.

Transfer Agent and Registrar

The transfer agent

and registrar for our common stock is

VStock Transfer, 18 Lafayette Place, Woodmere,

NY 11598. Tel: 212-828-8436.

In compliance

with the guidelines of the Financial Industry Regulatory Authority, Inc. (“FINRA”), the maximum consideration or discount

to be received by any FINRA member or independent broker dealer may not exceed 8% of the aggregate proceeds of the offering.

Underwriters,

dealers and agents may be entitled under agreements entered into with us or the selling stockholders to indemnification by us

or the selling stockholders against certain civil liabilities, including liabilities under the Securities Act, or to contribution

with respect to payments that the underwriters, dealers or agents may be required to make in respect thereof. Underwriters, dealers

and agents may be customers of, engage in transactions with, or perform services for us and our affiliates, or for the selling

stockholders, in the ordinary course of business.

The selling stockholders

may also sell all or a portion of their shares in reliance upon Rule 144 under the Securities Act or Section 4(1) under the Securities

Act, if available, rather than under this prospectus, provided that they meet the criteria and conform to the requirements of

those provisions. The selling stockholders may also transfer, devise or gift such shares by other means not described in this

prospectus. The selling stockholders are not obligated to, and there is no assurance that the selling stockholders will, sell

all or any of the shares of common stock we are registering.

Other than our

common stock, which is quoted on the OTC Markets Group’s OTCQB, each of the securities issued hereunder will be a new issue

of securities, will have no prior trading market, and may or may not be listed on a national securities exchange. Any common stock

sold pursuant to a prospectus will be quoted on the OTC Markets Group’s OTCQB, subject to official notice of issuance. Any

underwriters to whom VCBD or the selling stockholders sell securities for public offering and sale may make a market in the securities,

but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice. We cannot

assure you that there will be a market for the offered securities.

DESCRIPTION OF SECURITIES

The following description

of our capital stock is only a summary and is qualified in its entirety by reference to our articles of incorporation and bylaws,

each as amended, which have been filed as exhibits to the registration statement of which this prospectus forms a part.

General

We are authorized

to issue 112,500,000 shares of common stock, with a par value of $0.001 per share, and 5,000,000 shares of preferred stock. Our

articles of incorporation also authorize us to issue options, rights, warrants and appreciation rights relating to our common

stock for the consideration and on the terms and conditions established by our board of directors in its sole discretion, whether

in connection with acquisitions or otherwise. As of December 31, 2018, 29,638,900 shares of common stock were issued and outstanding

and no shares of preferred stock were issued and outstanding. As of May 10, 2019, 30,781,400 shares of common stock were issued

and outstanding and no shares of preferred stock were issued and outstanding.

Common Stock

Holders of common

stock are each entitled to cast one vote for each share held of record on all matters presented to stockholders. Cumulative voting

is not allowed; hence, the holders of a majority of our outstanding shares of common stock can elect all directors.

Holders of shares

of our common stock are entitled to receive such dividends as may be declared by our board of directors out of funds legally available

and, in the event of liquidation, to a

pro rata

portion of any distribution of our assets after payment of liabilities.

Our directors are not obligated to declare dividends, and it is anticipated that no dividend will be paid in the foreseeable future.

Holders of shares

of our common stock do not have preemptive rights to subscribe for any additional shares which may be issued in the future. There

are no conversion, redemption, sinking fund or similar provisions regarding the common stock. All outstanding shares of common

stock are fully paid and non-assessable.

Pursuant

to an Amendment to the Articles of Incorporation, effected under NRS 78.207 and .209, the Company effected a 2.5 for 1 forward

stock split of our

number of authorized shares of the Common Stock and a corresponding

increase in the number of issued and outstanding shares of Common Stock held by each stockholder of record as of February 8, 2018,

the “Effective Date” of the forward split, as set by

FINRA

.

All shares

referenced in this Prospectus have been retroactively adjusted to reflect this stock split.

Authorized but Unissued Capital Stock

Nevada law does

not require stockholder approval for any issuance of authorized shares. These additional shares may be used for a variety of corporate

purposes, including future public offerings to raise additional capital or to facilitate corporate acquisitions.

One of the effects

of the existence of unissued and unreserved common stock (and/or preferred stock) may be to enable our board of directors to issue

shares to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain

control of our board by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our

management and possibly deprive the stockholders of opportunities to sell their shares of our common stock at prices higher than

prevailing market prices.

The description

of certain matters relating to the securities of the Company is a summary and is qualified in its entirety by the provisions of

the Company's Certificate of Incorporation and By-Laws.

Preferred Stock

Our Articles of Incorporation authorizes

the issuance of up to 5,000,000 shares of preferred stock with designations, rights and preferences determined from time to time

by its Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue preferred stock

with dividend, liquidation, conversion, voting, or other rights which could adversely affect the voting power or other rights of

the holders of the common stock. In the event of issuance, the preferred stock could be utilized, under certain circumstances,

as a method of discouraging, delaying or preventing a change in control of the Company. Although we have no present intention to

issue any shares of its authorized preferred stock, there can be no assurance that the Company will not do so in the future.

Among other rights,

our board of directors may determine, without further vote or action by our stockholders:

|

|

•

|

the number of shares and the

designation of the series;

|

|

|

•

|

whether to pay dividends on the series and, if

so, the dividend rate, whether dividends will be cumulative and, if so, from which date or dates, and the relative rights

of priority of payment of dividends on shares of the series;

|

|

|

•

|

whether the series will have voting rights in

addition to the voting rights provided by law and, if so, the terms of the voting rights;

|

|

|

•

|

whether the series will be convertible into or

exchangeable for shares of any other class or series of stock and, if so, the terms and conditions of conversion or exchange;

|

|

|

•

|

whether or not the shares of the series will

be redeemable and, if so, the dates, terms and conditions of redemption and whether there will be a sinking fund for the redemption

of that series and, if so, the terms and amount of the sinking fund; and

|

|

|

•

|

the rights of the shares of the series in the

event of our voluntary or involuntary liquidation, dissolution or winding up and the relative rights or priority, if any,

of payment of shares of the series.

|

In addition,

preferred stock could be used to dilute a potential hostile acquirer. Accordingly, any future issuance of preferred stock or any

rights to purchase preferred shares may have the effect of making it more difficult for a third party to acquire control of us.

This may delay, defer or prevent a change of control in our Company or an unsolicited acquisition proposal. The issuance of preferred

stock also could decrease the amount of earnings attributable to, and assets available for distribution to, the holders of our

common stock and could adversely affect the rights and powers, including voting rights, of the holders of our common stock.

Holders

As of May 10, 2019, there were 1,083 qualified holders of

record of our common stock.

Dividends

The Registrant has not paid any cash

dividends to date and does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention

of management to utilize all available funds for the development of the Registrant's business.

Securities Authorized for Issuance

under Equity Compensation Plan

.

None.

Options and Warrants

On January 16, 2019, the Company issued a warrant to

Bruce Lee Beverage, LLC (“BLB”) granting BLB the right to purchase 1,500,000 shares of the Company’s common

stock at an exercise price of $1.01 per share. The warrant has a term of 2 years and expires on January 16, 2021. Please

see NOTE 5- STOCKHOLDERS’ DEFICIT in our financial statements, at page F-9,

infra

,

for

further information.

On March 29, 2019, the Company

entered into an agreement with a contractor for services. This contractor may earn a total of 1,000,000 shares of common stock

and 2,000,000 warrants to purchase common stock. Of the total awards, 250,000 shares and 334,000 warrants were earned upon

execution of the agreement, with the 250,000 shares being issued in April 2019. The warrants were issued March 29, 2019, and have

an exercise price of $1.50 per share, and an initial term of 3 years from the date of issuance. The contractor can elect to

extend the term for an additional year, at the holder’s option, with 90 days’ prior written notice from the holder.

The remaining shares and warrants vest upon completion of certain performance-related milestones. Please see NOTE 6-

STOCKHOLDERS’ DEFICIT in our financial statements, at page F-10,

infra

,

for further information.

Convertible Notes

On January 10, 2019, the Company entered into a Securities

Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required

to reserve One Million One Hundred Sixty Three Thousand and Seventy Six shares (1,163,076) of the Company’s common stock.

Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount

of One Hundred Twenty Six Thousand NO/100 Dollars ($126,000.00). The shares reserved in the PUL transaction will not be issued

until the Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and

outstanding before this offering within “The Offering” table. Please see NOTE 5- CONVERTIBLE NOTES PAYABLE in

our financial statements, at page F-9,

infra

,

for further information.

On February 7, 2019, the Company entered into a Securities

Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required

to reserve Seven Hundred Sixty Six Thousand One Hundred and Fifty Three shares (766,153) of the Company’s common stock.

Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount

of Eighty Three Thousand NO/100 Dollars ($83,000.00). The shares reserved in the PUL transaction will not be issued until the

Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and outstanding

before this offering within “The Offering” table. Please see NOTE 5- CONVERTIBLE NOTES PAYABLE in our financial

statements, at page F-9,

infra

,

for further information.

On March 29, 2019, the Company entered into a Securities Purchase

Agreement with Triton Funds LP (“Triton”). As per the terms of the Agreement, the Company is required to reserve Two

Million Two Hundred and Thirty Two Thousand One Hundred and Forty Two shares (2,232,142) of the Company’s common stock.

Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to Triton in

the amount of Two Hundred and Fifty Thousand NO/100 Dollars ($250,000.00). The shares reserved in the Triton transaction

will not be issued until the Company receives a Notice of Conversion, and are not included in the shares calculated in the common

stock issued and outstanding before this offering within “The Offering” table. Please see NOTE 9- SUBSEQUENT

EVENTS in our financial statements, at page F-12,

infra

,

for further information.

Fundraising and Previous Offerings

BLB was issued a warrant to purchase 1,500,000 shares of

the Company’s common stock, and the contractor was issued a warrant to purchase 1,500,000 shares of the Company’s

common stock, and an additional 2,000,000 warrants were issued to the contractor. The shares to be issued under these warrants

were not included in the offering nor in the calculation of the shares outstanding as of May 10, 2019. In the event that BLB and

the contractor were to fully exercise their respective warrants, of which there can be no assurance, the total number of

shares outstanding would increase to 34,281,400. Please see NOTE 6- STOCKHOLDERS’ DEFICIT in our financial statements,

at page F-10,

infra

,

for further information. We will, however, receive proceeds from the issuance of 3,500,000

shares of our common stock underlying the warrant issued to BLB pursuant to the Securities Purchase Agreement dated December 31,

2018 and the warrant issued to the independent contractor pursuant to the agreement dated March 29, 2019. The BLB warrants

have an exercise price of $1.01 and are exercisable for a period of two (2) years. The contractor warrants have an exercise price

of $1.50 per share and are exercisable for a period of three (3) years, with an additional one-year term at the holder’s

option, with 90 days’ prior written notice from the holder.

On January 10, 2019, the Company entered into a Securities

Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required

to reserve One Million One Hundred Sixty Three Thousand and Seventy Six shares (1,163,076) of the Company’s common stock.

Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount

of One Hundred Twenty Six Thousand NO/100 Dollars ($126,000.00). The shares reserved in the PUL transaction will not be issued

until the Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and

outstanding before this offering within “The Offering” table. Please see NOTE 5- CONVERTIBLE NOTES PAYABLE

in

our financial statements, at page F-10,

infra,

for further information.

On February 7, 2019, the Company entered into a Securities

Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required

to reserve Seven Hundred Sixty Six Thousand One Hundred and Fifty Three shares (766,153) of the Company’s common stock.

Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount

of Eighty Three Thousand NO/100 Dollars ($83,000.00). The shares reserved in the PUL transaction will not be issued until the

Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and outstanding

before this offering within “The Offering” table. Please see

NOTE 5- CONVERTIBLE NOTES PAYABLE

in our financial

statements, at page F-10,

infra,

for further information.

On March 29, 2019, the Company entered into a Securities Purchase

Agreement with Triton Funds LP (“Triton”). As per the terms of the Agreement, the Company is required to reserve Two

Million Two Hundred and Thirty-wo Thousand One Hundred and Forty-Two shares (2,232,142) of the Company’s common stock. Simultaneous

with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to Triton in the amount of

Two Hundred and Fifty Thousand NO/100 Dollars ($250,000.00). The shares reserved in the Triton transaction will not be

issued until the Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued

and outstanding before this offering within “The Offering” table. Please see NOTE 9- SUBSEQUENT EVENTS

in

our financial statements, at page F-10,

infra

,

for further information.

Anti-Takeover Effects of our Articles of Incorporation

and Bylaws

Certain

provisions of our articles of incorporation and bylaws may have the effect of delaying, deferring or preventing a change in control

of the Company. Such provisions may also prevent or frustrate attempts by our stockholders to replace or remove our management.

In particular, our articles of incorporation and bylaws, among other things, provide the board of directors with the ability to

alter the bylaws without stockholder approval; provide that vacancies on the board of directors may be filled by a majority of

directors in office, although less than a quorum; and, as discussed above, authorize our board of directors, without further stockholder