Report of Foreign Issuer (6-k)

April 03 2019 - 8:38AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or

15d-16 of the Securities Exchange Act of 1934

For the month of April 2019

Commission File Number: 1-15256

_____________________

OI S.A. – In Judicial Reorganization

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

Rua Humberto de Campos, No. 425, 8th floor – Leblon

22430-190 Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F:

ý

Form 40-F:

o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)):

Yes

:

o

No

:

ý

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)):

Yes

:

o

No

:

ý

(Indicate by check mark whether the registrant by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

:

o

No

:

ý

If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

Oi S.A. – In Judicial Reorganization

Federal Taxpayers’ (CNPJ/MF) No. 76.535.764/0001-43

Board of Trade (NIRE) No. 33.3.0029520-8

Publicly-Held Company

NOTICE TO THE MARKET

Approval of Agreement between Oi and Phorol

Oi S.A. – In Judicial Reorganization

(“

Oi

” or “

the

Company

”), supplementing the Material Fact disclosed by Oi and the Notice disclosed by its indirect shareholder Pharol SGPS S.A. (“

Pharol

”), both on January 9, 2019, inform the market that the Approval of the Agreement became effective, in accordance with the terms of the Agreement entered into on January 8, 2019 between Oi, its direct shareholder Bratel S.à.r.l. (“

Bratel

”) and Pharol (together, “

the Parties

”), due to the expiration of the fifteen (15) business days from the publication of the judicial decision that granted it.

Thus, in accordance with the Agreement, the period for compliance with the second part of the obligations set forth for both Parties to the Agreement begins as of this date, including (a) the request for the termination of all disputes involving the Parties and indicated in the Agreement (“

Litigation

”) and (b) the delivery to Bratel of 33.8 million Oi shares held in Treasury, comprising 32 million common shares and 1.8 million preferred shares.

In addition, a number of obligations and rights of the Parties described in the Material Fact disclosed by Oi and in the Notice disclosed by Pharol, on January 9, 2019, which, pursuant to the terms of the Agreement, could have been terminated if the Judicial Reorganization Court had not approved the Agreement, are now fully perfected.

The Company will keep its shareholders and the market informed of any relevant development of the subject matter of this Notice to the Market.

Rio de Janeiro, April 3, 2019.

Oi S.A. – In Judicial Reorganization

Carlos Augusto Machado Pereira de Almeida Brandão

Chief Financial Officer and Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 3, 2019

OI S.A. – In Judicial Reorganization

By:

/s/ Carlos Augusto Machado Pereira de Almeida Brandão

Name: Carlos Augusto Machado Pereira de Almeida Brandão

Title: Chief Financial Officer and Investor Relations Officer

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

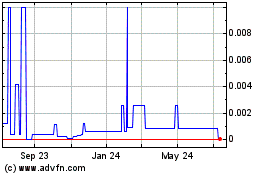

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024