CorEnergy Infrastructure Trust, Inc. (“CorEnergy” or the

“Company”) today announced financial results for the fiscal year

ended December 31, 2018.

Fiscal Year 2018 Performance Summary

Fiscal Year 2018 financial highlights are as follows:

For the Year Ended December 31, 2018

Per Share Total Basic

Diluted Net Income (Attributable to Common

Stockholders)1 $ 34,163,499 $ 2.86 $ 2.79 NAREIT Funds from

Operations (NAREIT FFO)1 $ 46,796,201 $ 3.92 $ 3.61 Funds From

Operations (FFO)1 $ 47,959,311 $ 4.02 $ 3.69 Adjusted Funds From

Operations (AFFO)1 $ 49,024,120 $ 4.11 $ 3.70 Dividends Declared to

Common Stockholders $ 3.00 1 Management uses AFFO as a

measure of long-term sustainable operational performance. NAREIT

FFO, FFO, and AFFO are non-GAAP measures. Reconciliations of NAREIT

FFO, FFO and AFFO, as presented, to Net Income Attributable to

CorEnergy Stockholders are included at the end of this press

release. See Note 1 for additional information.

Recent Developments

- Sale of Portland

Terminal to tenant, Zenith Energy: Sold the Portland

Terminal Facility and the Company’s remaining interest in the

Joliet Terminal to Zenith Energy for an aggregate consideration of

$61 million

- Exchange of

Convertible Debt: Exchanged $43.8 million face amount of the

Company’s 7% Convertible Senior Notes for an aggregate of 837,040

shares of common stock and $19.8 million in cash

- Repurchase of

Preferred Equity: Repurchased $4.5 million par value of the

Company’s 7.375% Series A Preferred Stock

- Maintained

dividend: Declared common stock dividend of $0.75 per share

($3.00 annualized) for the fourth quarter 2018, in line with the

previous 13 quarterly dividends

“CorEnergy entered 2019 a different company than it began 2018,

having sold the Portland Terminal to our tenant, an asset which

returned rates in the mid-teens since its purchase in January 2014.

Recently, we deleveraged our capital structure through the

repurchase of preferred equity and the exchange of convertible

debt,” said CorEnergy President, Chairman and CEO Dave Schulte. “We

engaged in several deep dives of evaluating asset acquisitions

which, while not ultimately resulting in a transaction, allowed our

team to stretch our understanding of which assets best fit our

risk-return profile. In 2019, we expect to continue our disciplined

approach in assessing real property assets to add to our

portfolio.”

Portfolio Update

Grand Isle Gathering System: On

October 18, 2018, the parent company of the tenant of the GIGS,

EGC, completed its previously announced acquisition by the

privately-held Gulf of Mexico operator, Cox Oil, for approximately

$332 million. The tenant continues to utilize the system and make

timely rent payments.

Pinedale Liquids Gathering System:

UPL made strides to strengthen its balance sheet in 2018 and

refocused its drilling plan on vertical wells, following mixed

results from horizontal well testing. Utilization of the Pinedale

LGS generated $4.3 million of variable rent revenue in 2018,

despite UPL’s financial results being adversely affected by lower

realized natural gas prices. CorEnergy intends to utilize excess

cash flows such as these to reduce its leverage profile and / or

invest in new assets.

MoGas Pipeline: On May 31, 2018,

MoGas filed a general rate case before the FERC with a proposed

revenue requirement of approximately $20.0 million, annually. The

proposed rates went into effect on December 1, 2018, subject to

refund upon final ruling. The FERC rate case remains ongoing.

Omega Pipeline: Omega and its

third-party consultants are reviewing potential projects, including

those for its utility energy services contract (UESC) at Fort

Leonard Wood in south-central Missouri. The UESC initiative is

expected to last four to five years and will produce incremental

earnings.

Portland Terminal: On December 21,

2018, CorEnergy sold the Portland Terminal Facility to its tenant,

Zenith Energy, as well as its remaining interest in the Joliet

Terminal, for an aggregate consideration of $61 million. The

Company had purchased the Portland Terminal in January 2014 for $42

million and invested an additional $10 million for improvements in

the asset.

Outlook

CorEnergy regularly assesses its ability to pay and grow its

dividend to common stockholders above the current $0.75 per

quarter. The Company targets long-term revenue growth of 1-3%

annually from existing contracts through inflation-based and

participating rent adjustments and additional growth from

acquisitions. CorEnergy believes that a number of actions can be

taken to adequately offset the lost revenue from the sale of the

Portland Terminal, which could include a combination of i)

additional investments in revenue generating assets and / or ii)

deleveraging of the Company’s balance sheet through preferred

equity and convertible debt repurchases, at attractive prices.

There can be no assurance that any potential acquisition

opportunities will result in consummated transactions.

Dividend Declaration

Common Stock: A fourth quarter 2018

dividend of $0.75 per share (or $3.00 per share annualized) was

declared for CorEnergy’s common stock. The dividend is payable on

February 28, 2019, to stockholders of record on

February 14, 2019.

Preferred Stock: For the Company’s

7.375% Series A Cumulative Redeemable Preferred Stock, a cash

dividend of $0.4609375 per depositary share was declared. The

preferred stock dividend, which equates to an annual dividend

payment of $1.84375 per depositary share, is payable on

February 28, 2019, to stockholders of record on

February 14, 2019.

Fiscal Year 2018 Earnings Conference Call

CorEnergy will host a conference call on Thursday, February 28,

2019, at 1:00 p.m. Central Time to discuss its financial results.

Please dial into the call at 877-407-8035 (for international,

1-201-689-8035) approximately five to ten minutes prior to the

scheduled start time. The call will also be webcast in a

listen-only format. A link to the webcast will be accessible at

corenergy.reit.

A replay of the call will be available until 1:00 p.m. Central

Time on March 28, 2019 by dialing 877-481-4010 (for international,

1-919-882-2331). The Conference ID is 43972. A replay of the

conference call will also be available on the Company’s

website.

About CorEnergy Infrastructure Trust, Inc.

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA), is a

real estate investment trust (REIT) that owns critical energy

assets, such as pipelines, storage terminals, and transmission and

distribution assets. We receive long-term contracted revenue from

operators of our assets, primarily under triple-net participating

leases. For more information, please visit corenergy.reit.

Forward-Looking Statements

This press release contains certain statements that may include

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical fact, included herein are "forward-looking statements."

Although CorEnergy believes that the expectations reflected in

these forward-looking statements are reasonable, they do involve

assumptions, risks and uncertainties, and these expectations may

prove to be incorrect. Actual results could differ materially from

those anticipated in these forward-looking statements as a result

of a variety of factors, including those discussed in CorEnergy’s

reports that are filed with the Securities and Exchange Commission.

You should not place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

Other than as required by law, CorEnergy does not assume a duty to

update any forward-looking statement. In particular, any

distribution paid in the future to our stockholders will depend on

the actual performance of CorEnergy, its costs of leverage and

other operating expenses and will be subject to the approval of

CorEnergy’s Board of Directors and compliance with leverage

covenants.

Notes

1NAREIT FFO represents net income (computed in accordance with

GAAP), excluding gains (or losses) from sales of depreciable

operating property, impairment losses of depreciable properties,

real estate-related depreciation and amortization (excluding

amortization of deferred financing costs or loan origination costs)

and after adjustments for unconsolidated partnerships and

non-controlling interests. Adjustments for non-controlling

interests are calculated on the same basis. FFO as we have

presented it here, is derived by further adjusting NAREIT FFO for

distributions received from investment securities, income tax

expense (benefit) from investment securities, net distributions and

dividend income and net realized and unrealized gain or loss on

other equity securities. CorEnergy defines AFFO as FFO Adjusted for

Securities Investment plus (gain) loss on extinguishment of debt,

provision for loan (gain) loss, net of tax, transaction costs,

amortization of debt issuance costs, amortization of deferred lease

costs, accretion of asset retirement obligation, amortization of

above market leases, income tax expense (benefit) unrelated to

securities investments, non-cash costs associated with derivative

instruments, (gain) loss on the settlement of ARO, and certain

costs of a nonrecurring nature, less maintenance, capital

expenditures (if any), amortization of debt premium, and other

adjustments as deemed appropriate by Management. Reconciliations of

NAREIT FFO, FFO Adjusted for Securities Investments and AFFO to Net

Income Attributable to CorEnergy Stockholders are included in the

additional financial information attached to this press

release.

Consolidated Balance Sheets

December 31, 2018 December 31, 2017

Assets Leased property, net of accumulated depreciation of

$87,154,095 and $72,155,753 $ 398,214,355 $ 465,956,467 Property

and equipment, net of accumulated depreciation of $15,969,346 and

$12,643,636 109,881,552 113,158,872 Financing notes and related

accrued interest receivable, net of reserve of $600,000 and

$4,100,000 1,300,000 1,500,000 Note receivable 5,000,000 — Other

equity securities, at fair value — 2,958,315 Cash and cash

equivalents 69,287,177 15,787,069 Deferred rent receivable

25,942,755 22,060,787 Accounts and other receivables 5,083,243

3,786,036 Deferred costs, net of accumulated amortization of

$1,290,236 and $623,764 2,838,443 3,504,916 Prepaid expenses and

other assets 668,584 742,154 Deferred tax asset, net 4,948,203

2,244,629 Goodwill 1,718,868 1,718,868

Total Assets $

624,883,180 $ 633,418,113

Liabilities and Equity

Secured credit facilities, net of debt issuance costs of $210,891

and $254,646 37,261,109 40,745,354 Unsecured convertible senior

notes, net of discount and debt issuance costs of $1,180,729 and

$1,967,917 112,777,271 112,032,083 Asset retirement obligation

7,956,343 9,170,493 Accounts payable and other accrued liabilities

3,493,490 2,333,782 Management fees payable 1,831,613 1,748,426

Income tax liability — 2,204,626 Unearned revenue 6,552,049

3,397,717

Total Liabilities $ 169,871,875 $

171,632,481

Equity Series A Cumulative Redeemable Preferred

Stock 7.375%, $125,555,675 and $130,000,000 liquidation preference

($2,500 per share, $0.001 par value), 10,000,000 authorized; 50,222

and 52,000 issued and outstanding at December 31, 2018 and December

31, 2017, respectively $ 125,555,675 $ 130,000,000 Capital stock,

non-convertible, $0.001 par value; 11,960,225 and $11,915,830

shares issued and outstanding at December 31, 2018 and December 31,

2017 (100,000,000 shares authorized) 11,960 11,916 Additional

paid-in capital 320,295,969 331,773,716 Retained earnings 9,147,701

—

Total Equity 455,011,305 461,785,632

Total Liabilities and Equity $ 624,883,180 $

633,418,113

Consolidated Statements of Income and

Comprehensive Income

For the Years Ended December 31, 2018 2017

2016 Revenue Lease revenue $ 72,747,362 $ 68,803,804

$ 67,994,130 Transportation and distribution revenue 16,484,236

19,945,573 21,094,112 Financing revenue — — 162,344

Total Revenue 89,231,598 88,749,377

89,250,586

Expenses Transportation and distribution

expenses 7,210,748 6,729,707 6,463,348 General and administrative

13,042,847 10,786,497 12,270,380 Depreciation, amortization and ARO

accretion expense 24,947,453 24,047,710 22,522,871 Provision for

loan (gain) loss (36,867 ) — 5,014,466

Total

Expenses 45,164,181 41,563,914 46,271,065

Operating Income $ 44,067,417 $ 47,185,463 $

42,979,521

Other Income (Expense) Net distributions

and dividend income $ 106,795 $ 680,091 $ 1,140,824 Net realized

and unrealized gain (loss) on other equity securities (1,845,309 )

1,531,827 824,482 Interest expense (12,759,010 ) (12,378,514 )

(14,417,839 ) Gain on the sale of leased property, net 11,723,257 —

— Loss on extinguishment of debt — (336,933 ) —

Total Other Expense (2,774,267 ) (10,503,529 ) (12,452,533 )

Income before income taxes 41,293,150 36,681,934

30,526,988

Taxes Current tax expense (benefit)

(585,386 ) 2,831,658 (313,107 ) Deferred tax benefit (1,833,340 )

(486,340 ) (151,313 )

Income tax expense (benefit), net

(2,418,726 ) 2,345,318 (464,420 )

Net Income

43,711,876 34,336,616 30,991,408 Less: Net Income attributable to

non-controlling interest — 1,733,826 1,328,208

Net Income attributable to CorEnergy Stockholders $

43,711,876 $ 32,602,790 $ 29,663,200 Preferred dividend

requirements 9,548,377 7,953,988 4,148,437

Net Income attributable to Common Stockholders $ 34,163,499

$ 24,648,802 $ 25,514,763 Net Income $

43,711,876 $ 34,336,616 $ 30,991,408 Other comprehensive income

(loss): Changes in fair value of qualifying hedges / AOCI

attributable to CorEnergy stockholders — 11,196 (201,993 ) Changes

in fair value of qualifying hedges / AOCI attributable to

non-controlling interest — 2,617 (47,226 )

Net

Change in Other Comprehensive Income (Loss) $ — $ 13,813

$ (249,219 )

Total Comprehensive Income 43,711,876

34,350,429 30,742,189 Less: Comprehensive income attributable to

non-controlling interest — 1,736,443 1,280,982

Comprehensive Income attributable to CorEnergy Stockholders

$ 43,711,876 $ 32,613,986 $ 29,461,207

Earnings Per Common Share: Basic $ 2.86 $ 2.07 $ 2.14 Diluted $

2.79 $ 2.07 $ 2.14 Weighted Average Shares of Common Stock

Outstanding: Basic 11,935,021 11,900,516 11,901,985 Diluted

15,389,180 11,900,516 11,901,985 Dividends declared per share $

3.000 $ 3.000 $ 3.000

Consolidated Statements of

Cash Flow For the Years Ended December 31,

2018 2017 2016

Operating Activities

Net Income

$ 43,711,876 $ 34,336,616 $ 30,991,408 Adjustments to reconcile net

income to net cash provided by operating activities: Deferred

income tax, net (1,845,710 ) (486,340 ) (151,313 ) Depreciation,

amortization and ARO accretion 26,361,907 25,708,891 24,548,350

Gain on sale of leased property (11,723,257 ) — — Provision for

loan (gain) loss (36,867 ) — 5,014,466 Loss on extinguishment of

debt — 336,933 — Non-cash settlement of accounts payable — (221,609

) — (Gain) loss on sale of equipment (8,416 ) 4,203 — Gain on

repurchase of convertible debt — — (71,702 ) Net distributions and

dividend income, including recharacterization of income — 148,649

(117,004 ) Net realized and unrealized (gain) loss on other equity

securities 1,845,309 (1,531,827 ) (781,153 ) Unrealized gain on

derivative contract — — (75,591 ) Settlement of derivative contract

— — (95,319 ) Loss on settlement of asset retirement obligation

310,941 — — Common stock issued under directors compensation plan

67,500 67,500 60,000 Changes in assets and liabilities: Increase in

deferred rent receivables (7,038,848 ) (7,184,005 ) (8,360,036 )

(Increase) decrease in accounts and other receivables (1,297,207 )

752,848 (174,390 ) Decrease in financing note accrued interest

receivable — — 95,114 (Increase) decrease in prepaid expenses and

other assets 73,505 (16,717 ) 329,735 Increase (decrease) in

management fee payable 83,187 13,402 (28,723 ) Increase (decrease)

in accounts payable and other accrued liabilities 476,223 (225,961

) (231,151 ) Increase (decrease) in income tax liability (2,204,626

) 2,204,626 — Increase (decrease) in unearned revenue (152,777 )

2,884,362 155,961 Net cash provided by operating

activities $ 48,622,740 $ 56,791,571 $ 51,108,652

Investing Activities Proceeds from the sale of leased

property 55,553,975 — — Proceeds from sale of other equity

securities 449,067 7,591,166 — Proceeds from assets and liabilities

held for sale — — 644,934 Purchases of property and equipment, net

(105,357 ) (116,595 ) (191,926 ) Proceeds from asset foreclosure

and sale 17,999 — 223,451 Principal payment on financing note

receivable 236,867 — — Increase in financing notes receivable — —

(202,000 ) Return of capital on distributions received 663,939

120,906 4,631 Net cash provided by investing

activities $ 56,816,490 $ 7,595,477 $ 479,090

Financing Activities

Debt financing costs

(264,010 ) (1,462,741 ) (193,000 ) Net offering proceeds on Series

A preferred stock — 71,161,531 — Repurchases of common stock — —

(2,041,851 ) Repurchases of convertible debt — — (899,960 )

Repurchases of Series A preferred stock (4,275,553 ) — — Dividends

paid on Series A preferred stock (9,587,500 ) (8,227,734 )

(4,148,437 ) Dividends paid on common stock (34,284,059 )

(34,731,892 ) (34,896,727 ) Distributions to non-controlling

interest — (1,833,650 ) — Advances on revolving line of credit —

10,000,000 44,000,000 Payments on revolving line of credit —

(54,000,000 ) — Proceeds from term debt — 41,000,000 — Principal

payments on secured credit facilities (3,528,000 ) (45,600,577 )

(60,131,423 ) Purchase of non-controlling interest —

(32,800,000 ) — Net cash used in financing activities $

(51,939,122 ) $ (56,495,063 ) $ (58,311,398 ) Net Change in Cash

and Cash Equivalents $ 53,500,108 $ 7,891,985 $ (6,723,656 ) Cash

and Cash Equivalents at beginning of period 15,787,069

7,895,084 14,618,740 Cash and Cash Equivalents at end

of period $ 69,287,177 $ 15,787,069 $ 7,895,084

Supplemental Disclosure of Cash Flow

Information Interest paid $ 11,200,835 $ 10,780,150 $

12,900,901 Income taxes paid (net of refunds) 2,136,563 199,772

37,736

Non-Cash Investing Activities Note receivable

in consideration of the sale of leased property $ 5,000,000 $ — $ —

Investment in other equity securities — (1,161,034 ) — Change in

accounts and other receivables — — (450,000 ) Net change in Assets

Held for Sale, Property and equipment, Prepaid expenses and other

assets, Accounts payable and other accrued liabilities and

Liabilities held for sale — — (1,776,549 )

Non-Cash

Financing Activities Change in accounts payable and accrued

expenses related to debt financing costs $ (255,037 ) $ 255,037 $ —

Reinvestment of distributions by common stockholders in additional

common shares 1,509,830 962,308 815,889 Common stock issued upon

conversion of convertible notes 42,654 — —

NAREIT

FFO, FFO Adjusted for Securities Investment and AFFO Reconciliation

(Unaudited) For the Years Ended December

31, 2018 2017

2016 Net Income attributable to CorEnergy

Stockholders $ 43,711,876 $ 32,602,790 $ 29,663,200 Less:

Preferred Dividend Requirements 9,548,377 7,953,988

4,148,437

Net Income attributable to Common

Stockholders $ 34,163,499 $ 24,648,802 $ 25,514,763 Add:

Depreciation 24,355,959 23,292,713 21,704,275 Less: Gain on the

sale of leased property, net 11,723,257 — — Non-Controlling

Interest attributable to NAREIT FFO reconciling items —

1,632,546 1,645,819

NAREIT funds from operations

(NAREIT FFO) $ 46,796,201 $ 46,308,969 $ 45,573,219 Add:

Distributions received from investment securities 106,795 949,646

1,028,452 Income tax expense (benefit) from investment securities

(682,199 ) 1,000,084 760,036 Less: Net distributions and dividend

income 106,795 680,091 1,140,824 Net realized and unrealized gain

(loss) on other equity securities (1,845,309 ) 1,531,827

824,482

Funds from operations adjusted for securities

investments (FFO) $ 47,959,311 $ 46,046,781 $ 45,396,401 Add:

Loss of extinguishment of debt — 336,933 — Provision for loan

(gain) loss, net of tax (36,867 ) — 4,409,359 Transaction costs

521,311 592,068 520,487 Amortization of debt issuance costs

1,414,457 1,661,181 2,025,478 Amortization of deferred lease costs

91,932 91,932 91,932 Accretion of asset retirement obligation

499,562 663,065 726,664 Non-cash (gain) loss associated with

derivative instruments — 33,763 (75,591 ) Loss on settlement of ARO

310,941 — — Less: Non-cash settlement of accounts payable — 221,609

— Income tax (expense) benefit 1,736,527 (1,345,234 ) 619,349

Non-Controlling Interest attributable to AFFO reconciling items —

13,154 37,113

Adjusted funds from

operations (AFFO) $ 49,024,120 $ 50,536,194 $

52,438,268 Weighted Average Shares of Common Stock

Outstanding: Basic 11,935,021 11,900,516 11,901,985 Diluted

15,389,180 15,355,061 15,368,370

NAREIT FFO attributable to

Common Stockholders Basic $ 3.92 $ 3.89 $ 3.83 Diluted (1) $

3.61 $ 3.59 $ 3.54

FFO attributable to Common Stockholders

Basic $ 4.02 $ 3.87 $ 3.81 Diluted (1) $ 3.69 $ 3.57 $ 3.53

AFFO

attributable to Common Stockholders Basic $ 4.11 $ 4.25 $ 4.41

Diluted (2) $ 3.70 $ 3.81 $ 3.93

(1)

Diluted per share calculations include

dilutive adjustments for convertible note interest expense,

discount amortization and deferred debt issuance amortization.

(2)

Diluted per share calculations include a

dilutive adjustment for convertible note interest expense.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190227005977/en/

CorEnergy Infrastructure Trust, Inc.Investor RelationsLesley

Schorgl, 877-699-CORR (2677)info@corenergy.reit

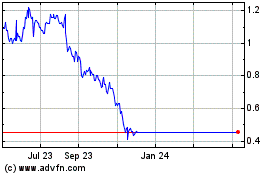

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

From Mar 2024 to Apr 2024

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

From Apr 2023 to Apr 2024