Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

December 11 2018 - 6:55AM

Edgar (US Regulatory)

FREE WRITING PROSPECTUS

Filed Pursuant to Rule 433

Registration Statement No. 333-227176

Oi S.A. - In Judicial Reorganization

Corporate

Taxpayers’ Registry (CNPJ/MF) No. 76.535.764/0001-43

Board of Trade (NIRE) No. 33.30029520-8

Publicly-Held Company

NOTICE TO ADS HOLDERS

Oi S.A. - In Judicial Reorganization

(“

Oi

” or “

Company

”) (NYSE:OIBR.C; OTC: OIBRQ) announced today that its Board of Directors has extended the expiration of the Company’s previously announced preemptive rights offer (the “

Rights Offer

”) until 6:00

p.m. (Brasília time) on January 4, 2019. The Rights Offer was originally scheduled to expire on December 26, 2018. Except as otherwise described herein, all other terms and conditions of the Rights Offer remain unchanged.

The Rights Offer is being made in the United States and elsewhere outside of Brazil pursuant to a Prospectus dated November 13, 2018 that has been filed by

Oi

with the U.S. Securities and Exchange Commission (the “

Prospectus

”) in connection with an effective Registration Statement. Capitalized terms used in this Notice and not otherwise defined herein have the meanings set forth in the Prospectus.

The Company also today entered into an amendment to the Commitment Agreement described in the Prospectus under which the automatic termination of the Commitment Agreement was extended until December 31, 2018.

The commitments of the Backstop Investors remain subject to our satisfaction of certain conditions set forth in the Commitment Agreement

. The extension of the automatic termination of the Commitment Agreement will enable the Company to continue to seek to satisfy these conditions. It allows the Company to continue our ongoing and constructive discussions with the requisite Backstop Investors to obtain waivers of any unmet conditions, extend certain termination event deadlines and eliminate the remaining conditionality of the Backstop Investors' commitments in favor of a fully backstopped offering. In addition, the Company has discussed with the Backstop Investors a proposal under which the ADS Depositary's issuance fee of US$0.05 per New Common ADS would be reduced or eliminated in the event that Backstop Investors holding more than 60% in amount of the total Backstop Commitments fully and unconditionally waive all conditions set forth in the Commitment Agreement.

In light of the Company’s ongoing discussions with Backstop Investors, the Company has determined to extend the Common ADS Rights Expiration Time and the Share Rights Expiration Time (each, as defined below) in an effort to conclude these negotiations prior to the Common ADS Rights Expiration Time.

Principal Terms of the Rights Offer

·

Each h

older of the common shares of the Company (“

Common Shares

”) and/or preferred shares of the Company (“

Preferred Shares

”) as of 6:00 p.m. (Brasília time) on November 19, 2018 (the “

Share Record Date

”) was granted 1.333630 transferable preemptive rights to subscribe for Common Shares (“

New Common Shares

”) for each Common Share or Preferred Share held by such holder (the “

Common Share Right

s”).

·

Only whole numbers of Common Share Rights were issued and all entitlements were reduced to the next lower number of whole Common Share Rights.

·

Holders of Common Share Rights are entitled to exercise Common Share Rights during the period commencing at 10:00 a.m. (Brasília time) on November 22, 2018,

and ending at 6:00

p.m. (Brasília time) on January 4, 2019 (the “

Share Rights Expiration Time

”).

·

Each h

older of American Depositary Shares, each representing five Common Shares (the “

Common ADSs

”) as of 5:00 p.m. (New York City time) on November 21, 2018 (the “

ADS Rights Record Date

”) was granted 1.333630 transferable preemptive rights to subscribe for Common ADS (“

New Common ADSs

”) for each Common ADS held by such holder (“

Common ADS Rights

”).

·

Each h

older of American Depositary Shares, each representing one Preferred Share (the “

Preferred ADSs

”) as of the ADS Rights Record Date was granted 0.266726 Common ADS Rights.

·

Only whole numbers of Common ADS Rights were issued and all entitlements were reduced to the next lower number of whole Common ADS Rights.

·

Holders of Common ADS Rights will be entitled to exercise Common ADS Rights during the period commencing at 9:00 a.m. (New York City time) on November 26, 2018,

and ending at 5:00

p.m. (New York City time) on December 26, 2018 (the “

Common ADS Rights Expiration Time

”). Brokers and other securities intermediaries may set their own cutoff dates and times to receive exercise instructions that may be earlier than the Common ADS Rights Expiration Time. Therefore, holders of Common ADS Rights held through brokers or other securities intermediaries should contact those brokers or other securities intermediaries to determine the cut-off dates and times that apply to them.

·

Trading in Common Share Rights on the

B3 S.A. – Brasil, Bolsa, Balcão

under the trading symbol “OIBR1” will cease at 6:00 p.m. (Brasília time) on December 26, 2018.

·

Trading in Common ADS Rights on the New York Stock Exchange (NYSE:OIBR RT) will cease at 4:00 p.m. (New York City time) on December 20, 2018.

Changes to Settlement and Related Dates

As a result of the extension of the Share Rights Expiration Time, the following dates relating to the settlement of the subscriptions received in the Rights Offer to holders of Common Shares and Preferred Shares have been modified.

All times referred to in this timetable are Brasília time unless stated otherwise.

|

Oi determines number of Excess New Common Shares

.......

|

On or about January 7

, 2019

|

|

Oi’s board of directors ratifies the issuance of initial New Common Shares

.........................................................................

|

On or about January 8

, 2019

|

|

Announcement of results of Share Rights Offer

..........

|

On or about January 8

, 2019

|

|

B3 Notification Date

....................................................

|

On or about

January 9, 2019

|

|

Excess New Common Shares Notification Date

..........

|

On or about January 10, 2019

|

|

Issuance of initial New Common Shares and delivery of initial New Common Shares to holders

.........................................

|

On or about

January 11, 2019

|

|

Commencement of trading in initial New Common Shares on the B3

|

On or about

January 11, 2019

|

|

Excess New Common Shares Subscription Price Deposit Date

|

5:00

p.m. on

January 15, 2019

|

|

Oi’s board of directors ratifies the issuance of Excess New Common Shares

.........................................................................

|

On or about

January 16, 2019

|

|

Issuance of Excess New Common Shares and delivery of Excess New Common Shares to holders

.........................................

|

On or about

January 21, 2019

|

|

Commencement of trading in Excess New Common Shares on the B3

|

On or about

January 21, 2019

|

As a result of the extension of the Common ADS Rights Expiration Time, the following dates relating to the settlement of the subscriptions received in the Rights Offer to holders of Common ADSs and Preferred ADSs have been modified.

All times referred to in this timetable are New York City time unless stated otherwise.

|

Announcement of results of ADS Rights Offer

...........

|

On or about January 8

, 2019

|

|

Delivery of initial New Common Shares to

custodian of ADS Depositary with respect to Common ADS Rights subscribed......

|

On or about

January 11, 2019

|

|

Issuance and delivery of initial New Common ADSs..

|

On or about

January 15, 2019

|

|

Rights Agent makes refund to DTC of excess funds received for Initial ADSs

..........................................................................

|

On or about

January 15, 2019

|

|

Commencement of trading in initial New Common ADSs on the NYSE

|

On or about

January 15, 2019

|

|

Delivery of Excess New Common Shares, if any, to

custodian of ADS Depositary..................................................................

|

On or about

January 21, 2019

|

|

Issuance and delivery of subscribed Excess New Common ADSs

|

On or about January 23, 2019

|

|

Rights Agent makes refund to DTC of excess funds received for Excess ADSs..........................................................................

|

On or about January 23, 2019

|

|

Commencement of trading in Excess New Common ADSs on the NYSE

|

On or about January 23, 2019

|

D.F. King & Co., Inc., the information agent for the Rights Offer (the “

Information Agent

”) has mailed Subscription Forms relating to Common ADS Rights to holders of Common ADSs and Preferred ADSs registered directly with the Depositary as of the

ADS Rights Record Date, and those Common ADS Rights were initially registered directly with The Bank of New York Mellon, as ADS Rights Agent.

The Company has deposited Common ADS Rights with respect to Common ADSs and Preferred ADSs held through The Depository Trust Company (“

DTC

”) as of the ADS Rights Record Date in DTC. Inquiries regarding the Rights Offer should be directed to the Information Agent:

D.F. King & Co., Inc.

48 Wall Street

New York, NY 10005

Banks and Brokers Call: +1 (212) 269-5550

All Others Call: +1 (800) 628-8536

Rio de Janeiro, December 10, 2018.

Oi S.A. – In Judicial Reorganization

Carlos Augusto Machado Pereira de Almeida Brandão

Chief Financial Officer and Investor Relations Officer

Important Information

The offering of Common Shares and Common ADSs upon the exercise of preemptive rights is being made pursuant to an effective registration statement

(including a prospectus) that has been filed with the

U.S. Securities and Exchange Commission (“

SEC

”). Before you invest, you should read the prospectus

in that registration statement

and other documents that Oi has filed with the SEC for more complete information about the company and the offering of Common Shares and Common ADSs upon the exercise of preemptive rights. You may access these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, Oi will arrange to send you the prospectus if you request it by calling toll-free 1-800-628-8536.

Special Note regarding Forward-looking Statements:

This Notice to ADS Holders contains forward-looking statements. Statements that are not historical facts, including statements regarding the beliefs and expectations of the Company, business strategies, future synergies and cost savings, future costs and future liquidity, are forward-looking statements. The words “will,” “will be,” “should,” “could,” “may,” “should be,” “could be,” “may be,” “estimates,” “has as an objective,” “targets,” “target,” “goal,” “anticipates,” “believes,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “foretells,” “projects,” “points to” and similar expressions, as they relate to the Company, are intended to identify forward-looking statements and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, tendencies or results will actually occur. Such statements reflect the current views of management of the Company, and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, corporate approvals, operational factors and other factors. Any changes in such assumptions or factors could

cause actual results to differ materially from current expectations. All forward-looking statements attributable to the Company or its affiliates, or persons acting on their behalf, are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. Forward-looking statements speak only as of the date they are made. Except as required under the Brazilian or the U.S. federal securities laws or the rules and regulations of the Brazilian Securities Commission (

Comissão de Valores Mobiliários

) (“

CVM

”), SEC or of regulatory authorities in other applicable jurisdictions, the Company and its affiliates do not have any intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. You are advised, however, to consult any further disclosures the Company makes on related subjects in reports and communications the Company files with the CVM and the SEC.

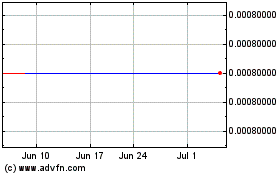

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

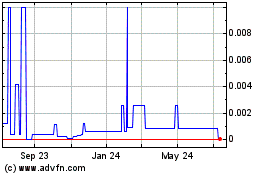

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024