Report of Foreign Issuer (6-k)

November 05 2018 - 3:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2018

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

This Notice to the Market is neither an offer to sell nor a request of an offer to buy securities in Brazil. The Notes

will not be offered to the public in Brazil and, accordingly, there will not be registration with the Brazilian Securities Commission – CVM or traded on any Brazilian securities market.

BANCO SANTANDER (BRASIL) S.A.

Publicly-Held Company with Authorized Capital

CNPJ/MF No. 90.400.888/0001-42

NIRE 35.300.332.067

NOTICE TO THE MARKET

BANCO SANTANDER (BRASIL) S.A.

(“

Santander Brazil

” or “

Company

”) announces to its shareholders and to the market in general that the Board of Directors of the Company approved a transaction aimed at reducing the financial costs of its current indebtedness and, consequently, optimizing the capital structure of Santander Brazil at a board meeting held on November 5, 2018, in accordance with the following combined steps:

(1)

Issue of Notes

:

issue, through Santander Brazil’s Grand Cayman Branch, of instruments that make up the tier 1 and tier 2 of the regulatory capital (

patrimônio de referência

) of Santander Brazil (the “

Notes

”

), pursuant to National Monetary Council (CMN) Resolution No. 4,192 of March 1, 2013 (“

CMN Resolution 4,192/13

”), in the aggregate amount of two billion, five hundred million American dollars (US$2,500,000,000.00), pursuant to an offering to be made outside Brazil and outside the United States to non-US Persons under Regulation S of the U.S. Securities Act of 1933, as amended (the “

Securities Act

”), with the following characteristics (the “

Offering of Notes

”):

(A) common characteristics

(a)

Unit Value

: the unit face value of the Notes will be one hundred and fifty thousand American dollars (US$150,000.00) and integral multiples of one thousand American dollars (US$ 1,000.00) to the extent exceeding such minimum value; (b)

Repurchase and Redemption

: subject to the occurrence of certain events and conditions defined in the issue documents of the Notes, the Notes may be repurchased or redeemed by Santander Brazil (i) after the fifth (5

th

) anniversary of the issue date of the Notes, at the sole discretion of the Company or as a result of changes in tax laws applicable to the Notes; or (ii) at any time, as a result of the occurrence of certain regulatory events; (c)

Write-off of the Notes

: the Notes may be permanently written-off upon the occurrence of certain regulatory events defined in CMN Resolution No. 4,192/13; (d)

Offering and Trading

: The Notes will not be offered to the public in the United States, Brazil or elsewhere. Accordingly, they will not be registered with the U.S. Securities and Exchange Commission, the Brazilian Securities Commission – CVM or any other authority, nor will they be traded on securities markets in the U.S. or Brazil. The Notes will be offered outside the United States of America and outside Brazil to non-US Persons, pursuant to Regulation S of the Securities Act. The Notes will be listed on the Luxembourg Stock Exchange and admitted to trading on the Euro MTF Market of the Luxembourg Stock Exchange; (e)

Sole Investor

: Santander Spain, controlling shareholder of Santander Brazil, will purchase all the Notes to be issued in the Offering of Notes; (f)

Other conditions

: the Notes shall comply with all other conditions required under CMN Resolution 4,192/13; (B)

specific characteristics of the Tier 1 Notes

: (a)

Amount of Principal

: one billion, two hundred and fifty million American dollars (US$1,250,000,000); (b)

Interest Rate

: 7.250% per year; (c)

Maturity Date

: the Tier 1 Notes will be perpetual notes; (d)

Interest Payment Frequency

: interest will be paid semi-annually on each May 8 and November 8, commencing on May 8, 2019; (C)

specific characteristics of Tier 2 Notes

: (a)

Amount of Principal

: one billion, two hundred and fifty million American dollars (US$1,250,000,000);

(b)

Interest Rate

: 6.125% per year; (c)

Maturity Date

: the Tier 2 Notes will mature on November 8, 2028; (d)

Interest Payment Frequency

: interest will be paid semi-annually on each May 8 and November 8, commencing on May 8, 2019.

(2) Redemption of instruments

: redemption of instruments currently making up Santander Brazil’s Tier 1 and Tier 2 regulatory capital pursuant to CMN Resolution 4,192/13, which were issued based on the resolution approved at Santander’s Board of Directors meeting held on January 14, 2014 (the “

Redemption

”). The Redemption will be carried out with funds raised through the Offering of Notes, in accordance with the terms and conditions of the documents that formalized the issuance of these instruments.

The inclusion of the Notes in Santander Brazil’s Tier 1 and Tier 2 regulatory capital and the consummation of the Redemption are subject to prior approval of the Central Bank of Brazil (the “

Central Bank

”). The Company will apply for simultaneous approvals to the Central Bank for such purposes. The Company will publish a new Notice to the Market upon obtaining the authorizations from the Central Bank.

This notice does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor will there be any sale of these securities in any state of the United States or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities act of any such state or jurisdiction. The Notes will be offered outside Brazil and outside the United States to non-US Persons, in accordance with Regulation S under the Securities Act.

São Paulo, November 5, 2018

Angel Santodomingo

Investor Relations Officer

BANCO SANTANDER (BRASIL) S.A.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: November 5, 2018

|

Banco Santander (Brasil) S.A.

|

|

|

|

|

|

By:

|

/

S

/

Amancio Acurcio Gouveia

|

|

|

|

Amancio Acurcio Gouveia

Officer Without Specific Designation

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/

S

/

Angel Santodomingo Martell

|

|

|

|

Angel Santodomingo Martell

Vice - President Executive Officer

|

|

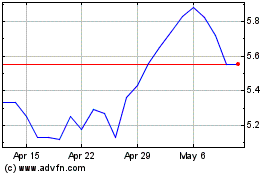

Banco Santander Brasil (NYSE:BSBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

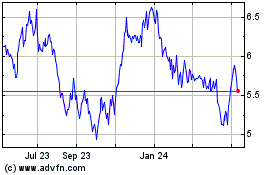

Banco Santander Brasil (NYSE:BSBR)

Historical Stock Chart

From Apr 2023 to Apr 2024