Current Report Filing (8-k)

September 07 2018 - 5:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 31, 2018

MEDICAL PROPERTIES TRUST, INC.

MPT OPERATING PARTNERSHIP, L.P.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Maryland

Delaware

|

|

001-32559

333-177186

|

|

20-0191742

20-0242069

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

1000 Urban Center Drive, Suite 501

Birmingham, AL

|

|

35242

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(205) 969-3755

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act

(17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

The disclosures contained below in Item 2.01 of this Current Report on Form

8-K

are incorporated into

this Item 1.01 by reference.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On August 31, 2018, affiliates of Medical Properties Trust, Inc. (together with its consolidated subsidiaries, the “Company”)

and MPT Operating Partnership, L.P. (together with its consolidated subsidiaries, the “Operating Partnership”) completed the previously announced transaction in which Primotop Holdings S.a r.l. (“Primotop”), a company managed by

an entity of the Primonial group, acquired a 50% interest by way of a joint venture in the real estate of 71 post-acute hospitals in Germany (the “Portfolio”) with an aggregate agreed valuation of approximately €1.635 billion.

Primotop subscribed for 50% of the outstanding interests in MPT RHM Holdco S.a r.l. (the “Joint Venture”), a subsidiary of the

Company and the indirect owner of the Portfolio, in exchange for a cash amount equal to 50% of the estimated net asset value of the Portfolio at the closing of the transaction (the “Closing”), subject to certain adjustments set forth in a

subscription agreement that was entered into among the Company and Primotop on June 7, 2018. The Company retained the remaining 50% interest in the Joint Venture. Immediately following the Closing, the Joint Venture made cash distributions to

the Company in an aggregate amount of approximately €1.14 billion from the proceeds of the cash contributions and certain debt financings. The Company expects to use such proceeds to repay balances under its revolving credit facility, make

investments in additional U.S. and European healthcare assets and for general corporate purposes.

In anticipation of Closing, the Joint

Venture entered into a €655 million secured financing arrangement on the Portfolio with a consortium of lenders, including Societe Generale S.A. Frankfurt Branch as Mandated Lead Arranger and affiliates of AXA. Provisions of the debt

include a seven year term and a swapped fixed rate of approximately 2.3%.

Affiliates of the Company will continue to manage the Portfolio

pursuant to a management agreement entered into upon Closing.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On September 5, 2018, we issued a press release announcing closing of the transactions described above in Item 2.01 of this Current

Report on Form

8-K. A

copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The information contained in this Item 7.01 is being “furnished” and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934 or otherwise. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act or into any

filing or other document pursuant to the Securities Exchange Act of 1934, as amended, except as otherwise expressly stated in any such filing.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(b) Pro Forma Financial Information.

The

unaudited pro forma condensed consolidated financial statements of the Company and the Operating Partnership as of June 30, 2018 and for the year ended December 31, 2017 and for the six months ended June 30, 2018, are attached as

Exhibit 99.2 hereto and are incorporated by reference herein.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunder duly authorized.

|

|

|

|

|

MEDICAL PROPERTIES TRUST, INC.

|

|

|

|

|

By:

|

|

/s/ R. Steven Hamner

|

|

Name:

|

|

R. Steven Hamner

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

Date: September 7, 2018

|

|

|

|

|

MPT OPERATING PARTNERSHIP, L.P.

|

|

|

|

|

By:

|

|

/s/ R. Steven Hamner

|

|

Name:

|

|

R. Steven Hamner

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer of the sole member of the general partner of MPT Operating Partnership, L.P.

|

Date: September 7, 2018

4

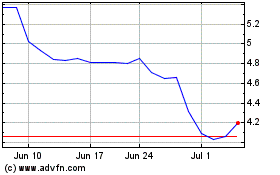

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

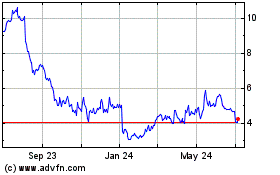

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Apr 2023 to Apr 2024