Current Report Filing (8-k)

July 20 2018 - 6:12AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 17, 2018

Diego

Pellicer Worldwide, Inc.

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

|

333-189731

|

|

33-1223037

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

9030

Seward Park Ave S. #501, Seattle, WA 98118

Registrant’s

telephone number, including area code:

(516) 900-3799

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

|

1.01

|

Entry

into a Definitive Material Agreement;

|

Equity

and Debt Restructure Agreement

.

On

July 17, 2018, Diego Pellicer Worldwide, Inc. (the “Company”) entered into a certain Equity and Debt Restructure Agreement

with two, long-time investors in the Company (the “Restructure Agreement”). Pursuant to the material terms of the

Restructure Agreement, the investors agreed to return and cancel their collective 55,481,868 restricted Company common shares,

received from the prior conversion of their older convertible notes, in exchange for the Company’s issue to them of recast

convertible promissory notes. Accordingly, on the same date, these investors were each issued a First Priority Secured Promissory

Note, in the principal amount of $2,383,667.77 and $545,606.96, respectively.

In

connection with this transaction, one of these investors loaned the Company an additional $700,000.00 for the Company’s

expansion plans in Colorado and California

.

Convertible

Notes

The

Notes are convertible, in whole or part, by the investors into shares of the Company’s common stock at a conversion rate

calculated as the lower of fifty (50%) percent of the 10-day trailing average closing price of the Company’s trading common

stock or $0.20 per share, determined at the conversion date. The Notes accrue interest at the rate of 10% and quarterly payments

equal to the lesser of 15% of the Company’s pretax profit or the monthly payment that would be made if the Notes were amortized

over a 2-year period, ending on the 24-month maturity date, commence September 30, 2018.

Subject

to the investors’ rights to conversion, the Company has a one-time right to prepay the Notes outstanding principal and accrued

interest (the Optional Prepayment Amount”), including a prepayment penalty equal to 12% of the Optional Prepayment Amount

anytime, commencing 90 days after their issue date.

A.

Note Covenants

In

addition to the customary terms and provisions found in secured, convertible notes of this type, the Notes’ covenants include

the Company’s obligation to provide the investors: (i) with 30-day’s written notice of any proposed change in the

Company’s name, state of formation or relocation of its principal offices ; (ii) with 10-day’s written notice if the

Company suffers the departure or replaces its chief executive officer or chief financial office , and; (iii) in the event of such

occurrence, the Company is required to appoint an interim replacement or fill such vacancies within 30 days. In addition, the

Notes require the prior written consent of the investors in the events: (iv) that the Company intends to liquidate, wide up or

otherwise cease to conduct business in the ordinary course or permit it or its subsidiaries to engage in business, other than

or reasonable related to the Company’s business; (v) effect a Change in Control; (vi) merge, consolidate or permit any of

its subsidiaries to do so; (vii) acquire or permit its subsidiaries to acquire all of the capital stock or property of another

person; (vii) acquire, assume or guarantee or by liable for any new indebtedness in excess of $500,000 or permit any subsidiary

to do so; (viii) permit any new indebtedness unless the lender acknowledges the first priority security interests of the investors;

(ix) suffer any liens or encumbrances on the assets of the Company; (x) pay any dividends or make any payments to redeem, retire

or purchase any capital stock; (xi) acquire or make an investment in any person or entity; (xii) enter into any material transaction

with an affiliate of the Company; (xiii) make any payment to the in respect of any indebtedness for borrowed money; (xiv) use

the services of any bailee, warehouseman colocation facility or similar services without their written acknowledgement of the

investors’ first priority security interest, and; (xv) provide to investors a budget, subject to investors’ approval,

in the event the Company no longer is an SEC reporting company or is not current in its SEC reports.

B.

Events of Default Under the Notes

Company

events of default under the Notes are: (i) failure to pay principal, interest or any other amounts payable under the Notes; (ii)

failure to reserve sufficient common shares necessary for the full conversion of the Notes; (iii) filing any petition for bankruptcy,

reorganization, insolvency or moratorium law for relief from creditors, seeking the appointment of a receiver, custodian or trustee

or make an assignment of all or a substantial portion of its assets for the benefit of creditors; (iv) suffers the resignation

of a majority of its Board of Directors in anticipation of any event or action contemplated by subsection (iii) above, and fails

to fill such vacancies within 15 days; (v) failure to dismiss or discharge an involuntary petition filed or any proceeding is

commenced against the Company within 60 days; (vi) the Company, its executives or majority shareholders breach any other instrument

or agreement with the investors, including under the Security Agreement of even date with the Notes, certain warrants previously

issued to the investors and under that certain Deferral, Subordination and Board Seat Agreement dated February 8, 2016. In the

event of any default under these referenced agreements, the Notes become immediately due and payable, the interest rates under

the Notes is increased to 20% and the investors shall have al rights and remedies afforded to creditors generally by applicable

federal laws and the laws of the State of Delaware.

Security

Agreement

.

Both

Notes are secured by a first priority security interest in all of Company’s assets which the investors share on a

pari

passu

basis. The Security Agreement contains the customary terms and provisions for security agreements of this genre, including

the Company’s obligation to preserve the collateral for the benefit of the secured investors and permits the investors to

file UCC financing statements with required notice from the Company if it changes its principal place of business, trade name,

etc. The investors’ remedies in the event of default are customary for secured parties including the right to publicly sell

the collateral upon notice to the Company.

The

foregoing descriptions of the material terms and provisions of the Restructure Agreement, Notes and Security Agreement do not

purport to be complete and is qualified in its entirety by reference to the full text of these documents which are included as

Exhibits 10.1, 10.2, 10.3 and 10.4 to this Current Report on Form 8-K and are incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits.

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Equity and Debt Restructure Agreement, effective June 29, 2018;

|

|

|

|

|

|

10.2

|

|

First Priority Secured Convertible Promissory Note, effective June 29, 2018, made by the Company in the principal amount of $545,606.96, and payable to investor, Chester Aldridge;

|

|

|

|

|

|

10.3

|

|

First Priority Secured Convertible Promissory Note, effective June 29, 2018, made by the Company in the principal amount of $2,383,667.77, and payable to investor, 0851229 BC Ltd.;

|

|

|

|

|

|

99.1

|

|

Company Press Release issued July 19, 2018.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

Diego

Pellicer Worldwide, Inc.

|

|

|

|

|

Date:

July 19, 2018

|

By:

|

/s/

Ron Throgmartin

|

|

|

|

Ron

Throgmartin, CEO

|

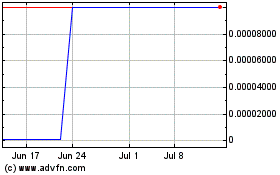

Diego Pellicer Worldwide (CE) (USOTC:DPWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

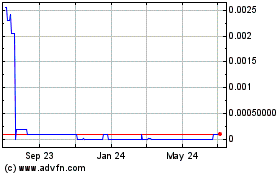

Diego Pellicer Worldwide (CE) (USOTC:DPWW)

Historical Stock Chart

From Apr 2023 to Apr 2024