As filed with the Securities and Exchange

Commission on April 6, 2018.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

RASNA THERAPEUTICS, INC.

(Exact name of registrant as specified in

its charter)

|

Nevada

|

|

2834

|

|

39-2080103

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

420 Lexington Ave., Suite 2525

New York, New York 10170

(646) 396-4087

(Address and telephone number of registrant’s

principal executive offices)

Dr. Kunwar Shailubhai

Chief Executive Officer

Rasna Therapeutics, Inc.

420 Lexington Ave., Suite 2525

New York, New York 10170

(646) 396-4087

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Jeffrey J. Fessler, Esq.

Sheppard, Mullin, Richter & Hampton

LLP

30 Rockefeller Plaza

New York, New York 10112-0015

(212) 653-8700

Approximate date of commencement of

proposed sale to the public:

From time to time after the effective date of this registration statement

.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box

.

¨

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box

.

x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

¨

|

|

Accelerated filer

x

|

|

Non-accelerated filer

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

¨

|

|

|

|

|

|

|

|

Emerging growth company

x

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided to Section 7(a)(2)(B) of the Securities Act.

x

CALCULATION

OF REGISTRATION FEE

Title of each class of

securities to be registered

|

|

Amount to be

registered/proposed

maximum

offering price

per unit/proposed

maximum aggregate

offering price

|

|

|

Amount of

registration fee

|

|

|

Common Stock

|

|

|

|

(1)(2)

|

|

|

|

|

|

Preferred Stock

|

|

|

|

(1)(2)

|

|

|

|

|

|

Debt Securities

|

|

|

|

(1)

|

|

|

|

|

|

Warrants

|

|

|

|

(1)

|

|

|

|

|

|

Units

|

|

|

|

(1)

|

|

|

|

|

|

Total

|

|

$

|

75,000,000

|

(3)

|

|

$

|

9,338

|

(4)

|

|

|

(1)

|

An unspecified number of securities or aggregate principal

amount, as applicable, is being registered as may from time to time be offered at unspecified prices.

|

|

|

(2)

|

Includes rights to acquire common stock or preferred stock

of the Company under any shareholder rights plan then in effect, if applicable under the terms of any such plan.

|

|

|

(3)

|

Estimated solely for the purpose of calculating the registration

fee. No separate consideration will be received for shares of common stock or preferred stock that are issued upon conversion

of debt securities, depositary shares or preferred stock or upon exercise of warrants registered hereunder. The aggregate maximum

offering price of all securities issued by the registrant pursuant to this registration statement will not exceed $75,000,000.

|

|

|

(4)

|

The registration fee has been calculated in accordance

with Rule 457(o) under the Securities Act of 1933, as amended.

|

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with

Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information

in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted.

|

|

SUBJECT TO COMPLETION,

|

DATED APRIL

6

, 2018

|

PROSPECTUS

RASNA THERAPEUTICS, INC.

$75,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may offer and sell, from time to time

in one or more offerings, any combination of common stock, preferred stock, debt securities, warrants to purchase common stock,

preferred stock or debt securities, or any combination of the foregoing, either individually or as units comprised of one or more

of the other securities, having an aggregate initial offering price not exceeding $75,000,000.

This

prospectus provides a general description of the securities we may offer.

Each time we sell a particular class or series

of securities, we will provide specific terms of the securities offered in a supplement to this prospectus. T

he

prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus.

We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should

read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents

incorporated by reference herein or therein before you invest in any of our securitie

s.

This prospectus may not be used to offer

or sell our securities unless accompanied by a prospectus supplement relating to the offered securities.

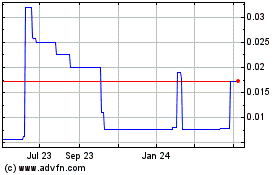

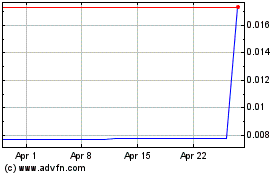

Our common stock is quoted on the OTCQX under the symbol “RASP.”

On April 5, 2018, the last reported sale price of our common stock on the OTCQX was $2.00 per share.

The

applicable prospectus supplement will contain information, where applicable, as to any other listing on the OTCQX or any securities

market or other exchange of the securities, if any, covered by the prospectus supplement.

These securities may be sold directly by

us, through dealers or agents designated from time to time, to or through underwriters, dealers or through a combination of these

methods on a continuous or delayed basis. See “Plan of Distribution” in this prospectus. We may also describe

the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents, underwriters

or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose

their names and the nature of our arrangements with them in a prospectus supplement. The price to the public of such securities

and the net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

We are an “emerging growth company” as that term

is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, as such, elect to comply with certain reduced

public company reporting requirements for future filings.

Investing in our securities involves

various risks. See “Risk Factors” contained herein for more information on these risks. Additional risks

will be described in the related prospectus supplements under the heading “Risk Factors”. You should review that

section of the related prospectus supplements for a discussion of matters that investors in our securities should consider.

Neither the Securities and Exchange Commission, or SEC, nor

any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ____, 2018

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus

is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) under the

Securities Act of 1933, as amended (the “Securities Act”) using a “shelf” registration process. Under this

shelf registration process, we may from time to time sell common stock, preferred stock, debt securities or warrants to purchase

common stock, preferred stock or debt securities, or any combination of the foregoing, either individually or as units comprised

of one or more of the other securities, in one or more offerings up to a total dollar amount of $75,000,000. We have provided to

you in this prospectus a general description of the securities we may offer. Each time we sell securities under this shelf registration,

we will, to the extent required by law, provide a prospectus supplement that will contain specific information about the terms

of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information

relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided

to you may also add, update or change information contained in this prospectus or in any documents that we have incorporated by

reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus and the

prospectus supplement or any related free writing prospectus, you should rely on the information in the prospectus supplement or

the related free writing prospectus; provided that if any statement in one of these documents is inconsistent with a statement

in another document having a later date — for example, a document incorporated by reference in this prospectus or any prospectus

supplement or any related free writing prospectus — the statement in the document having the later date modifies or supersedes

the earlier statement.

We have not authorized

any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated

by reference in this prospectus, any accompanying prospectus supplement or any related free writing prospectus that we may authorize

to be provided to you. You must not rely upon any information or representation not contained or incorporated by reference in this

prospectus or an accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be provided

to you. This prospectus, the accompanying prospectus supplement and any related free writing prospectus, if any, do not constitute

an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate,

nor do this prospectus, the accompanying prospectus supplement or any related free writing prospectus, if any, constitute an offer

to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such

offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus, any applicable

prospectus supplement or any related free writing prospectus is accurate on any date subsequent to the date set forth on the front

of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the

document incorporated by reference (as our business, financial condition, results of operations and prospects may have changed

since that date), even though this prospectus, any applicable prospectus supplement or any related free writing prospectus is delivered

or securities are sold on a later date.

As permitted

by the rules and regulations of the SEC, the registration statement, of which this prospectus forms a part, includes

additional information not contained in this prospectus. You may read the registration statement and the other reports we

file with the SEC at the SEC’s web site or at the SEC’s offices described below under the heading “Where

You Can Find More Information.”

Company References

In this prospectus, “Rasna,” “the Company,”

“we,” “us,” and “our” refer to Rasna Therapeutics, Inc., a Nevada corporation, unless the context

otherwise requires.

PROSPECTUS SUMMARY

Overview

We are a leukemia-focused biotechnology

company that has been developing therapeutics to address the unmet need that exists for acute myeloid leukemia, or AML, and other

forms of leukemia and lymphoma

.

AML is generally a disease of older

adults, with onset typically after the age of 45 (average patient age approximately 68 years old). Our strategy is to develop small

molecule drug candidates targeting two genes: NPM1 and LSD1, which are considered to control major pathways underlying etiology

of majority of AML sub-types.

RASP-101 is our lead compound and is a

controlled release, nanoparticulate, intravenous formulation of dactinomycin, which is an established anticancer therapeutic. Our

consultants, Prof. Falini and Prof. Martelli conducted a Phase 2 clinical trial using unformulated free dactinomycin, or ACT D,

in refractory/relapse (R/R) AML patients carrying NPM1 gene mutation. Treatment with ACT D at 15 µg/kg/day for 5 days every

28 days induced complete remission, or CR, in 4 out of the 9 evaluable patients (44.4%) with only 1 or 2 cycles of therapy. We

believe these results demonstrated proof-of-concept for therapy with ACT D for NPM1 gene mutated AML patients. However, intravenous

treatment with ACT D treatment also produced severe dose-limiting oral mucositis. Pursuant to a license agreement that we entered

into with Prof. Falini and Prof. Martelli, we have developed RASP-101 which is a nanoparticle controlled release formulation of

ACT D which we believe will maximize therapeutic effectiveness while minimizing oral mucositis. Our investigational new drug, or

IND, submission to the U.S. Food and Drug Administration, or FDA, is anticipated in 2020. After completion of animal safety toxicity

and pharmacokinetic, or PK, studies in animals, we are planning to conduct a Phase 1 safety and PK study, followed by a single,

bridging Phase 3 trial in AML patients to support a 505(b)(2) submission for registration which if approved by the FDA may provide

a shortened approval pathway by the end of 2023.

RASP-201 is a novel, orally-dosed, selective

reversible inhibitor of lysine specific demethylase, or LSD1, a pathway that blocks differentiation and confers a poor prognosis

to AML. We expect RASP-201 to display a safer metabolic profile than competitor irreversible inhibitors such as GSK2879552 (GlaxoSmithKline)

and ORY-1001 (Oryzon/Roche). RASP-201 when dosed orally shows

in vivo

therapeutic utility in murine (mouse) models of AML.

A lead candidate has been identified and IND submission is anticipated in 2019.

RASP-301 is our innovative, first- in-class,

oral, small molecule inhibitor that in preclinical studies has been shown to disrupt NPM1 oligomerization (aggregation of individual

subunits) and has the potential to treat refractory AML with reduced toxicity at low dose levels. RASP-301 exhibits cytotoxic effects

at nanomolar concentrations against AML cells in culture and was not cytotoxic to normal cells at the same concentrations. In vivo

usefulness of these compounds in AML murine models has been evaluated confirming the druggability of the target and its potential

to treat refractory AML. This program is in preclinical development with lead candidate selection anticipated by the first quarter

2019.

AML is a cancer of the blood and bone marrow

in which primitive bone marrow stem cells produce abnormal myeloblasts (immature white blood cells normally found only in the bone

marrow and not the peripheral blood, normally representing only about 3% of bone marrow cells), red blood cells or platelets. Levels

of these abnormal leukemia blast cells (white cells, red cells and platelets) can build up in bone marrow and blood resulting in

“crowding” of normal cells leading to infection, anemia and easy bleeding in patients. The leukemic cells can in turn

spread outside the blood circulation to other organ systems including brain, spinal cord, skin and gums. The disease may be fatal

within weeks to months, has a 5-year survival rate of only about 25% and very poor prospects for long-term survival of patients.

Our efforts are based around three druggable

intervention points with potential to improve safety and efficacy of current AML mono and/or combination therapies, namely “stemness”

(activation of stem cell-like growth patterns), cell signaling (between nucleus and cytoplasm) and stress-induced apoptosis (programmed

cell death). We are focused on two master modulatory targets which are known to play important roles in AML pathogenesis: NPM1

mutation, which accounts for approximately one third of adult AML cases and LSD-1, an enzyme involved in epigenetic (non-genetic

influenced gene expression) control.

According to the American Cancer Society,

it is estimated that approximately 21,000 new AML cases will be diagnosed in the US each year and the projected cost of drug therapy

for each patient over the course of one year of the disease is approximately $280,000 for chemotherapy alone (Preussler et. al.

Biol. Blood Marrow Transplant 23 (2017) 1021-1028) amounting to a total cost of approximately $5.9 billion. Of this it is

estimated that 50% of the costs are attributable to standard of care chemotherapy. Thus, the assessment is that the U.S.

market potential for AML is approximate $3 billion annually. The rest of the world is estimated to constitute 50% of the

AML market; thus, the total annual world market is approximately $6 billion. If our NPM1 targeted therapy proves beneficial

to only the 20% of AML patients with mutated NPM1 genes, the addressable market will be diminished but we believe that our NPM1

targeted therapy would then be the only therapy to address that sub-population.

RASP-101 (nanoparticle formulated ACT

D)

Our RASP-101 program focuses on nanoparticle

formulated actinomycin D to achieve therapeutic benefit. ACT D was previously approved by the FDA for treatment of Wilm’s

Tumor, Ewing’s Sarcoma, Metastatic Nonseminomatous Testicular Cancer, Gestational Trophoblastic Neoplastic, Childhood Rhabdomyosarcoma

and Regional Perfusion in Locally Recurrent and Locoregional Solid Malignancies under the trade name, Cosmegen

®

(Ovation Pharmaceuticals). We intend to seek approval of RASP-101 (for injection) for treatment of AML as a 505(b)(2) submission

which if approved by the FDA may provide shortened approval timelines for this regulatory pathway.

Although the precise mechanism of ACT

D in NPM1 mutated AML has not been clearly deciphered, Drs. Brunangelo Falini, Lorenzo Brunetti, and Maria Paola Martelli (N Engl.

J Med, 2015, 373(12):1180-2) hypothesized that NPM1-mutated AML cells might be vulnerable to a drug like ACT D that triggers a

nucleolar stress response by interfering with ribosome biogenesis through inhibition of RNA polymerase I. In an initial evaluation

conducted by Falini et. al., a single patient was treated for six cycles of five consecutive daily intravenous doses of 12.5 µg/kg

at intervals of 3 to 4 weeks. Morphologic and immunohistochemical CR was evident after the fourth cycle, and an assay for

mutant copies of NPM1 showed molecular complete remission after the fourth cycle. In a subsequent Phase 2 clinical trial conducted

by Dr. Falini and Dr. Martelli, in refractory/relapse (R/R) AML patients carrying NPM1 gene mutation, treatment with ACT D at

15 µg/kg/day for 5 days every 28 days induced CR in 4 out of the 9 evaluable patients (44.4%) with only 1 or 2 cycles of

therapy. One patient underwent haploidentical allogeneic peripheral blood stem cell, or PBSC, transplantation at 3 months after

CR achievement and is alive in molecular CR [minimal residual disease (MRD)-negative] after 24 months.

Figure 1: Quantitative reverse-transcriptase–polymerase-chain-reaction

(RT-PCR) assay for mutant copies of NPM1 in bone marrow samples shows a progressive reduction in copies during dactinomycin treatment.

Negativity for minimal residual disease was achieved after the fourth cycle. Red arrows indicate when dactinomycin cycles were

administered. Complete remission (CR) indicates the time when hematologic response was achieved (after two cycles of dactinomycin).

Source:

Falini B, Brunetti L and Martelli MP. N Engl. J Med. (2015);373:1180-1182

Patients in the subsequent Phase 2 trial

who did not respond to treatment with ACT D did not have the NPM1 mutation which accounts for 25%-35% of all gene mutations leading

to development of AML Other mutations can give rise to AML, albeit at a lower incidence rate. Internal tandem duplications of the

FMS-like tyrosine kinase 3 (FLT3) gene are another one of the most frequent gene mutations in AML (~20%) and are associated with

poor clinical outcome. Combination of a FLT-3 inhibitor (midostaurin, lestaurtinib, tandutinib, sunitinib, sorafenib, quizartinib)

with ACT D treatment would likely improve therapeutic effect.

We have developed four, controlled-release,

intravenous, prototype formulations of ACT D using encapsulated polymeric nanoparticles and conducted preclinical animal studies

to evaluate drug release profile and tolerability, side-by-side with unformulated ACT D. The rationale for developing RASP-101

is to permit weekly or biweekly dosing to limit drug toxicity associated with daily dosing in human subjects. Animal studies performed

to date have shown that at the dose at which 80% of rats die within 13 days of administering ACT D, no mortality was observed in

groups of animals administered the same dose of RASP-101 candidate formulations. Therapeutic utility in animal disease models and

toxicology studies are being planned to enable selection of a lead formulation for scale-up and cGMP manufacturing of clinical

trial material. We intend to approach regulatory authorities in the US and European Union, or EU, before the Phase 3 trial begins

to determine suitability of the product for Orphan Drug status based on the low incidence of the disease indication (American Cancer

Society expects about 21,380 new cases of AML in 2017 accounting for approximately 1.3% of all cancer deaths in the U.S.) and potential

suitability for Fast-Track status.

Lysine Specific Demethylase -1 (reversible

inhibitor of

lysine specific demethylase-1 (

LSD1))

LSD1 facilitates epigenetic (changes that

does not involve modification of DNA sequence) regulation of gene expression by removing methyl groups from methylated lysine side

chain of nuclear proteins, including histone H3. LSD1 has been reported to be overexpressed in several human cancers that includes

AML and loss of expression of this enzyme inhibits growth of cancer cells. In 2012, a paper published in Nature Medicine established

that LSD1 inhibitors can make drug-insensitive forms of AML responsive to treatment with all-trans-retinoic acid, or ATRA. ATRA

is used to treat a subtype of AML called acute promyelocytic leukemia, or APL, but it is normally not effective in non-APL AML

because the drug does not cause proper transcriptional activation of retinoic acid receptor target genes. This is a result

of reduced methylation (specifically histone 3lysine 4 (H3K4) demethylation) on the promoter regions of these target genes.

Therefore, the authors of the article hypothesized that inhibiting LSD1 might facilitate ATRA-induced differentiation of AML cells,

which is known to halt the division of these cells. The research highlights a crosstalk between the ATRA-induced myeloid

differentiation pathway and H3K4 methylation and suggests that ATRA combined with LSD1 inhibitors might be therapeutically beneficial

in AML.

Small molecule irreversible inhibitors

of LSD1 such as GSK2879552 (GlaxoSmithKline) and ORY-1001 (Oryzon) are in clinical development. Reversible LSD1 inhibitors are

expected to display a safer metabolic profile than irreversible inhibitors. Pursuant to a research agreement with us, one of our

collaborators and a principal stockholder, TES Pharma, has developed several classes of LSD1 inhibitors. The current lead compound

DDP_43242 is a highly selective reversible inhibitor of LSD1. Results from preclinical studies conducted in AML animal models

suggest that DDP_43242 is safe and induces dose-dependent increase in survival of animals.

In vitro

and

in vivo

studies are underway to further characterize the current lead to facilitate selection of drug candidate for clinical trials. We

anticipate submitting an IND in 2019. We believe that this breakthrough program may have significant benefits across all forms

of leukemia.

Nucleophosmin 1 (antagonist to nucleophosmin

1(NPM1) gene)

The NPM1 gene is up-regulated, mutated

and chromosomally translocated in many tumor types. NPM1 is transferred from nucleolus to nucleoplasm and cytoplasm by anticancer

drugs. When expressed at elevated levels, NPM1 could promote tumor growth by inactivation of tumor suppressor p53/ARF pathway;

when expressed at low level, NPM1 could suppress tumor growth by inhibition of centrosome duplication. NPM1 is haplo insufficient

in hemizygous mice that are vulnerable to tumor development. NPM1c+ (cytoplasm form) translocation into cytoplasm could serve as

an AML remission signal. NPM1 forms a pentamer that could serve as a potential anticancer target.

Our

approach is to identify small molecule drugs that physically interfere with the aggregation of NPM1 which is important for normal

function.

RASP-301 is our first-in-class, oral, small molecule, potent inhibitor that disrupts NPM1 oligomerization (aggregation

of individual subunits) and has the potential to treat refractory (resistant to treatment) AML with reduced toxicity at low dose

levels. One of our candidates, TES 2169, exhibits cytotoxic (toxic to cancer cells) effects at nanomolar concentrations against

AML cells in culture and was not cytotoxic to normal cells at the same concentrations. In vivo usefulness of these compounds in

AML murine (mouse) models has been evaluated confirming the druggability of the target and its potential to treat refractory AML.

This program is in preclinical development with lead candidate selection anticipated by the first quarter of 2019.

Strategy

Our strategy is to target master regulators

of cancer through deep knowledge of highly conserved pathways that are common to leukemia sub-types. Employing a multi-pronged

approach, our programs are focused on three druggable intervention points with a potential to improve safety and efficacy of current

AML mono and/or combination therapies. Our near-term strategy includes:

|

|

·

|

Rapidly develop and seek approval for our lead drug candidate, RASP-101 taking advantage of shortened

timelines associated with the 505(b)(2) regulatory pathway, if approved by the FDA

|

|

|

·

|

Determine feasibility of Orphan Drug Designation for RASP-101 and other pipeline products used

for treating AML

|

|

|

·

|

Determine feasibility of Breakthrough Therapy and Accelerated Approval for RASP-101 and other pipeline

products

|

|

|

·

|

Complete development of orally-available, small molecule, highly-selective, reversible inhibitor

of LSD1 (RASP-201) and file IND by 2019

|

|

|

·

|

Selection of a lead candidate for first in class NPM1 inhibitor (RASP-301) by the first quarter

of 2019

|

|

|

·

|

Evaluate strategic opportunities to accelerate development timelines and maximize the commercial

potential of the drug candidates

|

Our Team

We have assembled a management

team with extensive experience in the discovery, development and bench-to-market processes. Dr. Kunwar Shailubhai, our Chief Executive

Officer and Chief Scientific Officer, has more than 20 years of experience translating technologies from bench-to-market. Dr. Shailubhai

is a co-founder and former chief scientific officer of Synergy Pharmaceuticals Inc., which developed and commercialized plecanatide

(Trulance®), an FDA approved drug for constipation-predominant Irritable Bowel Syndrome and chronic idiopathic constipation.

Dr. Shailubhai is a co-inventor of plecanatide. Our scientific advisors include: Dr. Napoleone Ferrara who is the discoverer of

Avastin® (bevacizumab), Dr. Roberto Pelliciari who is the inventor of Ocalavia®, a drug marketed by Intercept Pharmaceuticals,

Inc. and Dr. Brunangelo Falini, the discoverer of the gene NPM1 and its pathophysiological role in the etiology of AML. We employ

a lean and virtual R&D model using highly experienced teams of experts for each business function to maximize value accretion

and focus capital on the drug development and discovery processes. A network of contract research organizations, or CROs, commercial

manufacturing organization, or CMOs, and collaborators are engaged for development of our compounds.

Risks Relating to Our Business

We are a leukemia-focused biotechnology company, and our business

and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to

buy our common stock. In particular, you should consider the following risks, which are discussed more fully in the section entitled

“Risk Factors”:

|

|

·

|

We are a leukemia-focused biotechnology company with limited operations to date.

|

|

|

·

|

We expect to continue to incur increasing net losses for the foreseeable future, and we may

never achieve or maintain profitability.

|

|

|

·

|

We will require substantial additional funding which may not be available to us on acceptable terms,

or at all. If we fail to raise the necessary additional capital, we may be unable to complete the development and commercialization

of our product candidates, or continue our development programs.

|

|

|

·

|

Our independent registered public accounting firm has expressed substantial doubt about our ability

to continue as a going concern, which may hinder our ability to obtain future financing.

|

|

|

·

|

If we fail to select product candidates, fail to successfully complete clinical trials and commercialize product candidates

or fail to obtain regulatory approval, our business would be harmed and the value of our securities would decline.

|

|

|

·

|

While ACT D is used to treat multiple cancers, the formulation of ACT D that we

intend

to use has not been proven to be safe or efficacious.

|

|

|

·

|

All of our current data for our lead product candidate are the result of Phase 2 clinical trials conducted by third parties

and do not necessarily provide sufficient evidence that our product candidates will be viable as potential pharmaceutical products.

|

|

|

·

|

If we cannot demonstrate an acceptable toxicity profile for our product candidates, if any, in non-clinical studies, we will

not be able to initiate or continue clinical trials or obtain approval for our product candidates.

|

|

|

·

|

We, or our collaborators, may face delays in completing our preclinical or clinical trials, and

may not be able to complete them at all.

|

|

|

·

|

If we encounter difficulties enrolling patients in our clinical trials, our clinical trials could

be delayed or otherwise adversely affected.

|

|

|

·

|

Results of earlier studies and clinical trials may not be predictive of future trial results.

|

|

|

·

|

Regulatory authorities may not approve our product candidates, if any, even if they meet safety

and efficacy endpoints in clinical trials.

|

|

|

·

|

If we, or our collaborators, are unable to comply with foreign regulatory requirements or obtain

foreign regulatory approvals, our ability to develop foreign markets for our products could be impaired.

|

|

|

·

|

Competitive products for treatment of AML may reduce or eliminate the commercial opportunity for

our product candidates, if any.

|

|

|

·

|

Our product candidates may not be accepted in the marketplace; therefore, we may not be able

to generate significant revenue, if any.

|

|

|

·

|

We will need to develop or acquire additional manufacturing and distribution capabilities in order

to commercialize our product candidates, if any, that obtain marketing approval, and we may encounter unexpected costs or difficulties

in doing so.

|

|

|

·

|

We expect to rely heavily on orphan drug status to commercialize some of our product candidates,

if approved, but we might not receive such designation and any orphan drug designations we receive may not confer marketing exclusivity

or other expected commercial benefits.

|

|

|

·

|

We may seek a breakthrough therapy designation for RASP-101 or one or more of our other product

candidates, we might not receive such designation, and even if we do, such designation may not lead to a faster development or

regulatory review or approval process.

|

|

|

·

|

We may see priority review designation for RASP-101 or one or more of our other product candidates,

but we might not receive such designation, and even if we do, such designation may not lead to a faster development or regulatory

review or approval process.

|

|

|

·

|

Our product candidates may cause undesirable side effects or have other properties that could delay

or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences

following marketing approval, if any.

|

|

|

·

|

If we cannot demonstrate an acceptable toxicity profile for our product candidates, if any, in

non-clinical studies, we will not be able to initiate or continue clinical trials or obtain approval for our product candidates.

|

The Securities We May Offer

We may offer shares

of our common stock and preferred stock, various series of debt securities and warrants to purchase any of such securities, either

individually or in units, with a total value of up to $75,000,000 from time to time under this prospectus, together with any applicable

prospectus supplement and related free writing prospectus, at prices and on terms to be determined by market conditions at the

time of offering. If we issue any debt securities at a discount from their original stated principal amount, then, for purposes

of calculating the total dollar amount of all securities issued under this prospectus, we will treat the initial offering price

of the debt securities as the total original principal amount of the debt securities. Each time we offer securities under this

prospectus, we will provide offerees with a prospectus supplement that will describe the specific amounts, prices and other important

terms of the securities being offered, including, to the extent applicable:

|

|

•

|

designation or classification;

|

|

|

•

|

aggregate principal amount or aggregate offering price;

|

|

|

•

|

maturity, if applicable;

|

|

|

•

|

original issue discount, if any;

|

|

|

•

|

rates and times of payment of interest or dividends, if

any;

|

|

|

•

|

redemption, conversion, exchange or sinking fund terms,

if any;

|

|

|

•

|

conversion or exchange prices or rates, if any, and, if

applicable, any provisions for changes to or adjustments in the conversion or exchange prices or rates and in the securities or

other property receivable upon conversion or exchange;

|

|

|

•

|

restrictive covenants, if any;

|

|

|

•

|

voting or other rights, if any; and

|

|

|

•

|

important United States federal income tax considerations.

|

A prospectus supplement

and any related free writing prospectus that we may authorize to be provided to you may also add, update or change information

contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement or free writing

prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the

registration statement of which this prospectus is a part.

We may sell the

securities to or through underwriters, dealers or agents or directly to purchasers. We, as well as any agents acting on our behalf,

reserve the sole right to accept and to reject in whole or in part any proposed purchase of securities. Each prospectus supplement

will set forth the names of any underwriters, dealers or agents involved in the sale of securities described in that prospectus

supplement and any applicable fee, commission or discount arrangements with them, details regarding any over-allotment option granted

to them, and net proceeds to us. The following is a summary of the securities we may offer with this prospectus.

Common Stock

We currently have

authorized 200,000,000 shares of common stock, par value $0.001 per share. We may offer shares of our common stock either alone

or underlying other registered securities convertible into or exercisable for our common stock. Holders of our common stock are

entitled to such dividends as our Board of Directors may declare from time to time out of legally available funds, subject to the

preferential rights of the holders of any shares of our preferred stock that are outstanding or that we may issue in the future.

Currently, we do not pay any dividends on our common stock. Each holder of our common stock is entitled to one vote per share.

In this prospectus, we provide a general description of, among other things, the rights and restrictions that apply to holders

of our common stock.

Preferred Stock

We currently have

authorized 20,000,000 shares of preferred stock, none of which are outstanding. Any authorized and undesignated shares of preferred

stock may be issued from time to time in one or more series pursuant to a resolution or resolutions providing for such issue duly

adopted by our Board of Directors (authority to do so being hereby expressly vested in the Board of Directors). The Board of Directors

is further authorized, subject to limitations prescribed by law, to fix by resolution or resolutions the designations, powers,

preferences and rights, and the qualifications, limitations or restrictions thereof, of any wholly unissued series of preferred

stock, including without limitation authority to fix by resolution or resolutions the dividend rights, dividend rate, conversion

rights, voting rights, rights and terms of redemption (including sinking fund provisions), redemption price or prices, and liquidation

preferences of any such series, and the number of shares constituting any such series and the designation thereof, or any of the

foregoing.

The rights, preferences,

privileges and restrictions granted to or imposed upon any series of preferred stock that we offer and sell under this prospectus

and applicable prospectus supplements will be set forth in a certificate of designation relating to the series. We will incorporate

by reference into the registration statement of which this prospectus is a part the form of any certificate of designation that

describes the terms of the series of preferred stock we are offering before the issuance of shares of that series of preferred

stock. You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related

to the series of preferred stock being offered, as well as the complete certificate of designation that contains the terms of the

applicable series of preferred stock.

Debt Securities

We may offer general

debt obligations, which may be secured or unsecured, senior or subordinated and convertible into shares of our common stock. In

this prospectus, we refer to the senior debt securities and the subordinated debt securities together as the “debt securities.”

We may issue debt securities under a note purchase agreement or under an indenture to be entered between us and a trustee; forms

of the senior and subordinated indentures are included as an exhibit to the registration statement of which this prospectus is

a part. The indentures do not limit the amount of securities that may be issued under it and provides that debt securities may

be issued in one or more series. The senior debt securities will have the same rank as all of our other indebtedness that is not

subordinated. The subordinated debt securities will be subordinated to our senior debt on terms set forth in the applicable prospectus

supplement. In addition, the subordinated debt securities will be effectively subordinated to creditors and preferred stockholders

of our subsidiaries. Our Board of Directors will determine the terms of each series of debt securities being offered. This prospectus

contains only general terms and provisions of the debt securities. The applicable prospectus supplement will describe the particular

terms of the debt securities offered thereby. You should read any prospectus supplement and any free writing prospectus that we

may authorize to be provided to you related to the series of debt securities being offered, as well as the complete note agreements

and/or indentures that contain the terms of the debt securities. Forms of indentures have been filed as exhibits to the registration

statement of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of

debt securities being offered will be incorporated by reference into the registration statement of which this prospectus is a part

from reports we file with the SEC.

Warrants

We may offer warrants

for the purchase of shares of our common stock or preferred stock or of debt securities. We may issue the warrants by themselves

or together with common stock, preferred stock or debt securities, and the warrants may be attached to or separate from any offered

securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and the investors

or a warrant agent. Our Board of Directors will determine the terms of the warrants. This prospectus contains only general terms

and provisions of the warrants. The applicable prospectus supplement will describe the particular terms of the warrants being offered

thereby. You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you

related to the series of warrants being offered, as well as the complete warrant agreements that contain the terms of the warrants.

Specific warrant agreements will contain additional important terms and provisions and will be incorporated by reference into the

registration statement of which this prospectus is a part from reports we file with the SEC.

Units

We may offer units

consisting of our common stock or preferred stock, debt securities and/or warrants to purchase any of these securities in one or

more series. We may evidence each series of units by unit certificates that we will issue under a separate agreement. We may enter

into unit agreements with a unit agent. Each unit agent will be a bank or trust company that we select. We will indicate the name

and address of the unit agent in the applicable prospectus supplement relating to a particular series of units. This prospectus

contains only a summary of certain general features of the units. The applicable prospectus supplement will describe the particular

features of the units being offered thereby. You should read any prospectus supplement and any free writing prospectus that we

may authorize to be provided to you related to the series of units being offered, as well as the complete unit agreements that

contain the terms of the units. Specific unit agreements will contain additional important terms and provisions and will be incorporated

by reference into the registration statement of which this prospectus is a part from reports we file with the SEC.

Implications

of Being an Emerging Growth Company

As a company with less than $1.07 billion

in revenues during our last fiscal year, we qualify as an emerging growth company as defined in the Jumpstart Our Business Startups

Act, or the JOBS Act, enacted in 2012. As an emerging growth company, we expect to take advantage of reduced reporting requirements

that are otherwise applicable to public companies. These provisions include, but are not limited to:

|

|

·

|

not being required to comply with the auditor attestation requirements of Section 404 of the

Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act;

|

|

|

·

|

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy

statements and registration statements;

|

|

|

·

|

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation

and shareholder approval of any golden parachute payments not previously approved; and

|

|

|

·

|

the ability to adopt new accounting standards based on private company deadlines.

|

We may use these provisions until the last

day of our fiscal year following the fifth anniversary of the sale of common equity pursuant to an effective registration statement

under the 1933 Act. However, if certain events occur prior to the end of such five-year period, including if we become a "large

accelerated filer," our annual gross revenues exceed $1.07 billion or we issue more than $1.0 billion of non-convertible

debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

The JOBS Act provides that an emerging

growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have

irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting

standards as other public companies that are not emerging growth companies.

Corporate Information

We were incorporated in the State of Nevada on December 6, 2012

as Active With Me, Inc. On August 15, 2016, we entered into an Agreement of Merger and Plan of Reorganization with Rasna Therapeutics,

Inc., a Delaware corporation (“Rasna DE”), and Rasna Acquisition Corp., our wholly-owned subsidiary (“Rasna Acquisition”),

pursuant to which Rasna Acquisition merged into Rasna DE and Rasna DE became our wholly-owned subsidiary. Subsequently, we changed

our name to Rasna Therapeutics, Inc. and Rasna DE changed its name to Rasna Research, Inc. Our principal executive offices are

located at 420 Lexington Avenue, Suite 2525, New York, New York, 10170. Our telephone number is (646) 396-4087. Our website address

is

www.rasna.com

. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

We have included our website address in this prospectus solely as an inactive textual reference. On October 11, 2017, we changed

our fiscal year end from March 31 to September 30.

RISK FACTORS

An

investment in our securities involves a high degree of risk. This prospectus contains, and the prospectus supplement applicable

to each offering of our securities, will contain a discussion of the risks applicable to an investment in our securities. Prior

to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the

heading “Risk Factors” in this prospectus and the applicable prospectus supplement, together with all of the other

information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this

prospectus. You should also consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,”

in our Annual Report on Form 10-KT for the 6 month fiscal year ended September 30, 2017 and any updates described in our Quarterly

Reports on Form 10-Q, all of which are incorporated herein by reference, and may be amended, supplemented or superseded from time

to time by other reports we file with the SEC in the future and any prospectus supplement related to a particular offering. The

risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known

to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these known or unknown risks

might cause you to lose all or part of your investment in the offered securities.

Risks Relating to Our Business

We are a leukemia-focused biotechnology company with limited

operations to date.

We are a leukemia-focused biotechnology

company with limited operations to date and no revenue. We have not yet commenced clinical trials, have no product candidates ready

for commercialization, have not generated any revenue from operations and expect to incur substantial net losses for the foreseeable

future to further develop and commercialize our product candidates. We are unable to predict the extent of these future net losses,

or when we may attain profitability, if at all. We may never be able to generate any revenues or royalties from the sales of our

therapeutics or become profitable even if we do generate revenues or royalties.

We expect to continue to incur increasing net losses

for the foreseeable future, and we may never achieve or maintain profitability.

Investment

in biopharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and

significant risk that any potential product candidate will fail to demonstrate adequate effect or an acceptable safety profile,

gain regulatory approval and become commercially viable. We have no products approved for commercial sale and have not generated

any revenue from product sales to date, and we continue to incur significant research and development and other expenses related

to our ongoing operations. As a result, we are not profitable and have incurred losses in each period since our inception. For

the three months ended December 31, 2017, the six month fiscal year ended September 30, 2017 and the year ended March 31, 2017,

we reported a net loss of approximately $2.0 million, $3.0 million and $4.4 million, respectively. As of December 31, 2017, we

had an accumulated deficit of approximately $14.3 million.

To

become and remain profitable, we or our partners must succeed in developing our product candidates, obtaining regulatory approval

for them, and manufacturing, marketing and selling those products for which we or our partners may obtain regulatory approval.

We or they may not succeed in these activities, and we may never generate revenue from product sales that is significant enough

to achieve profitability.

Because of the numerous risks and uncertainties associated with biopharmaceutical product

development and commercialization, we are unable to accurately predict the timing or amount of future expenses or when, or if,

we will be able to achieve or maintain profitability. Currently, we have no products approved for commercial sale, and to date

we have not generated any product revenue. We have financed our operations primarily through the sale of equity securities. The

size of our future net losses will depend, in part, on the rate of growth or contraction of our expenses and the level and rate

of growth, if any, of our revenues. Our ability to achieve profitability is dependent on our ability, alone or with others, to

complete the development of our products successfully, obtain the required regulatory approvals, manufacture and market our proposed

products successfully or have such products manufactured and marketed by others, and gain market acceptance for such products.

There can be no assurance as to whether or when we will achieve profitability.

We will require substantial additional

funding which may not be available to us on acceptable terms, or at all. If we fail to raise the necessary additional capital,

we may be unable to complete the development and commercialization of our product candidates, or continue our development programs.

We expect to significantly increase our

spending to advance the pre-clinical and clinical development of our product candidates and launch and commercialize any product

candidate for which we receive regulatory approval, including building our own commercial organizations to address certain markets.

We will require additional capital for the further development and commercialization of our product candidates, as well as to fund

our other operating expenses and capital expenditures.

We cannot be certain that additional funding

will be available on acceptable terms, or at all. If we are unable to raise additional capital in sufficient amounts or on terms

acceptable to us we may have to significantly delay, scale back or discontinue the development or commercialization of our product

candidates. We may also seek collaborators for one or more of our current or future product candidates at an earlier stage than

otherwise would be desirable or on terms that are less favorable than might otherwise be available. Any of these events could significantly

harm our business, financial condition and prospects.

Our future capital requirements will depend

on many factors, including:

|

|

•

|

the progress of the development of our product candidates;

|

|

|

•

|

the number of product candidates we pursue;

|

|

|

•

|

the time and costs involved in obtaining regulatory approvals;

|

|

|

•

|

the costs involved in filing and prosecuting patent applications

and enforcing or defending patent claims;

|

|

|

•

|

our plans to establish sales, marketing and/or manufacturing

capabilities;

|

|

|

•

|

the effect of competing technological and market developments;

|

|

|

•

|

the terms and timing of any collaborative, licensing and

other arrangements that we may establish;

|

|

|

•

|

general market conditions for offerings from biopharmaceutical

companies;

|

|

|

•

|

our ability to establish, enforce and maintain selected

strategic alliances and activities required for product commercialization; and

|

|

|

•

|

our revenues, if any, from successful development and commercialization

of our product candidates.

|

In order to carry out our business plan

and implement our strategy, we anticipate that we will need to obtain additional financing from time to time and may choose to

raise additional funds through strategic collaborations, licensing arrangements, public or private equity or debt financing, bank

lines of credit, asset sales, government grants, or other arrangements. We cannot be sure that any additional funding, if needed,

will be available on terms favorable to us or at all. Furthermore, any additional equity or equity-related financing may be dilutive

to our stockholders, and debt or equity financing, if available, may subject us to restrictive covenants and significant interest

costs. If we obtain funding through a strategic collaboration or licensing arrangement, we may be required to relinquish our rights

to certain of our product candidate or marketing territories. Our inability to raise capital when needed would harm our business,

financial condition and results of operations, and could cause our stock price to decline or require that we wind down our operations

altogether.

Our independent registered public accounting firm has

expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our consolidated financial statements as of September 30, 2017

were prepared under the assumption that we will continue as a going concern for the next twelve months. Our independent registered

public accounting firm has issued an audit opinion that included an explanatory paragraph referring to our projected future losses

along with recurring losses from operations and expressing substantial doubt in our ability to continue as a going concern without

additional capital becoming available. Our ability to continue as a going concern is dependent upon our ability to obtain additional

equity or debt financing, attain further operating efficiencies, reduce expenditures, and, ultimately, to generate revenue. The

financial statements do not include any adjustments that might result from the outcome of this uncertainty.

If we fail to select product candidates,

fail to successfully complete clinical trials and commercialize product candidates or fail to obtain regulatory approval, our business

would be harmed, and the value of our securities would decline.

We must be evaluated in light of the uncertainties

and complexities affecting a pre-commercial biopharmaceutical company. We have not yet completed preclinical research, commenced

clinical trials, and have not completed the development of our product candidates. Our failure to develop and commercialize such

product candidates successfully may cause us to cease operations. We are performing preclinical research on NPM1 and LSD1. This

research will require significant additional development efforts by us and significant additional development efforts by us and

regulatory approvals prior to commercialization. We cannot be certain that our efforts in this regard will lead to commercially

viable therapeutics. We do not know what the final cost to select and commercialize product candidates will be.

We do not know whether any of our molecular

targets under development ultimately will be selected as product candidates or whether our product candidates will be shown to

be effective. Moreover, governmental authorities may enact new legislation or regulations that could limit or restrict our development

efforts. We may receive unfavorable results from pre-clinical studies or clinical studies on the molecular targets, which may cause

us to abandon the product selection process and further development efforts.

Regulatory agencies must approve our product

candidates, if any, before they can be marketed or sold. The approval process is lengthy, requires significant capital expenditures,

and uncertain as to outcome. Our ability to obtain regulatory approval of any product candidate depends on, among other things,

completion of additional clinical trials, whether our clinical trials demonstrate statistically significant efficacy with safety

issues that do not potentially outweigh the therapeutic benefit of the product candidates, and whether the regulatory agencies

agree that the data from our future clinical trials are sufficient to support approval for any of our product candidates. The results

of our current and future preclinical or clinical trials may not meet FDA or other regulatory agencies’ requirements to approve

a product candidate for marketing, and the regulatory agencies may otherwise determine that our manufacturing processes or facilities

are insufficient to support approval. We or our collaborators may need to conduct more preclinical or clinical trials than we currently

anticipate. Even if we do receive FDA or other regulatory agency approval, we or our collaborators may not be successful in commercializing

approved product candidates. If any of these events occur, our business could be materially harmed, and the value of our securities

would decline.

While ACT D is used to treat multiple

cancers, the formulation of ACT D that we intend to use has not been proven to be safe or efficacious.

ACT

D is

an established anticancer therapeutic

that has been used to

treat a number of types of cancer. However, the formulation

of ACT D that we intend to use for

the treatment of AML in our lead compound, RASP-101, has not yet to tested in clinical trials and has not been proven to be safe

or efficacious. Our consultants have only tested ACT D in clinical trials and we intend to use a nanoparticle controlled release

formulation of ACT D in our clinical trials.

All of our current data for our lead

product candidate are the result of Phase 2 clinical trials conducted by third parties and do not necessarily provide sufficient

evidence that our product candidates will be viable as potential pharmaceutical products.

Through our proprietary

access to relevant laboratory and clinical trial results of Phase 2 trials conducted by Professors Falini and Martelli, we possess

toxicology, pharmacokinetic, and other preclinical data and clinical data on ACT D. Previous clinical trials using

ACT

D

have had different trial designs, doses, parameters and endpoints than our planned clinical trial. There is no guarantee

that Phase 2 results can or will be replicated by us with use of our formulation of RASP-101.

To date, long-term safety

and efficacy have not yet been demonstrated in clinical trials for our product candidates. Favorable results in early studies or

trials may not be repeated in later studies or trials. Even if our clinical trials are initiated and completed as planned, we cannot

be certain that the results will support our product candidate claims. Success in preclinical testing and early clinical trials

does not ensure that later clinical trials will be successful. We cannot be sure that the results of later clinical trials would

replicate the results of prior clinical trials and preclinical testing, nor that they would satisfy the requirements of the FDA

or other regulatory agencies. Clinical trials may fail to demonstrate that our product candidate is safe for humans and effective

for indicated uses. Preclinical and clinical results are frequently susceptible to varying interpretations that may delay, limit

or prevent regulatory approvals or commercialization. Any delay in, or termination of, our clinical trials would delay our obtaining

FDA or EMA approval for the affected product candidate and, ultimately, our ability to commercialize that product candidate.

If we cannot demonstrate an acceptable

toxicity profile for our product candidates, if any, in non-clinical studies, we will not be able to initiate or continue clinical

trials or obtain approval for our product candidates.

To move a product candidate into human

clinical trials, we must first demonstrate an acceptable toxicity profile in preclinical testing. Furthermore, to obtain approval,

we must also demonstrate safety in various non-clinical tests. We may not have conducted or may not conduct the types of non-clinical

testing required by regulatory authorities, or future non-clinical tests may indicate that our product candidates are not safe

for use. Preclinical and non-clinical testing is expensive, time-consuming and has an uncertain outcome. In addition, success in

initial non-clinical testing does not ensure that later non-clinical testing will be successful. We may experience numerous unforeseen

events during the non-clinical testing process, which could delay or prevent our ability to develop or commercialize our product

candidates, including:

|

|

•

|

our preclinical and non-clinical testing may produce inconclusive

or negative safety results, which may require us to conduct additional non-clinical testing or to abandon product candidates;

|

|

|

•

|

our product candidates may have unfavorable pharmacology

or toxicity characteristics;

|

|

|

•

|

RASP-101 has not been tested in humans;

|

|

|

•

|

our product candidates may cause undesirable side effects

such as negative immune responses that lead to complications;

|

|

|

•

|

our enrolled patients may have allergies that lead to complications

after treatment; and

|

|

|

•

|

the FDA or other regulatory authorities may determine that

additional safety testing is required.

|

Any such events would increase our costs

and could delay or prevent our ability to commercialize our product candidates, which could adversely impact our business, financial

condition and results of operations.

We, or our collaborators, may face

delays in completing our preclinical or clinical trials, and may not be able to complete them at all.

We have not completed the preclinical and

clinical trials necessary to support an application for approval to market of our product candidates, if any. Our or our collaborators’

current and future clinical trials may be delayed, unsuccessful, or terminated because of many factors, including:

|

|

•

|

delays in designing an appropriate clinical trial protocol

and reaching agreement on trial design with investigators and regulatory authorities;

|

|

|

•

|

governmental or regulatory delays, failure to obtain regulatory

approval or changes in regulatory requirements, policy or guidelines;

|

|

|

•

|

adding new clinical trial sites

|

|

|

•

|

reaching agreement on acceptable terms with prospective

contract research organizations, or CROs, and clinical trial sites, the terms of which can be subject to extensive negotiation

and may vary significantly among different CROs and trial sites;

|

|

|

•

|

the actual performance of CROs and clinical trial sites

in ensuring the proper and timely conduct of our clinical trials;

|

|

|

•

|

adverse effects experienced by subjects in clinical trials;

|

|

|

•

|

manufacturing sufficient quantities of product candidates

for use in clinical trials; and

|

|

|

•

|

delays in achieving study endpoints and completing data

analysis for a trial.

|

In addition to these factors, our trials

may be delayed, unsuccessful or terminated because:

|

|

•

|

regulators or institutional review boards, or IRBs, may

not authorize us to commence a clinical trial;

|

|

|

•

|

regulators or IRBs may suspend or terminate clinical research

for various reasons, including noncompliance with regulatory requirements or concerns about patient safety;

|

|

|

•

|

we may suspend or terminate our clinical trials if we believe

that they expose the participating patients to unacceptable health risks;

|

|

|

•

|

patients may not complete clinical trials due to safety

issues, side effects, such as injection site discomfort, a belief that they are receiving placebo instead of our product candidates,

or other reasons;

|

|

|

•

|

patients with serious diseases included in our clinical

trials may die or suffer other adverse medical events for reasons that may not be related to our product candidates;

|

|

|

•

|

in those trials where our product candidate is being tested

in combination with one or more other therapies, deaths may occur that may be attributable to the other therapies;

|

|

|

•

|

we may have difficulty in maintaining contact with patients

after treatment, preventing us from collecting the data required by our study protocol;

|

|

|

•

|

product candidates may demonstrate a lack of efficacy during

clinical trials;

|

|

|

•

|

personnel conducting clinical trials may fail to properly

administer our product candidates; and

|

|

|

•

|

our collaborators may decide not to pursue further clinical

trials.

|

We could encounter delays if our clinical

trials are suspended or terminated by us, by IRBs of the institutions in which such trials are being conducted, by the Data Safety

Monitoring Boards for such trials or by the FDA or other regulatory authorities. Such authorities may impose such a suspension

or termination due to a number of factors, including potential for unacceptable safety risks to patients, inspection of the clinical

trial operation or trial site, changes in government regulations or administrative actions.

In addition, we rely on academic institutions,

physician practices and clinical research organizations, or CROs, to conduct, supervise or monitor some or all aspects of clinical

trials involving our product candidates. We have less control over the timing and other aspects of these clinical trials than if

we conducted the monitoring and supervision entirely on our own. Third parties may not perform their responsibilities for our clinical

trials on our anticipated schedule or consistent with a clinical trial protocol or applicable regulations. We also may rely on

CROs to perform our data management and analysis. They may not provide these services as required or in a timely or compliant manner,

and we may be held legally responsible for any or all of their performance failures or inadequacies.

Moreover, our development costs will increase

because we will be required to complete additional or larger clinical trials for our product candidates prior to FDA or other regulatory

approval. If we or our collaborators experience delays in the completion of, or termination of, any clinical trial of our product

candidates, the commercial prospects of our product candidates will be harmed, and our ability to generate product revenues from

any of these product candidates will be delayed or eliminated. In addition, any delays in completing our clinical trials will increase

our costs, slow down our product candidate development and approval process, and jeopardize our ability to commence product sales

and generate revenues. Any of these occurrences may harm our business, financial condition and prospects. In addition, many of

the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also lead to the denial of

regulatory approval of our product candidates.

We have limited experience in the development of therapeutic

product candidates and therefore may encounter difficulties developing our product candidate or managing our operations in the

future.

We have limited experience in the discovery,

development and manufacturing of therapeutic compounds. In order to successfully develop our product candidate, we must continuously

supplement our research, clinical development, regulatory, medicinal chemistry, and manufacturing capabilities through the addition

of key employees, consultants or third-party contractors to provide certain capabilities and skill sets that we do not possess.

Furthermore, we have adopted an operating

model that largely relies on the outsourcing of a number of responsibilities and key activities to third-party consultants, and

contract research and manufacturing organizations in order to advance the development of our product candidates. Therefore, our

success depends in part on our ability to retain highly qualified key management, personnel, and directors to develop, implement

and execute our business strategy, operate the company and oversee the activities of our consultants and contractors, as well as

academic and corporate advisors or consultants to assist us in this regard. We are currently highly dependent upon the efforts

of our management team. In order to develop our product candidates, we need to retain or attract certain personnel, consultants

or advisors with experience in drug development activities that include a number of disciplines, including research and development,

clinical trials, medical matters, government regulation of pharmaceuticals, manufacturing, formulation and chemistry, business

development, accounting, finance, regulatory affairs, human resources and information systems. We are highly dependent upon our