Perfect Match: Golden Dawn Minerals Takes Over Multi-Million

Ounce Gold-Silver-Zinc Project in BC

Full version / The J&L

Deposit is an advanced-stage gold-silver-zinc underground mining

project.

Today, Golden Dawn Minerals Inc. made a game-changing

announcement: The acquisition of

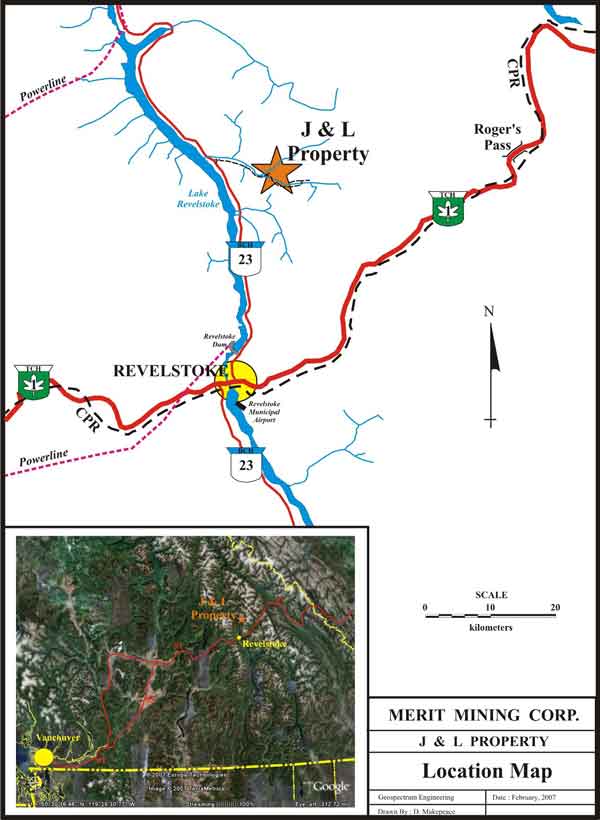

the J&L Property, located in the prolific Revelstoke Mining

Division of southeastern British Columbia, some 600 km east of

Vancouver, Canada.

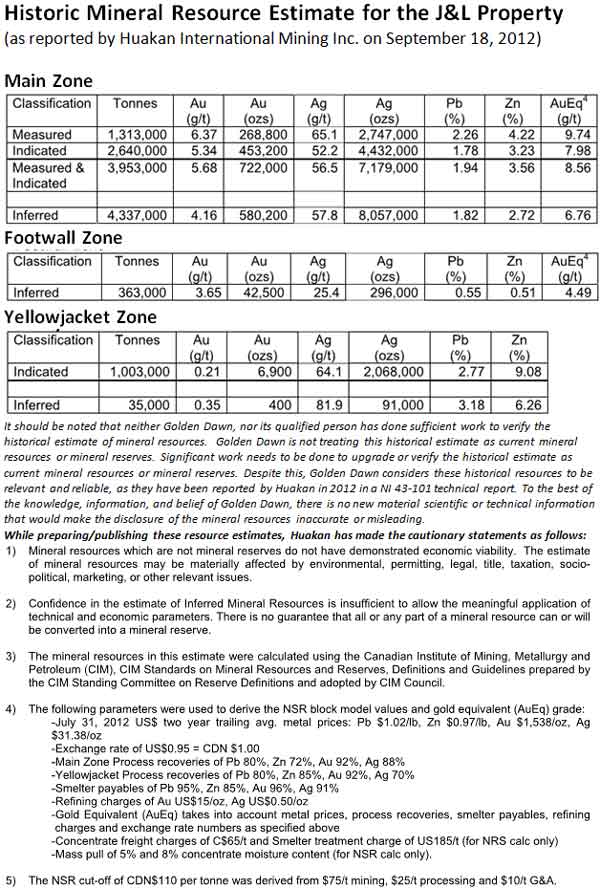

What makes this project so attractive is not only its great

location near existing infrastructure but being an advanced-stage

multi-million ounce project with immense upside potential. With

1.3 million ounces of gold and 15 million

ounces of silver, plus significant zinc and lead

by-product credits, in historic (2012) resources, J&L is a

perfect match for Golden Dawn Minerals.

The seller of this major gold-silver-zinc-lead project is Huakan

International Mining Inc., from which Golden Dawn Minerals also

acquired the Lexington Mine, the Golden Crown Deposit and the

Greenwood Processing Plant in February of 2016.

As the Lexington Underground Mine and the Greenwood Plant are

well on track to re-start gold-copper production in early 2018,

Golden Dawn has shown its ability to execute its plans while

creating shareholder value (share price doubled). So it does not

surprise now that Huakan has full faith in Golden Dawn to bring

into production the J&L Project, and profit once again from a

significantly increased share position in Golden Dawn.

Golden Dawn Minerals' current market valuation of $36

million CAD is based on its exploration and mining projects in the

historic Greenwood Mining District, currently with total resources

of 171,900 ounces of gold equivalents (Lexington: 96,300 oz gold

equivalents; Golden Crown: 75,600 oz gold

equivalents).

Over night, some 1.3 million ounces of gold and 15 million

ounces of silver in historic resources were added. You do the math!

No matter what, J&L is a significant value add for the company

and its shareholders because this new acquisition lifts the company

to a whole different level in the gold mining business. It's

getting serious now, we are talking big numbers from now on.

Golden Dawn emphasized in the press-release that J&L is a

stand-alone project, fully independent from and not interfering

with its Greenwood Projects. It represents a further implementation

of the company's strategy of acquiring significant advanced-stage

to near-production mineral properties with ancillary assets.

Full version

Full version

Full version

And now, Golden Dawn's latest announcement of December 6

appointing 2 world-class mining professionals to its management

team should make even more sense going forward:

Perfect Match: It's All About the

PEOPLE Behind Great Projects

Newly appointed Peter Cooper appears to be the perfect

match for Golden Dawn's Greenwood mining and exploration projects,

while newly added Dr. Serguei Soloviev looks like the perfect

professional to advance the J&L Project into production over

the next years.

Peter Cooper has spent the better part of the

past 20 years working in the Republic Gold District of northeastern

Washington State and southern BC. Since 2007, he was Chief

Geologist and subsequently Manager of Operations Strategy for

Kinross' Kettle River Operations, located 40 km south of Golden

Dawn Minerals' Greenwood Projects. Mr. Cooper has participated in 3

successful new gold mine start-ups, including Kinross' prolific

Buckhorn Mine, located 20 km southwest of Golden Dawn Minerals

Lexington Mine, where he played a significant role in

pre-production exploration and development.

Dr. Serguei Soloviev is a Professional

Geologist with more than 35 years' exploration experience in Canada

and abroad. He was most recently with Rio Tinto Exploration, where

he served as Chief Geologist for Russian operations from 2010-2016.

From 2006-2008, he was involved in the exploration of gold and

copper deposits in British Columbia and Yukon, including Harper

Creek and Skukum Creek. In 2000-2005, he was the Chief Geologist

and a board member for Chapleau Resources Ltd., where he oversaw a

number of exploration projects in British Columbia, Yukon, and

Alaska. Dr. Soloviev has published over 50 technical papers in

leading peer-reviewed journals.

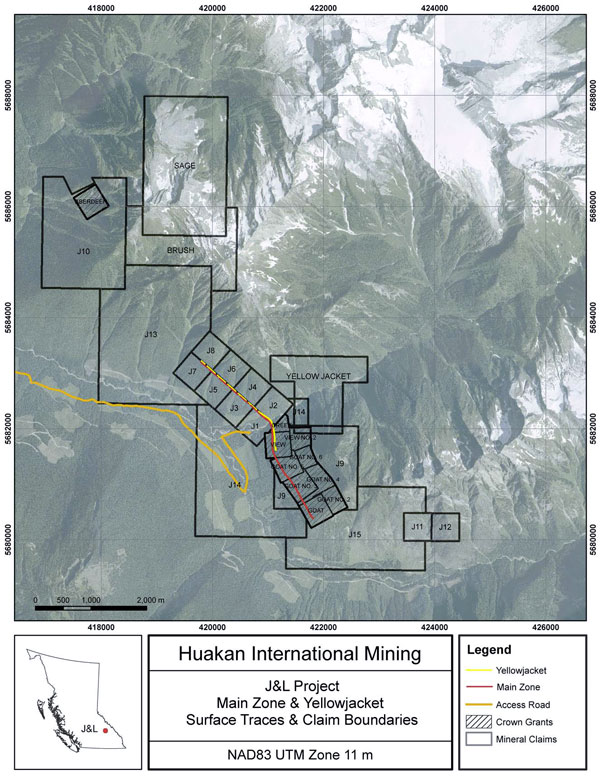

While the Main and Footwall

Zones have already been defined well historically, the

Yellowjacket Zone is a parallel deposit with

immese upside potential, it also hosts very favorable material

for processing, with very high zinc grades.

Golden Dawn's Plans

Following the Option Agreement, as outlined in the

press-release, Golden Dawn plans to initiate and complete an

updated Preliminary Economic Assessment (the "UPEA"), which will be

based on a verified and an updated resource estimate and current

economic parameters. Subject to a positive UPEA and after

permitting, further exploration of the J&L Property will be

undertaken. This will include underground drilling aimed at

upgrading inferred mineral resources to the indicated category

after establishing an access decline and a drift at a deeper level.

Large volume metallurgical testing will also be conducted. All this

will constitute a base for a Pre-Feasibility Study. Additional

exploration drilling aimed at resource expansion will be done along

strike and downdip of the known mineralized zones, as well as in

areas of potential parallel and blind zones.

Full version

Full version

The J&L Property is located 35 km north of Revelstoke in

British Columbia. The property consists of 20 mineral tenure claims

and 10 crown granted claims for a total of 3,052 hectares.

The J&L Property has been explored intermittently during the

20th century by a number of operators. In total, 311 drill holes

(40,886 m) have been completed, together with about 3 km of

underground development.

In 2010, a 100% unencumbered interest in the property was

acquired by Huakan (formerly, Merit Mining Corp.) after making

payments totaling $10.79 million. Huakan completed

extensive drilling and drifting on the property, advancing it to

the point of a Preliminary Economic Assessment ("PEA") in 2012;

further work, however, ceased due to financial constraints in

2014.

Full version

Full version

Full version

The property has a well-established road access via paved

highways and forestry roads; it has an easy access to railroad,

with a 100%-owned rail siding and load-out facility in Revelstoke.

Power source could be provided by transmission from Revelstoke and

Mica Major hydro-generation facilities. The property infrastructure

includes mine buildings (40-person camp, maintenance buildings and

workshops) and an underground mining equipment fleet.

In 2012, before the completion of the Phase 2 exploration

program, a PEA on the J&L Property was completed by Micon; it

was based on a mineral resource estimate published in a Technical

Report dated May 2011. There has not been an updated Technical

Report based on the subsequent year-2012 exploration results and

the new resource estimate. The 2012 PEA by Micon considered the

potential production of gold, silver, lead and zinc from the

J&L Main Zone. That PEA was based on the proposed underground

mining and carbon-in-leach processing at a rate of 1,500 t/d to

produce gold dor and saleable concentrates.

The underground mine plan in the PEA was based on a 1,500 t/d

underground bulk mining operation, using ramp access. The main

mining method considered was mechanized longhole stoping with truck

haulage, and stope backfill using waste rock and process

tailings.

Two process flowsheet options were considered for this PEA and

each includes a heavy mineral separation (HMS) circuit ahead of

milling to remove 40% of the rock by weight, with estimated metal

losses of 2%. The main difference between the two proposed options

is whether a single lead concentrate or two concentrates, lead and

zinc are produced for sale.

The 2012 PEA recommended that the J&L project be advanced to

the pre-feasibility stage, including additional drilling,

metallurgical testing, and engineering design. Part of the

recommended work was completed by Huakan since the PEA was

completed.

The next planned phase of exploration includes: drive Ramp 1

decline approximately 2,180 m; drive five cross cuts totaling 976 m

at elevations ranging from approximately 730 m to 660 m; drill 47

holes totaling 7,800 m.

Technical disclosure in the news release has been approved

by Dr. Serguei Soloviev, P.Geo., a Qualified

Person as defined by NI 43-101, and Chief Geologist for the

J&L Project of Golden Dawn Minerals Inc.

Read the full news release here for further

details.

Technical Perspective

Updated version

Updated version

Updated version

Company Details

Golden Dawn Minerals Inc.

#318 - 1199 West Pender Street

Vancouver, B.C. V6E 2R1 Canada

Phone: +1 604 221 8936

Email: allinfo@goldendawnminerals.com

www.GoldenDawnMinerals.com

www.GoldenDawnMinerals.de

Shares Issued & Outstanding: 127,143,073

Chart

Canadian Symbol (TSX.V): GOM

Current Price: $0.28 CAD (12/18/2017)

Market Capitalization: $36 Million CAD

Chart

USA Symbol (OTC): GDMRF

Current Price: $0.21 USD (12/18/2017)

Market Capitalization: $27 Million USD

Chart

German Symbol / WKN (Frankfurt): 3G8A / A1XBWD

Current Price: €0.177 EUR (12/18/2017)

Market Capitalization: €23 Million EUR

Previous Coverage

Report #21: "Golden Dawn

Minerals Strengthens its Management Team" (December 7, 2017)

Report #19: "New Drill Results

from Golden Crown Show New Potentials" (November 5, 2017)

Report #18: "High-Grade Gold and

Copper Drill Results Near Surface at Golden Crown" (November 1,

2017)

Report #17: "Rapid Progress with

the Reactivation of Mine and Mill" (October 25, 2017)

Report #16: "Dewatering Start!

Gold Production Expected in Novembert" (August 22, 2017)

Report #15: "Golden Dawn

receives Mine and Mill Permits and Rockstone publishes a Site Visit

Report" (June 21, 2017)

Report #14: "Golden Dawn

Minerals getting increasingly attractive with latest acquisition

plans" (June 6, 2017)

Report #13: "Golden Dawn in the

spotlight of the press " (February 9, 2017)

Report #12: "Gold and Gold

Stocks: The Best Hedge Against Trump and Other Uncertainties"

(January 31, 2017)

Report #11: "Golden Dawn

Discovers New Prospect For A Possible World-Class Deposit" (January

26, 2017)

Report #10: "Golden Dawn

discovers 10 g/t gold over 15 m at surface and delivers top results

from the underground"

Report #9: "Golden Dawn passed

environmental and safety inspection, provides progress report on

Greenwood projects"

Report #8: "Coverage on Golden

Dawn"

Report #7: "Golden Dawn

Minerals: B.C.´s next powerhouse gold miner?"

Report #6: "Golden Dawn acquires

several major past producing mines and becomes largest land holder

in the Greenwood District next to Kinross"

Report #5: "Golden Dawn moving

rapidly toward renewed operation"

Report #4: "Starting Shot for

the May Mac Mine"

Report #3: "Ascend from explorer

to producer secured: A Just-in-Time success story par excellence

"

Report #2: "Golden Dawn secures

funding to go into gold production in BC "

Report #1: "Perfect timing to go

into gold production in British Columbia"

Disclaimer: Please read the full disclaimer within the full

research report as a PDF (Cautionary Statement: The

June-2017-PEA is preliminary in nature and it includes Inferred

Mineral Resources that are considered too speculative geologically

to have the economic considerations applied to them that would

enable them to be categorized as Mineral Reserves. Mineral

resources that are not Mineral Reserves do not have demonstrated

economic viability. There is no certainty that the PEA will be

realized. Golden Dawn Minerals Inc. (the "Company") would

like to clarify that its decision to proceed to extract mineralized

material from the Lexington, Golden Crown and May Mac mines for

processing at its facility located at the Greenwood Precious Metals

Project was not based on a Feasibility Study. The Company cautions

that, in such cases, there is increased uncertainty and higher

economic and technical risks of failure. The Company notes that,

since the mining and processing infrastructure is in place, it

intends to proceed to trial mining and processing on the basis of

Mineral Resource Estimates and the Preliminary Economic

Assessment.

CanXGold Mining (CE) (USOTC:GDMRF)

Historical Stock Chart

From Mar 2024 to Apr 2024

CanXGold Mining (CE) (USOTC:GDMRF)

Historical Stock Chart

From Apr 2023 to Apr 2024