Current Report Filing (8-k)

November 17 2017 - 6:04AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 8, 2017

GLOBAL

HEALTHCARE REIT, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Utah

|

|

0-15415

|

|

87-0340206

|

|

(State

or other jurisdiction

|

|

Commission

|

|

(I.R.S.

Employer

|

|

of

incorporation)

|

|

File

Number

|

|

Identification

number)

|

8480

E. Orchard Road, Suite 4900, Greenwood Village, CO 80111

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code:

(303) 449-2100

(Former

name or former address, if changed since last report)

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

[X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

ITEM

2.03

CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBGLIATION UNDER

AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

On

November 8, 2017, the Company completed the sale of an aggregate of $300,000 of its 10% Senior Promissory Notes (“Notes”)

for a purchase price equal to the principal amount of the Notes. For every $1.00 in principal amount of Note, each investor will

receive one warrant (“Warrant”) exercisable for 12 months to purchase one share of common stock at an exercise price

of $0.75 per share. The Notes are due and payable on October 31, 2020, (the “Maturity Date”). Each investor will be

required to be bound by an Agreement Among Lenders pursuant to which the rights of investors under the Notes a will be governed

by investors holding a Majority in Interest in the Notes. The form of Agreement Among Lenders is filed herewith as Exhibit 10.1

and the form of Note is filed herewith as Exhibit 99.1.

ITEM

3.02

UNREGISTERED SALE OF EQUITY SECURITIES

ITEM

7.01

REGULATION FD DISCLOSURE

The

following sets forth the information required by Item 701 of Regulation S-K with respect to the unregistered sales of equity securities

by Global Healthcare REIT, Inc., a Utah corporation (the “Company”), effective November 8, 2017:

|

|

a.

|

On

November 8, 2017, Global Healthcare REIT, Inc. (the “Company”), completed the sale of an aggregate of $300,000

of its Units, each Unit consisting of a 10% Senior Promissory Note (“Note”) and one Warrant for every $1.00 in

principal amount of Note. The purchase price for the Units is equal to the principal amount of the Notes as reflected in Item

2.03 above. Each Warrant is exercisable for 12 months to purchase a share of common stock at an exercise price of $.75 per

share.

|

|

|

|

|

|

|

b.

|

The

Notes and Warrants were sold to four investors, each of whom qualified as an “accredited investor” within the

meaning of Rule 501(a) of Regulation D under the Securities Act of 1933 as amended (the “Securities Act”).

|

|

|

|

|

|

|

c.

|

The

Company paid no fees or commissions in connection with the issuance of the Units.

|

|

|

|

|

|

|

d.

|

The

issuance of the Securities was undertaken without registration under the Securities Act in reliance upon an exemption from

the registration requirements of the Securities Act set forth in Sections 4(2) thereunder. The investors each qualified as

an “accredited investor” within the meaning of Rule 501(a) of Regulation D. In addition, the Securities, which

were taken for investment purposes and not for resale, were subject to restrictions on transfer. We did not engage in any

public advertising or general solicitation in connection with this transaction, and we provided the investor with disclosure

of all aspects of our business, including providing the investor with our reports filed with the Securities and Exchange Commission

and other financial, business and corporate information. Based on our investigation, we believed that the accredited investors

obtained all information regarding the Company that each requested, received answers to all questions posed and otherwise

understood the risks of accepting our Securities for investment purposes.

|

|

|

|

|

|

|

e.

|

Not

applicable.

|

|

|

|

|

|

|

f.

|

The

proceeds will be used for general working capital.

|

ITEM

9.01:

FINANCIAL STATEMENTS AND EXHIBITS

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

|

|

Global Healthcare REIT, Inc.

(Registrant)

|

|

|

|

|

|

|

Dated:

|

November

16, 2017

|

|

/s/

Zvi Rhine

|

|

|

|

|

Zvi

Rhine, President

|

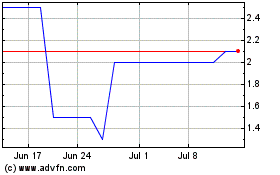

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

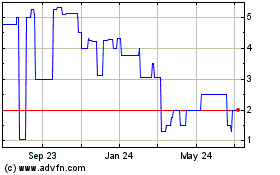

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Apr 2023 to Apr 2024