Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

October 06 2017 - 5:10PM

Edgar (US Regulatory)

PROSPECTUS SUPPLEMENT NO. 2

(To Prospectus dated April 6, 2017)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-216618

1,775,000 Shares of Common Stock

This prospectus supplement supplements the prospectus dated April 6, 2017 (the “Prospectus”) of Q BioMed Inc. (the “Company”, “we”, “us’ and “our”), which is part of a registration statement on Form S-1 (File No. 333-216618) filed with the United States Securities and Exchange Commission relating to the resale of securities by the selling stockholder as described therein, as well as prior supplements to the Prospectus.

This prospectus supplement should be read in conjunction with the Prospectus, as supplemented to date, and this prospectus supplement is qualified by reference to the Prospectus, as supplemented to date, except to the extent that the information provided by this prospectus supplement supersedes the information contained in the Prospectus. This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus with respect to the securities described above, including any amendments or supplements thereto.

You should read this prospectus supplement, the Prospectus, as supplemented to date, and the registration statement of which it forms a part before you invest in any of our securities.

Investing in our securities involves risks. You should review carefully the risks and uncertainties described under the heading “

Risk Factors

” on page 1 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Supplement is being filed for the purpose of updating information provided under the heading “Selling Stockholder” commencing on page 18 of the Prospectus and to disclose that the Maturity (as defined in the Prospectus) of the Convertible Notes (as defined in the Prospectus) has been extended by one year to November 30, 2018.

Subsequent to the filing of the Prospectus, on October 3, 2017, YA II CD, Ltd., identified in the Prospectus as the selling stockholder, transferred all of the outstanding Convertible Notes held by it and all interest thereon to its affiliate YA II PN, Ltd. Accordingly, the selling stockholder table is being updated to remove YA II CD, Ltd., and to substitute YA II PN, Ltd. in its place as a selling stockholder, as presented below.

We have prepared the table below based on (i) 11,496,169 shares outstanding as of October 3, 2017, (ii) 461,203 shares having been sold pursuant to the Prospectus and the related registration statement prior to

October 3, 2017

and (iii) information provided to us by the selling stockholder on or prior to

October 3, 2017

.

Under the terms of the Convertible Notes and the Purchase Agreement, the selling stockholder may not convert the Convertible Notes and we may not exercise the puts under the Purchase Agreement (as defined in the Prospectus) to the extent (but only to the extent) such selling stockholder or any of its affiliates would beneficially own a number of shares of our common stock which would exceed 4.99%. The number of shares in the second column reflects these limitations.

|

Name of Selling Stockholder

|

Number of Shares of Common Stock Owned Prior to Offering(2)

|

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus (3)

|

Number of Shares of Common Stock Owned After Offering (4)

|

Number of Shares of Common Stock

Which May Be Sold in this Offering as A Percentage of Currently Outstanding Shares (5)

|

Percentage of Shares of Common Stock Owned After the Offering (6)

|

|

YA II PN, LTD.(1)

|

594,000

|

1,313,797

|

324,000

|

11.4%

|

2.6%

|

|

(1)

|

YA II PN, Ltd (“YA”) is the investor under the Purchase Agreement. Yorkville Advisors Global, LP ("Yorkville LP") is YA II PN, Ltd.’s. investment manager and Yorkville Advisors Global II, LLC ("Yorkville LLC") is the General Partner of Yorkville LP. All investment decisions for YA II PN, Ltd. are made by Yorkville LLC's President and Managing Member, Mr. Mark Angelo. The address of YA is 1012 Springfield Avenue, Mountainside, NJ 07092, Attention: Mark Angelo, Portfolio Manager.

|

|

(2)

|

Includes 162,000 shares of common stock held by an affiliate under common control, 162,000 shares of common stock underlying warrants and 270,000 shares of common stock underlying the Convertible Notes (which are not exercisable if such conversion would result in beneficial ownership greater than 4.99% of all outstanding shares).

|

|

(3)

|

Includes shares of common stock underlying the Convertible Notes that may held by the selling stockholder that are covered by this prospectus, including any such securities that, due to contractual restrictions, may not be exercisable if such conversion would result in beneficial ownership greater than 4.99%.

|

|

(4)

|

Represents 162,000 shares of common stock held by an affiliate under common control, 162,000 shares of common stock underlying warrants and the difference between the maximum number of shares into which the principal and interest on the Convertible Notes may be converted and the shares being registered under the registration statement of which this prospectus forms a part.

|

|

(5)

|

Assumes that the total number of our issued and outstanding common shares remains unchanged at

11,496,169

prior to the issuance of the common shares underlying the Convertible Notes. If all of the shares are sold pursuant to this offering and the total number of our issued and outstanding common shares otherwise remains unchanged at

11,496,169

, such shares sold in this offering shall equal approximately 10.1% of the then issued outstanding shares of our common stock

|

|

(6)

|

Assumes that the total number of our issued and outstanding common shares remains unchanged at

11,496,169

prior to the issuance of the common shares underlying the Convertible Notes, that the selling stockholder exercises its right to convert all of the principal and interest on the convertible notes at the floor price of $2.00, that it sells all of the shares offered pursuant to this prospectus and that is sells no other shares of common stock beneficially owned by it.

|

The date of this prospectus supplement is October 6, 2017

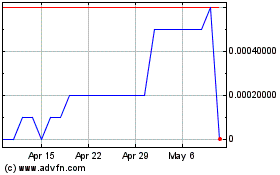

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

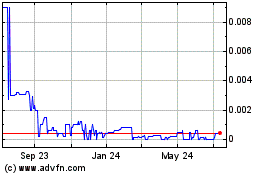

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Apr 2023 to Apr 2024