The New Black Gold

By Jeff Nielson

Stockhouse

Hi-tech and “green” metals and minerals have captured the

interest of many mining investors. Large, new markets are emerging

for several of these commodities. The most-famous of these

green/hi-tech applications is the rapidly emerging market for

lithium-ion batteries. In turn, the most important end use for

lithium-ion batteries is the exploding demand for electric

vehicles.

Yet one of these hi-tech/green tech commodity markets has

largely escaped the radar of mining investors. Which one?

Elon Musk of Tesla Motors provides a large

clue:

“Our cells should be called Nickel-Graphite, because

primarily the cathode is nickel and the anode side is

graphite with silicon oxide… [there’s] a little

bit of lithium in there, but it’s like the salt on the salad,” the

CEO explained.

The nickel market is a large, well-publicized market. But who is

talking about graphite? Perhaps the better question is why aren’t

more mining investors talking about the New Black Gold?

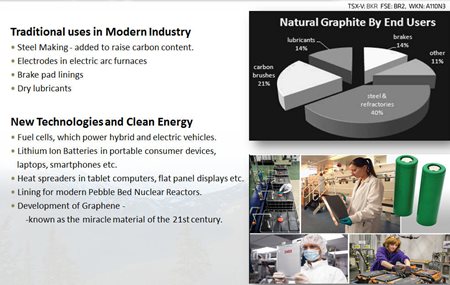

The fundamentals for the graphite market are very compelling.

This is a specialty mineral in that it does not naturally occur in

the same abundance as many of the larger metals and minerals

markets. At the same time, graphite possesses some extraordinary

properties.

Graphite is a carbon-based mineral that is geologically similar

to diamonds. However, graphite offers one very important property

not possessed by the more aesthetically-pleasing form of carbon.

Graphite is highly conductive of electricity. This opens up

numerous energy-based applications for graphite – including

lithium-ion batteries.

As a smaller market, investors seeking to gain exposure to this

vitally important mineral have only a limited number of investment

options. For junior mining investors, one company offers a

compelling investment opportunity: Berkwood Resources Ltd.

(TSXV:

BKR ,

OTC: CZSVF, FSE: A2DNV4 ).

The Company is led by CEO Thomas Yingling. In a conference call

with Stockhouse Editorial, a single point immediately stood out.

Thomas Yingling hates risk. He hates it for his Company. He hates

it for the Company’s shareholders.

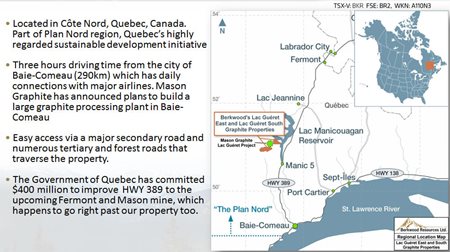

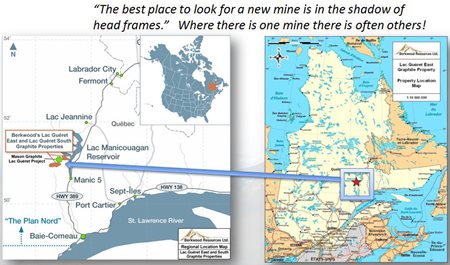

BKR’s flagship property is the Lac Gueret Extensions Project,

located in Quebec, perhaps Canada’s most exploration-friendly

jurisdiction. The Berkwood management team has made it its driving

mission over the past six years to de-risk this project to

the maximum degree possible.

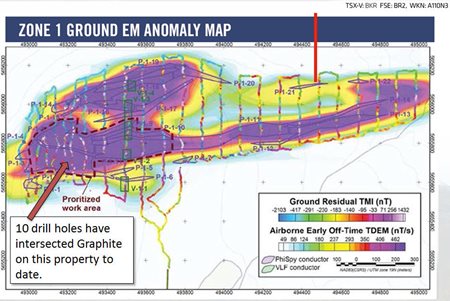

How? It starts with diligently working through all of the

lower-cost forms of exploration work. First Berkwood did an

airborne Mag-EM survey of the prospective zones. Then BKR moved to

ground geophysical targeting, to confirm the large magnetic

anomalies.

After that, BKR advanced to a program of surface sampling, which

yielded surface assays as high as 36.3% carbon

(graphite). It was only after thoroughly engaging in these

preliminaries that the Company was satisfied that it was finally

time to move a drill rig on site.

Thomas Yingling is no neophyte to the mining industry. He has

logged more than 23 years of experience in the industry, including

serving as President and CEO of several other public companies in

the resource space. Along the way, Yingling has gathered an

understanding of how to conduct exploration operations in a manner

that conserves shareholder capital by minimizing the level of

risk.

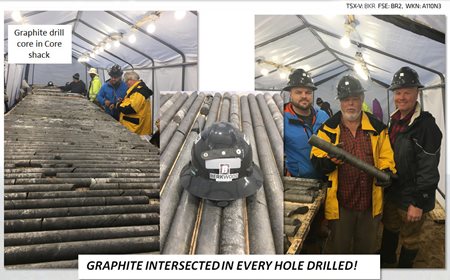

The CEO explains:

There is an old saying in the junior mining industry, “Why

ruin a great project by drilling it?” This is because more often

than not, drill results are poor and it kills the project. Berkwood

has done the opposite. We have intersected graphite in every drill

hole completed to date!”

Through methodically conducting all of this preliminary work,

Berkwood has avoided “ruining” its flagship Project. Now was the

time to sink some drill holes into these highly prospective targets

– and produce the drill results craved by mining investors.

On August 16,

2017; BKR announced the commencement of the first

drilling program at Lac Gueret: up to 18 drill holes in the Zone 1

target area. On August 22,

2017; Berkwood announced it had intersected graphite

mineralization on its first two holes. By September 6th;

the Company was reporting 10-out-of-10 on its

drilling to date – a perfect record. Assays are

pending.

Probably the least-surprised people with respect to these

results are the BKR management team. Their high expectations were

only based in part on their diligent preliminary work. Why is La

Gueret described as an “Extensions Project”? It is because BKR’s

property is on-strike and adjacent to a high grade graphite deposit

being developed by Mason Graphite – Mason’s “Lac Gueret

Deposit”.

A visit to that company’s website is illuminating:

Mason Graphite is a Canadian graphite mining and processing

company focused on the development of the Lac Guéret project

located in northeastern Quebec, where the graphite grade is

believed by management to be among the highest in the

world. [emphasis mine]

Grades “among the highest in the world”: if you’re a junior

mining company focused on graphite, being next-door to this deposit

is a great place to be situated. BKR’s location has also

substantially reduced the risk in this project.

It’s not just the fact that Berkwood’s graphite Project is

adjacent to this high-grade deposit. Mason Graphite is steadily

advancing its own project toward production. To facilitate this

mining project (and others), the provincial government is making a

$400 million infrastructure investment, committed toward

improvements of HWY 389.

HWY 389 passes right past the Berkwood property and these

improvements will significantly improve access to Lac Gueret. This

improved access will reduce exploration and developments costs,

further de-risking BKR’s graphite Project.

Thomas Yingling modestly observes that Berkwood can’t take any

credit for how development of the Mason Graphite project has

reduced the risk for BKR. However, management does earn kudos for

finding and acquiring this ideally situated graphite land

package.

With graphite, grades are only a part of the equation. Like

diamonds, graphite occurs naturally in different qualitative forms.

For industrial purposes, the naturally occurring graphite that is

in greatest demand is the “large flake” form of graphite. The Mason

Graphite deposit (and the Lac Gueret Project) host large-flake

graphite.

Where has the world previously been obtaining most of its

graphite supply? China. In 2016; China

produced 780,000 metric tonnes of graphite, more than four times as

much as the next-leading producer: India. Here is where the

dynamics of the graphic market become especially interesting.

Going back as far as December 2014, Benchmark Mineral

Intelligence was suggesting that China could have reached “peak

graphite” in terms of its production level. That’s the supply side.

On the demand side, in May 2016

Benchmark was projecting that graphite demand from lithium-ion

batteries would triple in just four years.

Flattening production from the world’s leading producer combined

with a tripling of demand for the graphite used in electric

vehicles: where will this extra graphite come from?

Turning back to Tesla, that company has already famously

proclaimed its intent to supply its North American

“gigafactory” with metals and minerals only provided from North

American sources. How much graphite is produced in North America?

Not much.

Mexico and Canada rank #6 and #7 in global production. But (as

of 2016) Mexico produced a mere 22,000 metric tonnes of graphite

and Canada produced 21,000 metric tonnes. Combined, these two

nations produce little more than 5% as much graphite as China. The

United States doesn’t even rank in the top-10.

Where will Tesla get its North American graphite?

Over the medium term, one answer to that question might be Mason

Graphite. Their Feasibility Study boasts a post-tax IRR of over

34%. Cap-ex is a modest $165.9 million and the projected

construction timeline is a mere 13 – 16 months.

This may lead investors to a second question. Given the very

attractive economics of Mason Graphite’s project, why buy into

Berkwood Resources?

Market cap for Mason Graphite: $203

million.

Market cap for Berkwood Resources: $6.6

million.

Two next-door neighbours with virtually identical geology. Mason

Graphite is clearly currently in the lead in terms of the level of

development. However, the two companies may ultimately end up in

the same place. For investors looking further down the road, BKR is

also holding two other green metals exploration properties.

Meanwhile, Berkwood is sitting in the middle of a very promising

drill campaign, with its $6.6 million market cap, and with

(potential) investors already knowing that the Company has hit on

its first 10 drill holes as they await the assay results. Shrewdly,

management recently staked-out additional claims,

quintupling the size of the land package. For

small-cap mining investors, this is a very intriguing scenario – to

say the least.

Investors buying shares today will be buying into more than a

promising project. Including CEO Thomas Yingling’s 23 years of

experience, the BKR management team has collectively amassed a

century of mining experience. Berkwood’s field work has

particularly benefitted from the experience and expertise of Edward

Lyons, PGeo (Project Lead) and Michel Robert (Advisor).

This is a Company focused on structure: geology, management, and

shares.

Berkwood is confident it has acquired the geological structure

necessary for mining success. It has assembled a management

structure capable of executing on this promising geology. And it

has maintained a (tight) share structure that will allow BKR

shareholders to fully participate in the success of the Lac Gueret

Extensions Project – only 18.5 million shares

outstanding.

Connecting the dots, we have a Company with a market cap of only

$6.4 million. It’s holding a highly prospective property in a

rapidly emerging commodity market. It’s already hit on its first 10

drill holes on this property, with assay results imminent.

Going back as far as 2014, industry analysts were already

pointing to graphite as “the new black

gold”. As investors await the results on BKR’s first

drill holes, they may be contemplating some “gold” of their own:

investment profits.

|