Principal Real Estate Income Fund (the “Fund”), which is traded

on the New York Stock Exchange under the symbol “PGZ,” announced

today that its Board of Trustees has approved the adoption of a

managed distribution plan whereby the Fund will, beginning in

October 2017, make monthly distributions to common shareholders set

initially at a fixed monthly rate of $0.11 per common share. This

information updates and supersedes information provided in the

press release dated August 7, 2017, regarding the Fund’s

distribution for October, 2017. The managed distribution plan

represents a reduction from the Fund’s recent distributions of

$0.145 per common share. This reduction is due to proceeds from

maturing bonds being reinvested in a lower yield environment. Based

on the Fund’s current share price of $19.15 as of market close on

September 12, 2017, the distributions represent an approximate

annualized distribution rate of 6.89%.

The following dates apply to the distributions declared:

Ex Date Record Date

Payable Date October 12, 2017 October 13, 2017

October 26, 2017 November 16, 2017

November 17, 2017 November 30,

2017 December 14, 2017 December 15, 2017

December 28, 2017 January 11, 2018

January 12, 2018 January 25,

2018

A call will be held to provide an update on the Fund:

September 26, 20174:15pm ETDial in:

866-395-6628Access code: 86021413

The primary purpose of the managed distribution plan is to

provide shareholders with a constant, but not guaranteed, fixed

distribution and is intended to narrow the discount between the

market price and the NAV of the Fund’s common shares, but there is

no assurance that the plan will be successful in doing so.

Under the managed distribution plan, to the extent that

sufficient investment income is not available on a monthly basis,

the Fund’s distributions may consist of long-term capital gains

and/or return of capital in order to maintain the distribution

rate. Return of capital includes distributions paid by the Fund in

excess of its net investment income and such excess is distributed

from the Fund’s assets. Investors should not make any conclusions

about the Fund’s investment performance from the amount of the

Fund’s distributions or from the terms of the Fund’s managed

distribution plan.

Shareholders will receive a notice in connection with each

distribution that will disclose the amounts and sources of income

for the distribution. Information reported in the notice to

shareholders are only estimates and are not being provided for tax

reporting purposes. Shareholders should refer to Form 1099-DIV for

the character and amount of distributions for income tax reporting

purposes.

The Board may amend the terms of the plan or terminate the plan

at any time without prior notice to the Fund’s shareholders. The

amendment or termination of the managed distribution plan could

have an adverse effect on the market price of the Fund’s common

shares.

RISKS

_____________________

This press release is not for tax reporting purposes but is

being provided to announce the amount of the Fund’s distributions.

In early 2018, after definitive information is available, the Fund

will send shareholders a Form 1099-DIV, if applicable, specifying

how the distributions paid by the Fund during the prior calendar

year should be characterized for purposes of reporting the

distributions on a shareholder’s tax return (e.g., ordinary income,

long-term capital gain or return of capital). An investment in the

Fund is not appropriate for all investors and is not intended to be

a complete investment program. The Fund is designed as a long-term

investment and not as a trading vehicle.

Investing in the Fund involves risks, including the risk that

you may receive little or no return on your investment or that you

may lose part or even all of your investment and exposure to

below-investment grade investments (i.e., “junk bonds”). The Fund’s

net asset value will vary and its distribution rate may vary and

both may be affected by numerous factors, including changes in the

market spread over a specified benchmark, market interest rates and

performance of the broader equity markets. Fluctuations in net

asset value may be magnified as a result of the Fund’s use of

leverage. Therefore, before investing you should carefully consider

the risks that you assume when you invest in the Fund's common

shares.

Securities backed by commercial real estate assets are subject

to market risks similar to those of direct ownership of commercial

real estate assets including, but not limited to, declines in the

value of real estate, declines in rental or occupancy rates and

risks related to general and local economic conditions.

The Fund's investment objectives and policies are not designed

to seek to return the initial investment to investors that purchase

shares.

Sources of distributions to shareholders may include net

investment income, net realized short-term capital gains, net

realized long-term capital gains and return of capital. The actual

amounts and sources of the amounts for tax reporting purposes will

depend upon the Fund’s investment experience during the remainder

of its fiscal year and may be subject to changes based on tax

regulations. If a distribution includes anything other than net

investment income, the fund provides a Section 19(a) notice of the

best estimate of its distribution sources at that time, available

at www.principalcef.com. These estimates may not match the final

tax characterization (for the full year’s distributions) contained

in shareholders’ 1099-DIV forms after the end of the year. The rate

is the monthly distribution per share times 12, divided by the end

of month market price. Past performance is not a guarantee of

future results.

An investor should consider investment objectives, risks,

charges and expenses carefully before investing. To obtain a

prospectus, annual report or semi-annual report which contains this

and other information visit www.principalcef.com or

call 855.838.9485. Please read them carefully before

investing.

Shares of closed-end investment companies frequently trade at a

discount from their net asset value and initial offering

prices.

NOT FDIC INSURED | May Lose Value | No Bank Guarantee

The Fund is a closed-end fund and does not continuously issue

shares for sale as open-end mutual funds do. Since the initial

public offering, the Fund now trades in the secondary market.

Investors wishing to buy or sell shares need to place orders

through an intermediary or broker. The share price of a closed-end

fund is based on the market's value.

ALPS Advisors, Inc. is the investment adviser to the Fund.

Principal Real Estate Investors LLC is the investment

sub-adviser to the Fund. Principal Real Estate Investors LLC is not

affiliated with ALPS Advisors, Inc. or any of its affiliates.

ALPS Portfolio Solutions Distributor, Inc. is the FINRA Member

firm.

About ALPS

ALPS provides customized asset servicing and asset gathering

solutions to the financial services community through an

entrepreneurial culture based on the commitment to “Do Things

Right.” Founded in 1985, ALPS continues to actively promote all of

its various business segments, from asset servicing through ALPS

Fund Services, Inc. to asset gathering through ALPS Distributors,

Inc. and ALPS Advisors, Inc. Headquartered in Denver, with offices

in Boston, New York, Seattle, and Toronto, ALPS, a wholly-owned

subsidiary of DST Systems, Inc., today represents more than 400

employees, over 200 clients, and an executive team that has been in

place for more than 18 years. For more information about ALPS and

its services, visit www.alpsinc.com. Information about ALPS

products is available at www.alpsfunds.com.

About Principal Real Estate Investors

Principal Real Estate Investors manages or sub-advises $71.8

billion in commercial real estate assets, as of December 31, 2016.

The firm’s real estate capabilities include both public and private

equity and debt investment alternatives. Principal Real Estate

Investors is the dedicated real estate group of Principal Global

Investors, a diversified asset management organization and a member

of the Principal Financial Group®.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170913006537/en/

ALPS Advisors, Inc.Patricia Lobato,

720-917-0644www.alpsinc.comorPrincipal Real Estate

InvestorsJaime Naig, 515-247-0798naig.jaime@principal.com

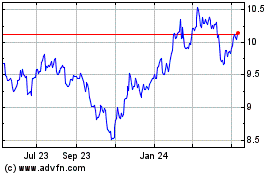

Principal Real Estate In... (NYSE:PGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

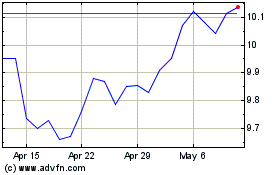

Principal Real Estate In... (NYSE:PGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024