California Business Bank (OTCBB:CABB) (“CBB”) announced today

its fourth quarter 2009 unaudited (“Q-4”) results. CBB reported a

net operating loss of $1.915 million for the fourth quarter 2009,

or ($1.02) per share, and total fiscal year end losses for the

period ended December 31, 2009 (“FYE-09”) of $3.915 million or

($2.08) per share.

The major drivers causing current quarter losses and

year-to-date losses, and information about the Bank’s remediation

follows:

- The non-accrual and OREO assets

are the Bank’s legacy construction loans (originated in 2006 and

2007) and this loan category has decreased to under $500 thousand

at Q409 from $7.2 million at Q408, and further reductions are

anticipated in the 1st quarter of 2010. These legacy assets

caused:

- Increases to the allowance for

loan losses of $1.15 million for Q-4 2009 and $2.25 million YTD for

FYE2009 resulted from loan charge-offs and the replenishment of our

loan loss reserve to 2%,

- OREO and third party collection

expenses of $501,720 for Q4 2009 and $1.04 million YTD for 2009

impacted earnings,

- Loss of income opportunity on

non-performing legacy loans and OREO of approximately

$470,000,

- The Bank made marked improvement

in the level of Non-Performing Assets (“NPA”) that decreased to 38%

of Tier-1 Capital as of FYE-09 from a high of 69% of Tier-1 Capital

as of Q-3.

- The bank has experienced two

consecutive quarters of no 30-89 day past due loans.

ASSETS: (000)

Asset Type FYE-09

FYE-08 FYE-07 FYE-06 Cash

2,774 1,666 1,426 1,499 Investments

21,367 17,419 31,845 29,513 Loans

84,544 82,936 82,632 52,804 Fixed Assets

686 772 769 656 Accruals 274

405 491 337 OREO 4,250 2,189

-- -- Other Assets 1,516 1,331

678 332 Total Assets 115,411 106,718

117,841 85,141

Loans: FYE-09 FYE-08

FYE-07 FYE-06 Commercial & Industrial

56,270 53,205 53,909 34,585 SBA Loans

1,588 908 150 -- Construction

467 7,182 13,740 5,936 Commercial Real Estate

27,664 23,488 15,781 12,938 Consumer

Loans 378 155 129 11 Deferred Loan Fees

-95 -10 -36 -87 Deferred Loan Premiums

35 43 44 -- Less: Reserves 1,763

2,035 1,085 579 Net Loans 84,544

82,936 82,632 52,804

Investments: FYE-09

FYE-08 FYE-07 FYE-06 Fed Funds

Sold 16,415 3,775 7,760 12,950

Securities Available for Sale 4,493 11,394

24,084 16,562 Due from Banks Interest Bearing 459

2,250 1 1 Total Investments 21,367

17,419 31,845 29,513

Total loans at 12/31/09 increased by 2% from the prior year end.

The majority of this growth was in both Commercial and Industrial

loans which grew by 6% and commercial real estate loans by 18%.

CBB’s Other Real Estate Owned (“OREO”) balances decreased to

$4.2 million at the end of the 4th quarter ending December 31, 2009

(“Q-4 2009”) from $4.9 million at September 30, 2009, and

non-accrual (“NA”) loans decreased to $800 thousand at Q-4 2009,

from $3.9 million at September 30, 2009. CBB expects non-performing

legacy assets to further reduce throughout 2010. The remaining

loans in CBB’s portfolio are performing and at the end of Q-4, CBB

had no loans 30-89 days past due for the second consecutive

quarter. However, no assurance can be given that CBB’s

expectations will be realized.

CBB’s long-term investments consist of two (2) securities; a

Government Agency for $2.3 million issued from the FHLBB, and one

issued by GNMA for $2.0 million that is backed by the full-faith

and credit of the United States The Bank has deliberately

maintained a short term on investments which sacrifices short-term

yield. This affords the bank protection from any sudden upward

shocks in a volatile rate environment.

LIABILITIES & EQUITY: (000)

Liabilities & Equity FYE-09

FYE-08 FYE-07 FYE-06

Deposits 103,599 85,110 94,231 68,264

Other Borrowings -- 6,000 5,000 --

Accrual Interest Payable 73 87 234 76

Other Liabilities 385 242 400 185 Total

Liabilities 104,057 91,438 99,865

68,525 Equity 11,354 15,279 17,976

16,616 Total Liabilities & Equity 115,411 106,718

117,841 85,141

Deposits: FYE-09 FYE-08

FYE-07 FYE-06 Non-Interest Deposits

16,306 18,315 16,680 12,383 NOW

Accounts 3,735 1,651 4,422 384 Savings

18,357 6,400 18,663 4,561 Money Market

9,446 17,669 12,769 19,313 Time

Deposits 55,755 41,075 41,697 31,623

Total Deposits 103,599 85,110 94,231

68,264

Total Deposits increased by 8.0% from Q-3 2009 and totaled

$103.6 million as of Q-4 2009.

The growth in savings and money market deposits resulted

primarily from new deposit products, appropriately called Stimulus

Savings® and Stimulus Money Market®. These accounts require a

transaction account and a transfer from either Stimulus Savings® or

Stimulus Money Market® to a transaction account monthly.

Additionally, CBB has had good success in generating new and

existing customers for debit card and on-line banking services, all

of which have resulted in deepening the quality and penetration of

our customer base, with that base increasing the number of products

per customer, in many cases to 5 to 7 products per customer. These

products generated $15 million in interest bearing deposits and $1

million in transaction account deposits since implementation

approximately very early in October, from both existing and new

customers.

LIQUIDITY:

The bank’s loan-to-deposit ratio was 83.39% and net liquid

assets were 17.02% as of FYE-09. Additionally, the bank has back-up

sources of liquidity at both the Federal Home Loan Bank of $8.2

million and Federal Reserve Bank Discount Window of $34.4 million,

respectively. These sources of both on balance and off balance

sheet provide significant liquidity and funding sources.

CAPITAL:

CBB’s book balance as of the fourth quarter 2009 was $6.04 per

share based upon shareholders’ equity of $11.4 million. CBB capital

ratios exceed the “Well Capitalized” regulatory standards in all

three capital ratios:

- Tier 1 Leverage - 9.15%

- Tier-1 Risk Based - 12.87%

- Total Risk Base Capital -

14.13%

LOOKING FORWARD:

Although CBB can give no assurance that the following events

will occur, CBB believes the following:

- We expect continued improvement

in the quality of our asset portfolio within 2010, and we project

that the majority of the legacy assets will be finally resolved

either by the end of 2010 or the 1st quarter 2011,

- The Bank is moving towards

sustainable profitability,

- CBB is now better positioned to

focus on sustainable profitability. The bank’s loan spread will

also improve with the continued reduction in NPA and further

placement of loan floors on variable priced loans that began in the

fourth quarter of 2008, and

- CBB has been extremely proactive

in analyzing its expenditures in all areas; reducing staff where

appropriate, cutting overhead costs in all areas, and maximizing

the value of all expenditures.

California Business Bank offers a wide range of financial

services to individuals, small and medium size businesses in Los

Angeles, and the surrounding communities in Southern California.

Our commitment is to deliver the highest quality financial services

and products to our customers.

Forward Looking Statements

Certain matters discussed in this press release constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, and are subject to the

safe harbors created by the act. These forward-looking statements

refer to the CBB’s current expectations regarding future operating

results, and growth in loans, deposits, and assets. These forward

looking statements are subject to certain risks and uncertainties

that could cause the actual results, performance, or achievements

to differ materially from those expressed, suggested, or implied by

the forward looking statements. These risks and uncertainties

include, but are not limited to (1) the impact of changes in

interest rates, a decline in economic conditions, and increased

competition by financial service providers on the CBB’s results of

operation, (2) the CBB’s ability to continue its internal growth

rate, (3) the CBB’s ability to build net interest spread, (4) the

quality of the CBB’s earning assets, and (5) governmental

regulations.

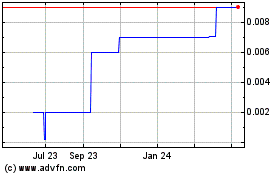

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From Mar 2024 to Apr 2024

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From Apr 2023 to Apr 2024