Zero-interest rates for the next 3 years?

The moment we all have been waiting for has finally arrived – the Nasdaq 100 surged to a new intraday record. The vast majority of US stocks, meanwhile, have rebounded over 40% from their March lows. Thus, the pessimistic forecast hasn’t panned out – even analysts have stopped cutting their projections for company results. Nevertheless, some hedge funds still believe that stock markets will take yet another nosedive. In this context, they purchased put options and currency puts on the Korean won and the Australian dollar.

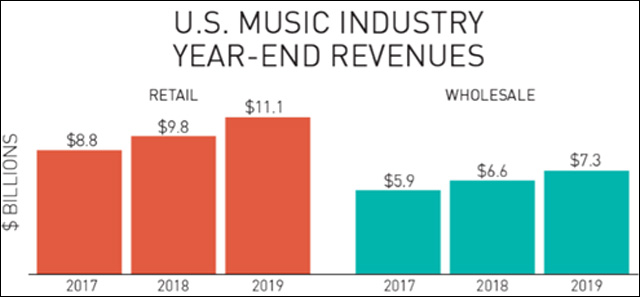

Probably thanks to the FOMO environment, Warner Music Group Corp.’s (home to Lizzo, Dua Lipa, Bruno Mars, Ed Sheeran, and many others) was able to raise almost $2 billion. It also means that the music industry continues to grow and improve.

According to the Recording Industry Association of America, “Revenues from recorded music in the United States grew 13% in 2019 from $9.8 billion to $11.1 billion at estimated retail value. This is the fourth year in a row of double-digit growth, reflecting continued increases primarily from paid subscription services, which reached more than 60 million subscriptions in the United States. Revenues from recorded music measured at wholesale value grew 11% to $7.3 billion.”

Another good piece of news was that U.S. Treasury yields increased after better-than-expected unemployment data, underlying investors’ optimism about an economic recovery. Better growth expectations normally affect long-term bonds by pushing their yields higher in comparison to their short-term counterparts. Curiously, the last time the world was talking about the Treasury curve it was upside down.

At the moment, it is expected that the target policy rate will be at zero bond for at least the next couple of years, meaning that front-end yields will be pinned down. UBS economist Seth Carpenter expects three important announcements Wednesday:

- A commitment to hold the Fed funds at a zero rate for the next three years

- Front-end yields curve control

- A switch to monthly, open-ended QE

It is worth mentioning that the Federal Reserve Bank of New York announced on Friday that it will purchase approximately $4 billion in Treasury securities every day next week. It means that the total amount of weekly purchases will be lowered to $20 billion from $22.5 billion this week.

In the case of Europe, on June 4th, the ECB took the following monetary policy decisions:

- The envelope for the pandemic emergency purchase program (PEPP) will be increased by €600 billion to a total of €1,350 billion. In response to the pandemic-related downward revision to inflation over the projection horizon, the PEPP expansion will further ease the general monetary policy stance, supporting funding conditions in the real economy, especially for businesses and households.

- The horizon for net purchases under the PEPP will be extended to at least the end of June 2021.

- The maturing principal payments from securities purchased under the PEPP will be reinvested until at least the end of 2022.

- Net purchases under the asset purchase program (APP) will continue at a monthly pace of €20 billion, together with the purchases under the additional €120 billion temporary envelope until the end of the year.

- Reinvestments of the principal payments from maturing securities purchased under the APP will continue, in full, for an extended period of time past the date when the Governing Council starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favorable liquidity conditions and an ample degree of monetary accommodation.

- The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25%, and -0.50% respectively.

Meanwhile, the latest round of talks between the UK and EU didn’t show any progress. Boris Johnson has already said that he would rather walk away without a deal than prolonging the talks. Thus, there is a high chance that Britain would default to trading with the European Union on World Trade Organization terms in 2021, aka a “no-deal Brexit.”

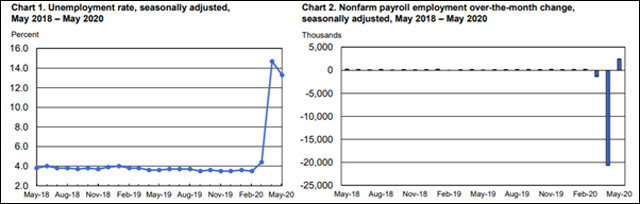

Talking about the macroeconomic data, it is important to mention that the US job market unexpectedly rose by 2,5 million in May, with the unemployment rate falling to 13,3%. According to the Bureau of Labor Statistics, in May, employment rose sharply in leisure and hospitality, construction, education and health services, and retail trade. By contrast, employment in the government continued to decline sharply.

Nevertheless, job openings are still low, and the trillions of dollars in government stimulus that have helped keep the economy on life support may be nearing their end. Additionally, the Payroll Protection Program requires that firms keep workers for at least eight weeks in order to receive funds. Considering that many restaurants are still closed it remains to be seen if employers will be able to retain workplaces after wage subsidies expire.

On Sunday, China published Trade Balance for May in USD terms, reporting a bigger-than-expected increase in the trade surplus as exports fell less than expected. To be more precise, exports decreased 3,3% in dollar terms YoY, while imports plummeted 16,7%. Overall, Trade Balance (USD) came in at +62.93B versus +39.0B expected and +45.34B previous.

In the case of the energy market, the OPEC and its allies (OPEC+) agreed to extend the oil output cuts of the current 9.7 million barrels per day till the end of July. The next OPEC meeting will take place on November 30 and the OPEC+ meeting will be held on December 1, 2020.

- On Wednesday, Saudi Arabia and Russia have agreed to extend record oil-production cuts through July.

- On Saturday, it has been announced that Iraq has renewed its full commitment to the oil production adjustments decisions reached in April 2020 by OPEC Members Countries and non-OPEC oil-producing countries participating in the Declaration of Cooperation.

- The Ministry of Petroleum Resources, Nigeria, on the other hand, stated: “Nigeria reconfirms our commitment under the existing agreement; Subscribes to the concept of compensation by countries who are unable to attain full conformity (100%) in May and June to accommodate it in July, August and September.”

Macroeconomic Data & Events

The week ahead, it is important to keep an eye on the latest FOMC meeting with updated US economic projections, Europe GDP data, and industrial production releases. Besides that, inflation data for the US will be also published, as well as consumer sentiment numbers for June. Finally, yet importantly, credit and money supply will be a key release for China.

June 8: Germany industrial output (Apr), Taiwan trade (May), Japan average cash earnings (Apr)

June 9: EU Q1 GDP, Germany Trade (Apr), France trade balance (Apr), US IBD/TIPP Economic Optimism (Jun), South Korea unemployment rate (May), Japan machinery orders (Apr)

June 10: Fed meeting (will be announced the control of the slope of the curve?), China inflation (May) France industrial output (Apr), Brazil inflation

June 11: Japan machinery tool orders (May), Italy industrial output (Apr), US jobless claims (6-Jun), Eurogroup meeting

June 12: UK Industrial/Manufacturing Production, GDP (Apr), Japan industrial output (Final, Apr), trade balance (Apr) Euro area, and UK industrial output (Apr), inflation (May) US Michigan surveys (Prelim, Jun), China new yuan loans, FDI, total social financing, M2 (May).