Preliminary Final Results

October 23 2001 - 11:54AM

UK Regulatory

RNS Number:0244M

Exeter Smaller Co's Income Fund Ld

23 October 2001

EXETER SMALLER COMPANIES INCOME FUND LIMITED

PRELIMINARY ANNOUNCEMENT OF THE FINAL RESULTS

The Directors announce the unaudited final results for the period 1 September,

2000 to 30 September, 2001 as follows:-

SUMMARISED CONSOLIDATED STATEMENT OF OPERATIONS

of the Company (unaudited)

1 Sept 2000

to 30 Sept 2001

#'000

Income

Dividends 4,818

Bond interest 924

Bank interest 319

-------

6,061

-------

Expenses

Management fee (743)

Interest payable (2,883)

Amortisation on zero dividend

preference shares (812)

Custodian and safekeeping fees (27)

Administration fees (99)

Audit fee (6)

Directors' fees (49)

Miscellaneous expenses (69)

-------

(4,688)

-------

Income less expenses 1,373

Net Investment Losses

Realised losses on investments (6,654)

Unrealised depreciation on investments (26,538)

-------

(33,192)

-------

Net decrease in net assets

from operations (31,819)

-------

Basic deficit per ordinary share (54.58)p

Return per zero dividend

preference share 9.23p

SUMMARISED STATEMENT OF CHANGES IN NET ASSETS (unaudited)

1 Sept 2000

to30 Sept 2001

#'000

Movements in net assets

Net assets, beginning of year -

Issue of ordinary share capital 56,690

Decrease in net assets from operations (31,819)

Dividends paid and proposed (5,247)

-------

19,624

-------

SUMMARISED CONSOLIDATED BALANCE SHEET (unaudited)

As at

30 Sept 2001

#'000

Investments 59,139

Net current assets 8,997

-------

Total assets less current liabilities 68,136

7.33% Fixed rate loan 2007 (38,902)

Zero dividend preference shares (9,610)

-------

Net assets attributable to ordinary Shareholders 19,624

-------

Net asset value per ordinary share 33.66p

Net asset value per zero dividend preference share 109.23p

SUMMARISED STATEMENT OF CASH FLOW (unaudited)

1 Sept 2000

to30 Sept 2001

#'000

OPERATING ACTIVITIES

Cash received from investments 5,026

Interest received 310

Operating expense payments (3,793)

-------

Net Cash inflow from operating activities 1,543

-------

INVESTING ACTIVITIES

Purchase of investments (137,063)

Sale of investments 43,923

-------

Net cash outflow from investing activities (93,140)

-------

FINANCING ACTIVITIES

Issue of ordinary share capital 56,690

Issue of zero dividend preference shares 8,798

Draw down of fixed rate loan 38,902

Dividends paid (3,906)

--------

Net Cash inflow from financing activities 100,484

--------

INCREASE IN CASH AND CASH EQUIVALENTS 8,887

========

Notes:

In accordance with the articles of association of ESCIF Securities Limited,

the holders of the 8,798,000 zero dividend preference shares are entitled on a

winding up to an amount equal to 100p per ZDP share as increased daily at such

a compound rate as would give a final capital entitlement of 183.24p on the

ZDP Repayment Date, the first such increase occurring on 22 September 2000 and

the last on the date of actual payment.

The Company's Financial Statements have been prepared in accordance with

International Accounting Standards. An appropriation is taken to Reserves to

increase the amounts attributable to the zero dividend preference shares from

the net proceeds of their issue, to the expected redemption price on 30

September 2007 at a constant daily compound rate. The total net assets

attributable to the zero dividend preference shares at 30 September 2001

calculated in accordance with the accounting standard and shown in the Group's

balance sheet amounted to #9,610,251.

Chairman's Statement

This is the first Annual Report of Exeter Smaller Companies Income Fund

covering the period ended 30 September 2001. The distributable return per

Ordinary share was 9.97 p and the Directors have declared dividends totalling

9.0p. The first two interim dividends of 2.2p each were paid in February and

May while the third interim dividend of 2.3p was paid in August. A fourth

interim dividend of 2.3p is payable on 14 November 2001 to shareholders on the

register on 2 November 2001.

The last year has been a difficult one for equity investors in general and for

geared split funds in particular. These difficulties are reflected in the

performance of the Exeter Smaller Companies Income Fund. In the period from

the launch of the Company to end of September 2001 the FTSE All-Share Index

fell by 22.8 %. UK smaller companies fared worse falling by 38.0 % as

illustrated by the FTSE Small Cap Index. In comparison total assets fell by

35.3 % during the period. The net asset value per Ordinary share fell as a

result from 97.21p to 33.66p as the Company's capital structure magnified this

decline in total assets.

The intention from the outset has been for the Company's Portfolio to be

balanced across different managers, investment styles, assets and classes of

shares, dependant on the structure and gearing of a particular investment

trust. Despite this, the sharp fall in equity and high yield bond markets has,

due to the level of gearing inherent in split capital investment trusts, been

very detrimental to the performance of a number of the Company's holdings in

this area.

The Company's policy of investing predominantly through investment trusts has,

however, been beneficial in reducing stock specific risk over the last year.

The slowdown in the UK economy over the last year or so has resulted in a

stream of earnings disappointments from companies from a broad range of

sectors. In particular, in the technology and telecommunications sectors a

number of companies have seen their share prices fall by over 90% following a

sharp reversal in both sentiment and prospects.

The Company has taken advantage of the opportunity, as intimated in the

Prospectus, to purchase a small number of direct holdings in the shares of UK

smaller companies. This has been beneficial to performance and the underlying

liquidity of the Portfolio. It is likely therefore that this exposure will be

increased over the next six months as and when the manager finds further

attractive opportunities.

The performance of UK smaller company shares since the launch of the Company

has, however, been disappointing both in absolute terms but also relative to

larger companies as illustrated by the FTSE All-Share Index. Despite their

greater domestic earnings bias UK smaller companies have not as yet recovered

significantly following their initial falls after the tragic events of 11

September 2001.

Low inflation and falling interest rates and arguably the low valuations of

equities relative to bonds are reasons why the UK equity market should make

more positive progress over the next year. The increased buying by directors

of their own shares relative to those that have been selling, particularly of

small and mid-cap sized UK companies, is also positive.

Nevertheless equity markets are likely to continue to face uncertainties in

the short term. As a precautionary measure a number of holdings were either

sold or reduced, towards the end of the period, to increase the level of cash.

A decision was also taken to issue a further 5.8 million Ordinary shares, at

a premium to the net asset value, which raised approximately #3.2 million to

strengthen the Company's balance sheet. Trading in these new shares commenced

on 11 October 2001.

Looking forward, although the Board and the Manager remain cautiously

optimistic, there are a number of risks. In particular there are a number of

holdings in the income and ordinary shares of split capital investment trusts

that could suffer further falls in their prices and/or reductions in their

dividends. This could affect the Company's ability to maintain the current

level of dividends payable to ordinary shareholders. In light of this the

current strategy is to minimise this risk where possible and cash will only be

reinvested as and when the outlook becomes more positive.

Richard Crowder

23rd October 2001

The annual report will be issued to shareholders in November and will be

available to members of the public from the Company's registered office,

Sydney Vane House, Rue du Commerce, St Peter Port, Guernsey, GY1 3EP.

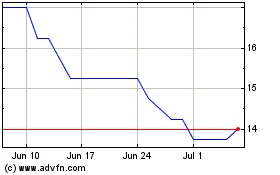

Xp Factory (LSE:XPF)

Historical Stock Chart

From Jun 2024 to Jul 2024

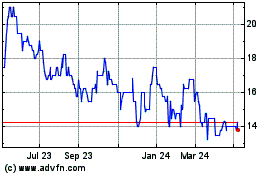

Xp Factory (LSE:XPF)

Historical Stock Chart

From Jul 2023 to Jul 2024