Shell Profited on Higher Energy Prices, Refining Margins, Gas-and-Power Trading in 2Q -- Energy Comment

July 28 2022 - 4:36AM

Dow Jones News

By Jaime Llinares Taboada

Shell PLC on Thursday reported that its earnings rose even

further in the second quarter, reflecting higher energy prices,

refining margins and gas-and-power trading profits. Here's what the

energy giant had to say:

On 2Q performance:

"Income attributable to Shell plc shareholders, compared with

the first quarter 2022, mainly reflected higher realised prices,

higher refining margins, and higher gas and power trading and

optimisation results, partly offset by lower LNG trading and

optimisation results."

"[Integrated Gas] earnings, compared with the first quarter

2022, mainly reflected higher production (increase of $109 million,

post-tax), more than offset by the net of lower trading and

optimisation results and assets realising higher prices (decrease

of $296 million, post-tax)."

"[Upstream] earnings, compared with the first quarter 2022,

mainly reflected higher realised oil and gas prices (increase of

$1,417 million, post-tax), and share of profit of joint ventures

and associated gain relating to storage and working gas transfer

effects ($480 million, post-tax).

"[Marketing] earnings, compared with the first quarter 2022,

reflected higher Marketing margins (increase of $127 million,

post-tax) including higher Mobility sales volumes due to

seasonality, partly offset by lower Lubricants margins due to

higher feedstock costs. These were partly offset by tax charges

mainly linked to hyperinflation (increase of $96 million,

post-tax)."

"[Chemicals and Products] earnings, compared with the first

quarter 2022, reflected higher Products margins (increase of $1,096

million, post-tax) reflecting higher realised Refining margins

including the effects of dislocation in product markets, partly

offset by lower contributions from trading and optimisation, as

well as lower operating expenses (decrease of $111 million,

post-tax). These were partly offset by lower Chemicals margins

(decrease of $160 million, post-tax) due to higher feedstock and

utility costs as well as higher turnarounds."

"[Renewables and Energy Solutions] earnings, compared with the

first quarter 2022, mainly reflected higher trading and

optimisation results for gas and power, due to extraordinary gas

and power price volatility, across North America, Europe and

Australia, and favourable movements in joint venture earnings

related to tax."

On 3Q outlook:

"Cash capital expenditure is expected to be in line with the $23

- $27 billion range for the full year."

"Integrated Gas production is expected to be approximately 890 -

940 thousand boe/d. LNG liquefaction volumes are expected to be

approximately 6.9 - 7.5 million tonnes. Third quarter 2022 outlook

includes substantially more planned maintenance compared with

second quarter 2022 and uncertainty around the impact of "Permitted

Industrial Actions" at Prelude."

"Upstream production is expected to be approximately 1,750 -

1,950 thousand boe/d in the third quarter 2022. The third quarter

production outlook reflects that Salym-related volumes in Russia

are no longer recognised."

"Marketing sales volumes are expected to be approximately 2,350

- 2,850 thousand b/d. Refinery utilisation is expected to be

approximately 90% - 98%."

"Chemicals manufacturing plant utilisation is expected to be

approximately 82% - 90%. Chemicals sales volumes are expected to be

approximately 3,100 - 3,600 thousand tonnes."

"Corporate Adjusted Earnings are expected to be a net expense of

approximately $450 - $650 million in the third quarter 2022 and a

net expense of approximately $2,000 - $2,400 million for the full

year 2022. This excludes the impact of currency exchange rate

effects."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

July 28, 2022 04:21 ET (08:21 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

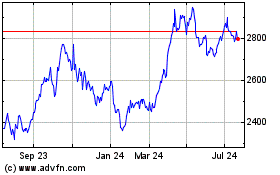

Shell (LSE:SHEL)

Historical Stock Chart

From Jun 2024 to Jul 2024

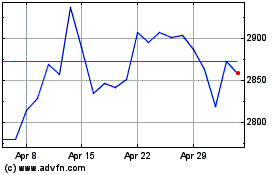

Shell (LSE:SHEL)

Historical Stock Chart

From Jul 2023 to Jul 2024