Lookers PLC Half Year Trading Update (3053F)

July 12 2019 - 2:00AM

UK Regulatory

TIDMLOOK

RNS Number : 3053F

Lookers PLC

12 July 2019

12 July 2019

LOOKERS plc

Half Year Trading Update

Lookers plc, ("Lookers" or "the Group"), one of the leading UK

motor retail and aftersales service groups, today provides the

following pre-close trading update ahead of the publication of its

half year results for the six months ended 30 June 2019 ("H1") on

14 August 2019.

H1 Performance

As reported in our AGM statement, trading for the three months

ended 31 March 2019 ("Q1") was positive, underpinned by

outperformance of the UK new car market and growth in both turnover

and gross profit in used vehicles and aftersales.

Whilst the period began satisfactorily, trading during the three

months ended 30 June 2019 ("Q2"), against strong comparatives, has

proved increasingly more challenging. During Q2 the UK new car

market continued to decline with registrations down -4.6% (Q1:

-2.4%) versus the comparable period last year. In addition, weaker

demand and the resulting margin pressure in the used car market has

significantly increased, notably during the month of June in which

we took a disciplined approach to managing stock.

Throughout H1 and in line with general retail sector trends the

Group has continued to experience cost inflation pressures.

As a result, underlying profit before tax for H1 is expected to

be approximately GBP32m* compared to GBP43m* in the comparable

period last year.

*Underlying PBT before the proposed reclassification of

amortisation on intangible assets.

Review of Regulated Activities

As announced on 25 June 2019, the Group has been informed by the

FCA that it intends to carry out an investigation into sales

processes between the period of 1 January 2016 to 13 June 2019. The

Group continues to co-operate fully with the investigation and will

provide a further update at the Interims on the level of investment

required to support our improvement plan and other costs associated

with this process.

Balance Sheet

The Group's balance sheet remains strong. In December 2018 the

Group agreed a new, fully committed GBP250m revolving credit

facility with a term to March 2022. At 31 December 2018 the Group

had net assets of GBP399m, including freehold and long leasehold

property of GBP309m at net book value.

Outlook

Notwithstanding the more challenging market conditions in H1,

particularly in Q2, the Group has delivered a robust financial

performance underpinned by maintaining its strategy of strong

operational execution and focus on the right brands in the right

locations.

The Board now expects that the more recent challenging

conditions are likely to continue into H2, exacerbated by continued

weakness in consumer confidence in light of wider political and

economic uncertainty, and further pressure on used car margins.

There is also the possibility of new vehicle supply restrictions as

new emissions regulations come into force during Q3. In addition,

the retail sector cost inflation experienced in H1 is likely to

continue to impact earnings during the second half of the year.

As a result of the above factors, the Board's current outlook

for underlying profit before tax for the full year is now below its

previous expectations.

Notwithstanding these short-term challenges, the Board continues

to believe that over the long term the Group is extremely well

positioned to take advantage of the many opportunities ahead as the

sector continues to develop, underpinned by the Group's strong

balance sheet and cash generation.

Notice of Results

The Group intends to report its Half Year results on 14 August

2019.

ENDS

Enquiries

Lookers Tel: 0161 291 0043

Andy Bruce, Chief Executive Officer

Robin Gregson, Chief Financial Officer

MHP Communications Tel: 0203 128 8742

Tim Rowntree Email: Lookers@mhpc.com

Simon Hockridge

Alistair de Kare-Silver

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) No 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTDFLFFKDFZBBZ

(END) Dow Jones Newswires

July 12, 2019 02:00 ET (06:00 GMT)

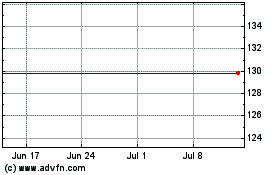

Lookers (LSE:LOOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

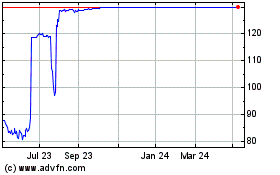

Lookers (LSE:LOOK)

Historical Stock Chart

From Apr 2023 to Apr 2024