JZ Capital Ptnrs Ltd Real Estate Valuations

September 17 2020 - 2:00AM

UK Regulatory

TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

Real Estate Valuations

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) NO. 596/2014 ("MAR").

17 September 2020

JZ Capital Partners Limited ("JZCP" or the "Company"), the London listed fund

that invests in US and European micro-cap companies and US real estate, today

announces that it has now received appraisals for most of its real estate

portfolio assets as at 31 August 2020. The Board and the Company's investment

adviser had, as previously announced in the Company's annual results for the

year ended 29 February 2020, commissioned these further appraisals to establish

an updated value of its real estate investments in light of the effects of the

Covid-19 pandemic, believing its impact to be potentially significant and

adverse though its quantum could not be estimated at the time.

Whilst the Company has not yet received all of the appraisals and is still in

the process of reviewing those that it has received, the newly received

appraisals do, in line with the Company's previously announced expectation in

its annual results, indicate materially lower valuations. As a consequence, the

Company expects it will likely experience further net write downs; based on the

information at the Company's disposal at this time, the Company currently

believes the mark down to its net asset value could be in the approximate range

of between $80 to $100 million, subject to receiving and reviewing all of the

appraisals. The Company will make further announcements regarding the

appraisals and related write downs as required.

As a consequence of the aforementioned write downs, the Company currently

expects that it will require a waiver under its senior facility with Guggenheim

Partners, as the Company will breach its minimum asset coverage ratio by the

end of September 2020. The Company is working towards and expects to receive

such a waiver. Absent this waiver (or otherwise obtaining consent), the Company

will be prohibited from making an interest payment due on 30 September 2020 to

the holders of its Convertible Unsecured Loan Stock due 2021 ("CULS"). Any

interest not paid under the CULS in accordance with the terms of the

subordination agreement to which the CULS are subject will not constitute a

default under the CULS. Again, as mentioned above, the Company does expect to

receive a waiver (or to otherwise obtain consent) to allow for the payment of

the upcoming interest payment under the CULS.

Moreover, the Company and its lenders have made significant progress in their

ongoing discussions to amend the current lending arrangements in a favourable

way to the Company. As is the case for the real estate valuations, the Company

will make further announcements as required in relation to the status of

discussions with its lenders including their impact on the CULS as matters

progress. Separately, the Company is pleased to report that its US micro-cap

portfolio is performing quite well and positive progress is being made in

relation to the previously announced secondary sale of certain of its US

micro-cap assets. It is anticipated that the Company will reach an agreement in

the near term on the secondary sale and an announcement will follow. The

secondary sale if completed will provide the Company with the needed liquidity

to repay a substantial portion of its senior debt. The Company remains

committed to its strategy of realising value from its investment portfolio, and

to paying down debt in the first order.

Market Abuse Regulation:

The information contained within this announcement is inside information as

stipulated under MAR. Upon the publication of this announcement, this inside

information is now considered to be in the public domain. The person

responsible for arranging for the release of this announcement on behalf of

JZCP is David Macfarlane, Chairman of JZCP.

For further information:

Ed Berry +44 (0) 20 3727

FTI Consulting 1046

David Zalaznick +1 (212) 485

Jordan/Zalaznick Advisers, Inc. 9410

Sam Walden +44 (0)1481

Northern Trust International Fund Administration Services 745385

(Guernsey) Limited

Important Notice

This announcement includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters that are not

historical facts. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements are not

guarantees of future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, policies and the

development of its strategies may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the investment performance, result of operations, financial condition,

liquidity and policies of the Company and development of its strategies, are

consistent with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or developments

in subsequent periods. These forward-looking statements speak only as at the

date of this announcement. Subject to their legal and regulatory obligations,

each of the Company, the Investment Adviser and their respective affiliates

expressly disclaims any obligations to update, review or revise any

forward-looking statement contained herein whether to reflect any change in

expectations with regard thereto or any change in events, conditions or

circumstances on which any statement is based or as a result of new

information, future developments or otherwise.

END

(END) Dow Jones Newswires

September 17, 2020 02:00 ET (06:00 GMT)

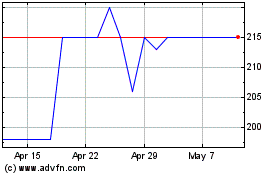

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

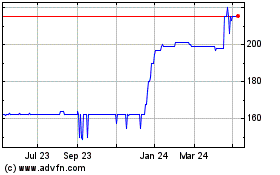

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jul 2023 to Jul 2024