JZ Capital Ptnrs Ltd Update on sale of Water Treatment Industries

September 07 2018 - 2:00AM

UK Regulatory

TIDMJZCP TIDMJZCN TIDMJZCC

JZ Capital Partners Ltd

FURTHER ANNOUNCEMENT IN RELATION TO

THE SALE OF TWH WATER TREATMENT INDUSTRIES

US$32 million in initial gross proceeds expected to be received

with up to US$5 million in additional gross earn-out proceeds possible,

representing a 3.1x MOIC and 25% IRR

07 September 2018

JZ Capital Partners Limited (LSE:JZCP.L or "JZCP"), the London listed fund that

invests in US and European microcap companies and US real estate, refers to its

announcement made on 3 September 2018 in which it was pleased to announce the

proposed disposal of its ownership interest in TWH Water Treatment Industries,

Inc. ("TWH").

As previously announced and subject to closing of the transaction, JZCP expects

to realise approximately US$32 million in initial gross proceeds from the sale

(subject to post-closing adjustments), plus potentially up to US$5 million of

additional gross proceeds from an earn-out based on certain revenue targets of

TWH. Including gross proceeds from a dividend recapitalization in November

2016, the transaction is expected to represent a gross multiple of invested

capital ("MOIC") of approximately 3.1x, and a gross internal rate of return

("IRR") of approximately 25%, in each case taking into account the receipt of

full post-closing adjustments and earn-out proceeds. Additionally, the sale of

TWH represents an uplift to JZCP's NAV at July 31, 2018 of approximately 2.7%,

again taking into account the receipt of full post-closing adjustments and

earn-out proceeds.

David Zalaznick, JZCP's Founder and Investment Adviser, commented: "We are

delighted to realise our investment in TWH. This further demonstrates our

commitment to building liquidity in order to make new investments, pay down

debt and buy back stock. We wish the TWH management team every success in the

future."

The transaction follows the announcement earlier this year on 14 March 2018

that JZCP sold Paragon Water Systems, Inc. ("Paragon") to Culligan Water, the

world leader in residential, office, commercial and industrial water treatment.

JZCP realized US$16.1 million in gross proceeds and expects remaining escrows

of approximately US$0.1 million in connection with the Paragon sale.

Completion of the TWH transaction is subject to a number of conditions

customary for US-style mergers as well as obtaining shareholder approval from

JZCP shareholders at an extraordinary general meeting of the company to be held

on 25 September 2018 and as announced on 4 September 2018.

__________________________________________________________________

Unless otherwise defined, defined terms in this announcement shall have the

same meaning as in the announcement of 3 September 2018. This announcement

should also be read in conjunction with the announcements of 3 and 4 September

2018 together with the shareholder circular being distributed to shareholders

in connection with the TWH transaction.

Ends

For further information:

Ed Berry / Kit Dunford +44 (0) 20 3727 1046 / 1143

FTI Consulting

David Zalaznick +1 212 485 9410

Jordan/Zalaznick Advisers, Inc.

Samuel Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

September 07, 2018 02:00 ET (06:00 GMT)

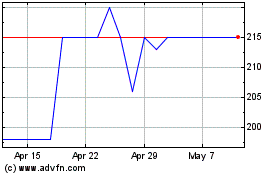

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2024 to Jun 2024

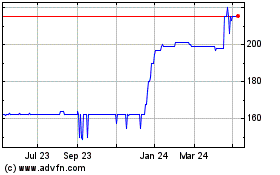

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2023 to Jun 2024