JZ Capital Ptnrs Ltd JZCP announces disposal of Water Treatment Industries

September 03 2018 - 2:00AM

UK Regulatory

TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company")

(a closed-ended investment company incorporated with limited liability under

the laws of Guernsey with registered number 48761)

LEI 549300TZCK08Q16HHU44

Proposed disposal of a 35.45 per cent. ownership interest in

TWH Water Treatment Industries, Inc.

3 September 2018

The Company today announces that TWH Water Treatment Industries, Inc. ("Water

Treatment Industries"), a subsidiary of one of the Company's portfolio

companies, Triwater Holdings LLC ("Triwater Holdings") agreed to enter into a

merger agreement with a newly incorporated subsidiary (incorporated for the

purposes of the merger) of DuBois Chemicals, Inc. ("DuBois") in relation to the

proposed merger between Water Treatment Industries and DuBois (the "Merger").

The shareholders of Water Treatment Industries, including Triwater Holdings,

will receive for the Merger, in aggregate, initial gross consideration of

approximately US$148 million in cash on completion of the Merger, subject to

post-closing adjustments for net working capital of Water Treatment Industries

and to reflect the amount of cash, indebtedness and transaction expenses of the

company at the time of closing (the "Initial Consideration") and additional

contingent earn-out consideration of up to US$17 million in cash based on

certain revenue targets of Water Treatment Industries (the "Earn-Out

Consideration"). The Company holds a 35.45 per cent. ownership interest in

Water Treatment Industries by way of both its 35.43 per cent. ownership

interest in Triwater Holdings (which owns 89.91 per cent. of Water Treatment

Industries) and its 3.59 per cent. ownership interest directly in Water

Treatment Industries. Accordingly, the Merger effectively involves the Company

disposing of its ownership interest in Water Treatment Industries. For its

ownership interest, the Company expects to receive approximately US$32 million

from the Initial Consideration, subject to the post-closing adjustments, and

potentially up to approximately US$5 million from the Earn-Out Consideration

(together, the "Transaction"). The amount expected to be received by the

Company reflects that the aggregate Initial Consideration and Earn-Out

Consideration (if any) is to be paid out first in respect of senior debt and

transaction fees, as well as preferred equity which as between investors

including the Company is held (directly or indirectly) in different percentages

than the common stock.

The Transaction would be considered a related party transaction under Chapter

11 of the Listing Rules (with which the Company voluntarily complies and

insofar as the Listing Rules are applicable to the Company by virtue of its

voluntary compliance) and therefore shareholder approval is required for the

Transaction. The Merger through which the Company is proposing to realise its

investment in Water Treatment Industries is subject to a number of conditions

customary for US-style mergers (including a no material adverse effect

condition) as well as obtaining such shareholder approval in relation to the

Transaction in order to complete the Merger.

Shareholder approval for the Transaction will be sought at an Extraordinary

General Meeting ("EGM") of the Company which the Company intends to convene by

giving notice of the EGM as soon as practicable. A shareholder circular

containing further details of the Transaction and the notice convening the EGM

will also be sent to shareholders as soon as practicable. A further

announcement will be made by the Company which will provide details of the

date, time and location of the EGM. This announcement should be read in

conjunction with the following announcement together with the shareholder

circular.

Proposed disposal of Water Treatment Industries

The Company intends to realise its investment in Water Treatment Industries

through the Merger of Water Treatment Industries with DuBois which the Board

believes currently provides the best opportunity to realise an attractive and

certain value for its investment.

Water Treatment Industries is a subsidiary of one of the Company's portfolio

companies, Triwater Holdings, which owns 89.91 per cent. of Water Treatment

Industries. The Company holds a 35.45 per cent. ownership interest in Water

Treatment Industries by way of both its 35.43 per cent. ownership interest in

Triwater Holdings and its 3.59 per cent. ownership interest directly in Water

Treatment Industries.

Water Treatment Industries is incorporated in Delaware and provides water

treatment chemical supplies and services in the US and Canada. It has a number

of subsidiaries, including Nashville Chemical & Equipment Company Inc.,

Klenzoid Canada Inc., Eldon Water Inc. and Chemco Products Inc. Water Treatment

Industries has gross profits of approximately US$15.4 million and total gross

assets of approximately US$49.2 million (including approximately US$26.7

million of intangible assets) for the 12 months ending 30 June 2018. These

figures, all of which are unaudited, are attributable to the whole of the Water

Treatment Industries business and not the proportionate 35.45 per cent.

ownership interest held and proposed to be disposed of by the Company through

the Merger. Existing members of the management team of Water Treatment

Industries run the Water Treatment Industries business and the key individual

important to the business is Ted Kusz who is the President of Water Treatment

Industries.

As mentioned above, the shareholders of Water Treatment Industries, including

Triwater Holdings, will receive for the Merger, in aggregate, approximately

US$148 million Initial Consideration in cash on completion of the Merger,

subject to the post-closing adjustments, and additional contingent Earn-Out

Consideration of up to US$17 million in cash based on certain revenue targets

of Water Treatment Industries.

The Initial Consideration is subject to customary financial adjustments to

reflect the amount of working capital in Water Treatment Industries at

completion of the Merger as well as the amount of cash, indebtedness and

transaction expenses of the company at the same time. Following completion of

the Merger, DuBois and Triwater Holdings will agree or determine the amount of

the adjustments to the Initial Consideration. In the case of the net working

capital adjustment, the adjustment to the Initial Consideration will be

determined by the amount by which the net working capital of Water Treatment

Industries as at the date of completion is either less than US$9.5 million or

greater than US$10.5 million. If the networking capital is less than US$9.5

million the adjustment will be equal to the amount of the deficit, if it is

greater than US$10.5 million the adjustment will be equal to the amount of the

excess, and in any other case the adjustment will be zero. For the other

post-closing adjustments, the adjustments will be made to reflect the amount of

cash, indebtedness and transaction expenses of the company at the time of

closing. Any upwards or downwards adjustment of the Initial Consideration will

be payable upon final determination of such adjustments in accordance with the

terms of the Merger, which is expected to be between 60 and 120 days after

completion.

The Earn-Out Consideration is based upon the amount by which Water Treatment

Industries' total net sales for the 12-month period ending 31 December 2018

exceeds approximately US$65 million provided that the Earn-Out Consideration

shall not exceed US$17 million. The Earn-Out Consideration, if any, will be

paid within 90 days following the publication of the audited financial

statements of DuBois for the calendar year ending 31 December 2018, which is

expected to be in or around May 2019.

For the Company's 35.45 per cent. ownership interest in Water Treatment

Industries, the Company expects to receive in connection with the Merger

approximately US$32 million from the Initial Consideration, subject to the

post-closing adjustments, and potentially up to approximately US$5 million from

the Earn-Out Consideration. The proceeds that the Company will receive in

connection with the Transaction are intended to be used for the Company's

general corporate purposes.

Related Party Transaction

Further details of the Transaction will be included in the shareholder circular

to be sent to shareholders as soon as practicable. However, shareholders should

note that the Transaction would be considered a related party transaction under

Chapter 11 of the Listing Rules.

The parent company of the counterparty to the Merger, DuBois is a portfolio

company of Resolute Fund III, L.P. ("Resolute Fund III") which has a 73.7 per

cent. ownership interest in DuBois and is one of the funds managed by The

Jordan Company, L.P. ("The Jordan Company"). Each of David Zalaznick and Jay

Jordan (together, the "JZAI Founders") who together are the founders and

principals of the Company's investment adviser, Jordan/Zalaznick Advisers, Inc.

("JZAI") are also the founders of The Jordan Company. In addition, Jay Jordan

is the non-executive Chairman of The Jordan Company. Both of the JZAI Founders

have an economic interest in Resolute Fund III or its affiliated funds by way

of certain fee arrangements including consultancy or similar fees or income,

and also receive carried interest in relation to such funds. As such and as

both of the JZAI Founders are related parties of the Company under the Listing

Rules, the Transaction would be considered a related party transaction.

Shareholders should also note that, whilst the Listing Rules provide that for a

related party transaction written confirmation is to be obtained from a sponsor

that its terms are fair and reasonable as far as shareholders are concerned,

such a confirmation has not been received in relation to the Transaction.

Shareholders are reminded that the Company also departed from the same

requirement in relation to the related party transaction of the Company

concerning Deflecto Holdings, LLC (the "Deflecto Proposal"), as described in

the circular to shareholders published by the Company on 6 June 2018 and

approved at the extraordinary general meeting of the Company that took place on

26 June 2018.

This is because, as was the case with the Deflecto Proposal, the Company has

been unable to obtain a fair and reasonable written confirmation for the

Transaction at a cost which can be justified relative to its size and within

the time constraints needed to be met in order to transact on and complete the

Transaction on the terms negotiated. The Company understands that the costs and

time for obtaining such a confirmation can often be greater for a related party

transaction that concerns an acquisition or disposal, such as the Deflecto

Proposal and the Transaction respectively. Such additional costs and time can

be attributed to the additional due diligence and valuation work that may need

to be undertaken on the target which is the subject of the acquisition or

disposal (as the case may be).

The Company has therefore decided to depart from the requirement to obtain a

fair and reasonable written confirmation on this occasion but notwithstanding

that, and as was also the case with the Deflecto Proposal, JZAI as the

Company's investment adviser has instead provided written confirmation to the

Company that the terms of the Transaction are fair and reasonable as far as

ordinary shareholders are concerned. Whilst the JZAI Founders do have an

economic interest in Resolute Fund III or its affiliated funds as described

above, the Company notes that the Merger and the selection of DuBois as the

preferred bidder for Water Treatment Industries was undertaken following a

competitive auction process and an assessment of DuBois as presenting the

superior offer as determined on the basis of price and ability to complete the

Merger in a short time frame with certainty. The Company also notes that

Edgewater Growth Capital Partners ("Edgewater") (which holds a 43.23 per cent.

ownership interest in Water Treatment Industries) is participating in the

Merger (separate to its ownership interest through the Company) on the same

terms, which the Company considers provides additional support for JZAI's

assessment that the terms of the Transaction are fair and reasonable. Moreover,

Edgewater has led the negotiations in relation to the Transaction on behalf of

Triwater Holdings and, as one of the Company's major shareholders, has

interests which are aligned with the Company's interests.

Shareholders are also reminded that the Company is not subject to, but rather

voluntarily complies with, the Listing Rules and, save for the absence of a

fair and reasonable written confirmation in a form prescribed by the Listing

Rules, the Transaction, like the Deflecto Proposal, is otherwise being treated

in accordance with the Listing Rules including in respect of the requirement to

obtain shareholder approval. The Directors of the Company, who have been so

advised by JZAI, consider this departure is justified for the aforementioned

reasons and is in the best interests of the Company and the ordinary

shareholders. The Company otherwise intends to continue to comply voluntarily

with the requirements of the Listing Rules.

______________________________________________________________________________________

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this announcement, this

inside information is now considered to be in the public domain. The person

responsible for arranging the release of this announcement on behalf of the

Company is David Macfarlane, Chairman.

Ends

For further information:

Ed Berry / Kit Dunford +44 (0) 20 3727 1046 / 1143

FTI Consulting

David Zalaznick +1 212 485 9410

Jordan/Zalaznick Advisers, Inc.

Samuel Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

September 03, 2018 02:00 ET (06:00 GMT)

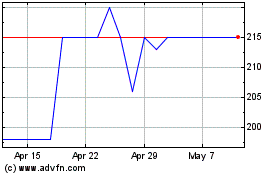

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2024 to Jun 2024

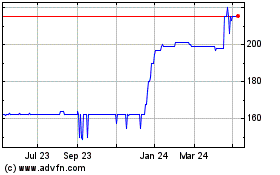

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2023 to Jun 2024