JZ Capital Ptnrs Ltd Notice of EGM

June 06 2018 - 11:12AM

UK Regulatory

TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company")

(a closed-ended investment company incorporated with limited liability under

the laws of Guernsey with registered number 48761)

LEI 549300TZCK08Q16HHU44

Notice of Extraordinary General Meeting

and

Recommended Proposals to approve

The Company's proposed acquisition of a 27.696% ownership interest and related

investments

in Deflecto Holdings, LLC and

The Company's proposed investments in JZI Fund IV, L.P.

6 June 2018

Notice of Extraordinary General Meeting

Notice is hereby given that the Extraordinary General Meeting ("EGM") of the

Company will be held at the offices of Northern Trust International Fund

Administration Services (Guernsey) Limited, Trafalgar Court, Les Banques, St

Peter Port, Guernsey GY1 3QL, Channel Islands at 1.30 p.m. on 26 June 2018 (or

as soon thereafter as the Annual General Meeting of the Company convened for

the same day and place has been concluded or adjourned).

The purpose of the EGM is to consider and, if thought fit, approve the

Company's proposed: (i) acquisition of a 27.696 per cent. ownership interest

and related initial and additional investments in Deflecto Holdings, LLC

("Deflecto") (the "Deflecto Proposal"), and (ii) investments in JZI Fund IV,

L.P. ("Fund IV") (the "Fund IV Proposal" and together with the Deflecto

Proposal, the "Proposals").

Both of the Proposals would be considered related party transactions under

Chapter 11 of the Listing Rules (with which the Company voluntarily complies

and insofar as the Listing Rules are applicable to the Company by virtue of its

voluntary compliance) and therefore shareholder approval is required for the

Proposals which will be sought at the EGM.

Deflecto Proposal

The Company intends to acquire from Edgewater Growth Capital Partners

("Edgewater") a 27.696 per cent. ownership interest in Deflecto for an amount

of initial consideration of approximately US$23.175 million payable to

Edgewater upon completion of the acquisition. The initial consideration

comprises approximately US$22.5 million payable to Edgewater plus an additional

amount of approximately US$675,000 as reimbursement to Edgewater for costs

incurred by it since the acquisition of its ownership interest in Deflecto in

2017. Following completion of the acquisition, the ownership interests in

Deflecto will be held 52.304 per cent. by Edgewater, 27.696 per cent. by the

Company, and 20 per cent. in aggregate by existing and future management of

Deflecto.

Deflecto is a diversified, highly scalable and global US company that designs,

manufactures and sells innovative plastic products to multiple industry

segments, including point-of-purchase/point-of-sale, safety, floor protection,

office products and air distribution. The business is headquartered in

Indianapolis, Indiana, USA and has operations elsewhere in the United States,

Canada, the United Kingdom, China and India. It serves a range of customers

across multiple channels including big box retailers, drug and convenience

stores, wholesalers and distributors, and original equipment manufacturers.

Prior to its acquisition by Edgewater in 2017 and since 1985, Deflecto was

owned by Jordan Industries International LLC, a company owned approximately 50

per cent. by David Zalaznick and Jay Jordan together being also the founders

and principals of the Company's investment adviser, Jordan/Zalaznick Advisers,

Inc. ("JZAI") with the balance of the company's ownership interests being owned

by their respective affiliates which included a small minority stake of less

than 0.1 per cent. owned by the Company. JZAI is therefore intimately familiar

with the Deflecto business and its operations for over the past 25 years.

Deflecto has gross assets of US$153.480 million as at 31 December 2017 and net

sales and EBITDA of US$151.347 million and US$15.082 million respectively for

the financial year ended 31 December 2017. These figures all of which are

unaudited are presented as the total gross assets of and net sales and EBITDA

attributable to the whole of Deflecto and not the proportionate 27.696 per

cent. ownership interest proposed to be acquired by the Company. Existing

members of the management team of Deflecto run the Deflecto business and the

key individuals important to the business are Jim Farrell and Bob Flynn as a

senior leader and chief financial officer of Deflecto respectively.

In addition to the initial consideration payable by the Company to Edgewater,

the Company intends to make investments in Deflecto jointly with Edgewater on a

pro rata basis according to their respective ownership interests (as between

themselves and excluding Deflecto management), being joint investments in the

proportions of 34.62 : 65.38 economically (the "Deflecto JZCP/Edgewater

Ownership Proportions"). The joint investments are intended to be made:

* firstly in the form of the Company making an initial working capital

contribution to Deflecto in an amount of approximately US$5 million with

Edgewater also making its own contribution to Deflecto's working capital

pro rata according to the Deflecto JZCP/Edgewater Ownership Proportions.

The working capital contributions are to be made by the Company and

Edgewater at the same time as the payment of the initial consideration; and

* thereafter in the form of the Company making additional joint investments

in Deflecto from time to time in an amount of up to approximately US$31.825

million with Edgewater also making its own additional joint investments in

Deflecto at the same time pro rata according to the Deflecto JZCP/Edgewater

Ownership Proportions. The additional joint investments are to be made by

the Company and Edgewater principally for the purpose of funding

complementary acquisitions to be made by Deflecto.

The total amount of the initial consideration payable to Edgewater together

with the initial and further joint investments in Deflecto in each case to be

made by the Company are not to exceed an amount of up to US$60 million.

Edgewater from whom the Company is acquiring its ownership interest in Deflecto

and making its related joint investments alongside is a substantial shareholder

of the Company and therefore a related party of the Company under the Listing

Rules. The Board believes that the Deflecto Proposal represents an attractive

investment opportunity for the Company particularly given JZAI's knowledge and

understanding of the Deflecto business and the Company's considerable

experience of co-investing with Edgewater.

Fund IV Proposal

JZAI, the Company's investment adviser, intends to establish Fund IV which will

be a Cayman Islands exempted limited partnership. The general partner of Fund

IV will be JZI Fund IV GP, L.P. ("Fund IV GP") which will also be a Cayman

Islands exempted limited partnership and of which JZAI will be the general

partner. Fund IV will be managed by JZ Asset Management, LLC ("JZAM"), acting

through JZ Asset Management UK LLP. JZAI is JZAM's managing member.

Fund IV will be a new pan European microcap buyout fund and a follow-on fund to

EuroMicrocap Fund 2010, L.P. and JZI Fund III, L.P. and is being established to

expand and diversify the Company's investments in Western Europe with

acquisitions intended to be made with a focus on buyouts and build-ups of

companies and in growth company platforms in the microcap market. Key

individuals important to Fund IV are the founders and principals of JZAI, David

Zalaznick and Jay Jordan, as well as Miguel Rueda who is the managing partner

of JZ International Ltd.

It is intended that JZAI will target aggregate capital commitments to make

investments in Fund IV of approximately EUR650 million (subject to a hard cap of

EUR800 million). The first closing of Fund IV is targeted to occur in or around

Q3 2018.

In light of the above, the Company is intending to make investments in Fund IV

jointly with David Zalaznick and Jay Jordan and various members of the JZAI

European investment team (together, the "Fund IV Principals"). Specifically,

the Company intends at or about the time of the first closing of Fund IV to

undertake a capital commitment to make investments in Fund IV (through Fund IV

GP) of up to EUR64 million. At or around the same time, the Fund IV Principals

would also undertake a capital commitment to make investments in Fund IV (also

through Fund IV GP) of up to EUR20 million. Both the Company's and the Fund IV

Principals' capital commitments taken together shall not however exceed in

aggregate approximately EUR80 million of which at JZAI's discretion the Company's

commitment shall be between approximately 75 - 80 per cent. and the Fund IV

Principals' commitment shall be between approximately 20 - 25 per cent. in each

of such aggregate amount. As such, the Company would be investing jointly with

the Fund IV Principals in Fund IV (all through Fund IV GP) in the proportions

of between approximately 75 : 25 and 80 : 20. The joint investments by the

Company and the Fund IV Principals in Fund IV will therefore be made on a 75 -

80 : 25 - 20 basis economically. It is anticipated that the balance of the

targeted aggregate capital commitments to Fund IV will be fulfilled by other

third party co-investors extending capital commitments to make investments in

Fund IV.

Each of the Fund IV Principals alongside whom the Company is proposing to make

its joint investments in Fund IV are related parties of the Company under the

Listing Rules. Following the Company's investments in EuroMicrocap Fund 2010,

L.P. and JZI Fund III, L.P., the Board considers that the participation in

further investment opportunities in Europe via Fund IV, and in particular the

increased diversification and access to third party co-investors offered by

this investment, also represents an attractive investment opportunity for the

Company.

Notice of EGM and Shareholder Circular

Further details of both Proposals are included in the Notice convening the EGM

and the circular of the Company in connection with the Proposals.

In particular, shareholders should note that, as detailed in the circular,

whilst the Listing Rules provide for written confirmation to be obtained from a

sponsor that the terms of a related party transaction are fair and reasonable

as far as shareholders are concerned, such a confirmation has only been

received in relation to the Fund IV Proposal and not the Deflecto Proposal.

This is because, whilst the Company has sought to obtain a fair and reasonable

written confirmation for Deflecto, it has been unable to do so at a cost which

can be justified relative to the size of the investment that the Company

proposes to make as part of the Deflecto Proposal and within the time

constraints needed to be met in order to transact on and complete the

transaction on the terms negotiated. The Company understands that the costs and

time for obtaining a fair and reasonable written confirmation can often be

greater for a related party transaction that concerns an acquisition such as

the Deflecto Proposal as opposed to a co-investment in the case of the Fund IV

Proposal, which can be attributed to the additional due diligence and valuation

work that may need to be undertaken on the target the subject of the

acquisition.

The Company has therefore decided to depart from the requirement to obtain a

fair and reasonable written confirmation on this occasion but notwithstanding

that the Board, which has been so advised by the Company's investment adviser,

JZAI nevertheless considers the Deflecto Proposal to have been negotiated on

arm's length terms. That negotiation has been undertaken on the Company's

behalf by JZAI, the founders and principals of which are also substantial

shareholders of the Company and whose combined shareholding exceeds that of

Edgewater's. JZAI has a selective and disciplined approach to investing which

is applied across all investments including in the case of Deflecto. In

addition, JZAI has also provided written confirmation to the Company that the

terms of the Deflecto Proposal are fair and reasonable as far as ordinary

shareholders are concerned. JZAI is ideally placed to assess the value and

merits of the Deflecto Proposal given its historic links and resultant in-depth

knowledge and understanding of the Deflecto business. Shareholders are also

reminded that the Company is not subject to, but rather voluntarily complies

with, the Listing Rules and, save for the absence of a fair and reasonable

written confirmation in a form prescribed by the Listing Rules, the Deflecto

Proposal is otherwise being treated in accordance with the Listing Rules

including the requirement to obtain shareholder approval. The Directors of the

Company, who have been so advised by JZAI, consider this departure is justified

for the aforementioned reasons and is in the best interests of the Company and

the ordinary shareholders. The Company otherwise intends to continue to comply

voluntarily with the requirements of the Listing Rules.

The Notice convening the EGM is being distributed to members of the Company and

will shortly be uploaded to the Company's website at www.jzcp.com. Copies of

the circular the Company is posting to shareholders are available for viewing,

during normal business hours, at the registered office of the Company at

Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3QL and will shortly

be available for viewing at www.morningstar.co.uk/uk/nsm. The notice convening

the EGM is also included within the circular.

Ends

For further information:

William Simmonds +44 (0)20 7742 4000

J.P. Morgan Cazenove

Kit Dunford / Jack Rodway +44 (0)20 3727 1143 / 3319 5726

FTI Consulting

David Zalaznick +1 212 485 9410

Jordan/Zalaznick Advisers, Inc.

Paul Ford +44 (0) 1481 745383

Northern Trust International Fund

Administration Services (Guernsey)

Limited

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

June 06, 2018 11:12 ET (15:12 GMT)

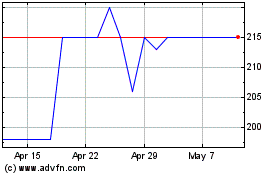

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2024 to Jun 2024

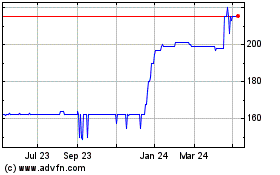

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2023 to Jun 2024