Net Asset Value(s)

April 07 2011 - 6:08AM

UK Regulatory

TIDMHGT

HgCapital Trust plc

All information is at 31 March 2011 and unaudited.

Performance at month end with net income reinvested

One month Three One Three Five Ten years

months year years years

Net asset value 1.6% 2.7% 24.3% 23.0% 92.7% 228.2%

(diluted)

Net asset value 1.4% 2.3% 20.7% 19.4% 87.1% 218.7%

(basic)

Share price 10.4% 6.9% 26.5% 37.5% 79.9% 282.5%

FTSE All-Share (0.8%) 1.0% 8.7% 17.0% 20.0% 44.2%

Index

Sources: HgCapital, Factset

At month end

Net asset value:*

Basic 1,149.6p

Diluted 1,116.3p

Share price ordinary shares: 1,075.0p

Ordinary share price discount to NAV 6.5%

(basic):

Ordinary share price discount to NAV 3.7%

(diluted):

Share price subscription shares: 122.8p

Total net assets: GBP357.6m

Net yield:** 2.6%

Gearing: Nil%

Ordinary shares in issue: 31,103,915

Subscription shares in issue: 6,220,783

* includes 3 months net revenue of 8.93p

** based on a dividend of 28.0p announced on 18 March 2011

Following the sale of SLV (expected to be completed in June 2011), the NAV is

estimated to be GBP367.6 million (1,181.9 pence per share basic; 1,143.2 pence

per share diluted). The ordinary share price is trading at a 9.0% discount to

the adjusted NAV of 1,181.9 pence per share; 6.0% discount to the adjusted

diluted NAV of 1,143.2 pence per share.

The NAV is recalculated monthly with respect to cash, cash equivalents and

quoted investments in the portfolio.

Unquoted investments were last revalued at 31 December 2010.

Sector Total Assets

%

Technology & Media 29.0

Industrials 11.7

Services 10.0

Healthcare 9.5

Consumer & Leisure 4.2

Renewable Energy 4.3

Other 6.9

Cash and other liquid assets* 24.4

100.0

* Cash and other liquid assets are stated before the sale of SLV scheduled to

complete in June 2011. After completion, cash and other liquid assets is

estimated to be 30.5% (28.2% after the proposed dividend to be paid in May

2011) of total adjusted net assets.

Ten Largest Investments

Company Total Assets Sector

%

TeamSystem 7.3 Technology & Media

VISMA 6.6 Technology & Media

Stepstone Solutions 5.5 Technology & Media

Frosunda 4.5 Healthcare

SLV Electronic 4.2 Industrials

SHL 4.1 Services

Mondo Minerals Co-op 3.8 Industrials

Achilles 3.6 Technology & Media

HG Renewable Energy (Fund 1) 3.6 Renewable Energy

Midas EqityCo 3.4 Healthcare

46.6

07 April 2011

END

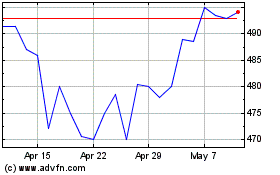

Hg Capital (LSE:HGT)

Historical Stock Chart

From Oct 2024 to Nov 2024

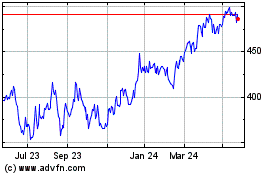

Hg Capital (LSE:HGT)

Historical Stock Chart

From Nov 2023 to Nov 2024