BlackRock Latin American Investment Trust Plc Portfolio Update

October 30 2023 - 2:53PM

UK Regulatory

TIDMBRLA

The information contained in this release was correct as at 30 September 2023.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/market-news

-home.html.

BLACKROCK LATIN AMERICAN INVESTMENT TRUST PLC (LEI - UK9OG5Q0CYUDFGRX4151)

All information is at 30 September 2023 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five

month months year years years

% % % % %

Sterling:

Net asset value^ 0.9 -1.8 13.4 62.0 24.9

Share price -1.2 -0.4 13.8 55.7 31.5

MSCI EM Latin America 1.4 -0.8 9.2 61.4 22.7

(Net Return)^^

US Dollars:

Net asset value^ -2.8 -5.7 24.0 53.0 16.9

Share price -4.9 -4.4 24.5 47.1 23.2

MSCI EM Latin America -2.3 -4.7 19.4 52.4 14.8

(Net Return)^^

^cum income

^^The Company's performance benchmark (the MSCI EM Latin America Index) may be

calculated on either a Gross or a Net return basis. Net return (NR) indices

calculate the reinvestment of dividends net of withholding taxes using the tax

rates applicable to non-resident institutional investors, and hence give a lower

total return than indices where calculations are on a Gross basis (which assumes

that no withholding tax is suffered). As the Company is subject to withholding

tax rates for the majority of countries in which it invests, the NR basis is

felt to be the most accurate, appropriate, consistent and fair comparison for

the Company.

Sources: BlackRock, Standard & Poor's Micropal

At month end

Net asset value - capital only: 452.49p

Net asset value - including income: 459.94p

Share price: 397.00p

Total assets#: £141.9m

Discount (share price to cum income 13.7%

NAV):

Average discount* over the month - 14.2%

cum income:

Net Gearing at month end**: 4.9%

Gearing range (as a % of net 0-25%

assets):

Net yield##: 8.3%

Ordinary shares in issue(excluding 29,448,641

2,181,662 shares held in treasury):

Ongoing charges***: 1.13%

#Total assets include current year revenue.

##The yield of 6.8% is calculated based on total dividends declared in the last

12 months as at the date of this announcement as set out below (totalling 40.06

cents per share) and using a share price of 484.56 US cents per share

(equivalent to the sterling price of 397.00 pence per share translated in to US

cents at the rate prevailing at 30 September 2023 of $1.221 dollars to £1.00).

2022 Q4 Interim dividend of 6.29 cents per share plus a Special Dividend of

13.00 cents per share (paid on 12 January 2023).

2023 Q1 Interim dividend of 6.21 cents per share (Paid on 16 May 2023)

2023 Q2 Interim dividend of 7.54 cents per share (Paid on 11 August 2023)

2023 Q3 Interim dividend of 7.02 cents per share (Payable on 09 October 2023)

*The discount is calculated using the cum income NAV (expressed in sterling

terms).

**Net cash/net gearing is calculated using debt at par, less cash and cash

equivalents and fixed interest investments as a percentage of net assets.

*** The Company's ongoing charges are calculated as a percentage of average

daily net assets and using the management fee and all other operating expenses

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain non-recurring items for the year ended 31

December 2022.

Geographic Exposure % of % of Equity MSCI EM Latin America Index

Total Portfolio *

Assets

Brazil 59.2 59.2 61.7

Mexico 26.9 26.8 28.4

Chile 5.8 5.8 5.8

Argentina 3.4 3.4 0.0

Colombia 3.3 3.3 1.1

Panama 1.5 1.5 0.0

Peru 0.0 0.0 3.0

Net current -0.1 0.0 0.0

Liabilities (inc.

fixed interest)

----- ----- -----

Total 100.0 100.0 100.0

===== ===== =====

^Total assets for the purposes of these calculations exclude bank overdrafts,

and the net current assets figure shown in the table above therefore excludes

bank overdrafts equivalent to 4.8% of the Company's net asset value.

Sector % of Equity Portfolio* % of Benchmark*

Financials 24.3 24.8

Materials 18.1 18.3

Consumer Staples 16.7 16.6

Energy 11.0 13.7

Consumer Discretionary 9.5 1.8

Industrials 9.2 10.5

Health Care 4.3 1.9

Real Estate 2.8 0.9

Information Technology 2.1 0.4

Communication Services 2.0 4.4

Utilites 0.0 6.7

----- -----

Total 100.0 100.0

===== =====

*excluding net current assets & fixed interest

Company Country of Risk % of % of

Equity Portfolio Benchmark

Vale - ADS Brazil 9.2 8.0

Petrobrás - ADR: Brazil

Equity 5.5 4.9

Preference 3.2 5.8

Shares

Banco Bradesco - Brazil

ADR:

Equity 4.1 0.7

Preference 1.5 2.7

Shares

Grupo Financiero Mexico 5.5 3.8

Banorte

FEMSA - ADR Mexico 5.0 3.7

B3 Brazil 4.9 2.5

AmBev - ADR Brazil 4.2 2.2

Grupo Aeroportuario Mexico 3.7 1.1

del Pacifico - ADS

Walmart de México y Mexico 3.4 3.5

Centroamérica

Hapvida Brazil 3.3 0.9

Participacoes

Commenting on the markets, Sam Vecht and Christoph Brinkmann, representing the

Investment Manager noted;

The Company's NAV was up 0.9% in September, underperforming the benchmark, MSCI

EM Latin America Index, which returned 1.4% on a net basis over the same period.

All performance figures are in sterling terms with dividends reinvested.1

September was a weak month for Latin American equities (USD -2.3% month-on

-month(/m), with negative returns in Peru (USD -7.5% m/m), Mexico (USD -6.4%

m/m) and Chile (USD -5.9% m/m). Colombia (USD 4.5% m/m) outperformed the region,

while Brazil was flat (USD 0.2% m/m). This compares positively with the

performance of global equities (USD -4.3% m/m) and broader Emerging Markets (USD

-2.6% m/m). On a year-to-date basis, Latin America remains the best performer

(+12.9%) compared to Developed Markets (+11.1%) and broader Emering Markets

(USD+1.8%).2

In terms of the portfolio, Mexico and Colombia were the top contributors from a

country perspective. The returns in Mexico were driven by stock selection in the

real estate sector and underweight positions in the telecommunications sector.

In Colombia, stock selection in the Energy and Financial sectors drove positive

returns. Brazil was the main detractor during the month. This was partially

domestically driven as the Finance Ministry announced measures to raise more

taxes from certain sectors. In addition, the rise in US interest rates in

response to strong US economic data has also pushed up the interest rates in

Brazil, which in turn hurt the domestic, rate-sensitive stocks.

On an issuer level Fibra Uno, Hapvida, Ecopetrol and Cemex were among the top

contributors to performance during the month. Fibra Uno, a real estate company

in Mexico, shares jumped early in the month as the company announced intentions

to carve out its industrial real estate portfolio. Hapvida, a health care

operator in Brazil, saw some strength despite the weaker market sentiment, as

the expectations for a normalization in their margins are being brought forward

on strong price increases. Ecopetrol, a petroleum producer in Colombia,

outperformed on the back of higher oil prices. Lastly, Cemex, the Mexican cement

producer, was among the top contributors on a relative basis. Being underweight

to the stock helped the portfolio returns as the stock declined on the back of

fears of rising input costs.

The Consumer Discretionary sector in Brazil has been particularly weak recently

as the sector has been repriced on the back of higher interest rate expectations

(largely driven by the rise in US interest rates) and a still weak Brazilian

economy in 3Q23. Among the key detractors during the period under review were

shoe retailer Arezzo, real estate developer, EZ Tec and truck leasing company,

Vamos. Our position in MAG Silver, a silver mining company in Mexico, also

detracted from performance on the back of lower silver prices.

We regard the weakness in the Brazilian equity market as a buying opportunity,

and we have added to our positioning in September. We remain positive on Brazil,

the country is in the early stages of a monetary easing cycle, and we expect the

economy to recover as rates continue to come down. We believe that the rise in

US interest rates have pushed up Brazilian rates to levels that are not aligned

with the outlook for the Brazilian economy and inflation. As a result, We have

added to our positions in the retail sector on the back of low valuations and we

believe we are at the cyclical bottom for the sector's earnings outlook.

Names we have added to in the month include Alpargatas, a footwear manufacturer

and Soma, a fashion retailer. We initiated a new position in Lojas Renner, a

clothing department store and have added to existing holdings in Brazil at the

start of the month following the impact of the tax measures, including Vamos,

B3, Ambev, and Hapvida.

The portfolio is overweight to Argentina (with two off-benchmark positions), and

Colombia. We are underweight to Peru and Mexico. From a sector position we are

overweight Consumer Discretionary and Industrials and underweight Utilities and

Communication Services.

Outlook

We remain optimistic about Latin America. Central banks have been proactive in

increasing interest rates to help control inflation, which has started to fall

across most countries in the region. With inflation at the lower range, we have

started to see central banks beginning to lower interest rates, which should

support both economic activity and asset prices. In addition to this normal

economic cycle, the whole region is benefitting from being relatively isolated

from global geopolitical conflicts. We believe that this will lead to both an

increase in foreign direct investment and an increase in allocation from

investors across the region.

Brazil is the showcase of this thesis, with the Brazilian central bank cutting

the policy rate by 50bps in both August and September 2023. The government's

fiscal framework being more orthodox than market expectations also helped to

reduce uncertainty regarding the fiscal outlook and was key for confidence. We

expect further upside to the equity market in the next 12-18 months as local

capital starts flowing into the market.

We remain positive on the outlook for the Mexican economy as it is key for the

re-shoring of global supply chains, though we have reduced our overweight

position, locking in outperformance versus our positioning a year ago. We also

note that the Mexican economy will be relatively more sensitive to a potential

slowdown in economic activity in the United States in response to rising

interest rates there.

1Source: BlackRock, as of 30 September 2023.

2Source: Bloomberg, as at 24 October 2023

30 October 2023

ENDS

Latest information is available by typing www.blackrock.com/uk/brla on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

October 30, 2023 14:53 ET (18:53 GMT)

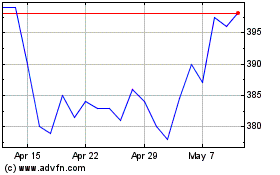

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From May 2024 to Jun 2024

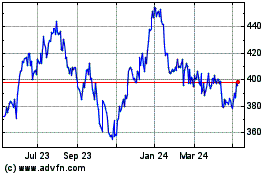

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From Jun 2023 to Jun 2024