TIDMBRLA

BlackRock Latin American Investment Trust plc

(Legal Entity Identifier: UK9OG5Q0CYUDFGRX4151)

Information disclosed in accordance with Article 5 Transparency Directive, DTR

4.1

Annual Results Announcement for the year ended 31 December 2022

PERFORMANCE RECORD

As at As at

31 December 31 December

2022 2021

Net assets (US$'000)1 148,111 194,838

Net asset value per ordinary share (US$ cents) 502.95 496.28

Ordinary share price (mid-market) (US$ cents)2 457.10 461.19

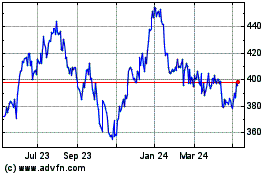

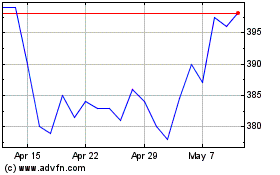

Ordinary share price (mid-market) (pence) 380.00 340.50

Discount3 9.1% 7.1%

Performance (with dividends reinvested)

Net asset value per share (US$ cents)3 6.6% -12.5%

Ordinary share price (mid-market) (US$ cents)2,3 4.7% -11.8%

Ordinary share price (mid-market) (pence)3 18.0% -11.0%

MSCI EM Latin America Index (net return, on a US 8.9% -8.1%

Dollar basis)4

For the For the

year ended year ended

31 December 31 December

2022 2021 Change %

Revenue

Net profit after taxation (US$'000) 13,842 10,247 +35.1

Revenue profit per ordinary share (US$ cents) 41.48 26.10 +58.9

Dividends per ordinary share (US$ cents)

Quarter to 31 March 7.76 6.97 +11.3

Quarter to 30 June 5.74 7.82 -26.6

Quarter to 30 September 6.08 6.56 -7.3

Quarter to 31 December 6.29 6.21 +1.3

Special dividend5 13.00 - n/a

Total dividends paid and payable (US$ cents) 38.87 27.56 +41.0

1 The change in net assets reflects the portfolio movements during the

year, the tender offer in the year and dividends paid.

2 Based on an exchange rate of US$1.20 to £1 at 31 December 2022 and

US$1.35 to £1 at 31 December 2021.

3 Alternative Performance Measures, see Glossary contained within the

annual report and financial statements.

4 The Company's performance benchmark (the MSCI EM Latin America Index) may

be calculated on either a gross or a net return basis. Net return (NR) indices

calculate the reinvestment of dividends net of withholding taxes using the tax

rates applicable to non-resident institutional investors, and hence give a

lower total return than indices where calculations are on a gross basis (which

assumes that no withholding tax is suffered). As the Company is subject to

withholding tax rates for the majority of countries in which it invests, the NR

basis is felt to be the most accurate, appropriate, consistent and fair

comparison for the Company.

5 During the year, revenue earned by the Company was enhanced by a number

of stock and special dividends, coupled with the effect of the tender offer

reducing the number of ordinary shares in issue post May 2022. In order to

maintain investment trust status, which requires the distribution of 85% of the

Company's revenue, the Board announced the payment of an additional dividend of

13.00 cents per ordinary share for the financial year to 31 December 2022.

Sources: BlackRock Investment Management (UK) Limited and Datastream.

Performance figures are calculated in US Dollar terms with dividends

reinvested.

CHAIRMAN'S STATEMENT

Dear Shareholder

I am pleased to present the Annual Report to shareholders for the year ended 31

December 2022.

MARKET OVERVIEW

Latin American equity markets were the only region in the world to deliver

positive returns in 2022. As such, they outperformed both developed markets and

the MSCI Emerging Markets Indices, which were all negative for the year under

review, with the MSCI EM Latin America Index up by 8.9% in US Dollar terms,

compared to a fall in the MSCI Emerging Markets EMEA Index of 28.3% in US

Dollar terms and a decline in the MSCI World Index of 18.1% in US Dollar terms.

It was a challenging year for global equity markets due to the difficult global

macro-economic and geo-political backdrop caused by Russia's invasion of

Ukraine impacting global markets. In spite of this the Board was pleased to see

our region showed its defensiveness through its prudent monetary and fiscal

policy and market recognition of its role as a primary crucial raw material

producer to the world.

PERFORMANCE

Against this backdrop, over the year ended 31 December 2022 the Company's net

asset value per share rose by 6.6% over the year in US Dollar terms (lagging

the benchmark by 2.3 percentage points). The share price rose by 4.7% in US

Dollar terms (but increased by 18.0% in Sterling terms). The underperformance

against the benchmark was largely driven by stock selection in Brazil, as

tighter global liquidity and a reduced risk appetite drove valuations down for

a number of what your portfolio managers believe to be quality, domestic growth

stocks. Another factor impacting the stock performance of these quality,

domestic growth equities include the steep hiking of local interest rates in

Brazil. As a result, the domestic Brazilian equity market saw a great deal of

redemptions from local investment funds forcing prices down in a somewhat

indiscriminate manner. We believe this has created a degree of disconnect

between underlying bottom-up fundamentals of Brazilian equities and stock

market valuations.

Additional information on the main contributors to and detractors from

performance for the period under review is given in the Investment Manager's

Report below.

GEARING

The Board's view is that 105% of NAV is the neutral level of gearing over the

longer term and that gearing should be used actively in an approximate range of

plus or minus 10% around this as measured at the time that gearing is

instigated. The Board is pleased to note that despite the high level of

uncertainty over the year that the Managers have been bold and used gearing

actively with a low of 105.5% in November 2022 and a high at 111.5% in March

2022. Average gearing for the year to 31 December 2022 was 108.7%.

REVENUE RETURN AND DIVIDS

Total revenue return for the year was 41.48 cents per share (2021: 26.10 cents

per share). The increase of 59% was partially due to the increase of special

dividends received in 2022 from the portfolio companies' revenue streams. Under

the Company's dividend policy dividends are calculated and paid quarterly,

based on 1.25% of the US Dollar NAV at close of business on the last working

day of March, June, September and December respectively. An additional special

dividend of 13.00 cents per ordinary share for the financial year to 31

December 2022 was declared alongside the fourth quarterly dividend. The revenue

earned by the Company was enhanced by a number of stock and special dividends,

coupled with the effect of the tender offer reducing the number of shares in

issue post May 2022. It was necessary to pay the special dividend to maintain

investment trust status which requires the distribution of 85% of the Company's

revenue.

Information in respect of the payment timetable is set out in the annual report

and financial statements. Dividends will be financed through a combination of

available net income in each financial year and revenue and capital reserves.

The Company has declared interim dividends totalling 38.87 cents per share in

respect of the year ended 31 December 2022 (2021: 27.56 cents per share) as

detailed in the table below; this represented a yield of 8.5% based on the

Company's share price at 31 December 2022.

The dividends paid and declared by the Company in 2022 have been funded from

current year revenue and brought forward revenue reserves. As at 31 December

2022, a balance of US$8,706,000 million remained in revenue reserves, which is

sufficient to cover approximately four and a half quarterly dividend payments

at the most recently declared dividend rate of 6.29 cents per share (excluding

the additional special dividend of 13.00 cents per share).

Dividends will be funded out of capital reserves to the extent that current

year revenue and revenue reserves are insufficient. The Board believes that

this removes pressure from the investment managers to seek a higher income

yield from the underlying portfolio itself which could detract from total

returns. The Board also believes the Company's dividend policy will enhance

demand for the Company's shares and help to narrow the Company's discount,

whilst maintaining the portfolio's ability to generate attractive total

returns. It is promising to note that since the dividend policy was introduced

in 2018, the Company's discount has narrowed from 14.9% as at 1 July 2018 to

9.1% as at 31 December 2022.

Dividends declared in respect of the year ended 31 December 2022

Dividend Pay date

Quarter to 31 March 2022 7.76 cents 16 May 2022

Quarter to 30 June 2022 5.74 cents 12 August 2022

Quarter to 30 September 2022 6.08 cents 9 November 2022

Quarter to 31 December 20221 19.29 cents 8 February 2023

Total 38.87 cents

1 Quarter to 31 December 2022 includes an additional special dividend of 13.00

cents.

ESG AND SOCIALLY RESPONSIBLE INVESTMENT

As a Board we believe that good Environmental, Social and Governance (ESG)

behaviour by the companies we invest in is important to the long-term financial

success of our Company and are very encouraged that ESG issues are also

increasingly at the forefront of investors' minds. The Latin American economies

are large producers to the world of vital food, timber, minerals and oil. These

are all areas that are at the forefront of modern concerns about climate

change, biodiversity and proportionate and sustainable use of land and ocean

resources. The Board is aware that there is significant room for improvement in

terms of disclosure and adherence to global best practices for many corporates

throughout the Emerging Markets2 area and the Latin American region is no

exception to this. The Board is also aware that as a whole the region lags

global peers when it comes to ESG best practices.

The Board receives regular reporting from the Portfolio Managers on ESG matters

and extensive analysis of our portfolio's ESG footprint and actively engages

with the Portfolio Managers to discuss when significant engagement may be

required with the management teams of our Company's portfolio holdings. The

Portfolio Managers are supported by the extensive ESG resources within

BlackRock and devote a considerable amount of time to understanding the ESG

risks and opportunities facing companies and industries in the portfolio. While

the Company has not adopted an ESG investment strategy or exclusionary screens,

consideration of ESG analytics, data and insights is integrated into the

investment process when weighing up the risk and reward benefits of investment

decisions. More information in relation to BlackRock's approach to ESG

integration can be found below.

The Board believes that communication and engagement with portfolio companies

can lead to better outcomes for shareholders and the environment than merely

excluding investment in certain areas. It is encouraged by the progress made

through BlackRock's company engagement to encourage sound corporate governance

frameworks that promote strong leadership by boards of directors and good

management practices contributing to a better outcome for all stakeholders.

More information in respect of our approach to ESG can be found within the

annual report and financial statements.

2 Emerging Markets in this respect represented by the MSCI Emerging Markets

Index.

PERFORMANCE TRIGGERED TER OFFER

Your Company's Directors have always recognised that our role is to act in the

best interests of all our shareholders. We have regularly consulted with our

major shareholders to understand their objectives and used their input to guide

our strategy and policies. We note their desire for the Company to continue

with its existing investment policy and the overwhelming shareholder support

for the vote on the continuation of the Company at the AGM in May 2022. We also

recognise that it is in the long-term interests of shareholders that shares do

not trade at a significant discount to their prevailing NAV and to this end,

the Board put in place a discount control mechanism covering the four years to

31 December 2021 to offer a tender for up to 24.99% of shares in issue to the

extent that certain performance and average discount targets over the four year

period to 31 December 2021 were not met (more detail on the performance and

discount targets and the tender mechanism for the period to 31 December 2021

can be found in the Company's Annual Report for the year to 31 December 2021 on

pages 7 and 8). This resulted in a tender offer for 24.99% of the Company's

shares being put to shareholders for approval at a General Meeting held on 19

May 2022 and subsequently implemented as summarised below.

A total of 22,844,851 shares were validly tendered under the tender offer,

representing approximately 58.2% of the Company's issued share capital,

excluding shares held in treasury. As the offer was oversubscribed, it was

scaled back and eligible shareholders who validly tendered shares in excess of

their basic entitlement of 24.99% had their basic entitlement satisfied in full

plus approximately 19.71% of the excess amount they tendered, in accordance

with the process described in the tender circular published on 5 April 2022. In

total, 9,810,979 shares (representing 24.99% of the eligible share capital)

were repurchased by the Company and subsequently cancelled.

The price at which tendered shares were repurchased was equal to 98% of the Net

Asset Value per share as at a calculation date of 20 May 2022, as adjusted for

the estimated related portfolio realisation costs per tendered share, and

amounted to 417.09 pence per share. Tender proceeds were paid to shareholders

on 26 May 2022.

DISCOUNT MANAGEMENT AND NEW DISCOUNT CONTROL MECHANISM

The Board remains committed to taking appropriate action to ensure that the

Company's shares do not trade at a significant discount to their prevailing NAV

and have sought to reduce discount volatility by offering shareholders a new

discount control mechanism covering the four years to 31 December 2025. This

mechanism will offer shareholders a tender for 24.99% of the shares in issue

excluding treasury shares (at a tender price reflecting the latest cum-income

NAV less 2% and related portfolio realisation costs) in the event that the

continuation vote to be put to the Company's AGM in 2026 is approved, where

either of the following conditions have been met:

(i) the annualised total NAV return of the Company does not exceed the

annualised benchmark index (being the MSCI EM Latin America Index) US Dollar

(net return) by more than 50 basis points over the four year period from 1

January 2022 to 31 December 2025 (the Calculation Period); or

(ii) the average daily discount to the cum-income NAV exceeds 12% as calculated

with reference to the trading of the shares over the Calculation Period.

In respect of the above conditions, the Company's total NAV return on a

US Dollar basis for the year ended 31 December 2022 was +6.6%, underperforming

the benchmark return of +8.9% over the year by 2.3 percentage points. The

cum-income discount of the Company's ordinary shares has averaged 8.9% for the

year ending 31 December 2022.

Other than the shares repurchased under the tender offer implemented in May

2022, the Company has not bought back any shares during the year ended 31

December 2022 and up to the date of publication of this report (no shares were

bought back in the year to 31 December 2021).

CHANGE IN PORTFOLIO MANAGER

As announced on 9 September 2022, Sam Vecht, who has co-managed the portfolio

alongside Ed Kuczma since December 2018, became the lead portfolio manager of

the Company with Mr Kuczma stepping down from his role. Christoph Brinkmann has

been appointed as deputy portfolio manager. Mr Vecht is a Managing Director in

BlackRock's Global Emerging Markets Equities team and has extensive Latin

American experience in the investment trust sector, having managed a number of

UK investment trusts since 2004. He has also been portfolio manager for the

BlackRock Emerging Markets Equity Strategies Fund since September 2015, and the

BlackRock Frontiers Investment Trust plc since 2010, both of which have

invested in the Latin American region since launch.

Mr Brinkmann, a Vice President in the Global Emerging Markets Equities team,

has covered multiple sectors and countries across the Latin American region. He

joined BlackRock in 2015 after graduating from the University of Cologne with a

Masters in Finance and a CEMS Masters in International Management.

Mr Vecht and Mr Brinkmann are supported by the extensive resources and

significant expertise of BlackRock's Global Emerging Market team which has a

proven track record in emerging market equities. The team is made up of c.40

investment professionals researching over 1,000 companies across the global

emerging markets universe inclusive of Latin America. Your Board notes that Mr

Vecht's new role as lead portfolio manager provides continuity for the Company

and welcomes the addition of Mr Brinkmann to the team as deputy portfolio

manager. The Board are grateful to Mr Kuczma for his commitment and

contribution to the Company and wish him well in his future endeavours.

BOARD COMPOSITION

As previously advised in last year's Annual Report, Professor Doctor has

indicated that she will not seek re-election at the 2023 AGM. The Board wishes

to thank Professor Doctor for her many years of excellent service, we wish her

the best for the future.

ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held in person at the offices of

BlackRock at 12 Throgmorton Avenue, London EC2N 2DL on Monday, 22 May 2023 at

12.00 noon. Details of the business of the meeting are set out in the Notice of

Annual General Meeting contained within the annual report and financial

statements.

The Board very much looks forward to meeting shareholders and answering any

question you may have on the day. We hope you can attend this year's AGM; a

buffet lunch will be made available to shareholders who have attended the AGM.

OUTLOOK

The end of years of government and central banks creating ultra low interest

rates, heavily intervening in the bond markets and creating excess money was

never likely to be smooth. Sharp adjustments in specific areas are starting to

emerge such as UK pensions Liability Driven Investing (LDI) problems in

September 2022 and the collapse of US banks such as SVB in March 2023. It would

be unduly optimistic not to expect more problems to suddenly emerge. Despite

the fact that central banks in Latin America have not pursued these monetary

policies, Latin America could remain vulnerable to getting caught in a fallout

of repricing of risk globally. However, we believe once this adjustment is

behind us the longer term fundamentals are much better in emerging markets than

in developed markets, especially in Latin America. Central banks in the region

have been ahead of the curve during this tightening cycle and most countries in

the region are now offering some of the highest real interest rates in the

world.

The region is rich in natural resources, including fossil fuels of crude oil

and natural gas, creating favourable supply and demand dynamics. It is also a

major source of copper and lithium, critical materials for the green energy

revolution. With the removal of Russia from western supply chains, the

importance of Latin America in these markets has increased. The post Covid-19

trend for companies to move away from off-shoring (especially in China) to

near-shoring should also benefit the Latin American region and your Board

believes Mexico will continue to be an even stronger global beneficiary of new

marginal foreign direct investment flows.

Carolan Dobson

Chairman

29 March 2023

INVESTMENT MANAGER'S REPORT

MARKET OVERVIEW

Latin America performed well in 2022 and was the only region globally to end

the year in positive territory, the MSCI EM Latin America Index gaining +8.9%.

For reference the MSCI Emerging Markets Index was down -20.1% with MSCI Asia

Pacific ex-Japan retracing -17.5% and the MSCI Emerging Markets EMEA Index

losing -28.3%. The region also significantly outpaced the MSCI USA Index, down

-19.8%, and Developed Market equities, as represented by the MSCI World Index,

down -18.1%.

The first half of the year was turbulent driven by external macro conditions.

Latin America1 surged +27.3% in the first quarter as the commodity rich region

benefitted from a spike in prices caused by Russia's invasion of Ukraine as

capacity was taken offline and supply chains were materially disrupted. The

resulting improvements in the current account, due to higher exports, paired

with already attractive interest rates benefitted both currency and bond

markets.

Whilst domestically, politics dominated the headlines with legislative and

primaries elections in Colombia, impeachment rejection in Peru and a new

constitution moving forward in Chile, it was not enough to derail stronger

macro factors. However, the region retracted -21.9%1 in the second quarter as

equities priced in falling commodity demand and growing fears of a global

recession. The pessimism was also felt in the currencies, as the Chilean Peso,

Brazilian Real and Colombian Peso were some of the worst performers across

emerging markets.

The second half of the year saw slightly less volatile returns for the region,

with all markets except for Colombia gaining in the last six months of the

year. Brazil fared well into October as inflation showed signs of peaking with

investors anticipating an easing of monetary policy. However, the presidential

election and subsequent uncertainty surrounding Lula's cabinet and future

fiscal policy put pressure on the market into the year-end. Colombia and Chile

also remained affected by politics. Whilst generally viewed as a more positive

outcome, the latter market still pulled back following a rejection in the

September 4th referendum of a new constitution. Argentina was a standout

performer in second half of the year, supported by newly appointed Finance

Minister Massa signalling that the country would not seek to alter the goals

already set with the IMF.

Argentina was the top performing market in the region for the 12 months ending

31 December 2022, gaining +35.9%, Chile +19.4%, Brazil +14.2% and Peru +9.4%

ended in positive territory, whilst Mexico fell -2.0% and Colombia -6.0% lagged

but still did considerably better than almost all developed and emerging

markets outside the region1.

1 Source: Bloomberg. As at 31 December 2022. All performance figures are the

local MSCI indices in USD terms on a net basis.

PERFORMANCE REVIEW AND POSITIONING

The Company underperformed its benchmark over the 12 month period ended 31

December 2022, returning +6.6% in NAV terms. Over the same time horizon, the

Company's benchmark, the MSCI Latin America Index, returned +8.9% on net basis

in US Dollar terms.

Stock selection in Mexico and having very limited exposure to Colombia

throughout the year contributed to relative returns. Brazil and Chile were the

largest detractors on a relative basis due to stock positioning. At the sector

level, Consumer Staples and Real Estate exposure performed well, whilst Health

Care, Materials and IT weighed on returns.

Overweight positions in Brazilian financials such as stock exchange, B3, and

insurer, BB Seguridade, were amongst the period's top performers as inflation

in Brazil appeared to be peaking, and investors began to anticipate an

inflection in interest rates. Staples exposure across the region also

contributed to relative returns, adding resiliency to the portfolio throughout

the year. Mexican beverage name, FEMSA, was amongst the largest contributors,

supported by their Oxxo convenience store chain showing strong earnings and

revenue growth in their same-store sales. Brazilian cash and carry outlet,

Assai, also performed well and is a great example of cheap, quality earnings

growth from a management team that has delivered. Elsewhere, off-benchmark

exposure to Mexican real estate company, Corporacion Inmobiliaria Vesta, helped

the Company, supported by attractive demand dynamics for industrial warehousing

on the back of near-shoring of supply chains benefitting Mexican property

developers. Grupo Financiero Banorte, our preferred financials exposure in

Mexico, did well throughout the period, and the stock was further supported in

the fourth quarter by an announcement that they will no longer be bidding for

Citi's Banamex unit, which should pave the way for higher dividends. Also in

the latter half of the year, travel-related names such as Mexican airport

operator, Grupo Aeroportuario del Pacifico, and regional, low-cost carrier,

Copa Holdings, contributed to performance as tourism and business travel

rebounded.

An off-benchmark position in Argentine IT and software developer, Globant,

weighed heavily on returns as global markets rotated away from growth stocks.

An overweight in Mexican cement company, Cemex, also hurt returns as

profitability was temporarily hit by rising energy costs due to the lagging

nature of cement price increases. In Brazil, health care service provider,

Hapvida Participações, was the period's largest detractor, as the company

continues to face a tough operating environment due to high medical usage and

continued cost pressures. In addition, the merger with Intermedica is proving

more complex than anticipated. Adding exposure to XP in the back end of the

year weighed on performance due in part to weaker domestic sentiment related to

the fiscal policy uncertainty in the fourth quarter. Expectations of higher

rates remaining for a longer period, has resulted in continued retail

preference for fixed income over equities, putting pressure on asset managers

like XP, given lower fees associated with those products. On the commodity

side, a persistent underweight to Chilean miner, SQM, was a drag on returns as

lithium prices remained elevated for much of the year, and an underweight to

Vale also detracted as the stock remained resilient despite weaker volumes

outlook.

During the period we added significantly to Brazil, and trimmed positions in

Mexico, whilst remaining overweight. We added to Brazilian brewing company,

AmBev, as we believe the stock is trading at attractive valuations while the

company focuses on premiumization, innovation and diversification to bring new

consumers on board and strengthen its brands. Despite underperformance we added

to our position in health care insurer, Hapvida Participações, where the market

seems too focused on the short-term environment for the sector and is

forgetting about the much brighter outlook for the name in 2023 and 2024 as

medical loss ratios should trend down and merger synergies will come through.

We have added to higher conviction consumer-related ideas, such as supermarket

chain, Assai, and clothing retailer, Arezzo Industria e Comercio SA after the

team visited stores and spoke to multiple competitors while travelling to

Brazil in November. In our view, domestic cyclicals continue to look attractive

in light of the anticipated decline in interest rates over the next

12-18 months.

On the other hand, we sold our position in Brazilian food processing company,

Marfrig, as we see signs of the cattle cycle turning for next few years leading

to downside in margin expectations. In Mexico we reduced exposure to

telecommunications company, América Movil, following strong relative

performance on the back of deleveraging efforts. We also reduced exposure to

Walmex, given a preference for FEMSA in the staples space, particularly given a

strong operating environment for its core convenience store business Oxxo.

Elsewhere, we exited Chilean retail platform, Falabella, as we expect

suboptimal returns following excessive investment. More broadly, we reduced the

number of stocks in Brazil, selling names which ranked at the lower end of our

conviction spectrum. Examples of stocks exiting the fund included Brazilian

small-caps Santos (port operator) and Afya (online education), which had the

added benefit of improving the liquidity profile of the portoflio.

The Company ended the period leveraged, given our highly positive outlook and

was overweight Brazil and Mexico, while maintaining off-benchmark exposure to

Argentina and Panama. We are underweight Colombia, Chile and Peru. At the

sector level, we are overweight real estate and financials, while being most

underweight materials and utilities.

OUTLOOK

We continue to believe that global interest rates need to rise from here and

global liquidity will tighten somewhat as central banks fight to bring

inflation down. While markets have adjusted somewhat in our view the risk of

further downside risk to global markets is still there. We maintain this view

even as several lead indicators of goods inflation look to have peaked out and

are retracing. However, the larger issue in our view remains excess broad money

creation in western markets which needs time to correct.

From this lens, Latin America could remain vulnerable to getting caught in

a fall out of repricing of risk globally. However, we believe once this

adjustment is behind us the longer term fundamentals are much better in

emerging markets than in developed markets, especially in Latin America.

Central banks in the region have been ahead of the curve during this tightening

cycle and most countries in the region are now offering some of the highest

real interest rates in the world. Chile is a standout case with rates now at

some of the highest observed levels over the past 25 years. Similarly, rates in

Colombia have not been this high since 2008. This is a very different backdrop

to developed markets, where central banks are earlier in their tightening

cycles and excess broad money creation has yet to be absorbed.

Brazil's economy is holding up well despite high interest rates. Real rates,

the difference between interest rates and inflation, are significantly positive

in Brazil as the country is farthest along in the rate rising cycle, setting up

a positive outlook for the equity market as rates peak. Historically when this

has happened it has attracted foreign capital and led to a significant rally in

risk asset prices. Despite continued uncertainty around future fiscal policy

and a potential delay in the downward path of interest rates, we still expect

interest rates to shift downwards from the current level of 13.75% over the

next twelve months, which should lay the foundation for a meaningful cyclical

pick-up.

We also like Mexico, based on the stable politics and solid economic trends,

including a rising share of exports to the U.S.

Elsewhere, whilst we remain underweight, parts of the Chilean market have begun

to pique our interest from a relative value lens as selling pressure across the

market, led by pension reductions and diversification efforts from

high-net-worth individuals, has led to decent assets trading at more attractive

valuations.

Sam Vecht and Christoph Brinkmann

BlackRock Investment Management (UK) Limited

29 March 2023

TEN LARGEST INVESTMENTS

as at 31 December 2022

1 = Vale (2021: 1st)

Materials

Market value - American depositary share (ADS): US$15,084,000

Share of investments: 9.5% (2021: 7.6%)

is one of the world's largest mining groups, with other business in logistics,

energy and steelmaking. Vale is the world's largest producer of iron ore and

nickel but also operates in the coal, copper, manganese and ferro-alloys

sectors.

2 = Petrobrás (2021: 2nd)

Energy

Market value - American depositary receipt (ADR): US$6,783,000

Market value - Preference shares ADR: US$4,384,000

Share of investments: 7.1% (2021: 7.5%)

is a Brazilian integrated oil and gas group, operating in the exploration and

production, refining, marketing, transportation, petrochemicals, oil product

distribution, natural gas, electricity, chemical-gas and biofuel segments of

the industry. The group controls significant assets across Africa, North and

South America, Europe and Asia, with a majority of production based in Brazil.

3 + FEMSA (2021: 15th)

Consumer Staples

Market value - ADR: US$9,513,000

Share of investments: 6.0% (2021: 2.5%)

is a Mexican beverages group which engages in the production, distribution and

marketing of beverages. The firm also produces, markets, sells and distributes

Coca-Cola trademark beverages, including sparkling beverages.

4 + AmBev (2021: 26th)

Consumer Staples

Market value - ADR: US$8,401,000

Share of investments: 5.3% (2021: 1.6%)

is a Brazilian brewing group which engages in the production, distribution and

sale of beverages. Its products include beer, carbonated soft drinks and other

non-alcoholic and non-carbonated products with operations in Brazil, Central

America, the Caribbean (CAC) and Canada.

5 = B3 (2021: 5th)

Financials

Market value - Ordinary shares: US$8,295,000

Share of investments: 5.2% (2021: 4.6%)

is a stock exchange located in Brazil, providing trading services in an

exchange and OTC environment. B3's scope of activities include the creation and

management of trading systems, clearing, settlement, deposit and registration

for the main classes of securities, from equities and corporate fixed income

securities to currency derivatives, structured transactions and interest rates,

and agricultural commodities. B3 also acts as a central counterparty for most

of the trades carried out in its markets and offers central depository and

registration services.

6 - Banco Bradesco (2021: 4th)

Financials

Market value - ADR: US$8,086,000

Share of investments: 5.1% (2021: 5.3%)

is one of Brazil's largest private sector banks. The bank divides its

operations in to two main areas - banking services and insurance services,

management of complementary private pension plans and savings bonds.

7 + Itaú Unibanco (2021: 21st)

Financials

Market value - ADR: US$7,701,000

Share of investments: 4.9% (2021: 1.9%)

is a Brazilian financial services group that services individual and corporate

clients in Brazil and abroad. Itaú Unibanco was formed through the merger of

Banco Itaú and Unibanco in 2008. It operates in the retail banking and

wholesale banking segments.

8 - Grupo Financiero Banorte (2021: 7th)

Financials

Market value - Ordinary shares: US$7,574,000

Share of investments: 4.8% (2021: 4.5%)

is a Mexican banking and financial services holding company and is one of the

largest financial groups in the country. It operates as a universal bank and

provides a wide array of products and services through its broker dealer,

annuities and insurance companies, retirements savings funds (Afore), mutual

funds, leasing and factoring company and warehousing.

9 + Hapvida Participações (2021: n/a)

Health Care

Market value - Ordinary shares: US$4,442,000

Share of investments: 2.8% (2021: n/a)

is a Brazilian holding healthcare company, the company operates with a vertical

service structure and is one of the largest healthcare solutions providers in

the country. The company provides medical assistance and dental care plans,

their operating structure includes facilities such as hospitals, walk-in

emergencies, clinics, or diagnostic imaging units.

10 - Cemex (2021: 8th)

Materials

Market value - ADR: US$4,437,000

Share of investments: 2.8% (2021: 3.6%)

is a Mexican multinational building materials company and is one of the world's

largest global building materials companies. It manufactures and distributes

cement, ready-mix concrete and aggregates in more than 50 countries.

All percentages reflect the value of the holding as a percentage of total

investments. For this purpose, where more than one class of securities is held,

these have been aggregated. The percentages in brackets represent the value of

the holding as at 31 December 2021.

Together, the ten largest investments represent 53.5% of the total investments

(ten largest investments as at 31 December 2021: 51.3%).

PORTFOLIO OF INVESTMENTS

as at 31 December 2022

Market

value % of

US$'000 investments

Brazil

Vale - ADS 15,084 9.5

Petrobrás - ADR 6,783 } 7.1

Petrobrás - preference shares ADR 4,384

AmBev - ADR 8,401 5.3

B3 8,295 5.2

Banco Bradesco - ADR 8,086 5.1

Itaú Unibanco - ADR 7,701 4.9

Hapvida Participações 4,442 2.8

Sendas Distribuidora 4,229 2.7

Suzano Papel e Celulose 3,513 2.2

Gerdau - Preference Shares 3,008 1.9

Arezzo Industria e Comercio SA 2,973 1.9

Iguatemi 2,796 1.8

XP 2,751 1.7

Banco Bradesco - Preference Shares 2,673 1.7

Rede D'or Sao Luiz 2,111 1.3

IRB Brasil Resseguros 1,894 1.2

Localiza Rent A Car 1,698 1.1

Movida Participações 1,608 1.0

Mrv Engenharia 1,570 1.0

Rumo 881 0.6

Localiza Rent A Car Rights 1 -

94,882 60.0

Mexico

FEMSA - ADR 9,513 6.0

Grupo Financiero Banorte 7,574 4.8

Cemex - ADR 4,437 2.8

Corporación Inmobiliaria Vesta 3,824 2.4

Grupo Aeroportuario del Pacifico - ADS 3,688 2.3

América Movil - ADR 3,642 2.3

Fibra Uno Administracion - REIT 3,601 2.3

Walmart de México y Centroamérica 3,010 1.9

Grupo México 2,759 1.7

Sitios Latinoamerica 86 0.1

42,134 26.6

Chile

Empresas CMPC 3,212 2.0

Banco Santander-Chile - ADR 3,043 1.9

Cia Cervecerias Unidas - ADR 1,385 } 1.7

Cia Cervecerias Unidas 1,237

8,877 5.6

Argentina

Tenaris 2,806 1.8

Globant 2,258 1.4

5,064 3.2

Peru

Credicorp 3,775 2.4

3,775 2.4

Panama

Copa Holdings 3,417 2.2

3,417 2.2

Total investments 158,149 100.0

All investments are in equity shares unless otherwise stated.

The total number of investments held at 31 December 2022 was 40 (31 December

2021: 40). At 31 December 2022, the Company did not hold any equity interests

comprising more than 3% of any company's share capital (31 December 2021:

none).

PORTFOLIO ANALYSIS

as at 31 December 2022

Geographical Weighting (gross market exposure) vs MSCI EM Latin America Index

% of MSCI EM Latin

net assets America Index

Brazil 64.0 62.1

Mexico 28.5 26.9

Chile 6.1 6.6

Argentina 3.4 0.0

Peru 2.5 3.1

Panama 2.3 0.0

Colombia 0.0 1.3

Sources: BlackRock and MSCI.

Sector and geographical allocations

Net other 2022 2021

Brazil Mexico Chile Argentina Peru Panama liabilities Total Total

% % % % % % % % %

Communication Services - 2.5 - - - - - 2.5 10.9

Consumer Discretionary 3.1 0.1 - - - - - 3.2 4.0

Consumer Staples 8.5 8.4 1.8 - - - - 18.7 12.2

Energy 7.5 - - 1.9 - - - 9.4 8.2

Financials 21.2 5.1 2.1 - 2.5 - - 30.9 27.1

Health Care 4.4 - - - - - - 4.4 5.7

Industrials 2.8 2.5 - - - 2.3 - 7.6 8.7

Information Technology - - - 1.5 - - - 1.5 3.1

Materials 14.6 4.9 2.2 - - - - 21.7 23.2

Real Estate 1.9 5.0 - - - - - 6.9 4.1

Utilities - - - - - - - - 1.7

Net other liabilities - - - - - - (6.8) (6.8) (8.9)

2022 total investments 64.0 28.5 6.1 3.4 2.5 2.3 (6.8) 100.0 -

2021 total investments 60.1 33.5 6.1 3.1 3.8 2.3 (8.9) - 100.0

Source: BlackRock.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ISSUES AND APPROACH

The Board's approach

Environmental, social and governance (ESG) issues can present both

opportunities and threats to long-term investment performance. The securities

within the Company's investment remit are typically large producers of vital

food, timber, minerals and oil supplies, and consequently face many ESG

challenges and headwinds as they grapple with the impact of their operations on

the environment and resources. The Board is also aware that there is

significant room for improvement in terms of disclosure and adherence to global

best practices for corporates throughout the Latin American region, which lags

global peers when it comes to ESG best practice. These ESG issues faced by

companies in the Latin American investment universe are a key focus of the

Board, and it is committed to a diligent oversight of the activities of the

Manager in these areas. Whilst the Company does not exclude investment in

stocks on ESG criteria, and has not adopted an ESG investment strategy, ESG

analytics are integrated into the investment process when weighing up the risk

and reward benefits of investment decisions. The Board believes that

communication and engagement with portfolio companies is important and can lead

to better outcomes for shareholders and the environment than merely excluding

investment in certain areas.

More information on BlackRock's global approach to ESG integration, as well as

activity specific to the BlackRock Latin American Investment Trust plc

portfolio, is set out below. BlackRock has defined ESG integration as the

practice of incorporating material ESG information and consideration of

sustainability risks into investment decisions in order to enhance

risk-adjusted returns. ESG integration does not change the Company's investment

objective. More information on sustainability risks may be found in the AIFMD

Fund Disclosures document of the Company available on the Company's website at

https://www.blackrock.com/uk/individual/literature/policies/

itc-disclosure-blackrock-latin-america-trust-plc.pdf. The Investment Manager

has access to a range of data sources, including principal adverse indicator

(PAI) data, when making decisions on the selection of investments. However,

whilst BlackRock considers ESG risks for all portfolios and these risks may

coincide with environmental or social themes associated with the PAIs, the

Company does not commit to considering PAIs in driving the selection of its

investments.

BlackRock Latin American Investment Trust plc - Investment Stewardship

Engagement with portfolio companies in the year ended 31 December 2022

Given the Board's belief in the importance of engagement and communication with

portfolio companies, it receives regular reports from the Manager in respect of

activity undertaken for the year under review. The Board reviews these closely

and asks for further updates and progress reports from the Portfolio Managers

in respect of evolving ESG issues and the action being taken where appropriate.

The Board notes that over the year to 31 December 2022, 58 total company

engagements were held with the management teams of 27 portfolio companies

representing 75% of the portfolio by value at 31 December 2022. Additional

information is set out in the tables below.

BlackRock Latin American Investment Trust

plc

year ended 31 December 2022

Number of engagements held 58

Number of companies met 27

% of equity investments covered 75%

Shareholder meetings voted at 55

Number of proposals voted on 544

Number of votes against management 56

% of total votes represented by votes 10.29%

against management

Engagement Themes1 Engagement Themes1

Governance 58%

Environmental 49%

Social 32%

Engagement Topics 1 Engagement Topics 1

Business oversight/risk management 51%

Governance structure 50%

Corporate strategy 49%

Board composition and effectiveness 46%

Executive management 40%

Climate risk management 40%

Operational sustainability 38%

Remuneration 34%

Environmental impact management 27%

Human capital management 21%

Social risks and opportunities 21%

1 Engagements include multiple company meetings during the year with the

same company. Most engagement conversations cover multiple topics and are based

on BlackRock's voting guidelines and BlackRock's engagement priorities can be

found at: www.blackrock.com/corporate/about-us/investment-stewardship#

engagement-priorities. Percentages reflect the number of meetings at which a

particular topic is discussed as a percentage of the total meetings held; as

more than one topic is discussed at each meeting the total will not add up to

100%.

BlackRock's approach

The importance and challenges of considering ESG when engaging with investee

companies in the Latin American Sector and BlackRock's approach to ESG

integration

Environmental Social Corporate Governance

As well as the longer-term In our experience, companies As with all companies, good

contribution to carbon are better positioned to corporate governance is

emissions and the impact on deliver long-term shareholder especially critical for

the environment, the value when they build strong natural resources companies.

activities undertaken by many relationships throughout In our experience, the sound

companies in the portfolio their value chain, including governance, in terms of both

such as digging mines or with employees, business process and practice, is

drilling for oil will partners (such as suppliers critical to the success of a

inevitably have an impact on and distributors), clients company, the protection of

local surroundings. It is and consumers, regulators, shareholders' interests, and

important how companies and the communities in which long-term shareholder value

manage this process and companies operate. creation.

ensure that an appropriate

risk oversight framework is In BlackRock's experience, Governance issues, including

in place, with consideration companies that build strong the management of material

given to all stakeholders. relationships with their sustainability issues that

The value wiped off the stakeholders are more likely have a significant impact for

market capitalisation of to meet their own strategic natural resource companies,

companies like Vale, after objectives, while poor all require effective

the Brumadinho dam collapse, relationships may create leadership and oversight from

highlights the key role that adverse impacts that expose a a company's board.

ESG has on share price company to legal, regulatory,

performance. operational, and reputational BlackRock believes that

risks and jeopardize their companies with experienced,

BlackRock's approach to ability to deliver engaged and diverse

climate risk and sustainable, long-term directors, who are effective

opportunities and the global financial performance. in actively advising and

energy transition is based on overseeing management as a

our role as a fiduciary to board, are well-positioned to

our clients. As the world deliver long-term value

works toward a transition to creation.

a low-carbon economy,

BlackRock are interested in It is our view that

hearing from companies about climate-related risks and

their strategies and plans opportunities can be an

for responding to the important factor in many

challenges and capturing the companies' long-term

opportunities that this prospects. We continue to

transition creates. When look for companies to

companies consider disclose strategies they have

climate-related risks, it is in place that mitigate and

likely that they will also are resilient to any material

assess their impact and risks to their long-term

dependence on natural business model associated

capital. with a range of

climate-related scenarios.

Engagement with investee companies

Case study: Grupo México

BIS determined that it was in the best financial interests of BlackRock's

clients to not support the proposal to elect directors at the 2022 AGM of Grupo

México, S.A.B. de C.V. (Grupo México), a Mexican materials company. At the time

of the shareholder meeting, the company did not have up to date

sustainability-related reporting, and in particular, their climate-related data

and disclosures had not been updated since the release of their 2020

Sustainable Development Report. This made it difficult for investors to assess

the progress the company had made against their targets.

BlackRock Investment Stewardship: Engagement with investee companies

The BlackRock Investment Stewardship team have regular engagement with investee

companies, examples can be seen below through the last AGM cycle:

https://www.blackrock.com/corporate/literature/press-release/

vote-bulletinpetrobras-april-2022.pdf

https://www.blackrock.com/corporate/literature/press-release/

vote-bulletinbanorte-april-2022.pdf

https://www.blackrock.com/corporate/literature/press-release/

vote-bulletingrupo-mexico-april-2022.pdf

BlackRock's approach to ESG integration

BlackRock believes that sustainability risk - and climate risk in particular -

now equates to investment risk, and this will drive a profound reassessment of

risk and asset values as investors seek to react to the impact of climate

policy changes. This in turn, in BlackRock's view, is likely to drive a

significant reallocation of capital away from traditional carbon intensive

industries over the next decade. BlackRock believes that carbon-intensive

companies will play an integral role in unlocking the full potential of the

energy transition, and to do this, they must be prepared to adapt, innovate and

pivot their strategies towards to low carbon economy.

As part of BlackRock's structured investment process, ESG risks and

opportunities (including sustainability/climate risk) are considered within the

portfolio management team's fundamental analysis of companies and industries

and the Company's portfolio managers work closely with BlackRock's Investment

Stewardship team to assess the governance quality of companies and investigate

any potential issues, risks or opportunities.

As part of their approach to ESG integration, the portfolio managers use ESG

information when conducting research and due diligence on new investments and

again when monitoring investments in the portfolio. In particular, portfolio

managers at BlackRock now have access to 1,200 key ESG performance indicators

in Aladdin (BlackRock's proprietary trading system) from third-party data

providers. BlackRock's internal sustainability research framework scoring is

also available alongside third-party ESG scores in core portfolio management

tools. BlackRock's analyst's sector expertise and local market knowledge allows

it to engage with companies through direct interaction with management teams

and conducting site visits. In conjunction with the portfolio management team,

BlackRock Investment Stewardship's (BIS) meets with boards of companies

frequently to evaluate how they are strategically managing their longer-term

issues, including those surrounding ESG and the potential impact these may have

on company financials. BIS's and the portfolio management team's understanding

of ESG issues is further supported by BlackRock's Sustainable and Transition

Solutions (STS). The STS team lead BlackRock's sustainability and transition

strategy, drive cross-functional change, support client and external

engagement, power product ideation, and embed expertise across the firm.

Investment Stewardship

Consistent with BlackRock's fiduciary duty as an asset manager, BIS seeks to

support investee companies in their efforts to deliver long-term durable

financial performance on behalf of our clients. These clients include public

and private pension plans, governments, insurance companies, endowments,

universities, charities and, ultimately, individual investors, among others.

BIS serves as an important link between BlackRock's clients and the companies

they invest in. Clients depend on BlackRock to help them meet their investment

goals; the business and governance decisions that companies make will have a

direct impact on BlackRock's clients' long-term investment outcomes and

financial well-being.

Global Principles

BlackRock's approach to corporate governance and stewardship is comprised in

BIS' Global Principles and market-specific voting guidelines. BIS' policies set

out the core elements of corporate governance that guide its investment

stewardship activities globally and within each regional market, including when

voting at shareholder meetings for those clients who have authorized BIS to

vote on their behalf. Each year, BIS reviews its policies and updates them as

necessary to reflect changes in market standards and regulations, insights

gained over the year through third-party and its own research, and feedback

from clients and companies. BIS' Global Principles are available on its website

at www.blackrock.com/corporate/literature/fact-sheet/

blkresponsible-investment-engprinciples-global.pdf.

Market-specific proxy voting guidelines

BIS' voting guidelines are intended to help clients and companies understand

its thinking on key governance matters. They are the benchmark against which it

assesses a company's approach to corporate governance and the items on the

agenda to be voted on at a shareholder meeting. BIS applies its guidelines

pragmatically, taking into account a company's unique circumstances where

relevant. BlackRock informs voting decisions through research and engages as

necessary. BIS reviews its voting guidelines annually and updates them as

necessary to reflect changes in market standards, evolving governance practice

and insights gained from engagement over the prior year. BIS' market-specific

voting guidelines are available on its website at www.blackrock.com/corporate/

about-us/investment-stewardship#stewardship-policies. BlackRock is committed to

transparency in terms of disclosure on its stewardship activities on behalf of

clients. BIS publishes its stewardship policies such as the Global Principles,

engagement priorities, and voting guidelines - to help BlackRock's clients

understand its work to advance their interests as long-term investors in public

companies. Additionally, BIS publishes both annual and quarterly reports

detailing its stewardship activities, as well as vote bulletins that describe

its rationale for certain votes at high profile shareholder meetings. More

detail in respect of BIS reporting can be found at www.blackrock.com/corporate/

about-us/investment-stewardship.

1 Source: BlackRock's 2022 voting spotlight report which can be found at https:

//www.blackrock.com/corporate/about-us/investment-stewardship.

BlackRock's reporting and disclosures

In terms of its own reporting, BlackRock believes that the SASB provides a

clear set of standards for reporting sustainability information across a wide

range of issues, from labour practices to data privacy to business ethics. For

evaluating and reporting climate-related risks, as well as the related

governance issues that are essential to managing them, the TCFD provides

a valuable framework.

BlackRock recognises that reporting to these standards requires significant

time, analysis and effort. BlackRock's 2021 TCFD report can be found at

www.blackrock.com/corporate/literature/

continuous-disclosure-andimportantinformation/tcfd-report-2021-blkinc.pdf.

STRATEGIC REPORT

The Directors present the Strategic Report of the Company for the year ended 31

December 2022.

Objective

The Company's objective is to secure long-term capital growth and an attractive

total return primarily through investing in quoted securities in Latin America.

Strategy, business model and investment policy

The Company invests in accordance with the objective given above. The Board is

collectively responsible to shareholders for the long-term success of the

Company and is its governing body. There is a clear division of responsibility

between the Board and the Manager. Matters for the Board include setting the

Company's strategy, including its investment objective and policy, setting

limits on gearing (both bank borrowings and the effect of derivatives), capital

structure, governance, and appointing and monitoring of performance of service

providers, including the Manager.

The Company's business model follows that of an externally managed investment

trust; therefore the Company does not have any employees and outsources its

activities to third party service providers including the Manager who is the

principal service provider.

In accordance with the Alternative Investment Fund Managers' Directive (AIFMD),

as implemented, retained and onshored in the UK, the Company is an Alternative

Investment Fund (AIF). BlackRock Fund Managers Limited (the Manager) is the

Company's Alternative Investment Fund Manager.

The management of the investment portfolio and the administration of the

Company have been contractually delegated to the Manager who in turn (with the

permission of the Company) has delegated certain investment management and

other ancillary services to BlackRock Investment Management (UK) Limited (BIM

(UK) or the Investment Manager). The Manager, operating under guidelines

determined by the Board, has direct responsibility for the decisions relating

to the day-to-day running of the Company and is accountable to the Board for

the investment, financial and operating performance of the Company. The Company

delegates fund accounting services to the Manager, which in turn sub-delegates

these services to The Bank of New York Mellon (International) Limited. Other

service providers include the Depositary, The Bank of New York Mellon

(International) Limited and the Registrar, Computershare Investor Services PLC.

Details of the contractual terms with these service providers are set out in

the Directors'Report contained with the annual report and financial sttatements

for the year ended 31 December 2022. Our strategy is that the portfolio will be

chosen from a spread of companies which are listed in, or whose main activities

are in, Latin America.

As an actively managed fund, over the medium term we seek outperformance of our

benchmark index (the MSCI EM Latin America Index - net total return basis) and

most of our competitors on a risk adjusted basis. Our portfolio and performance

will diverge from the returns obtained simply by investing in the index.

Investment policy

As a closed end company we are able to adopt a longer-term investment horizon,

and therefore may, when appropriate, have a higher proportion of less liquid

mid and smaller capitalisation companies than comparable open ended funds.

The portfolio is subject to a number of geographical restrictions relative to

the benchmark index but the Investment Manager is not constrained from

investing outside the index. For Brazil, Mexico, Chile, Argentina, Peru,

Colombia and Venezuela, the portfolio weighting is limited to plus or minus 20%

of the index weighting for each of those countries. For all other Latin

American countries the limit is plus or minus 10% of the index weighting.

Additionally, the Company may invest in the securities of quoted companies

whose main activities are in Latin America but which are not established or

incorporated in the region or quoted on a local exchange.

The Company's policy is that up to 10% of the gross assets of the portfolio may

be invested in unquoted securities.

The Company will not hold more than 15% of the market capitalisation of any one

company and no more than 15% of the Company's investments will be held in any

one company as at the date any such investment is made.

No more than 15% of the gross assets of the portfolio shall be invested in

other UK listed investment companies (including other investment trusts).

The Company may deal in derivatives (including options, futures and forward

currency transactions) for the purposes of efficient portfolio management (i.e.

for the purpose of reducing, transferring or eliminating investment risk in the

underlying investments of a collective investment undertaking, including any

technique or instrument used to provide protection against exchange and credit

risks). No more than 20% of the Company's portfolio by value may be under

option at any given time.

The Company may underwrite or sub-underwrite any issue or offer for the sale of

investments. No such commitment will be entered into if, at that time, the

aggregate of such investments would exceed 10% of the net asset value of the

Company or any such individual investment would exceed 3% of the net asset

value of the Company.

The Company may, from time to time, use borrowings to gear its investment

portfolio or in order to fund the market purchase of its own ordinary shares.

Under the Company's Articles of Association, the net borrowings of the Company

may not exceed 100% of the Company's adjusted capital and reserves (as defined

in the Glossary contained within the annual report and financial statements for

the year ended 31 December 2022). However, net borrowings are not expected to

exceed 25% of net assets under normal circumstances. The Investment Manager may

also hold cash or cash-equivalent securities when it considers it to be

advantageous to do so.

The Company's financial statements are maintained in US Dollars. Although many

investments are likely to be denominated and quoted in currencies other than in

US Dollars, the Company does not currently employ a hedging policy against

fluctuations in exchange rates.

No material change will be made to the Company's investment policy without

shareholder approval.

Investment process

An overview of the investment process is set out below.

The Investment Manager's main focus is to invest in securities that provide

opportunities for strong capital appreciation relative to our benchmark. We aim

to maintain a concentrated portfolio of high conviction investment ideas that

typically consists of companies with a combination of mispriced growth

potential and/or display attributes of sustained value creation that are

underappreciated by the financial markets.

The Manager's experienced research analyst team conducts on the ground

research, meeting with target companies, competitors, suppliers and others in

the region in order to generate investment ideas for portfolio construction. In

addition, the investment team meets regularly with government officials,

central bankers, industry regulators and consultants.

Final investment decisions result from a combination of bottom-up, company

specific research with top-down, macro analysis.

Share rating and discount control

The Directors recognise that it is in the long term interests of shareholders

that shares do not trade at a significant discount to their prevailing NAV. The

Board monitors the level of the Company's discount to NAV on an ongoing basis.

Over the year under review, the Company's share price traded in the range of a

discount of 19.6% to a premium of 0.6% and at the year end stood at a discount

of 9.1%. Further details setting out how the discount or premium at which the

Company's shares trade is calculated are included in the Glossary contained

within the annual report and financial statements for the year ended 31

December 2022).

A special resolution was passed at the AGM of the Company held on 19 May 2022,

granting the Directors' authority to make market purchases of the Company's

ordinary shares to be held, sold, transferred or otherwise dealt with as

treasury shares or cancelled upon completion of the purchase. The Board intends

to renew this authority at the AGM to be held in May 2023.

The Board adopted a new discount control mechanism, for the four year period

from 1 January 2022 to 31 December 2025. Under this new mechanism the Board

undertakes to make a tender offer to shareholders for 24.99% of the issued

share capital (excluding treasury shares) of the Company at a tender price

reflecting the latest cum-income Net Asset Value (NAV) less 2% and related

portfolio realisation costs if, over the four year period from 1 January 2022

to 31 December 2025 (the 'Calculation Period'), either of the following

conditions are met:

(i) the annualised total NAV return of the Company does not exceed the

annualised benchmark index (being the MSCI EM Latin America Index) US Dollar

net total return by more than 50 basis points over the Calculation Period; or

(ii) the average daily discount to the cum-income NAV exceeds 12% as calculated

with reference to the trading of the ordinary shares over the Calculation

Period.

The making and implementation of this tender offer will be conditional, amongst

other things, upon the Company having the required shareholder authority or

such shareholder authority being obtained, the Company having sufficient

distributable reserves to effect the repurchase of any successfully tendered

shares and, having regard to its continuing financial requirements, sufficient

cash reserves to settle the relevant transactions with shareholders, the

Company's biennial continuation votes being approved at the Annual General

Meetings in 2024 and 2026. The Board believes that a four year performance

target enables the Manager to take a sufficiently long term approach to

investing in quality companies in the region, and it believes that it is in

shareholders' interests as a whole that this time period for assessing

performance be adopted.

SECTION 172 STATEMENT: PROMOTING THE SUCCESS OF BLACKROCK LATIN AMERICAN

INVESTMENT TRUST PLC

The Companies (Miscellaneous Reporting) Regulations 2018 require directors to

explain more fully how they have discharged their duties under Section 172(1)

of the Companies Act 2006 in promoting the success of their companies for the

benefit of members as a whole. This enhanced disclosure covers how the Board

has engaged with and understands the views of stakeholders and how

stakeholders' needs have been taken into account, the outcome of this

engagement and the impact that it has had on the Board's decisions.

As the Company is an externally managed investment company and does not have

any employees or customers, the Board considers the main stakeholders in the

Company to be the shareholders, key service providers (being the Manager and

Investment Manager, the Custodian, Depositary, Registrar and Broker) and

investee companies. The reasons for this determination, and the Board's

overarching approach to engagement, are set out in the table below.

Stakeholders

Shareholders Manager and Other key service Investee companies

Investment Manager providers

Continued shareholder The Board's main In order for the Portfolio holdings

support and working relationship Company to function are ultimately

engagement are is with the Manager, as an investment shareholders' assets,

critical to the who is responsible trust with a listing and the Board

continued existence for the Company's on the premium recognises the

of the Company and portfolio management segment of the importance of good

the successful (including asset official list of the stewardship and

delivery of its allocation, stock and FCA and trade on the communication with

long-term strategy. sector selection) and London Stock investee companies in

The Board is focused risk management, as Exchange's (LSE) main meeting the Company's

on fostering good well as ancillary market for listed investment objective

working relationships functions such as securities, the Board and strategy. The

with shareholders and administration, relies on a diverse Board monitors the

on understanding the secretarial, range of advisors for Manager's stewardship

views of shareholders accounting and support in meeting arrangements and

in order to marketing services. relevant obligations receives regular

incorporate them into The Manager has and safeguarding the feedback from the

the Board's strategy sub-delegated Company's assets. For Manager in respect of

and objectives in portfolio management this reason the Board meetings with the

delivering long-term to the Investment considers the management of

growth and income. Manager. Successful Company's Custodian, investee companies.

management of Depositary, Registrar

shareholders' assets and Broker to be

by the Investment stakeholders. The

Manager is critical Board maintains

for the Company to regular contact with

successfully deliver its key external

its investment providers and

strategy and meet its receives regular

objective. The reporting from them

Company is also through the Board and

reliant on the Committee meetings,

Manager as AIFM to as well as outside of

provide support in the regular meeting

meeting relevant cycle.

regulatory

obligations under the

AIFMD and other

relevant legislation.

A summary of the key areas of engagement undertaken by the Board with its key

stakeholders in the year under review and how Directors have acted upon this to

promote the long-term success of the Company are set out in the table below.

Area of

Engagement Issue Engagement Impact

Investment mandate and The Board is committed The Board believes The portfolio

objective to promoting the role that responsible activities undertaken

and success of the investment and by the Manager, can be

Company in delivering sustainability are found in the

on its investment important to the Investment Manager's

mandate to longer-term delivery Report above.

shareholders over the of growth in capital

long term. However, and income and has

the Board recognises worked very closely

that securities within with the Manager

the Company's throughout the year to

investment remit may regularly review the

involve significant Company's performance,

additional risk due to investment strategy

the political and underlying

volatility and policies, and to

environmental, social understand how ESG

and governance considerations are

concerns facing many integrated into the

of the countries in investment process.

the Company's

investment universe. While the Company has

These ESG issues not adopted an ESG

should be a key focus investment strategy or

of our Manager's exclusionary screens,

research. More than the Manager's approach

ever, consideration of to the consideration

material ESG of ESG factors in

information and respect of the

sustainability risk is Company's portfolio,

an important element as well as its

of the investment engagement with

process and must be investee companies to

factored in when encourage the adoption

making investment of sustainable

decisions. The Board business practices

also has which support

responsibility to long-term value

shareholders to ensure creation, are kept

that the Company's under review by the

portfolio of assets is Board. The Manager

invested in line with reports to the Board

the stated investment in respect of its

objective and in a way consideration of ESG

that ensures an factors and how these

appropriate balance are integrated into

between spread of risk the investment

and portfolio returns. process; a summary of

BlackRock's approach

to ESG integration is

set out within the

annual report and

financial statements.

The Board discussed

ESG concerns in

respect of specific

portfolio companies

with the Manager,

including the

investment rationale

for holding companies

with poor ESG ratings

and the engagement

being entered into

with management teams

to address the

underlying issues

driving these ratings.

The Company does not

meet the criteria for

Article 8 or 9

products under the EU

Sustainable Finance

Disclosure Regulation

(SFDR) and the

investments underlying

this financial product

do not take into

account the EU

criteria for

environmentally

sustainable economic

activities. The

Investment Manager has

access to a range of

data sources,

including principal

adverse indicator

(PAI) data, when

making decisions on

the selection of

investments. However,

whilst BlackRock

considers ESG risks

for all portfolios and

these risks may

coincide with

environmental or

social themes

associated with the

PAIs, unless stated

otherwise in the AIFMD

Disclosure Document,

the Company does not

commit to considering

PAIs in driving the

selection of its

investments.

Dividend target A key element of the The Manager reports Since the dividend

Board's overall total return policy was introduced

strategy to reduce the performance statistics in July 2018, the

discount at which the to the Board on a Company's discount has

Company's shares trade regular basis, along narrowed from an

is the Company's with the portfolio average of 13.5% for

dividend policy yield and the impact the two year period

whereby the Company of the dividend policy preceding the

pays a regular on brought forward introduction of the

quarterly dividend distributable new policy on 13 March

equivalent to 1.25% of reserves. 2018 to an average of

the Company's US 11.0% for the period

Dollar NAV at the end The Board reviews the from 14 March 2018 to

of each calendar Company's discount on 31 December 2022. At

quarter. The Board a regular basis and 27 March 2023 the

believes this policy holds regular discount stood at

which produced a discussions with the 12.9%.

dividend yield of Manager and the

8.5%, including the Company's broker Of total dividends of

special dividend of regarding the discount US$12,207,000 paid out

13.00 cents per share level. in the year, all has

(based on the share been paid out of

price of 457.10 cents The Manager provides current year revenue.

per share at the Board with

31 December 2022, feedback and key The Company's

equivalent to the performance statistics portfolio managers

Sterling price of regarding the success attend professional

380.00 pence per share of the Company's investor/analyst

translated into US marketing initiatives meetings and webcast

cents at the rate which include presentations live to

prevailing at messaging to highlight professional and

31 December 2022 of the quarterly private investors over