UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

[X]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the SEC Only (as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to 14a-12

|

BREATHE ECIG CORP.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

1.

|

|

Title of each class of securities to which transaction applies:

|

|

2.

|

|

Aggregate number of securities to which transaction applies:

|

|

3.

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

4.

|

|

Proposed maximum aggregate value of transaction:

|

|

5.

|

|

Total fee paid:

|

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

1.

|

|

Amount Previously Paid:

|

|

2.

|

|

Form, Schedule or Registration Statement No.:

|

|

3.

|

|

Filing Party:

|

|

4.

|

|

Date Filed:

|

322 Nancy Lynn Lane, Suite 7

Knoxville, Tennessee 37919

Tel. (917) 796-9926

NOTICE OF CONSENT SOLICITATION

February __, 2016

Dear Breathe Ecig Corp. Stockholder:

The Board of Directors of Breathe Ecig Corp., a Nevada corporation (the “Company” or “we”), is writing to solicit your written consent on behalf of the Company to approve the following proposal:

|

●

|

an amendment to our Articles of Incorporation to increase the total number of our authorized shares of common stock, par value $0.001 per share (“Common Stock”), from 500 million shares to 8 billion shares (the “Authorized Share Increase Amendment”).

|

Our Board of Directors approved the Authorized Share Increase Amendment on February 1, 2016. Each of these matters is more fully discussed in the attached Consent Solicitation Statement.

Rather than calling a special meeting of our stockholders, and incurring the expense and management time associated with holding a special meeting, our Board of Directors has elected to obtain stockholder approval of the Authorized Share Increase Amendment by written consent (“Written Consent”) pursuant to Article II, Section 12 of our Bylaws and Section 78.370 of the Nevada Revised Statues. The close of business on February 4, 2016 has been fixed as the record date for the determination of holders of our Common Stock entitled to receive notice of and discretion to approve the Authorized Share Increase Amendment.

This consent solicitation is being made on the terms and subject to the conditions set forth in the accompanying Consent Solicitation Statement. To be counted, we must receive your properly completed Written Consent, a form of which is attached to the Consent Solicitation Statement, by 5:00 p.m. Eastern Time, on or before March 15, 2016 (the “Expiration Date”), provided, however, our Board of Directors may change the Expiration Date to an earlier date at its sole discretion.

Not submitting the requested Written Consent before the Expiration Date will have the same effect as a vote “AGAINST” the Authorized Share Increase Amendment.

Your Board of Directors recommends that all stockholders approve the Authorized Share Increase Amendment by returning their completed Written Consent to us by one of the methods set forth in the form of Written Consent.

By order of the Board of Directors,

/s/ Seth M. Shaw

Seth M. Shaw

Chairman

322 Nancy Lynn Lane, Suite 7

Knoxville, Tennessee 37919

Tel. (917) 796-9926

_____________________________________________________________________________________________

CONSENT SOLICITATION STATEMENT

_____________________________________________________________________________________________

This Consent Solicitation Statement is being furnished in connection with the solicitation of written consents of the stockholders of Breathe Ecig Corp., a Nevada corporation (the “Company “, “us “, “we “or “our”), with regard to the following proposal:

| ● |

an amendment to our Articles of Incorporation to increase the total number of our authorized shares of common stock, par value $0.001 per share (“Common Stock”), from 500 million shares to 8 billion shares (the “Authorized Share Increase Amendment”).

|

Our Board of Directors elected to seek stockholder approval by written consent (“Written Consent”), rather than calling a special meeting of stockholders, to eliminate the costs and management time involved in holding a special meeting. Written Consents are being solicited from all of our stockholders of record pursuant to Article II, Section 12 of our Bylaws and Section 78.320 of the Nevada Revised Statutes.

Who May Consent

This Consent Solicitation Statement and attached Written Consent form are being mailed to stockholders entitled to receive notice of and discretion to approve the Authorized Share Increase Amendment on or about February 4, 2016, the record date for the determination of stockholders entitled to act with respect to this consent solicitation (the “Record Date”). Only holders of our Common Stock as of the Record Date are entitled to act with respect to this consent solicitation, and on the Record Date there were 487,481,277 shares of Common Stock outstanding, each of which is entitled to one vote per share.

Stockholders who wish to consent to the Authorized Share Increase Amendment must complete and return the attached Written Consent form by 5:00 p.m. Eastern Time on or before March 15, 2016 (the “Expiration Date”). Our Board of Directors expressly reserves the right, in its sole discretion and regardless of whether any of the conditions of this consent solicitation have been satisfied, subject to applicable law, at any time prior to Expiration Date to (i) terminate this consent solicitation for any reason, including receipt of the consent of stockholders holding a majority of our outstanding shares of Common Stock, (ii) waive any of the conditions to this consent solicitation, or (iii) amend the terms of this consent solicitation.

Stockholders who wish to consent must deliver a properly completed and executed Written Consent form to Seth M. Shaw, our Chief Executive Officer, in accordance with the instructions set forth in the attached Written Consent form. The Company reserves the right (but is not obligated) to accept any Written Consent received by any other reasonable means or in any form that reasonably evidences the giving of consent to the approval of the Authorized Share Increase Amendment.

If you hold your shares in “street” name with a bank, brokerage firm, dealer, trust company or other nominee, only they can exercise your right to consent with respect to your shares of Common Stock, and only upon receipt of your specific instructions. Accordingly, it is critical that you promptly give instructions to consent to each of the proposals to your bank, brokerage firm, dealer, trust company or other nominee. Please follow the instructions to consent provided on the enclosed Written Consent form. If your bank, brokerage firm, dealer, trust company or other nominee provides for consent instructions to be delivered to them by telephone or Internet, instructions will be included on the Written Consent form.

Requests for copies of this Consent Solicitation Statement should be directed Breathe Ecig Corp. at the address and/or telephone number set forth above.

We will act as tabulation agent for this consent solicitation. If you have any questions regarding your Written Consent form, or if you need assistance submitting your completed Written Consent, please contact Seth M. Shaw at (917) 796-9926.

Consent Required

Stockholder approval of the Authorized Share Increase Amendment will be effective upon our receipt of affirmative Written Consent, not previously revoked, representing at least 243,740,639 shares of Common Stock, or a majority of the shares of Common Stock issued and outstanding as of the Record Date and entitled to approve of the Authorized Share Increase Amendment. Accordingly, abstaining from submitting your Written Consent will have the effect of a vote “AGAINST” each Proposal.

Revocation of Consents

You may withdraw or change your Written Consent at any time prior to the Expiration Date by submitting a written notice of revocation to our Chief Executive Officer at the address set forth above. A notice of revocation or withdrawal must specify the record stockholder’s name and the number of shares being withdrawn. After the Expiration Date, all Written Consents previously executed and delivered and not revoked will become irrevocable.

Absence of Appraisal Rights

Stockholders who abstain from approving of the Authorized Share Increase Amendment, or who withhold consent of the Authorized Share Increase Amendment, do not have the right to an appraisal of their shares of Common Stock, or any similar dissenters’ rights under the Nevada Revised Statutes, or our Articles of Incorporation and Bylaws.

Expenses of this Consent Solicitation

This consent solicitation is being made by our Board of Directors, and the Company will bear the entire cost of the solicitation, including preparation, printing and mailing costs. Written Consents will be solicited principally through the mail, but our directors, officers and employees may solicit Written Consents personally, by phone or electronically. Arrangements will be made with brokerage firms and other custodians, nominees and fiduciaries to forward these consent solicitation materials to stockholders whose shares of Common Stock are held of record by such entities, and we will reimburse suck brokerage firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection herewith.

PROPOSAL TO BE ACTED UPON BY STOCKHOLDERS:

AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE OUR AUTHORIZED SHARES OF COMMON STOCK FROM 500 MILLION SHARES TO 8 BILLION SHARES

The first paragraph of Article 3 of our Articles of Incorporation (as amended) currently reads as follows:

“The aggregated number of shares that the Corporation will have authority to issue is five hundred ten million (510,000,000) of which five hundred million (500,000,000) shall be common stock, with a par value of $0.001 per share, and ten million (10,000,000) shares will be preferred shares, with a par value of $0.001 per share.”

The Board of Directors approved and recommends that all stockholders approve an amendment to Article 3 of our Articles of Incorporation to increase the authorized number of shares of Common Stock from 500 million shares to 8 billion shares (the “Authorized Share Increase Amendment”). If this proposal is adopted, the first paragraph of Article 3 of our Articles of Incorporation will read as follows:

“The aggregated number of shares that the Corporation will have authority to issue is eight billion ten million (8,010,000,000) of which eight billion (8,000,000,000) shall be common stock, with a par value of $0.001 per share, and ten million (10,000,000) shall be preferred shares, with a par value of $0.001 per share.”

Only the number of shares of Common Stock issuable by the Company will be affected by the Authorized Share Increase Amendment. No other provision of our Articles of Incorporation will be affected. If approved by a majority of holders of our outstanding shares of Common Stock entitled to vote as of the Record Date, we will file an amendment, in substantially the form attached hereto as Appendix A , with the Nevada Secretary of State to implement the Authorized Share Increase Amendment.

Description of our Common Stock

Except as otherwise expressly provided in our Articles of Incorporation, or as required by applicable law, all shares of our Common Stock have the same rights and privileges and rank equally, share ratably and are identical in all respects as to all matters, including, without limitation, those described below. All of our outstanding shares of Common Stock are fully paid and non-assessable.

Voting rights

Each holder of our Common Stock is entitled to cast one vote for each share of Common Stock held on all matters submitted to a vote of stockholders. Cumulative voting for election of directors is not allowed under our Articles of Incorporation, which means that a plurality of the shares voted can elect all of the directors then outstanding for election. Except as otherwise provided under Nevada law or our Articles of Incorporation, and Bylaws, on matters other than election of directors, action on a matter is approved if the votes cast favoring the action exceed the votes cast opposing the action.

Dividend rights

The holders of our outstanding shares of Common Stock are entitled to receive dividends out of funds legally available, if our Board of Directors, in its discretion, determines to issue dividend, and only at the times and in the amounts that our board of directors may determine. Our Board of Directors is not obligated to declare a dividend. We have not paid any dividends in the past and we do not intend to pay dividends in the foreseeable future.

Liquidation rights

Upon our liquidation, dissolution or winding-up, the holders of our Common Stock will be entitled to share equally, identically and ratably in all assets remaining, subject to the prior satisfaction of all outstanding debt and liabilities and the preferential rights and payment of liquidation preferences, if any, on any of our outstanding shares of preferred stock. We currently do not have any shares of preferred stock designate or outstanding.

No preemptive or similar rights

Our Common Stock is not entitled to, or subject to conversion, redemption, sinking fund or similar provisions regarding the Common Stock.

Purpose of and Rationale for the Authorized Share Increase Amendment

As of February 4, 2016, there are: (i) 487,481,277 outstanding shares of Common Stock and (ii) 12,518,723 shares of Common Stock reserved for future issuance under our current convertible notes. The Company’s outstanding convertible notes are described further below. As such, we currently do not have the ability to enter into any new agreements to issue shares of our common stock.

Group 10 Holdings Convertible Note

On June 10, 2015, the Company entered into a Convertible Debenture with Group 10 Holdings, LLC (“Group 10”) in the principal amount of $96,000 with a maturity date of June 10, 2016 (the “Group 10 Note”). The note is currently accruing interest at 18% per annum. Pursuant to the terms of the Group 10 Note, at any time Group 10 may convert any principal and interest due to it at the lesser of (a) 40% discount to the lowest closing bid price of the common stock for the twenty trading days prior to the conversion notice or (b) $0.06. However, the discount rate increases to 75% in the event the Company’s stock price falls below $0.01. Additionally, the discounts will be adjusted on a ratchet basis in the event the Company offers a more favorable discount rate during the term of the Group 10 Note. The Company currently does not have the right to prepay the Group 10 Note without the consent of Group 10.

As of the date of the filing, there is currently $106,795 principal, accrued but unpaid interest and penalties still outstanding under the Group 10 Note. Currently, the Group 10 Note is accruing a $1,000 penalty every business day as a result of the Company’s inability to reserve the number of Shares required under the Group 10 Note, as noted below.

Based on the Company’s closing stock price of $0.0014 on February 3, 2016 and the 75% discount, the Company would be required to issue an additional 305,128,571 shares of its common stock under the Group 10 Note. If the Company’s stock price continues to fall, this amount will increase, perhaps substantially and cause additional material dilution. Additionally, the Company is required to reserve five times the number of shares of Common Stock currently underlying the Group 10 Note, which as of the filing date is approximately 1,525,642,855 shares of Common Stock. The Company will only be able to comply with this provision if Authorized Share Increase Amendment is approved.

EMA Financial Convertible Note

On December 23, 2015, the Company entered into a 10% Convertible Note with EMA Financial, LLC (“EMA Financial”) in the principal amount of $82,116.31 with a maturity date of December 23, 2016 (the “EMA Financial Note”).

Pursuant to the terms of the EMA Financial Note, at any time EMA Financial may convert any principal and interest due to it at the lesser of (a) 35% discount to the lowest closing bid price of the common stock for the twenty trading days prior to the conversion notice or (b) $0.0017. Additionally, the discounts will be adjusted on a ratchet basis in the event the Company offers a more favorable discount rate during the term of the EMA Financial Note.

The Company may prepay the amounts under the EMA Financial Note as follows: (i) if prepaid within ninety days, the Company must pay a 20% premium on all principal and interest outstanding and (ii) if prepaid after ninety days but before the one hundred and eighty days, the Company must pay a 40% premium on all principal and interest outstanding.

Additionally, the Company agreed the principal amount of the EMA Financial Note will increase to $164,332.62 if the Company is unable to reserve 647,000,000 shares of its Common Stock to satisfy its obligations under the EMA Financial Note by March 15, 2016.

Based on the Company’s closing stock price of $0.0014 on February 3, 2016 and the 35% discount, the Company would be required to issue an additional 90,237,70 shares of its common stock under the EMA Financial Note. If the Company’s stock price continues to fall, this amount will increase, perhaps substantially and cause additional significant dilution.

General Discussion

Except as set forth above, the Company currently does not have any plans, proposals or arrangements, written or otherwise, to issue additional shares of common stock

Thus, as of the Record Date, we do not have sufficient authorized shares of our Common Stock available to permit conversion or exercise of all currently outstanding derivative securities, and no additional shares of our authorized Common Stock are available for issuance to obtain additional financing for our current operations, execute our business plans, or provide us with the necessary flexibility to enter into favorable strategic financial transactions, including potential acquisitions and other collaborations involving equity or equity-linked components, that could improve our capital structure and enhance its opportunities for significant growth and advancement of product development programs.

The Authorized Share Increase Amendment will provide us with sufficient authorized but unissued Common Stock to permit conversion and exercise of all of our currently outstanding securities, and will enable us to both respond quickly to opportunities to raise capital in public or private securities offerings and pursue key acquisition opportunities. The availability of additional authorized shares will enable our Board of Directors to act with flexibility to issue shares of Common Stock in connection with future financing opportunities, or strategic acquisitions, debt restructurings or resolutions, strategic equity compensation and incentives to employees, officers, independent directors and advisors, forward stock splits and other favorable opportunities that may arise to enhance our capital structure and business prospects. We might also use shares of the Common Stock to settle various lawsuits which exist against the Company. If, however, stockholders do not consent to the Authorized Share Increase Amendment, we will be severely limited in our ability issue any shares of Common Stock, be it for strategic transactions, equity compensation, opportunities for additional working capital, or otherwise.

We believe that the Authorized Share Increase Amendment will provide us with sufficient shares of Common Stock to satisfy our obligations to issue Common Stock, and enable us to pursue a range of strategic opportunities in the best interest of our stockholders. Other than as specified above and as permitted or required under outstanding options, warrants and other securities convertible into shares of our Common Stock, we have no present arrangements, agreements or understandings for the use of the additional shares proposed by the Authorized Share Increase Amendment. We reserve the right to seek a further increase in authorized shares, from time to time in the future, if and as appropriate.

Effect on Outstanding Common Stock

The additional shares of Common Stock authorized by the Authorized Share Increase Amendment will have the same privileges as the shares of Common Stock currently authorized and issued. Stockholders do not have preemptive rights under our Articles of Incorporation and will not have such rights with respect to the additional authorized shares of Common Stock. The Authorized Share Increase Amendment would not affect the terms or rights of holders of existing shares of Common Stock. All outstanding shares of Common Stock will continue to have one vote per share on all matters to be voted on by our stockholders, including the election of directors.

The issuance of any additional shares of Common Stock may, depending on the circumstances under which those shares are issued, reduce stockholders' equity per share and, unless additional shares are issued to all stockholders on a pro rata basis, will reduce the percentage ownership of Common Stock of existing stockholders. In addition, if our Board of Directors elects to issue additional shares of Common Stock, such issuance could have a dilutive effect on the earnings per share, voting power and shareholdings of current stockholders. We expect, however, to receive consideration for any additional shares of Common Stock issued, thereby reducing or eliminating any adverse economic effect to each stockholder of such dilution.

The Authorized Share Increase Amendment will not otherwise alter or modify the rights, preferences, privileges or restrictions of the Common Stock.

Anti-Takeover Effects

Although the Authorized Share Increase Amendment is not motivated by anti-takeover concerns, and is not considered by our Board of Directors to be an anti-takeover measure, the availability of additional authorized shares of Common Stock could enable the Board of Directors to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of the Company more difficult or time-consuming. For example, shares of Common Stock could be issued to purchasers who might side with management in opposing a takeover bid that the Board of Directors determines is not in the best interests of our stockholders, thus diluting the ownership and voting rights of the person seeking to obtain control of the Company. In certain circumstances, the issuance of Common Stock without further action by the stockholders may have the effect of delaying or preventing a change in control of the Company, may discourage bids for our Common Stock at a premium over the prevailing market price and may adversely affect the market price of our Common Stock. As a result, increasing the authorized number of shares of our Common Stock could render more difficult and less likely a hostile takeover of the Company by a third-party, or a tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the possible removal of our incumbent management. We are not aware of any proposed attempt to take over the Company or of any present attempt to acquire a large block of our Common Stock.

Required Approval

We must receive affirmative, valid Written Consents approving this Proposal, representing at least 243,740,639 votes, or a majority of the shares of Common Stock issued and outstanding as of the Record Date and entitled to act upon this Proposal. Abstaining from submitting your Written Consent form will have the effect of a vote “AGAINST” this Proposal.

Board of Directors Recommendation

Your Board of Directors recommends that you mark the box entitled “FOR” the approval of the Authorized Share Increase Amendment.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our Common Stock as of February 4, 2016 for:

|

●

|

each stockholder known by us to be the beneficial owner of more than 5% of our Common Stock;

|

|

●

|

each of our directors;

|

|

●

|

each of our named executive officers; and

|

|

●

|

all of our directors and executive officers as a group.

|

Applicable percentage ownership is based on 487,481,277 shares of capital stock outstanding at February 4, 2016. In computing the number of shares of Common Stock beneficially owned by a person, we deemed to be outstanding all shares of Common Stock subject to options or warrants held by that person or entity that are currently exercisable or that will become exercisable within 60 days of February 4, 2016 and all shares of Common Stock issuable pursuant to promissory notes and related accrued interest convertible into shares of Common Stock at February 4, 2016. In computing the percentage of shares beneficially owned, we deemed to be outstanding all shares of Common Stock subject to options or warrants held by that person or entity that are currently exercisable or that will become exercisable within 60 days of February 4, 2016 and all shares of Common Stock issuable pursuant to promissory notes and related accrued interest convertible into shares of Common Stock at February 4, 2016. Unless otherwise noted below, the address of each beneficial owner listed in the table is c/o Breathe Ecig Corp., 322 Nancy Lynn Lane, Suite 7, Knoxville, Tennessee 37919.

|

Name and address of beneficial owner

|

|

Number of shares beneficially owned

|

|

Percent of shares beneficially owned (1)

|

|

|

Executive officers and directors:

|

|

|

|

|

|

|

|

Seth M. Shaw, Charmain of the Board, CEO and CFO

|

|

|

3,250,000

|

|

0.66

|

%

|

| |

|

|

|

|

|

|

|

5% Stockholders:

|

|

|

|

|

|

|

|

Breathe Ecigs Corp (2)

|

|

|

125,650,000

|

|

25.78

|

%

|

|

M Capital Partners LLC (3)

|

|

|

24,499,867

|

|

5.02

|

%

|

| |

|

|

|

|

|

|

|

All executive officers and directors as a group (1 person)

|

|

|

3,250,000

|

|

00.66

|

%

|

|

(1)

|

Assumes 487,481,277 shares of Common Stock are issued and outstanding as of February 4, 2016.

|

|

(2)

|

Breathe Ecigs Corp is a Tennessee corporation wholly-owned by Joshua Kimmel. The primary business address of Breathe Ecigs Corp is 9921 Lani Lane, Knoxville, Tennessee 37932. Mr. Kimmel has sole voting and investment control over the shares held by Breathe Ecigs Corp. Mr. Kimmel previously served as a member of the Board of Directors of the Company as well as our Chief Executive Officer and Chief Financial Officer. Mr. Kimmel resigned from all such positions on January 22, 2016.

|

|

(3)

|

The primary business address of M Capital Partners LLC is 1395 East 34th Street, Brooklyn, New York 11210. Sara Evans has voting and investment control over the shares held by M Capital Partners LLC.

|

| |

|

| |

|

Stockholder Proposals for 2016 Annual Meeting

A date has not yet been set for our 2016 Annual Meeting of Stockholders. If a stockholder wishes to submit a stockholder proposal pursuant to Rule 14a-5(e) of the Securities Exchange Act of 1934, as amended, for inclusion in our Proxy Statement for the 2016 Annual Meeting of Stockholders, we must receive such proposal and supporting statements, if any, at our principal executive office at a reasonable time before we begin to print our annual meeting proxy statement. A stockholder’s notice to our secretary must set forth as to each matter the stockholder proposes to bring before the 2016 Annual Meeting of Stockholders: (1) a brief description of the business desired to be brought before the 2016 Annual Meeting of Stockholders; (2) the reason(s) for conducting such business at the 2016 Annual Meeting of Stockholders; (3) the name and record address of the stockholder proposing such business; (4) the class and number of our shares that are beneficially owned by the stockholder proposing such business; and (5) any financial interest in the proposed business of the stockholder proposing such business.

If a stockholder wishes to submit a stockholder proposal outside of Rule 14a-5(e) to be brought before the 2016 Annual Meeting of Stockholders, the stockholder must give timely notice in writing to our secretary. We must receive such notice at our principal executive office not less than 60 days nor more than 90 days prior to the date of the 2016 Annual Meeting of Stockholders, pursuant to our Bylaws.

Stockholder Communications with the Board of Directors

Our Board of Directors provides stockholders with the ability to send communications to the Board of Directors, and stockholders may do so at their convenience. In particular, stockholders may send their communications to: Board of Directors, c/o Chief Executive Officer, Breathe Ecig Corp., 322 Nancy Lynn Lane, Suite 7, Knoxville, Tennessee 37919. All communications received by the corporate secretary are relayed to the Board of Directors of the Company.

Delivery of Documents to Stockholders

Householding Information : As permitted by the SEC’s rules, we will deliver only one copy of this Consent Solicitation Statement to two or more stockholders who share an address, unless we have received contrary instructions from one or more of the stockholders. We will deliver promptly, upon written or oral request, a separate copy of the annual report or consent solicitation statement to a stockholder at a shared address to which a single copy of the documents was delivered. Conversely, stockholders sharing an address who are receiving multiple copies of our annual reports, proxy statements or consent solicitation statements may request delivery of a single copy. Such a request must be a written request to the Company at 322 Nancy Lynn Lane, Suite 7, Knoxville, Tennessee 37919, or by calling (917) 796-9926. The Company undertakes to deliver promptly, upon any such oral or written request, a separate copy of its proxy materials to a stockholder at a shared address to which a single copy of these documents was delivered. Stockholders who currently receive multiple copies of the Company’s proxy materials at their address and would like to request “householding” of their communications should contact their broker, bank or other nominee, or contact the Company at the above address or phone number.

WHERE YOU CAN FIND ADDITIONAL INFORMATION ABOUT OUR COMPANY

We file reports, proxy statements and other information with the SEC. Such reports, statements and other information filed by us with the SEC can be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Copies of such material can also be obtained from the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates. Furthermore, the SEC maintains a web site that contains reports, proxy and Proxy Statements and other information regarding the Company. The address of such web site is http://www.sec.gov .

WRITTEN CONSENT SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS OF BREATHE ECIG CORP.

The undersigned hereby acknowledges receipt of a copy of the accompanying Notice for Action by Written Consent and the Consent Solicitation Statement of Breathe Ecig Corp., a Nevada corporation (the “Company”), dated February __, 2016 and hereby revokes any consent or consents heretofore given. This written consent may be revoked at any time before 5:00 p.m. (Eastern Time), on March 15, 2016, unless the solicitation period is shortened or extended by the Company’s Board of Directors in its sole discretion (“Expiration Date”). The undersigned, as the holder of shares of the Company’s common stock, par value $0.001 per share, (“Common Stock”), hereby takes the following actions with respect to all shares of Common Stock held by him, her or it as follows:

| |

|

x Please mark your votes as indicated in this example.

|

| |

|

|

|

|

|

|

|

|

|

FOR

|

|

AGAINST

|

| |

|

APPROVAL OF AN AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 500 MILLION SHARES TO 8 BILLION SHARES

|

|

|

|

|

|

|

|

[ ]

|

|

[ ]

|

This Written Consent, when properly executed and returned to the Company, will be voted in the manner directed herein by the undersigned. IF NO DIRECTION IS MADE FOR THE PROPOSAL, THIS WRITTEN CONSENT, IF SO EXECUTED AND RETURNED, WILL BE VOTED “FOR”THE PROPOSAL. When shares of Common Stock are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, give full legal title as such. If a corporation, sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person.

ALL WRITTEN CONSENTS MUST BE RECEIVED BY 5:00 P.M., EASTERN TIME, ON THE EXPIRATION DATE.

This Written Consent, when properly executed and returned to the Company, will be voted in the manner directed herein by the undersigned. IF NO DIRECTION IS MADE FOR THE PROPOSAL, THIS WRITTEN CONSENT, IF SO EXECUTED AND RETURNED, WILL BE VOTED “FOR”THE PROPOSAL. When shares of Common Stock are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, give full legal title as such. If a corporation, sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person.

ALL WRITTEN CONSENTS MUST BE RECEIVED BY 5:00 P.M., EASTERN TIME, ON THE EXPIRATION DATE.

|

|

IMPORTANT: This Written Consent must be signed exactly as your name appears hereon. If more than one name appears, all persons so designated should sign. Attorneys, executors, administrators, trustees and guardians should indicate their capacities. If the signer is a corporation, please print full corporate name and indicate capacity of duly authorized officer executing on behalf of the corporation. If the signer is a partnership, please print full partnership name and indicate capacity of duly authorized person executing on behalf of the partnership.

Dated: ________________________, 2016

(Print Name of Stockholder)

________________________________________________________________________

(Signature of Stockholder)

________________________________________________________________________

(Second Signature if held jointly)

________________________________________________________________________

|

IMPORTANT: PLEASE COMPLETE, SIGN, AND DATE YOUR WRITTEN CONSENT PROMPTLY

AND FAX IT TO 1-514-221-3336, OR RETURN IT TO:

Breathe Ecig Corp.

Attn: Seth M. Shaw, Chief Executive Officer

322 Nancy Lynn Lane, Suite 7

Knoxville, Tennessee 37919

Your executed written consent can also be sent via email in PDF form to sethsms47@aol.com.

Your written consent should be received by the Company before 5:00 pm (Eastern Time) on March 15, 2016.

CERTIFICATE OF AMENDMENT

TO

ARTICLES OF INCORPORATION

OF

BREATHE ECIG CORP.

Breathe Ecig Corp., a Nevada corporation (the “Corporation”), does hereby certify that:

FIRST: This Certificate of Amendment amends the provisions of the Corporation's Articles of Incorporation (the “Articles of Incorporation”).

SECOND: The terms and provisions of this Certificate of Amendment have been duly adopted in accordance with Section 78.380 of the Nevada Revised Statutes and shall become effective immediately upon filing this Certificate of Amendment.

THIRD: The first paragraph of Article 3 of the Articles of Incorporation is hereby amended in its entirety and replaced with the following:

“The aggregated number of shares that the Corporation will have authority to issue is eight billion ten million (8,010,000,000) of which eight billion (8,000,000,000) shall be common stock, with a par value of $0.001 per share, and ten million (10,000,000) shall be preferred shares, with a par value of $0.001 per share.”

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its officers thereunto duly authorized this __ day of _________, 2016.

By:

__________________________________

Name: Seth M. Shaw

Title: Chief Executive Officer

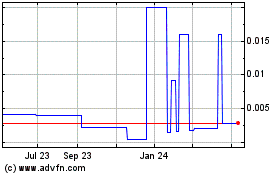

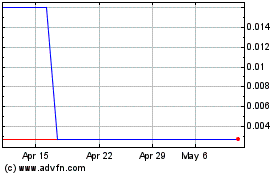

White Fox Ventures (PK) (USOTC:AWAW)

Historical Stock Chart

From May 2024 to Jun 2024

White Fox Ventures (PK) (USOTC:AWAW)

Historical Stock Chart

From Jun 2023 to Jun 2024