Victory Energy Corporation (PINKSHEETS: VYEY), an oil and gas

exploration and development company, today announced that it has

completed an internal review and examination of its financial

results for the fiscal years 2007, 2008, and 2009, and has filed

its 2009 Annual Report on Form 10-K with the Securities and

Exchange Commission. Included in this 10-K filing are audited

financial statements for the 2007 (restated), 2008 and 2009 fiscal

years.

In April 2009, Victory Energy Corporation (the Company)

announced that it planned to restate its annual and interim

financial statements for 2007 and interim financial statements for

2008 due to errors contained in the financial statements, and that

it expected certain delays in reporting subsequent financial

results. At that time the Company also stated that investors should

not rely on any of the Company's previously filed financial

statements covering 2007 and 2008.

The resulting restatements are a consequence of an internal

review conducted by Victory Energy's CFO at the request of the

board of directors in which irregularities in the Company's

financial statements were identified, examined and reported

upon.

The internal review and financial statement restatements were

completed on March 29, 2011. In summary, the Company reported the

following operating results for the years ended December 31:

VICTORY ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

Years Ended December 31:

-------------------------------------------

2007

2009 2008 (Restated)

------------- ------------- -------------

REVENUES $ 512,607 $ 1,642,631 $ -

COSTS AND EXPENSES

Costs of production 196,520 934,534 -

General and administrative

expense 935,983 3,519,409 10,320,050

Depletion and accretion 291,867 564,377 -

Loss from malfeasance 280,647 4,955,793 -

Loss from asset impairment 342,366 2,775,696 -

Loss (gain) on settlements (1,199,748) 390,000 -

------------- ------------- -------------

Total costs and expenses 847,635 13,139,809 10,320,050

------------- ------------- -------------

LOSS FROM OPERATIONS (335,028) (11,497,178) (10,320,050)

------------- ------------- -------------

Interest expense 50,111 979 6,639

------------- ------------- -------------

NET LOSS $ (385,139) $ (11,498,157) $ (10,326,689)

============= ============= =============

Weighted average shares,

basic and diluted 136,719,608 95,529,303 23,587,429

============= ============= =============

Net loss per share, basic

and diluted $ (0.00) $ (0.12) $ (0.44)

============= ============= =============

Robert J. Miranda, Victory Energy's chairman, chief executive

officer and chief financial officer, stated, "The process of

reviewing and restating the financials for the Company has been a

lengthy and arduous process. We worked closely with our board of

directors, legal counsel, independent public accounting firm, and

the Securities and Exchange Commission in an effort to bring our

financial reporting into compliance. We are pleased this long

process is over and we remain focused on completing the many tasks

at hand, including the preparation of the financial results for

fiscal 2010 and the continuing process of exploration and

development of the various oil and gas properties in which we have

invested."

Litigation with Former CEO Settled

On March 22, 2011, the Company, James Capital Energy, LLC, and

other related parties entered into a comprehensive Settlement

Agreement with Jon Fullenkamp, the Company's former Chairman and

CEO. Under the terms of the settlement agreement, Mr. Fullenkamp

will: i) dismiss with prejudice the lawsuit he filed against the

Company and others in California; ii) transfer to Victory Energy

two million shares of Victory Energy preferred stock; iii) transfer

to Victory Energy 400 thousand warrants for Victory Energy common

stock; iv) transfer to James Capital Energy, LLC approximately 16

million shares of Victory Energy common stock; v) voluntarily

appear for his deposition to discuss events that occurred at the

Adams-Baggett Ranch; vi) waive the claim he had to a $430 thousand

severance payment under his May 15, 2009 separation agreement; and

vii) provide Victory Energy and other related parties with a

general release.

$1.5 Million of New Capital Raised in Private

Placements

As reported in the filings, between October 15, 2010 and March

28, 2011, the Company sold to a group of 20 accredited investors

$1.0 million of 10% Senior Secured Convertible Debentures which are

convertible into an aggregate of 201 million shares of the

Company's common stock at a conversion price of $0.005 per share of

common stock. On December 31, 2010, the Company extended $0.5

million of unsecured loans that had been made by a related party

into a Senior Secured Convertible Debenture that is convertible

into an aggregate of 110.5 million shares of the Company's common

stock at a conversion price of $0.005 per share of common stock.

The maturity date of the Debentures is September 30, 2013, but may

be extended at the discretion of the Company to December 31, 2013.

The proceeds of these securities sales are being used for working

capital purposes.

The board of directors of Victory Energy Corporation recognized

the efforts undertaken to complete the internal review and restore

the Company's reporting status with the SEC. At a board meeting

held on March 28, 2011, the board acknowledged the work of the

management team and professionals that managed the turnaround. Dr.

Ronald Zamber, a member of the board of directors for Victory

Energy, has been the key financial sponsor of this corporate

turnaround process. The board of directors hired Robert Miranda as

the Company's chief financial officer at the end of 2008, and later

expanded the scope of his work to lead an internal review and

assist the board in identifying suspected financial malfeasance at

the Company. Miranda and his accounting firm, Miranda &

Associates, brought the Company's financial statements into

compliance; investigated and identified the financial malfeasance;

assisted legal counsel in prosecuting the malfeasance; corrected

the Company's past accounting records; and restored financial

controls and integrity in the financial reporting processes of the

Company.

Dr. Zamber stated, "The board is grateful to Robert Miranda and

his firm for their meticulous efforts in managing the turnaround of

Victory Energy Corporation. The process was painstakingly long, but

we now see vast improvements in the Company's financial management

and reporting processes. During Bob's tenure as interim CEO, the

company hired a new management team and established an office in

Austin, Texas, where it is successfully searching for and engaging

in new oil and gas opportunities. Bob and his accounting firm

worked diligently with the independent auditors and the SEC to

bring Victory Energy back into compliance."

Robert J. Miranda commented, "Miranda & Associates has

worked very closely with the board of directors of Victory Energy

to achieve this turnaround. Our legal team, including board member

and attorney David McCall in Texas, and attorney Jonathan Michaels

in Newport Beach, will continue to focus on the judgment award and

continuing legal proceedings in Texas and California. We will

continue to work diligently with our independent auditors and with

the new members of the management team in Austin. There is still a

lot more to be done to recover our assets and we remain focused on

doing the right thing for Victory Energy and its shareholders."

Robert J. Miranda is managing director of Miranda &

Associates, A Professional Accountancy Corporation. He is a

graduate of the University of Southern California and Harvard

Business School. He is also a certified public accountant, duly

licensed in California. His 35 year career includes five years with

KPMG's audit practice, fifteen years as founder/CEO of a regional

CPA firm, five years as a national director of Deloitte &

Touche, and five years with Jefferson Wells, an international

consultancy. His executive management experience includes founding

and managing a regional professional services firm that operated

multiple offices in the United States and internationally. While

associated with Jefferson Wells, an international consultancy, Mr.

Miranda served as Global Operations Director and was responsible

for managing a team of 250 professionals that implemented an

enterprise wide Sarbanes-Oxley compliance program for a major

Chicago-based aerospace and defense firm.

About Victory Energy Corporation

Victory Energy Corporation is engaged in the exploration,

acquisition, development, and exploitation of oil and gas

properties. The Company's current producing assets are located in

the state of Texas.

Victory Energy seeks to identify proven development prospects,

conduct thorough geological and engineering evaluations and then

target suitable farm-in partners for long term development of

additional prospects.

For more information, please visit our website www.vyey.com.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

There are forward-looking statements contained in this news

release. They use such words as "intend," "will," "may," "expect,"

"believe," "plan," or other similar terminology. These statements

involve known and unknown risks, uncertainties and other factors,

which may cause the actual results to be materially different than

those expressed or implied in such statements. These factors

include, but are not limited to: risks associated with the

implementation of the Company's strategic growth plan; legislation

and government regulation including the ability to obtain

satisfactory regulatory approvals; conditions beyond the Company's

control such as weather, natural disasters, disease outbreaks,

epidemics or pandemics impacting the Company's customer base or

acts of war or terrorism; availability and cost of materials and

labor; demand for natural gas; cost and availability of capital;

competition; the Company's overall marketing, operational and

financial performance; economic and political conditions; the

continued service of the Company's executive officer; adverse

developments in and increased or unforeseen legal costs related to

the Company's litigation; the success of the Company's strategic

partnerships and joint venture relationships; the Company's ability

to pay certain debts; adoption of new, or changes in, accounting

policies and practices; adverse court rulings; results of other

litigation in which the Company is involved; and other factors

discussed from time to time in the Company's news releases, public

statements and/or filings with the Securities and Exchange

Commission. Forward-looking information is provided by Victory

Energy Corporation pursuant to the safe harbor established under

the Private Securities Litigation Reform Act of 1995 and should be

evaluated in the context of these factors. In addition, the Company

disclaims any intent or obligation to update these forward-looking

statements.

Add to Digg Bookmark with del.icio.us Add to Newsvine

CONTACT: Robert J. Miranda Chairman and Chief Executive Officer

714.480.0305 Investor Relations 714.227.0391

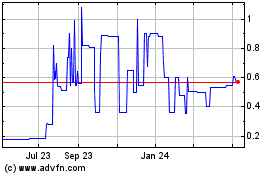

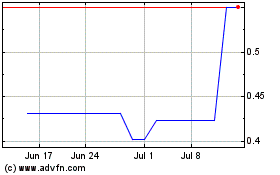

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Nov 2023 to Nov 2024