Victory Energy Corporation (PINKSHEETS: VYEY), an oil and gas

exploration and development company, today announced that it has

filed its first quarterly report for 2011 on Form 10-Q with the

Securities and Exchange Commission (SEC). Included in this 10-Q

filing are unaudited financial statements for the three month

period ended March 31, 2011.

In summary, the Company reported these results for the quarters

ended March 31, 2011 and 2010:

Quarters Ended March 31:

------------------------

2011 2010

----------- ------------

Revenues $ 108,320 $ 149,371

Costs and expenses 769,790 195,293

Interest expense 213,112 8,252

Gain on settlement with former officer __ 404,623

Income tax benefit 58,105 __

----------- ------------

Net Income (Loss) $ (816,477) $ 350,449

=========== ============

Weighted average shares, basic and diluted 136,719,608 136,719,608

=========== ============

Net loss per share, basic and diluted $ (0.01) $ 0.00

=========== ============

Our cash and cash equivalents, total current assets, total

assets, total current liabilities, and total liabilities as of

March 31, 2011, as compared to December 31, 2010, are as

follows:

March 31, December 31,

2011 2010

------------ ------------

Cash $ 187,494 $ 111,572

Total current assets 280,806 211,298

Total assets 1,034,207 763,033

Total current liabilities 677,905 631,195

Total liabilities 1,492,161 785,815

At March 31, 2011, we had a working capital deficit of $397.0

thousand compared to a working capital deficit of $712.2 thousand

at March 31, 2010. Current liabilities decreased to $677.9 thousand

at March 31, 2011, from $894.9 thousand at March 31, 2010.

The Company reported that as of May 16, 2011, it has raised a

total of $2.1 million of funds from a private placement of 10%

senior secured convertible debentures. The Company also reported

that it has invested in new oil & gas projects including an

option on a major gas project on South Padre Island, Texas; an oil

exploration project in Jones County, Texas; an oil and gas well

interest in Pecos County, Texas; and a natural gas well interest in

Wharton County, Texas.

Robert J. Miranda, Victory Energy's chairman, chief executive

officer and chief financial officer, stated, "We are pleased to

have completed the Company's first quarterly filing for 2011 with

the SEC and are now current in all of our SEC filings. Our

management team is now focused on the continuing process of

exploration and development of the various oil and gas properties

in which we have invested and identifying new opportunities."

About Victory Energy Corporation

Victory Energy Corporation is engaged in the exploration,

acquisition, development, and exploitation of oil and gas

properties. The company endeavors to utilize its broad range of oil

and gas industry relationships to acquire small interests in a

large volume of low- to moderate-risk oil and gas prospects. A

cornerstone of this strategy is an emphasis on developing and

maintaining relationships with proven, well established oil and gas

exploration and development companies.

Prospect acquisitions are ideally weighted toward oil, although

natural gas projects with high BTU content, favorable above market

pricing and modest decline rates will also be targeted. Targeted

prospects generally provide the company with a rapid return of

capital while offering multiple well locations for additional

drilling on an established trend. The model asset portfolio is

geologically and geographically diversified. The company's current

producing oil and gas assets are located in the United States.

For more information, please visit our website

http://www.vyey.com

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

There are forward-looking statements contained in this news

release. They use such words as "intend," "will," "may," "expect,"

"believe," "plan," or other similar terminology. These statements

involve known and unknown risks, uncertainties and other factors,

which may cause the actual results to be materially different than

those expressed or implied in such statements. These factors

include, but are not limited to: risks associated with the

implementation of the Company's strategic growth plan; legislation

and government regulation including the ability to obtain

satisfactory regulatory approvals; conditions beyond the Company's

control such as weather, natural disasters, disease outbreaks,

epidemics or pandemics impacting the Company's customer base or

acts of war or terrorism; availability and cost of materials and

labor; demand for natural gas; cost and availability of capital;

competition; the Company's overall marketing, operational and

financial performance; economic and political conditions; the

continued service of the Company's executive officer; adverse

developments in and increased or unforeseen legal costs related to

the Company's litigation; the success of the Company's strategic

partnerships and joint venture relationships; the Company's ability

to pay certain debts; adoption of new, or changes in, accounting

policies and practices; adverse court rulings; results of other

litigation in which the Company is involved; and other factors

discussed from time to time in the Company's news releases, public

statements and/or filings with the Securities and Exchange

Commission. Forward-looking information is provided by Victory

Energy Corporation pursuant to the safe harbor established under

the Private Securities Litigation Reform Act of 1995 and should be

evaluated in the context of these factors. In addition, the Company

disclaims any intent or obligation to update these forward-looking

statements.

Add to Digg Bookmark with del.icio.us Add to Newsvine

CONTACT: Robert J. Miranda Chairman and Chief Executive Officer

714.480.0305 Investor Relations 714.227.0391

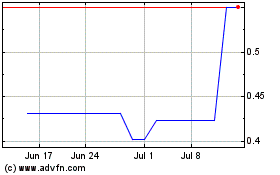

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Oct 2024 to Nov 2024

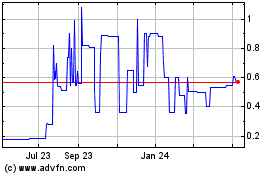

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Nov 2023 to Nov 2024