Unilife Announces Appointment of New Independent Director

November 11 2009 - 9:25AM

Marketwired

As announced on 1 September 2009, Unilife Medical Solutions Limited

("Unilife" or "the Company") (ASX: UNI) (PINKSHEETS: UNIFF) is

currently undertaking a transaction to redomicile the Unilife group

in the United States of America ("US") and is also seeking to list

on NASDAQ.

With a view to strengthening the credentials of the Unilife

board prior to Unilife's redomiciliation in the US ("Proposed

Transaction") and to meet NASDAQ independence requirements, the

Company today announced it has appointed Mr John M. Lund to its

Board of Directors as a non-executive member.

Mr Lund, a Certified Public Accountant, joins the Unilife Board

of Directors as its fifth member. As Unilife prepares to list on

NASDAQ, the addition of Mr Lund is particularly important as he

brings to the Board valuable expertise in the areas of SEC

reporting and compliance, mergers and acquisitions, and financial

analysis that qualify him to serve as Chairman of the Audit

Committee following Unilife's proposed listing on NASDAQ.

Mr Lund has held a number of distinguished, senior appointments

in the fields of finance and accounting. In the past year, he

served as an acquisition accounting consultant to support a major

merger project being undertaken by a NYSE-listed multinational

S&P 500 security technology company. In 2008, he was Vice

President and Controller of Nexstar Broadcasting Group, Inc, a

NASDAQ listed television broadcasting company. Prior to Nexstar he

served as the Vice President of Finance and Corporate Controller

for LQ Management, which operates more than 575 hotels across North

America. Between 1997 and 2001, he held the position of Chief

Financial Officer at North American telecommunications company CS

Wireless Systems, an SEC registrant that was acquired by MCI (also

a NASDAQ company) in 1999. While at KPMG (Peat Marwick) between

1991 and 1996, Mr Lund also assisted publicly listed companies with

SEC compliance and financial audits.

Mr Lund holds a Bachelor of Science in Accounting from the

University of North Texas (US) and is a member of the Financial

Executives Institute.

Comments by Unilife Non-Executive Chairman Mr Jim Bosnjak

OAM

"We are pleased to welcome an individual of John's calibre to

the Board of Unilife. The appointment of John will bolster the

strength and breadth of our Board as we progress towards a NASDAQ

listing. I believe that John's background and experience will make

him an ideal Chairman of our Audit Committee following the

completion of our proposed listing on NASDAQ."

Comments by Mr John Lund

"I am honoured to be associated with Unilife, and look forward

to supporting the continued expansion of the Company in the US as

it seeks to become a global industry leader. Unilife has generated

significant momentum during the past two years as it has moved to

transition itself to being a US-based company. I believe Unilife is

well-suited to being listed on the NASDAQ exchange, given its

expanding relationships with pharmaceutical companies and strong

cash-position."

The Company is also pleased to announce that as part of the

Proposed Transaction, all of the existing directors of Unilife

Medical Solutions Limited, including Mr Lund, have now been

appointed to the Board of Unilife Corporation, which will be the

parent company of the Unilife group following the Proposed

Transaction.

Issue of Incentives to Directors

In recognition of the efforts and contributions that the

directors of Unilife have made to the business and its operational

activities, as well as to reflect the greater level of fiduciary

responsibility following the completion of the Proposed

Transaction, the Company has agreed to grant the following

incentives to its directors:

-- 600,000 options to each of Mr Jeff Carter, Mr John Lund and Mr William

Galle under the Employee Share Option Plan of Unilife Medical Solutions

Limited with an exercise price of A$1.20 subject to approval by

shareholders as referred to below. These options would be exchanged for

options in Unilife Corporation on a 6 to 1 basis (ie 100,000 Unilife

Corporation options) upon completion of the Proposed Transaction;

-- 10,000 shares of restricted stock in Unilife Corporation to be granted

to each director (other than Mr Alan Shortall) under the Unilife

Corporation 2009 Stock Incentive Plan provided that the share scheme of

arrangement which will effect the proposed redomiciliation ("Share Scheme")

is approved by shareholders and the Federal Court.

Shares of restricted stock are a form of US security which are

not available in Australian companies but which are commonly used

in the United States as a form of incentive for executives and / or

directors. There is no exercise price payable on shares of

restricted stock granted under the Unilife Corporation 2009 Stock

Incentive Plan. Instead, shares of restricted stock are issued at

the grant date and are subject to forfeiture in certain events and

to transfer restrictions that fall away upon specified vesting

dates over a three year period or upon certain conditions being

met.

If the Share Scheme is not approved by shareholders and the

Federal Court and consequently the Proposed Transaction does not

proceed, each director (other than Alan Shortall) will receive

60,000 fully paid ordinary shares in the Company, to be issued over

a three year period, instead of the 10,000 shares of restricted

stock in Unilife Corporation.

The grant of the incentives to each of the directors identified

above is subject to shareholder approval being obtained for their

issue at an Extraordinary General Meeting ("EGM") of the Company

which is scheduled to occur on or around 8 January 2010. Full

details of the principal terms on which the options and shares of

restricted stock or shares in the Company will be issued will be

set out in the Notice of EGM which will be sent to shareholders in

early December 2009.

In connection with the Proposed Transaction, the Unilife group

is also considering providing a new equity incentive package to its

Chief Executive Officer, Mr Alan Shortall, as he has now met all of

the share price milestones included under his previous equity

incentive package. Details of the new equity incentive package,

which is to be structured in conjunction with the recommendations

of an independent remuneration consultant and the Unilife

Corporation remuneration committee to incentivise Mr Shortall to

further develop the Company's business going forward, will be

disclosed to the market once finalised and will also be subject to

shareholder approval at the Unilife EGM in January 2010.

About Unilife

Unilife Medical Solutions Ltd is an ISO 13485 certified company

that designs, develops and supplies innovative safety medical

devices. Listed on the Australian Securities Exchange (ASX: UNI)

since 2002, Unilife has FDA-registered manufacturing facilities in

the US State of Pennsylvania and a proprietary portfolio of

clinical and prefilled safety syringes designed for use within

healthcare and pharmaceutical markets.

Shareholder / Analyst Enquiries: Australia Jeff Carter Phone: +

61 2 8346 6500 United States Stuart Fine Phone: + 1 908 469

1788

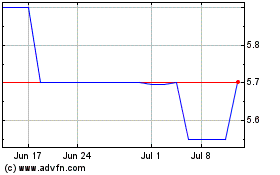

U and I Financial (QX) (USOTC:UNIF)

Historical Stock Chart

From May 2024 to Jun 2024

U and I Financial (QX) (USOTC:UNIF)

Historical Stock Chart

From Jun 2023 to Jun 2024