Current Report Filing (8-k)

May 28 2013 - 5:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): May 17, 2013

Smartmetric, Inc.

(Exact name of registrant as specified in

its charter)

|

Nevada

(State or other

jurisdiction of incorporation) |

|

000-54853

(Commission

File Number) |

|

05-0543557

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

| |

|

|

|

|

|

101 Convention Center Drive

Las Vegas, NV 89109

(Address of principal executive offices)

(zip code) |

| |

|

|

|

|

| |

|

|

|

|

|

(305) 495-7190

(Registrant’s telephone number, including

area code) |

| |

|

|

|

|

| |

|

Not Applicable |

|

|

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

Item 3.02 Unregistered Sale of Equity Securities

On May 17, 2013, Smartmetric,

Inc. (the “Company”) entered into subscription agreements with purchasers that qualified as either (i) an “accredited

investor,” as defined in Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities

Act”) or (ii) a non “U.S. Person,” as defied in Regulation S promulgated under the Securities Act, pursuant

to which the Company sold the investors 48.5 units, each unit consisting of seventy-five thousand (75,000) shares of the Company’s

common stock, par value $0.001 per share (the “Common Stock”) and a warrant to purchase seventy-five thousand

(75,000) shares of Common Stock (collectively, the “Warrants”), for aggregate gross proceeds of $581,973.00.

The Warrants are exercisable on a cashless basis until April 22, 2015 at an initial exercise price of $0.50, subject to adjustment. The

exercise price of the Warrants are subject to customary adjustments for stock splits, stock dividends, recapitalizations and the

like.

If at any time within

six months of the final closing of the Offering the Company shall determine to file with the Securities and Exchange Commission

(the “Commission”) a registration statement relating to an offering for its own account or the account of others

under the Securities Act, of any of its equity securities (other than (i) the amendment of a registration statement previously

filed or the filing of a registration statement that was previously filed and withdrawn or (ii) on Form S-4, Form S-8 or their

then equivalents relating to equity securities to be issued solely in connection with any acquisition of any entity or business

or equity securities issuable in connection with stock option or other bona fide, employee benefit plans), the Company shall use

its best efforts to include in such registration statement all of the shares of Common Stock issuable upon exercise of the Warrants

and the shares of Common Stock issued as part of the Units (collectively “Registrable Securities”); provided,

however, that if the registration statement (i) is to be made on a continuous basis pursuant to Rule 415 under the Securities

Act, it shall be within the Company’s sole discretion to reduce or eliminate the number of Registrable Securities that are

included in a registration statement to the extent necessary to satisfy the Commission’s requirements pursuant to Rule 415

under the Securities Act (ii) involves an underwritten offering of the securities of the Company and the managing underwriter of

such underwritten offering shall advise the Company in writing that, in its opinion, the distribution of all or a specified portion

of the Registrable Securities which the holders have requested the Company to register will materially and adversely affect the

distribution of such securities by such underwriters, then the Company may reduce or eliminate the number of Registrable Securities

that are included in a registration statement.

If

at any time during the 6 month period following the closing described above, the Company sells or issues any Common Stock

entitling any person to acquire shares of Common Stock at an effective price per share that is lower than $0.16 (such lower price,

the “Base Share Price” and such issuances, collectively, a “Dilutive Issuance”), then the

Company shall issue to each investor such number of additional shares of Common Stock equal to the difference between (i) the number

of shares of Common Stock held by the investor on the date of the Dilutive Issuance multiplied by a fraction, the numerator of

which is $0.16 and the denominator of which is the Base Share Price, and (ii) the number of shares of Common Stock held by the

investor on the date of the Dilutive Issuance. Notwithstanding the foregoing, no adjustment will be made in respect

of an Exempt Issuance (as defined in the subscription agreement).

FINRA registered broker-dealers

were engaged as placement agent and as select dealers in connection with the private placement (collectively, the “Agents”). We

collectively paid the Agents a cash fee in the amount of $61,780 and will issue the Agents an aggregate of 286,868 shares of Common

Stock.

The securities sold

in the private placement were not registered under the Securities Act, or the securities laws of any state, and were offered and

sold in reliance on the exemption from registration afforded by Section 4(2), Rule 506 promulgated under Regulation D and Regulation

S promulgated under the Securities Act and corresponding provisions of state securities laws, which exempt transactions by an issuer

not involving any public offering. The investors are either an “accredited investor” as such term is defined under

Regulation D promulgated under the Securities Act or a non “U.S. Person” as such term is defined under Regulation S

promulgated under the Securities Act. This current report shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall such securities be offered or sold in the United States absent registration or an applicable exemption

from the registration requirements and certificates evidencing such shares contain a legend stating the same.

The foregoing information

is a summary of the agreements involved in the transaction described above, is not complete, and is qualified in its entirety by

reference to the full text of such agreements, a copy of which are attached as an exhibit to this Current Report on Form 8-K. Readers

should review such agreements for a complete understanding of the terms and conditions associated with this transaction.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

Exhibits

The exhibits listed in the following Exhibit Index are filed

as part of this report.

| 4.1 |

|

Form of Warrant issued to the May 2013 Investor |

| 10.1 |

|

Form of subscription agreement by and among Smartmetric, Inc. and the May 2013 Investor |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: May 28, 2013 |

|

SMARTMETRIC, INC. |

| |

|

|

| |

|

|

| |

|

|

| |

|

By: /s/ C. Hendrick |

| |

|

Name: C. Hendrick |

| |

|

Title: Chief Executive Officer |

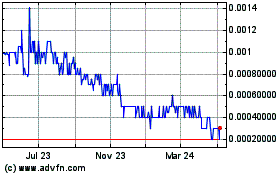

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Oct 2024 to Nov 2024

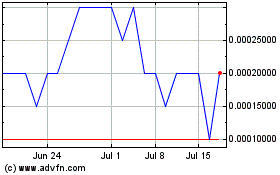

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Nov 2023 to Nov 2024