Current Report Filing (8-k)

March 06 2020 - 5:01PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 2, 2020

PRESSURE

BIOSCIENCES, INC.

(Exact

name of Registrant as specified in its charter)

|

Massachusetts

|

|

001-38185

|

|

04-2652826

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

14

Norfolk Avenue

South

Easton, MA 02375

(Address

of principal executive offices, including zip code)

(508)

230-1828

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions:

|

[ ]

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

1.01

|

Entry

into a Material Definitive Agreement.

|

On

March 2, 2020, Pressure BioSciences, Inc. (the “Company”) entered into an Amendment to the Standstill and Forbearance

Agreements (the “Amendment”) with twelve (12) lenders (the “Lenders”) who hold convertible promissory

notes with a total principal of $2,828,826 (the “Notes”). Pursuant to the Amendment, the Lenders agreed to

not convert any portion of the Notes into shares of the Company’s common stock until after close-of-business (“COB”)

April 6, 2020, assuming that the Notes have not been paid off as of that date, or that the Lenders have not agreed to extend

the current April 6th termination date of the Standstill and Forbearance Agreements. The Lenders also agreed to

waive, through COB April 6, 2020, any Company defaults under the Notes, if any occur. The Company offered the Lenders a cash fee

or shares of the Company’s common stock with a Securities Act restrictive legend in connection with the Lenders’ entrance

into the Amendment. The Lenders have until COB April 6, 2020 to choose the cash fee, the stock fee, or a combination

of both after which date the shares will be issued and the cash will be paid.

The

foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by its full text, the

form of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K covering the fiscal year that ended

on December 31, 2019.

|

Item

3.02

|

Unregistered

Sales of Equity Securities.

|

The

applicable information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02.

The shares of common stock to be issued on or about April 6, 2020 will not be registered under the Securities Act, but

will qualify for exemption under Section 4(a)(2) of the Securities Act. The securities will be exempt from registration under

Section 4(a)(2) of the Securities Act because the issuance of such securities by the Company will not involve a “public

offering,” as defined in Section 4(a)(2) of the Securities Act, due to the insubstantial number of persons involved in the

transaction and manner of the offering. The Company did not undertake an offering in which it sold securities to a high number

of investors. In addition, the Lenders had the necessary investment intent as required by Section 4(a)(2) of the Securities Act

since the Lenders agreed to, and will receive, the securities bearing a legend stating that such securities are restricted pursuant

to Rule 144 of the Securities Act. This restriction ensures that these securities will not be immediately redistributed into the

market and therefore not be part of a “public offering.” Based on an analysis of the above factors, the Company has

met the requirements to qualify for exemption under Section 4(a)(2) of the Securities Act.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

PRESSURE

BIOSCIENCES, INC.

|

|

|

|

|

|

Date:

March 6, 2020

|

By:

|

/s/

Richard T. Schumacher

|

|

|

|

Richard

T. Schumacher

|

|

|

|

President

and Chief Executive Officer

|

|

|

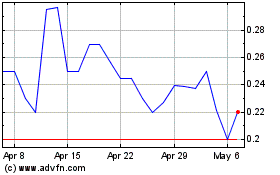

Pressure Biosciences (CE) (USOTC:PBIO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Pressure Biosciences (CE) (USOTC:PBIO)

Historical Stock Chart

From Sep 2023 to Sep 2024