January 4, 2021 -- InvestorsHub NewsWire -- via By Alex Carlson

-- The last half of 2020 was a banner year for penny stock

investors. There was no shortage of big runners

with Creative Medical Technologies (OTCMKTS:

CELZ), DSG Global (OTCMKTS:

DSGT), IQSTEL (OTCMKTS:

IQST), and Premier Products Group

(OTCMKTS:

PMPG) all closing 2020 strong.

In this article, we take a look at what’s happening with OTC

stocks CELZ, DSGT, IQST, and PMPG. We also give some insight on how

to trade penny stocks and what investors should look for when it

comes to the OTC Markets.

HOW TO TRADE PENNY STOCKS

First up, it’s important to understand that trading penny stocks

are not the same as trading blue chips. As we have stressed

repeatedly to our subscribers, the key to trading penny stocks is

finding momentum BEFORE it happens and then be patient.

We got our subscribers in early on TSNP,

which you can read our latest here,

and ENZC, which you can read

about here.

Now, when we say that we find momentum BEFORE it happens, we are

swing traders looking to position our subscribers BEFORE the move

happens. This is where the big money is made and why so many of our

subscribers are sitting on gains of

over 7750% in ENZC and over 18,650%

in TSNP.

If you want to day trade, this is not the place for you. If you

want to make a few hundred bucks and then lose a thousand dollars

the next day, we hear Tim Sykes has plenty of openings.

We always alert our subscribers first before we publish for our

regular readers. This is the value of having a subscription to

Insider Financial, which you can sign up for here. We

alert our subscribers with our best ideas before our regular

readers.

Insider Financial Talks OTC Stocks:

CELZ DSGT IQST PMPG

OTC STOCK #1: CELZ

CELZ was trading in the double zeroes and then really got moving

in the middle of December after announcing positive preclinical

data supporting the utilization of its ImmCelz® cell-based

immunotherapy for the treatment of stroke.

In an animal model of ischemia stroke, the middle cerebral

artery ligation model, administration of ImmCelz® resulted in a 34%

reduction in infarct volume, whereas control bone marrow

mesenchymal stem cells reduced infarct volume by 21%. Additionally,

improvements in functional recovery were observed using the Rotarod

test.

At 28 days after induction of stroke, the animals receiving

ImmCelz® had superior running time (92% of non-stroke controls)

compared to animals that received bone marrow mesenchymal stem

cells (73% of non-stroke control). Animals that received saline had

a running time that was 50% of non-stroke controls.

Further juicing the stock price was the ability of ImmCelz® to

reverse liver failure in the carbon tetrachloride preclinical model

of hepatocyte necrosis. These findings are the basis for a patent

filing covering various means of generating the ImmCelz® product in

a hepatoprotective specific manner. The Company has previously

reported that ImmCelz® is capable of treating animal models of

stroke, as well as inducing “immunological tolerance” in a model of

autoimmune rheumatoid arthritis.

To sum up CELZ, the company is a play on stem cells and its

technology works. To date, CELZ has demonstrated that ImmCelz® has

a therapeutic activity in stroke and liver failure. Liver failure

represents a significant unmet medical need and I am extremely

excited that ImmCelz® has the potential to help the numerous

patients on the liver transplant waiting list who currently have no

other option.

OTC STOCK #2: DSGT

On October 12, we wrote this article on DSGT saying that it was an EV play

with huge upside. DSGT closed at $.15 that day.

While it took over 10 months, DSGT turned into a 10-bagger for

our readers and subscribers that had the patience to stay in. We

pounded the table on DSGT for all those willing to listen. We

said:

DSGT is now a pure-play on electric vehicles trading under $1.

We know of no other pure-play EV stock trading under $1. We have

seen the moves this year in Tesla, NIO, Workhorse, and Lordstown, DSGT looks to be the next

EV rocket.

DSGT has been a steady climber as the company executes its

business plan. On December 22nd, Imperium Motors announced the

receipt of three shipments totaling 73 electric vehicles,

representing the first containers of Jonway, Skywell, and Rumble

Motors electric vehicles arriving at its location in Fairfield

California.

The current shipment included the high-speed Skywell ET-5 SUVs,

multiple Jonway scooters, a variety of 3- and 4-wheel cars, vans,

trucks, and a large container of Rover electric bike products and

other Rumble Motors models, which will be shown in the Company’s

Experience Center.

DSGT is now positioned to start off 2021 strong with vehicles

in-house to sell.

“With the arrival of these vehicles to our facility, we are now

officially on track to launch our 2021 Imperium Motors sales

efforts,” commented Rick Curtis, President of Imperium Motor Corp

“We have long spoken of the excellent quality and value of these

vehicles as well as their value to the environment. Importantly,

they are a key component of our projected 2021 revenue, and we

anticipate a strong start to the New Year.”

OTC STOCK #3: IQST

IQST is another OTC stock that we profiled back in October, but

took some time to pay off. We said that IQST was an undervalued

opportunity, which you can read here.

IQST was trading around $.06 at the time.

We believe IQST still has more room to run as its current market

cap is only $18.7 million. Year to date revenue is now $39,725,507

putting the company well on track to exceed its $42 million revenue

projection for 2020.

IQST is also making shareholder-friendly moves after converting

21 million common shares held among the CEO, CFO, and chief

commercial officer into Series B preferred shares, effectively

reducing the outstanding share count by more than 22%. These Class

B preferred shares have a one-year lock-up, and upon conversion,

management has opted for a one-year leak out on the shares into the

outstanding share count.

Back in October, Goldman Small Cap Research issued a research

report with a $.54 a share price target on IQST.

OTC STOCK #4: PMPG

PMPG is running as the company is a play on autonomous driving.

Its road pavement markers (Road Turtles) have the ability to

transmit data and transform a municipality into a Smart City. Every

road turtle on the road can house up to 7 sensors to interact

(transmit data) with automobiles. Sensors such as GPS, temperature,

movement, environment detection, humidity, and environmental to

name a few.

PMPG has completed the due diligence process of its SmartRoad

Turtle, LLC (SRT) joint venture project. SmartRoad Turtle, LLC,

expects to have a Letter of Intent for manufacturing and

distribution to be signed with Ennis-Flint in a few weeks. Ennis-Flint is a

global manufacturer of coatings with a broad portfolio of road

pavement marking products, thermoplastics, advanced traffic

technologies, and intelligent transportation systems.

Ennis-Flint is a really big deal. This will give PMPG and its

SmartRoad Turtle global reach. If the company can execute and

complete its fund-raising, there’s a lot more room PMPG can

run.

BOTTOM LINE

These four penny stocks are hot right now. There are always

opportunities on the OTC and it’s our job to find the bull markets.

Huge gains can be made in such a short amount of time.

For those that missed out on the recent run in these four OTC

stocks, our best advice is to be patient and throw bids in below

the market. Buying dips and selling rips as swing trades remains

the best strategy in these markets.

Remember, all it takes is one or two to become a TSNP or an ENZC

and you’re set to buy a new house and not just make a rent or

mortgage payment.

As always, good luck to all (except the shorts)!

WHEN INSIDER FINANCIAL HAS A STOCK ALERT, IT CAN PAY TO

LISTEN. AFTER ALL, OUR FREE NEWSLETTER HAS FOUND MANY TRIPLE-DIGIT

WINNERS FOR OUR SUBSCRIBERS. WE SPECIALIZE IN

FINDING MOMENTUM BEFORE IT HAPPENS!

Disclosure: We have no position in any

of the securities mentioned. We wrote this article ourselves

and it expresses our own opinions. We are not receiving

compensation for it. We have no business relationship with any

company whose stock is mentioned in this article. Insider Financial

is not an investment advisor and does not provide investment

advice. Always do your own research and make your own investment

decisions. This article is not a solicitation or recommendation to

buy, sell, or hold securities. This article is meant for

informational and educational purposes only and does not provide

investment advice.

Image by Matan Ray

Vizel from Pixabay

RELATED ITEMS:FEATURED, OTCMKTS:CELZ, OTCMKTS:DSGT, OTCMKTS:IQST, OTCMKTS:PMPG

Source -Alex Carlson : https://insiderfinancial.com/4-otc-stocks-on-the-move-celz-dsgt-iqst-pmpg/180804/

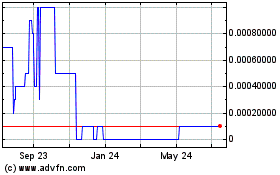

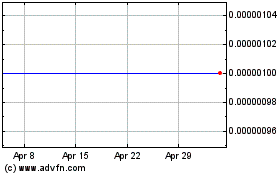

Premier Products (CE) (USOTC:PMPG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Premier Products (CE) (USOTC:PMPG)

Historical Stock Chart

From Nov 2023 to Nov 2024