false

0000770460

0000770460

2024-01-24

2024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

|

FORM 8-K

|

| |

|

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

Date of Report (Date of earliest event reported) January 24, 2024

|

| |

|

PEOPLES FINANCIAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

| |

|

|

Mississippi

(State or Other Jurisdiction of Incorporation)

|

|

001-12103

(Commission File Number)

|

64-0709834

(IRS Employer Identification No.)

|

| |

|

|

152 Lameuse Street Biloxi, MS

(Address of Principal Executive Offices)

|

39530

(Zip Code)

|

|

(228) 435-5511

(Registrant’s Telephone Number, Including Area Code)

|

| |

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

PFBX

|

None

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4( c) under the Exchange Act (17 CFR 240.13e-4( c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On January 24, 2024, Peoples Financial Corporation (the “Company”) issued a press release announcing its results for 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

| |

104

|

Cover Page Interactive Data File (formatted as Inline XBRL)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 24, 2024

| |

PEOPLES FINANCIAL CORPORATION

By: /s/ Chevis C. Swetman

Chevis C. Swetman

Chairman, President and CEO

|

|

Exhibit 99.1

Exhibit 99.1: Peoples Financial Corporation Press Release Dated January 24, 2024

FOR IMMEDIATE RELEASE

For more information, contact:

Chevis C. Swetman, President and CEO

228-435-8205

cswetman@thepeoples.com

PEOPLES FINANCIAL CORPORATION REPORTS RESULTS

FOR 2023, THE THIRD BEST YEAR OF EARNINGS EVER, AND SETS DATE FOR ANNUAL MEETING

BILOXI, MS (January 24, 2024) - Peoples Financial Corporation (the “Company”)(OTCQX Best Market: PFBX), parent of The Peoples Bank (the “Bank”), announced earnings for 2023 and the fourth quarter ending December 31, 2023. The Company also announced that its 2024 annual meeting of shareholders will take place on April 24, 2024.

Earnings

Net income for the fourth quarter of 2023 was $1,723,000 compared to net income of $5,250,000 for the fourth quarter of 2022. The earnings per weighted average common share for the fourth quarter of 2023 were $0.37 compared to earnings per weighted average common share of $1.12 for the fourth quarter of 2022. Per share figures are based on weighted average common shares outstanding of 4,666,349 and 4,678,186 for the fourth quarters of 2023 and 2022, respectively.

The decrease in net income for the fourth quarter of 2023 as compared with the fourth quarter of 2022 was primarily due to a nonrecurring deferred tax benefit in the amount of $2,446,000 recognized during the fourth quarter of 2022. There was also a decrease in net interest income of $41,000 to $5,873,000 for the fourth quarter of 2023 as compared with $5,914,000 for the fourth quarter of 2022. This decrease was attributable to higher interest expense on deposits and higher cost of borrowings due to an increase in interest rates. Total interest income on loans and securities was higher by $857,000 to $7,703,000 for the fourth quarter of 2023 as compared with $6,846,000 for the fourth quarter of 2022. This increase was mostly attributable to higher interest income on securities along with higher interest income on overnight fed funds and loans due to an increase in interest rates.

Net income for the year ended December 31, 2023 increased $225,000 to $9,166,000 compared to net income of $8,941,000 for the year ended December 31, 2022. The earnings per weighted average common share for the year ended December 31, 2023 were $1.96 compared to earnings per weighted average common share of $1.91 for the year ended December 31, 2022. Per share figures are based on weighted average common shares outstanding of 4,675,067 and 4,678,186 for the years ended December 31, 2023 and 2022, respectively.

Return on average assets for the year ended December 31, 2023 increased 0.04% to 1.10% compared to 1.06% for the year ended December 31, 2022. The Company’s efficiency ratio decreased 10% to 67% for the year ended December 31, 2023 compared to 77% for the year ended December 31, 2022.

The improvement in net income for the year ended December 31, 2023 was primarily due to an increase in net interest income of $4,924,000 to $26,474,000 for the year ended December 31, 2023 as compared with $21,550,000 for the year ended December 31, 2022. This increase was mostly attributable to higher interest income on securities along with higher interest income on overnight fed funds and loans due to an increase in interest rates. For the first time since 2021, the Company recorded income tax expense for the year ended December 31, 2023 because the Company utilized its remaining net operating loss carryforward during 2022.

Earnings for the year ended December 31, 2023 were also improved by a negative credit loss provision created by a reduction in the allowance for credit losses of $272,000 following the recovery during the second quarter of 2023 of a $468,000 loan that had been previously charged off.

Asset Quality

Other real estate decreased from $259,000 at December 31, 2022, to $1 at December 31, 2023.

“The Bank’s management, continues to focus on maintaining high asset quality of the loan portfolio as well as solid interest income on both securities and loans.” said Chevis C. Swetman, chairman and chief executive officer of the Company and the Bank.

Shareholders’ Equity

Total shareholders’ equity increased by $14,089,000 over the year ended December 31, 2023 from $55,194,000 at December 31, 2022, to $69,283,000 at December 31, 2023. The improvement in shareholders’ equity was mainly due to annual earnings of $9,166,000 less dividends of $2,473,000 paid out to shareholders during the year ended December 31, 2023. The Company also experienced a decrease of $8,042,000 in unrealized losses on securities in 2023 that partially reversed increases in unrealized losses on securities recorded during 2022. The Company reported $39,881,000 and $47,923,000 in unrealized losses on the available for sale securities portfolio as of December 31, 2023, and December 31, 2022, respectively. These unrealized losses are presented in accumulated other comprehensive income. The Company does not anticipate these unrealized losses to be realized. The cause of the unrealized losses has primarily resulted from higher interest rates that have impacted the current market value of available for sale securities, but they are not related to any credit deterioration within the portfolio. The Company has maintained strong liquidity and continues to do so; therefore, the Company does not foresee a sale of any affected securities that would cause the realization of these losses by the Company as part of net income in the near future.

The Bank’s leverage ratio has not been impacted by these unrealized losses on available for sale securities due to an opt-out election previously made by the Bank in accordance with current regulatory capital requirements and therefore remained strong at 12.59% as of December 31, 2023.

Liquidity

The Company maintains a well-capitalized balance sheet which includes strong capital and liquidity. The Bank provides a full range of banking, financial and trust services in our local markets. The majority of the Bank’s deposits are fully FDIC insured and the Company evaluates on an ongoing and continuous basis its financial health by preparing for various moderate to severe economic scenarios.

As interest rates have increased and the cost of attracting new deposits and replacing deposit run-off has increased, the Bank experienced a decrease in deposit balances during the year ended December 31, 2023. This decrease was mostly caused by the loss of several large public fund deposits following competitive bid processes whereby many public fund deposit accounts were awarded to other local banks.

The Company intends to offset the recent loss of public fund deposits with growth in other types of deposit accounts, proceeds from maturities of investment securities within the next year, earnings on investment securities, loan repayments and through borrowings with the Federal Home Loan Bank of Dallas, the Bank Term Funding Program with the Federal Reserve or other counterparties. Although any new deposits and borrowings may be at a higher cost than the interest rate previously paid on the deposits withdrawn, the Company expects to maintain adequate liquidity levels without having to liquidate any securities within its existing portfolio at a loss.

Franchise tax

The table below outlines how much in franchise taxes the Company has paid out over the last five years.

Franchise Tax Calculation- The franchise tax was historically $2.50 per $1,000 of capital.

|

The 2019 tax (paid with 2018 return) was $2.50 but only per $1,000 of capital above $100,000

|

$222,025

|

|

The 2020 tax (paid with 2019 return) was $2.25 per $1,000 of capital above $100,000

|

$196,025

|

|

The 2021 tax (paid with the 2020 return) $2.00 per $1,000 of capital above $100,000

|

$190,525

|

|

The 2022 tax (paid with the 2021 return) $1.75 per $1,000 of capital above $100,000

|

$160,025

|

|

The 2023 tax (paid with the 2022 return) $1.50 per $1,000 of capital above $100,000

|

$ 81,025

|

This expense will continue to decrease ratably each year until it is eliminated after 2028 due to legislative changes in Mississippi.

About the Company

Founded in 1896, with $798 million in total assets as of December 31, 2023, The Peoples Bank operates 17 branches along the Mississippi Gulf Coast in Hancock, Harrison, Jackson and Stone counties. In addition to offering a comprehensive range of retail and commercial banking services, the Bank also operates a trust and investment services department that has provided customers with financial, estate and retirement planning services since 1936.

Peoples Financial Corporation’s common stock is listed on the OTCQX Best Market under the symbol PFBX. Additional information is available on the Internet at the Company’s website, www.thepeoples.com, and at the website of the Securities and Exchange Commission, www.sec.gov.

This news release reflects industry conditions, Company performance and financial results and contains “forward-looking statements,’ which may include forecasts of our financial results and condition, expectations for our operations and businesses, and our assumptions for those forecasts and expectations. Do not place undue reliance on forward-looking statements. These forward-looking statements are subject to a number of risk factors and uncertainties which could cause the Company’s actual results and experience to differ materially from the anticipated results and expectation expressed in such forward-looking statements.

Factors that could cause our actual results to differ materially from our forward-looking statements are described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Regulation and Supervision” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and in other documents subsequently filed by the Company with the Securities and Exchange Commission, available at the SEC’s website and the Company’s website, each of which are referenced above. To the extent that statements in this news release relate to future plans, objectives, financial results or performance by the Company, these statements are deemed to be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are generally identified by use of words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology.

Forward-looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. All information is as of the date of this news release. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or update publicly any forward-looking statement for any reason.

|

PEOPLES FINANCIAL CORPORATION

|

|

(In thousands, except per share figures) (Unaudited)

|

|

EARNINGS SUMMARY

|

|

Three Months Ended December 31,

|

|

|

Year Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net interest income

|

|

$ |

5,873 |

|

|

$ |

5,914 |

|

|

$ |

26,474 |

|

|

$ |

21,550 |

|

|

Provision (reduction) for credit losses

|

|

|

3 |

|

|

|

- |

|

|

|

(272 |

) |

|

|

80 |

|

|

Non-interest income

|

|

|

1,639 |

|

|

|

1,906 |

|

|

|

6,894 |

|

|

|

6,895 |

|

|

Non-interest expense

|

|

|

5,251 |

|

|

|

5,001 |

|

|

|

22,353 |

|

|

|

21,855 |

|

|

Income tax expense (benefit)

|

|

|

535 |

|

|

|

(2,431 |

) |

|

|

2,121 |

|

|

|

(2,431 |

) |

|

Net income

|

|

|

1,723 |

|

|

|

5,250 |

|

|

|

9,166 |

|

|

|

8,941 |

|

|

Earnings per share

|

|

$ |

0.37 |

|

|

$ |

1.12 |

|

|

$ |

1.96 |

|

|

$ |

1.91 |

|

|

TRANSACTIONS IN THE ALLOWANCE FOR CREDIT LOSSES ON LOANS

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31,

|

|

|

Year Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Allowance for credit losses on loans, beginning of period

|

|

$ |

3,201 |

|

|

$ |

3,362 |

|

|

$ |

3,338 |

|

|

$ |

3,311 |

|

|

Recoveries

|

|

|

27 |

|

|

|

25 |

|

|

|

607 |

|

|

|

187 |

|

|

Charge-offs

|

|

|

(40 |

) |

|

|

(49 |

) |

|

|

(467 |

) |

|

|

(240 |

) |

|

Provision for (reduction of ) credit losses on loans and leases

|

|

|

36 |

|

|

|

- |

|

|

|

(244 |

) |

|

|

80 |

|

|

Impact of adopting ASC 326

|

|

|

- |

|

|

|

- |

|

|

|

(10 |

) |

|

|

- |

|

|

Allowance for credit losses on loans, end of period

|

|

$ |

3,224 |

|

|

$ |

3,338 |

|

|

$ |

3,224 |

|

|

$ |

3,338 |

|

|

PERFORMANCE RATIOS

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

2023

|

|

|

2022

|

|

|

Return on average assets

|

|

|

1.10 |

% |

|

|

1.06 |

% |

|

Return on average equity

|

|

|

14.73 |

% |

|

|

12.17 |

% |

|

Net interest margin

|

|

|

3.29 |

% |

|

|

2.64 |

% |

|

Efficiency ratio

|

|

|

67 |

% |

|

|

77 |

% |

|

BALANCE SHEET SUMMARY

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

2023

|

|

|

2022

|

|

|

Total assets

|

|

$ |

797,738 |

|

|

$ |

861,639 |

|

|

Securities

|

|

|

490,388 |

|

|

|

545,385 |

|

|

Loans,net

|

|

|

235,115 |

|

|

|

234,540 |

|

|

Other real estate

|

|

|

- |

|

|

|

259 |

|

|

Total deposits

|

|

|

688,490 |

|

|

|

785,780 |

|

|

Shareholders' equity

|

|

|

69,283 |

|

|

|

55,194 |

|

|

Book value per share

|

|

|

14.86 |

|

|

|

11.80 |

|

|

Weighted average shares

|

|

|

4,675,067 |

|

|

|

4,678,186 |

|

|

PERIOD END DATA

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

2023

|

|

|

2022

|

|

|

Allowance for credit losses on loans as a percentage of loans

|

|

|

1.35 |

% |

|

|

1.40 |

% |

|

Loans past due 90 days and still accruing

|

|

$ |

- |

|

|

$ |

- |

|

|

Nonaccrual loans

|

|

$ |

213 |

|

|

$ |

1,441 |

|

|

Leverage ratio

|

|

|

12.59 |

% |

|

|

10.78 |

% |

v3.23.4

Document And Entity Information

|

Jan. 24, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PEOPLES FINANCIAL CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 24, 2024

|

| Entity, Incorporation, State or Country Code |

MS

|

| Entity, File Number |

001-12103

|

| Entity, Tax Identification Number |

64-0709834

|

| Entity, Address, Address Line One |

152 Lameuse Street

|

| Entity, Address, City or Town |

Biloxi

|

| Entity, Address, State or Province |

MS

|

| Entity, Address, Postal Zip Code |

39530

|

| City Area Code |

228

|

| Local Phone Number |

435-5511

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000770460

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

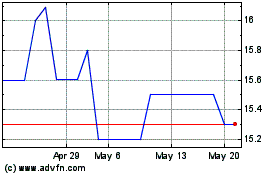

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Jul 2023 to Jul 2024