false

0001297937

0001297937

2024-05-14

2024-05-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

| May

14, 2024 |

|

000-51254 |

| Date

of Report (Date of earliest event reported) |

|

Commission

File Number |

PARKS!

AMERICA, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

91-0626756 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification

Number) |

1300

Oak Grove Road

Pine

Mountain, GA 31822

(Address

of Principal Executive Offices) (Zip Code)

(706)

663-8744

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

PRKA |

|

OTCPink |

Item

2.02. Results of Operations and Financial Condition.

On

May 14, 2024, Parks! America, Inc. (the “Company”) issued a news release (the “News Release”) reporting information

regarding its results of operations for the fiscal quarter ended March 31, 2024, and its financial condition as of March 31, 2024. A

copy of the News Release is attached as Exhibit 99.1 to this Report on Form 8-K.

The

information in the News Release is being furnished, not filed, pursuant to Item 2.02. Accordingly, the information in the News Release

shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(a)

Financial statements of businesses acquired:

Not

applicable

(b)

Pro forma financial information:

Not

applicable

(c)

Shell company transactions:

Not

applicable

(d)

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

May 14, 2024

| |

PARKS! AMERICA,

INC. |

| |

|

|

| |

By: |

/s/

Todd R. White |

| |

Name: |

Todd R. White |

| |

Title: |

Chief Financial Officer |

Exhibit

99.1

Parks!

America, Inc.

Reports

Second Quarter Fiscal 2024 Financial Results

Management

to host conference call today, May 14, 2024, at 4:30 PM ET

PINE

MOUNTAIN, Georgia, May 14, 2024 — Parks! America, Inc. (OTCPink: PRKA), a leading operator of regional safari parks in the

U.S., today announced the financial results for the second quarter of fiscal year 2024 ended March 31, 2024.

Q2

2024 & YTD Financial Highlights

| |

● |

Consolidated

revenues of $1.96 million for Q2 2024, an increase of 4.4%; YTD 2024 consolidated revenues totaled $3.86 million, an increase of

3.2%. |

| |

● |

Missouri

park revenue increased 48.0% in Q2 and 27.4% YTD, reflecting strong attendance gains. |

| |

● |

Cash

and short-term investments as of March 31, 2024, totaled $3.03 million. |

| |

● |

Debt

reduction continued, down $751,445 versus one year ago; debt-to-equity ratio: 0.28 end of Q2 2024 versus 0.32 one year ago. |

Recent

Developments

| |

● |

Proxy

issued for Annual Meeting of Stockholders to be held on June 6, 2024. |

| |

● |

Ongoing

proxy battle and Focused Compounding tactics have set the Company back financially and operationally. |

Lisa

Brady, President and CEO of Parks! America, said, “All things considered, we are pleased with the operational performance of the

Company in the second quarter of 2024. While the second quarter of our fiscal year is historically our slowest fiscal quarter in terms

of park attendance, consolidated revenue increased 4.4% to $1.96 million versus the comparable quarter last year, with our Missouri park

posting a 48% revenue increase on strong attendance gains. The operational plan we have in place is working and we are beginning to see

traction across all our initiatives including our updated marketing efforts, enhanced season pass sales, and overall culture of empowerment

and accountability. As we move into the second half of the year, we expect our Georgia and Texas parks’ visitor traffic to increase

and significantly drive revenue growth.

“While

our 2024 capital plan is heavily focused on rebuilding critical infrastructure in Georgia following the tornado, we are

pleased with the progress at all three parks as we have continued to make small and strategic investments in high-impact guest areas

including educational signage, landscaping, shade structures, and updated animal habitats. Our teams are focused on driving daily visitation

and ensuring a great visitor experience for everyone that comes through our gates, resulting in strong reviews and repeat visitation.

We are extremely pleased with the results from our marketing programs and are seeing strong return on our marketing investments. We remain

focused on driving Georgia park attendance and revenues. However, our Georgia park attendance and revenues continue lag 2022 pre-tornado

levels and we believe there are additional headwinds impacting Georgia park attendance, including continued settling from the Covid-19

bump in sales and increased competitive environment in the greater Atlanta market. Our teams are working hard and are focused

on driving results during the historically stronger quarters and are encouraged by momentum through the first six weeks of our

fiscal third quarter.”

Ms.

Brady concluded, “That said, I am compelled to say the ongoing proxy battle with Focused Compounding (“FC”) has had

a significant negative impact on our financial position, our ability to work on operational excellence at the location level, and to

continue the process of fully restoring our Georgia Park. Despite this shortsighted effort, we remain undaunted and continue to do everything

in our power to manage our resources to position Parks! America in the upper echelon of the safari park industry segment.”

Second

Quarter Fiscal 2024 Financial Results

Total

revenues for the fiscal quarter ended March 31, 2024, were $1.96 million, an increase of $82,735, or 4.4%, versus the comparable quarter

ended April 2, 2024. Park revenues increased by $66,675 or 3.6%, to $1.92 million, and higher animal sales increased by $16,060, to $33,960.

Reported

park revenues for the Georgia park - our largest revenue generating property for the Company – were down 1.3%. Reported park revenues

for our Missouri park increased 48.0%, while park revenues for our Texas park decreased 9.2%. On a pro forma basis, adjusting for the

impact of the tornado related closure of our Georgia park for the final eight days of our 2023 fiscal second quarter, as well as the

year-over-year park revenue impact of an improvement to our ticketing platform, Missouri park revenue increased 52.6%, while Georgia

and Texas park revenue decreased 21.8% and 6.9%, respectively.

The

Company reported a net loss of $1.0 million, or ($0.01) per fully diluted share, compared to $846,139 or ($0.01) per fully diluted

share, in the second quarter of fiscal 2023. Each year was impacted by significant unusual expenses and charges. The second quarter

of fiscal 2024 included $1.16 million of expenses associated with the FC contested proxy and related matters, while the second quarter

of fiscal 2023 included $632,372 of tornado related expenses and asset write-offs.

Excluding

these unusual expenses and charges, our adjusted net loss was $150,162, or ($0.00) per fully diluted share, compared to $384,507

or ($0.01) per fully diluted share, in the second quarter of fiscal 2023. The lower adjusted net loss is attributable to higher

park revenues and animal sales, lower overall staffing related costs, and lower advertising expense, partially higher animal feed and

insurance costs. Although the flat year-to-date, director compensation was declared and expensed second quarter of fiscal 2023, compared

first quarter of fiscal 2024.

EBITDA, a non-GAAP measure, for the second quarter of fiscal 2024 improved $306,010 to $108,965, compared to negative $197,045 for the

second quarter of fiscal 2023.

First

Half Fiscal 2024 Financial Results

Total

revenues for the six months ended March 31, 2024, were $3.86 million, an increase of $118,981, or 3.2%, versus the comparable period

ended April 2, 2023. Park revenues increased by $58,330 or 1.6%, to $3.73 million, and higher animal sales increased by $60,651, to $122,351.

Reported

park revenues for the Georgia park were down 4.0%. Reported park revenues

for our Missouri and Texas parks increased 27.4% and 2.0%, respectively. On a pro forma basis, adjusting for the impact of the tornado

related closure of our Georgia park for the final eight days of our 2023 fiscal second quarter, as well as a change in the accounting

for online ticketing fees effective mid-January 2024, Missouri and Texas park revenue increased 29.6% and 3.7%, respectively, while Georgia

park revenue decreased 14.1%.

The

Company reported a net loss of $1.37 million, or ($0.02) per fully diluted share, compared to $1.0 million or ($0.01) per fully diluted

share, for the first six months of fiscal 2023. Each year was impacted by significant unusual expenses and charges. The first six

months of fiscal 2024 included $1.29 million of expenses associated with the FC contested proxy and related matters, while the second

quarter of fiscal 2023 included $632,372 of tornado related expenses and asset write-offs.

Excluding

these unusual expenses and charges, our adjusted net loss was $462,967, or ($0.01) per fully diluted share, compared to $537,467 or ($0.01)

per fully diluted share, in the first six months of fiscal 2023. The lower adjusted net loss is attributable to higher park revenues

and animal sales, lower overall staffing related costs, lower advertising expense, and lower general operating expenses, partially higher

animal feed costs, lower margins on concessions revenues, as well as higher professional fees and insurance costs.

EBITDA, a non-GAAP measure, for the first six months of fiscal 2024 improved $154,900 to $50,215, compared to negative $104,685 for the

first six months of fiscal 2023.

Balance

Sheet, Liquidity and Capital Allocation

The

Company had working capital of $2.04 million as of March 31, 2024, compared to $3.1 million as of April 2, 2023. The Company had total

debt of $3.85 million as of March 31, 2024, compared to $4.60 million at the end of April 2, 2023. The Company’s debt-to-equity

ratio was 0.28 to 1.0 on March 31, 2024, compared to 0.32 to 1.0 on April 2, 2023. Capital expenditures for the first six months of 2024

were $484,872, compared to $952,640 in the first six months of 2023. Cash and short-term investments totaled $3.03 million as of March

31, 2024, compared to $3.86 million as of April 2, 2023.

Todd

R. White, CFO of Parks! America, commented, “We are prudently managing our resources in order to execute our strategic plan to

upgrade our facilities following years of neglect and the impact of the 2023 tornado at our Georgia property. Despite the diverted time,

attention, and resources required to deal with the ongoing needless proxy contest, we are making measurable progress on our plan. Excluding

the impacts of the proxy contest, our fiscal 2024 year-to-date cash flow is on plan, and we continue to pay down debt, which has declined

by approximately $750,000 or 16% over the trailing 12 months.”

Mr.

White continued, “you may recall that the Company entered into separate twelve-month lines of credit with Synovus Banks and First

Financial Bank, totaling $800,000 in October 2023. As of today, neither of the two lines of credit have been borrowed against.”

Conference

Call Access:

The

Company will host a conference call to review the results of the second quarter of the 2024 fiscal year today, May 14, 2024, at 4:30

pm ET.

Interested

parties can access the conference call by dialing (877) 270-2148 or (412) 902-6510 (international), or listen via a live webcast, which

is available in the Investors section of the Company’s website at https://animalsafari.com/investor-relations or at https://app.webinar.net/zN7jApOe40V

A

replay of the call will be available by dialing (877) 344-7529 or (412) 317-0088, replay access code 6230594 through May 21, 2024, or

by visiting https://animalsafari.com/investor-relations for the next 90 days.

About

Parks! America, Inc.

Parks!

America, Inc. (OTCPink: PRKA), through its wholly owned subsidiaries, owns and operates three regional safari parks - the Wild Animal

Safari theme park in Pine Mountain, Georgia, the Wild Animal Safari theme park located in Strafford, Missouri, and the Aggieland Wild

Animal Safari theme park, located near Bryan/College Station, Texas.

Additional

information, including our Form 10-K for the fiscal year ended October 1, 2023, is available on the Company’s website, https://animalsafari.com/investor-relations/.

Cautionary

Note Regarding Forward Looking Statements

This

news release may contain “forward-looking statements” within the meaning of U.S. securities laws. Forward-looking statements

include statements concerning our future plans, business strategy, liquidity, capital expenditures, sources of revenue and other similar

statements that are not historical in nature. You are cautioned not to place undue reliance on these forward-looking statements, which

are based on our expectations as of the date of this news release and speak only as of the date hereof. Forward-looking statements are

subject to known and unknown risks, uncertainties and other factors that may cause our actual results to differ significantly from those

expressed or implied by such forward-looking statements. Readers are advised to consider the factors listed under the heading “Risk

Factors” and the other information contained in the Company’s annual report and other reports filed from time to time with

the SEC. We undertake no obligation to publicly update or revise any forward looking statements whether as a result of new information,

future events or otherwise, except as required by law.

Important

Additional Information

The

Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s

stockholders in connection with any matters to be considered at the upcoming annual meeting of stockholders, scheduled to be held on

June 6, 2024 (including any adjournments or postponements thereof, the “Annual Meeting”). On April 23, 2024, the Company

filed a definitive proxy statement, as amended May 3, 2024 (the “Definitive Proxy Statement”), and a WHITE proxy card

with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies from the Company’s

stockholders with respect to the Annual Meeting. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT,

THE ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AS THEY CONTAIN IMPORTANT INFORMATION RELATING

TO THE ANNUAL MEETING. The Definitive Proxy Statement contains information regarding the direct and indirect interests, by security

holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities. Such information can

be found in the section entitled “Security Ownership of Certain Beneficial Owners and Management” in the Definitive Proxy

Statement on page 16 and available here. Stockholders can obtain the definitive proxy statement with respect to the Annual Meeting,

including any amendments or supplements to such proxy statement and other documents, if any, filed by the Company with the SEC at no

charge at the SEC’s website at www.sec.gov. Copies would also be available at no charge on the Company’s website at

https://animalsafari.com/investor-relations/.

Contact:

Lisa

Brady

President

and Chief Executive Officer

(706)

663-8744

PARKS!

AMERICA, INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS

For

the Three Months and Six Months Ended March 31, 2024 and April 2, 2023

| | |

For the three months ended | | |

For the six months ended | |

| | |

March 31, 2024 | | |

April 2, 2023 | | |

March 31, 2024 | | |

April 2, 2023 | |

| Park revenues | |

$ | 1,924,240 | | |

$ | 1,857,565 | | |

$ | 3,733,474 | | |

$ | 3,675,144 | |

| Sale of animals | |

| 33,960 | | |

| 17,900 | | |

| 122,351 | | |

| 61,700 | |

| Total revenues | |

| 1,958,200 | | |

| 1,875,465 | | |

| 3,855,825 | | |

| 3,736,844 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 314,985 | | |

| 282,881 | | |

| 610,919 | | |

| 555,501 | |

| Selling, general and administrative | |

| 1,568,276 | | |

| 1,821,295 | | |

| 3,264,604 | | |

| 3,347,307 | |

| Depreciation and amortization | |

| 218,593 | | |

| 209,449 | | |

| 441,796 | | |

| 426,633 | |

| Contested proxy and related matters | |

| 1,164,612 | | |

| - | | |

| 1,291,252 | | |

| - | |

| Tornado expenses and write-offs, net | |

| - | | |

| 632,372 | | |

| - | | |

| 632,372 | |

| Loss on asset disposals, net | |

| 21,337 | | |

| 30,584 | | |

| 35,754 | | |

| 30,584 | |

| Loss from operations | |

| (1,329,603 | ) | |

| (1,101,116 | ) | |

| (1,788,500 | ) | |

| (1,255,553 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 34,026 | | |

| 31,666 | | |

| 69,913 | | |

| 61,279 | |

| Interest expense | |

| (49,147 | ) | |

| (56,489 | ) | |

| (100,592 | ) | |

| (115,225 | ) |

| Loss before income taxes | |

| (1,344,724 | ) | |

| (1,125,939 | ) | |

| (1,819,179 | ) | |

| (1,309,499 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit | |

| (344,400 | ) | |

| (279,800 | ) | |

| (449,600 | ) | |

| (310,400 | ) |

| Net loss | |

$ | (1,000,324 | ) | |

$ | (846,139 | ) | |

$ | (1,369,579 | ) | |

$ | (999,099 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per share - basic and diluted | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

$ | (0.02 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding (in

000’s) - basic and diluted | |

| 75,727 | | |

| 75,270 | | |

| 75,653 | | |

| 75,248 | |

PARKS!

AMERICA, INC. AND SUBSIDIARIES

REPORTED

AND PRO FORMA PARK REVENUES

For

the Three Months and Six Months Ended March 31, 2024 and April 2, 2023

| | |

For the three months ended | |

| | |

| | |

April 2, 2023 | |

| | |

March 31, 2024 | | |

Actual | | |

Pro Forma | |

| Georgia Park | |

$ | 1,036,469 | | |

$ | 1,050,455 | | |

$ | 1,326,055 | |

| Missouri Park | |

| 400,733 | | |

| 270,827 | | |

| 262,627 | |

| Texas Park | |

| 487,038 | | |

| 536,283 | | |

| 523,133 | |

| Total park revenues | |

$ | 1,924,240 | | |

$ | 1,857,565 | | |

$ | 2,111,815 | |

| | |

For the six months ended | |

| | |

| | |

April 2, 2023 | |

| | |

March 31, 2024 | | |

Actual | | |

Pro Forma | |

| Georgia Park | |

$ | 2,252,640 | | |

$ | 2,345,797 | | |

$ | 2,621,397 | |

| Missouri Park | |

| 625,004 | | |

| 490,592 | | |

| 482,389 | |

| Texas Park | |

| 855,830 | | |

| 838,755 | | |

| 825,591 | |

| Total park revenues | |

$ | 3,733,474 | | |

$ | 3,675,144 | | |

$ | 3,929,377 | |

| 1. |

Pro Forma Park Revenues reflect: |

| |

a. |

The

estimated impact of lost park revenues associated with the closure of our Georgia Park for the final eight days of the fiscal quarter

ended April 2, 2023, assuming Georgia park revenues were flat to the comparable period in fiscal 2022; and |

| |

b. |

The

estimated impact of a change strategic switch to a new ticketing platform early in the second quarter of fiscal 2024. We believe

this change will improve the overall guest experience, lowering the overall transaction fees incurred by our guests for online ticket

purchases, while also improving functionality for our park customer service teams. While we believe this change will have a net neutral

impact on profitability, we no longer directly up-charge customer transaction fees, resulting in a reduction in park revenues,

with a corresponding decrease in operating expenses. |

PARKS!

AMERICA, INC. AND SUBSIDIARIES

RECONCILIATION

OF NON-GAAP MEASURE - ADJUSTED NET INCOME (1)

For

the Three Months and Six Months Ended March 31, 2024 and April 2, 2023

| | |

For the three months ended | | |

For the six months ended | |

| | |

March 31, 2024 | | |

April 2, 2023 | | |

March 31, 2024 | | |

April 2, 2023 | |

| Net loss | |

$ | (1,000,324 | ) | |

$ | (846,139 | ) | |

$ | (1,369,579 | ) | |

$ | (999,099 | ) |

| Contested proxy and related matters | |

| 1,164,612 | | |

| - | | |

| 1,291,252 | | |

| - | |

| Tax impact - contested proxy and related matters | |

| (314,450 | ) | |

| - | | |

| (348,640 | ) | |

| - | |

| Tornado expenses and write-offs, net | |

| - | | |

| 632,372 | | |

| - | | |

| 632,372 | |

| Tax impact - tornado expenses and write-offs | |

| - | | |

| (170,740 | ) | |

| - | | |

| (170,740 | ) |

| Adjusted net loss | |

$ | (150,162 | ) | |

$ | (384,507 | ) | |

$ | (519,417 | ) | |

$ | (537,467 | ) |

| 1. |

Adjusted

net income for the three months and six months ended October 1, 2023 excludes contested proxy and related matters expenses of $1,164,612

and $1,291,252, respectively. Adjusted net income for the three months and six months ended April 2, 2023, excludes $632,372 of tornado

expenses and write-offs, net in each period. |

PARKS!

AMERICA, INC. AND SUBSIDIARIES

RECONCILIATION

OF EBITDA

For

the Three Months and Year Ended October 1, 2023 and October 2, 2022

| | |

For the three months ended | | |

For the six months ended | |

| | |

March 31, 2024 | | |

April 2, 2023 | | |

March 31, 2024 | | |

April 2, 2023 | |

| Reported loss | |

$ | (1,000,324 | ) | |

$ | (846,139 | ) | |

$ | (1,369,579 | ) | |

$ | (999,099 | ) |

| Income tax benefit | |

| (344,400 | ) | |

| (279,800 | ) | |

| (449,600 | ) | |

| (310,400 | ) |

| Interest expense | |

| 49,147 | | |

| 56,489 | | |

| 100,592 | | |

| 115,225 | |

| Depreciation and amortization | |

| 218,593 | | |

| 209,449 | | |

| 441,796 | | |

| 426,633 | |

| Contested proxy and related matters | |

| 1,164,612 | | |

| - | | |

| 1,291,252 | | |

| - | |

| Tornado expenses and write-offs | |

| - | | |

| 632,372 | | |

| - | | |

| 632,372 | |

| Loss on asset disposals, net | |

| 21,337 | | |

| 30,584 | | |

| 35,754 | | |

| 30,584 | |

| EBITDA | |

$ | 108,965 | | |

$ | (197,045 | ) | |

$ | 50,215 | | |

$ | (104,685 | ) |

| 1. |

EBITDA is not a measurement of operating performance computed in accordance with generally accepted accounting principles (“GAAP”)

and should not be considered as a substitute for operating income, net income or cash flows from operating activities computed in

accordance with GAAP. We believe that EBITDA is a meaningful measure as it is widely used by analysts, investors and comparable companies

in the entertainment and attractions industry to evaluate our operating performance on a consistent basis, as well as more easily

compare our results with those of other companies in our industry. We also believe EBITDA is a meaningful measure of park-level operating

profitability. EBITDA is a supplemental measure of our operating results and is not intended to be a substitute for operating income,

net income or cash flows from operating activities as defined under GAAP. |

PARKS!

AMERICA, INC. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

As

of March 31, 2024, October 1, 2023 and April 2, 2023

| | |

March 31, 2024 | | |

October 1, 2023 | | |

April 2, 2023 | |

| ASSETS | |

| | |

| | |

| |

| Cash | |

$ | 2,011,620 | | |

$ | 4,098,387 | | |

$ | 3,861,632 | |

| Short-term investments | |

| 1,021,609 | | |

| - | | |

| - | |

| Accounts receivable | |

| 6,239 | | |

| 36,172 | | |

| 3,335 | |

| Inventory | |

| 444,446 | | |

| 419,149 | | |

| 532,143 | |

| Prepaid expenses | |

| 980,738 | | |

| 558,678 | | |

| 572,891 | |

| Total current assets | |

| 4,464,652 | | |

| 5,112,386 | | |

| 4,970,001 | |

| | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 14,891,050 | | |

| 14,910,097 | | |

| 15,067,473 | |

| Intangible assets, net | |

| 38,199 | | |

| 52,331 | | |

| 76,207 | |

| Other assets | |

| 20,909 | | |

| 20,909 | | |

| 20,909 | |

| Total assets | |

$ | 19,414,810 | | |

$ | 20,095,723 | | |

$ | 20,134,590 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | |

| Accounts payable | |

$ | 1,151,161 | | |

$ | 79,352 | | |

$ | 623,234 | |

| Other current liabilities | |

| 494,057 | | |

| 571,343 | | |

| 494,266 | |

| Current portion of long-term debt, net | |

| 783,447 | | |

| 767,675 | | |

| 749,879 | |

| Total current liabilities | |

| 2,428,665 | | |

| 1,418,370 | | |

| 1,867,379 | |

| | |

| | | |

| | | |

| | |

| Long-term debt, net | |

| 3,062,351 | | |

| 3,459,816 | | |

| 3,847,364 | |

| Deferred tax liability, net | |

| 232,329 | | |

| 232,329 | | |

| - | |

| Total liabilities | |

| 5,723,345 | | |

| 5,110,515 | | |

| 5,714,743 | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | | |

| | |

| Common stock | |

| 75,727 | | |

| 75,518 | | |

| 75,389 | |

| Capital in excess of par | |

| 5,178,098 | | |

| 5,102,471 | | |

| 5,052,600 | |

| Retained earnings | |

| 8,437,640 | | |

| 9,807,219 | | |

| 9,291,858 | |

| Total stockholders’ equity | |

| 13,691,465 | | |

| 14,985,208 | | |

| 14,419,847 | |

| Total liabilities and stockholders’ equity | |

$ | 19,414,810 | | |

$ | 20,095,723 | | |

$ | 20,134,590 | |

PARKS!

AMERICA, INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS

For

the Six Months Ended March 31, 2024 and April 2, 2023

| | |

For the six months ended | |

| | |

March 31, 2024 | | |

April 2, 2023 | |

| OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (1,369,579 | ) | |

$ | (999,099 | ) |

| Reconciliation of net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization expense | |

| 441,796 | | |

| 426,633 | |

| Interest expense - debt financing cost amortization | |

| 5,444 | | |

| 2,944 | |

| Stock-based compensation | |

| 75,836 | | |

| 65,000 | |

| Accrued interest on certificates of deposit | |

| (21,609 | ) | |

| - | |

| Tornado asset write-offs | |

| - | | |

| 250,696 | |

| Loss (gain) loss on asset disposals | |

| 35,754 | | |

| 30,584 | |

| Changes in assets and liabilities | |

| | | |

| | |

| (Increase) decrease in accounts receivable | |

| 29,933 | | |

| 1,070 | |

| (Increase) decrease in inventory | |

| (25,297 | ) | |

| 9,843 | |

| (Increase) decrease in prepaid expenses | |

| (422,060 | ) | |

| (402,109 | ) |

| Increase (decrease) in accounts payable | |

| 1,071,809 | | |

| 355,667 | |

| Increase (decrease) in other current liabilities | |

| (77,286 | ) | |

| (27,606 | ) |

| Net cash used in operating activities | |

| (255,259 | ) | |

| (286,377 | ) |

| | |

| | | |

| | |

| INVESTING ACTIVITIES: | |

| | | |

| | |

| Investments in certificates of deposit | |

| (1,000,000 | ) | |

| - | |

| Acquisition of property and equipment | |

| (484,872 | ) | |

| (952,640 | ) |

| Investment in intangible assets | |

| - | | |

| (5,466 | ) |

| Proceeds from the disposition of property and equipment | |

| 40,875 | | |

| - | |

| Net cash used in investing activities | |

| (1,443,997 | ) | |

| (958,106 | ) |

| | |

| | | |

| | |

| FINANCING ACTIVITIES: | |

| | | |

| | |

| Payments on 2020 Term Loan | |

| (248,737 | ) | |

| (236,957 | ) |

| Payments on 2021 Term Loan | |

| (133,774 | ) | |

| (128,964 | ) |

| Line-of-credit fees | |

| (5,000 | ) | |

| - | |

| Net cash used in financing activities | |

| (387,511 | ) | |

| (365,921 | ) |

| | |

| | | |

| | |

| Net decrease in cash | |

| (2,086,767 | ) | |

| (1,610,404 | ) |

| Cash at beginning of period | |

| 4,098,387 | | |

| 5,472,036 | |

| Cash at end of period | |

$ | 2,011,620 | | |

$ | 3,861,632 | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

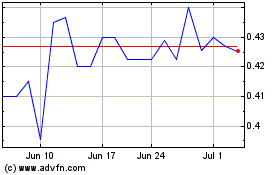

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Nov 2023 to Nov 2024