UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material under §240.14a-12 |

OCEAN POWER TECHNOLOGIES,

INC.

(Name of Registrant as Specified In Its Charter)

PARAGON TECHNOLOGIES,

INC.

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11. |

On August 11, 2023, Paragon Technologies,

Inc. issued a press release relating to Ocean Power Technologies, Inc., a copy of which is set forth below:

Paragon Technologies Calls on Ocean Power Technologies

to Refrain from Dilutive Equity Issuances and Immediately Announce a Significant Cost Cutting Plan

EASTON, PA – August 11, 2023

Paragon Technologies, Inc.

(“Paragon”) (OTC: PGNT), a diversified holding company which owns approximately 4.0% of the outstanding shares of Ocean Power

Technologies, Inc. (“Company”) (“OPT”) (NYSE American: OPTT), calls on OPT to REFRAIN from ALL future equity share

sales that will dilute shareholders and immediately announce a significant cost cutting plan to demonstrate the Board’s commitment

to protecting shareholder value.

On August 2, 2023 Paragon issued a press release

asking OPT to answer critical questions regarding the future viability of the Company in response to OPT’s 10-K filing disclosure

that the Company has enough cash to last through at least July 31, 2024, or less than one year from today.

As shareholders, we asked the Board to demonstrate

its stated commitment to enhancing ALL shareholder value by addressing:

| 1. | How the Company will fund its

business without diluting shareholders. |

| 2. | Provide shareholders with an accountable

business plan to get OPT to cash flow breakeven. |

| 3. | Reducing Board and named executive

compensation given that such compensation has historically EXCEEDED the TOTAL ANNUAL REVENUE of the Company. |

In response to our questions, on August 7, OPT

announced a share offering whereby the Company intends to sell up to $13.8 million of its shares in the market. Seeking to raise $13.8

million when OPT has $34.8 million and adequate time to reduce expenses seems to indicate no desire to cut costs.

Since the August 7 announcement, OPT’s

share price has DECLINED by nearly 15% from $0.55 to $0.47.

Rather than reduce expenses, OPT instead continues

to take actions that are not enhancing shareholder value but, as the market has indicated, destroying shareholder value.

OPT continues to ignore shareholders’ request

for a viable and measurable business plan that shows a significant reduction in annual expenses.

What is the OPT Board hiding from shareholders?

We call on OPT’s Board and management to

cease from issuing any further equity issuances which are likely to harm shareholders. The Company needs implement an immediate and significant

cost cutting plan.

Instead of diluting shareholders by 50% - while

the Board and management continue to pay themselves fees and salaries that exceed OPT’s annual revenues - management should take

immediate action and announce a 50% reduction in quarterly and annual cash burn.

With approximately $34 million in cash and ST

investments as of April 30, 2023, OPT needs to immediately implement a business plan that reduces quarterly expenses to $2.5 million

or approximately $10 million per year. We believe this cost structure will create a more disciplined organization and allow OPT the

appropriate time to focus on the most promising areas of its business. We believe the announcement of an aggressive and necessary cost

cutting plan is the critical first step for OPT and that the market would view this plan favorably.

If Paragon’s nominees are elected to the Board, we will take

immediate steps to:

| · | immediately and significantly reduce expenses. |

| · | develop a measurable plan that will bring OPT to cash flow break even. |

| · | Implement a disciplined and focused capital allocation strategy. |

| · | focus on the potential growth of the Company’s intelligence data and leverage the possible market opportunities of Marine Advanced

Robotics. |

Paragon’s books and records litigation against OPT is an expected

first step in broader litigation that Paragon intends to file against OPT and its directors individually for what Paragon believes have

been years of financial mismanagement (leading to accumulated losses of approximately $300 million) and excessive Board and executive

compensation (in annual amounts greater than OPT’s annual revenues).

Paragon is determined to hold each individual director of OPT personally

accountable for these actions and require them to justify the amounts paid in compensation and the serial dilution of shareholders. We

remind all OPT shareholders that all directors and senior management own less than 1% of OPT’s outstanding shares so the imposed

dilution has little impact on them and simply continues to fund what we believe to be excessive compensation.

We appreciate the support from shareholders thus

far. Please email us at ir@pgntgroup.com if you would like to learn more.

____________

Paragon Technologies, Inc. intends to make a filing with the Securities

and Exchange Commission (the “SEC”) of a proxy statement to be used to solicit votes for the election of director nominees

at the 2023 annual meeting of shareholders of Ocean Power Technologies, Inc., a Delaware corporation (the “company”).

Paragon Technologies, Inc. is the beneficial owner of 2,229,443 shares

of common stock of the company, par value $0.001 per share (“Common Stock”).

Paragon Technologies, Inc., and Paragon’s director nominees will

be the participants in the proxy solicitation. Updated information regarding the participants and their direct and indirect interests

in the solicitation, by security holdings or otherwise, will be included in Paragon’s proxy statement and other materials filed

with the SEC. SHAREHOLDERS OF THE COMPANY SHOULD READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS CAREFULLY AND IN THEIR ENTIRETY AS

THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE COMPANY’S ANNUAL MEETING, PARAGON’S SOLICITATION

OF PROXIES AND PARAGON’S NOMINEES TO THE BOARD. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE

AT WWW.SEC.GOV OR FROM PARAGON TECHNOLOGIES, INC.

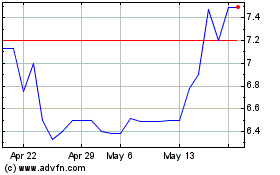

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Apr 2024 to May 2024

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From May 2023 to May 2024